During the Covid-19 pandemic, as the nation has grappled with health and financial crises, many people across the country have seen their debts rise and their ability to pay them fall.

As businesses cut back or closed, workers not only saw their income decline or disappear but also lost their medical insurance coverage. A Lending Tree survey published this March found that 60% of Americans were facing medical debt, with the amount exceeding $5,000 for 53% of them. (Click here to see how many people in your state are burdened with medical debt.)

But debt was already growing before the pandemic hit. In March, the Consumer Financial Protection Bureau and the Federal Trade Commission jointly released a report saying that U.S. consumer debt had risen to a record $14.3 trillion in the first quarter of 2020.

Overdue debts are frequently referred to collection agencies. The Urban Institute considers debt in collections “to include debt accounts (e.g., credit cards) that were previously more than 180 days past due and have been closed and charged off,” as well as unpaid student and car loans, medical and utility bills, parking tickets, child support payments, and membership fees that have been referred to a credit bureau.

Click here to see the counties where the most people have debt in collections.

To identify the counties where people are struggling the most in debt, 24/7 Wall St. reviewed data from the “Debt in America 2021” report, based on credit bureau information from 2020, published by the non-profit think tank the Urban Institute.

Debt collectors can be notoriously aggressive — and new rules from the Consumer Financial Protection Bureau will allow them, beginning at the end of November, to contact debtors via direct messages or friend requests on social media. (However, they will be prohibited from communicating on social media in a way that can be seen by the public.)

Individuals in some parts of the country have more debt in collections than in others. Sometimes the differences are dramatic. McKenzie County, North Dakota, for instance, tops the list with a median amount of $4,972 in collections. (Here are the worst counties to live in.)

50. Jackson County, Wisconsin

> Median debt in collections: $3,004

> Adults with any debt in collections: 24.6% — #2027 out of 2,934 counties

> Population: 20,522

[in-text-ad]

49. Fairbanks North Star Borough, Alaska

> Median debt in collections: $3,008

> Adults with any debt in collections: 25.0% — #1992 out of 2,934 counties

> Population: 99,072

48. Iron County, Utah

> Median debt in collections: $3,015

> Adults with any debt in collections: 22.8% — #2155 out of 2,934 counties

> Population: 51,213

46. Bledsoe County, Tennessee

> Median debt in collections: $3,016

> Adults with any debt in collections: 37.4% — #851 out of 2,934 counties

> Population: 14,836

[in-text-ad-2]

46. Medina County, Texas

> Median debt in collections: $3,016

> Adults with any debt in collections: 42.0% — #534 out of 2,934 counties

> Population: 50,057

45. Jefferson County, Idaho

> Median debt in collections: $3,017

> Adults with any debt in collections: 17.3% — #2575 out of 2,934 counties

> Population: 28,534

[in-text-ad]

44. Caddo County, Oklahoma

> Median debt in collections: $3,025

> Adults with any debt in collections: 41.7% — #553 out of 2,934 counties

> Population: 29,242

43. Cass County, Indiana

> Median debt in collections: $3,045

> Adults with any debt in collections: 35.8% — #982 out of 2,934 counties

> Population: 37,880

42. Bonner County, Idaho

> Median debt in collections: $3,050

> Adults with any debt in collections: 15.6% — #2678 out of 2,934 counties

> Population: 43,611

[in-text-ad-2]

41. Lamb County, Texas

> Median debt in collections: $3,052

> Adults with any debt in collections: 51.2% — #126 out of 2,934 counties

> Population: 13,123

40. Pennington County, South Dakota

> Median debt in collections: $3,063

> Adults with any debt in collections: 17.9% — #2534 out of 2,934 counties

> Population: 110,685

[in-text-ad]

39. Gadsden County, Florida

> Median debt in collections: $3,066

> Adults with any debt in collections: 47.5% — #236 out of 2,934 counties

> Population: 45,945

38. Perry County, Indiana

> Median debt in collections: $3,070

> Adults with any debt in collections: 23.2% — #2130 out of 2,934 counties

> Population: 19,102

37. Wilson County, Texas

> Median debt in collections: $3,092

> Adults with any debt in collections: 36.0% — #969 out of 2,934 counties

> Population: 49,173

[in-text-ad-2]

36. Allendale County, South Carolina

> Median debt in collections: $3,108

> Adults with any debt in collections: 65.0% — #4 out of 2,934 counties

> Population: 9,024

35. Bollinger County, Missouri

> Median debt in collections: $3,113

> Adults with any debt in collections: 41.8% — #546 out of 2,934 counties

> Population: 12,225

[in-text-ad]

34. Dakota County, Nebraska

> Median debt in collections: $3,156

> Adults with any debt in collections: 24.6% — #2028 out of 2,934 counties

> Population: 20,173

33. Robertson County, Texas

> Median debt in collections: $3,169

> Adults with any debt in collections: 48.9% — #187 out of 2,934 counties

> Population: 16,990

32. Texas County, Missouri

> Median debt in collections: $3,188

> Adults with any debt in collections: 33.3% — #1193 out of 2,934 counties

> Population: 25,604

[in-text-ad-2]

31. Kenai Peninsula Borough, Alaska

> Median debt in collections: $3,191

> Adults with any debt in collections: 24.0% — #2073 out of 2,934 counties

> Population: 58,464

30. Natrona County, Wyoming

> Median debt in collections: $3,253

> Adults with any debt in collections: 30.5% — #1482 out of 2,934 counties

> Population: 80,333

[in-text-ad]

29. Marshall County, Oklahoma

> Median debt in collections: $3,267

> Adults with any debt in collections: 41.0% — #598 out of 2,934 counties

> Population: 16,505

28. Franklin County, Texas

> Median debt in collections: $3,272

> Adults with any debt in collections: 41.4% — #574 out of 2,934 counties

> Population: 10,716

27. Runnels County, Texas

> Median debt in collections: $3,277

> Adults with any debt in collections: 37.4% — #855 out of 2,934 counties

> Population: 10,277

[in-text-ad-2]

26. St. Helena Parish, Louisiana

> Median debt in collections: $3,280

> Adults with any debt in collections: 56.6% — #44 out of 2,934 counties

> Population: 10,297

25. Long County, Georgia

> Median debt in collections: $3,316

> Adults with any debt in collections: 37.5% — #839 out of 2,934 counties

> Population: 18,692

[in-text-ad]

24. Choctaw County, Oklahoma

> Median debt in collections: $3,321

> Adults with any debt in collections: 48.1% — #207 out of 2,934 counties

> Population: 14,807

23. Shoshone County, Idaho

> Median debt in collections: $3,322

> Adults with any debt in collections: 24.7% — #2016 out of 2,934 counties

> Population: 12,609

22. Candler County, Georgia

> Median debt in collections: $3,372

> Adults with any debt in collections: 40.8% — #611 out of 2,934 counties

> Population: 10,812

[in-text-ad-2]

21. Goliad County, Texas

> Median debt in collections: $3,413

> Adults with any debt in collections: 41.7% — #555 out of 2,934 counties

> Population: 7,565

19. Plumas County, California

> Median debt in collections: $3,420

> Adults with any debt in collections: 24.9% — #1994 out of 2,934 counties

> Population: 18,660

[in-text-ad]

19. Jefferson County, Mississippi

> Median debt in collections: $3,420

> Adults with any debt in collections: 52.8% — #93 out of 2,934 counties

> Population: 7,225

18. Brown County, Indiana

> Median debt in collections: $3,447

> Adults with any debt in collections: 21.1% — #2294 out of 2,934 counties

> Population: 15,064

17. Lincoln County, Montana

> Median debt in collections: $3,449

> Adults with any debt in collections: 20.0% — #2370 out of 2,934 counties

> Population: 19,537

[in-text-ad-2]

16. Jim Wells County, Texas

> Median debt in collections: $3,469

> Adults with any debt in collections: 62.6% — #9 out of 2,934 counties

> Population: 40,972

15. Andrew County, Missouri

> Median debt in collections: $3,494

> Adults with any debt in collections: 25.6% — #1929 out of 2,934 counties

> Population: 17,503

[in-text-ad]

14. San Jacinto County, Texas

> Median debt in collections: $3,519

> Adults with any debt in collections: 44.8% — #360 out of 2,934 counties

> Population: 28,180

13. Jefferson County, Florida

> Median debt in collections: $3,528

> Adults with any debt in collections: 34.2% — #1127 out of 2,934 counties

> Population: 14,161

12. Noble County, Oklahoma

> Median debt in collections: $3,551

> Adults with any debt in collections: 33.3% — #1193 out of 2,934 counties

> Population: 11,335

[in-text-ad-2]

11. Douglas County, Nevada

> Median debt in collections: $3,567

> Adults with any debt in collections: 19.9% — #2386 out of 2,934 counties

> Population: 48,132

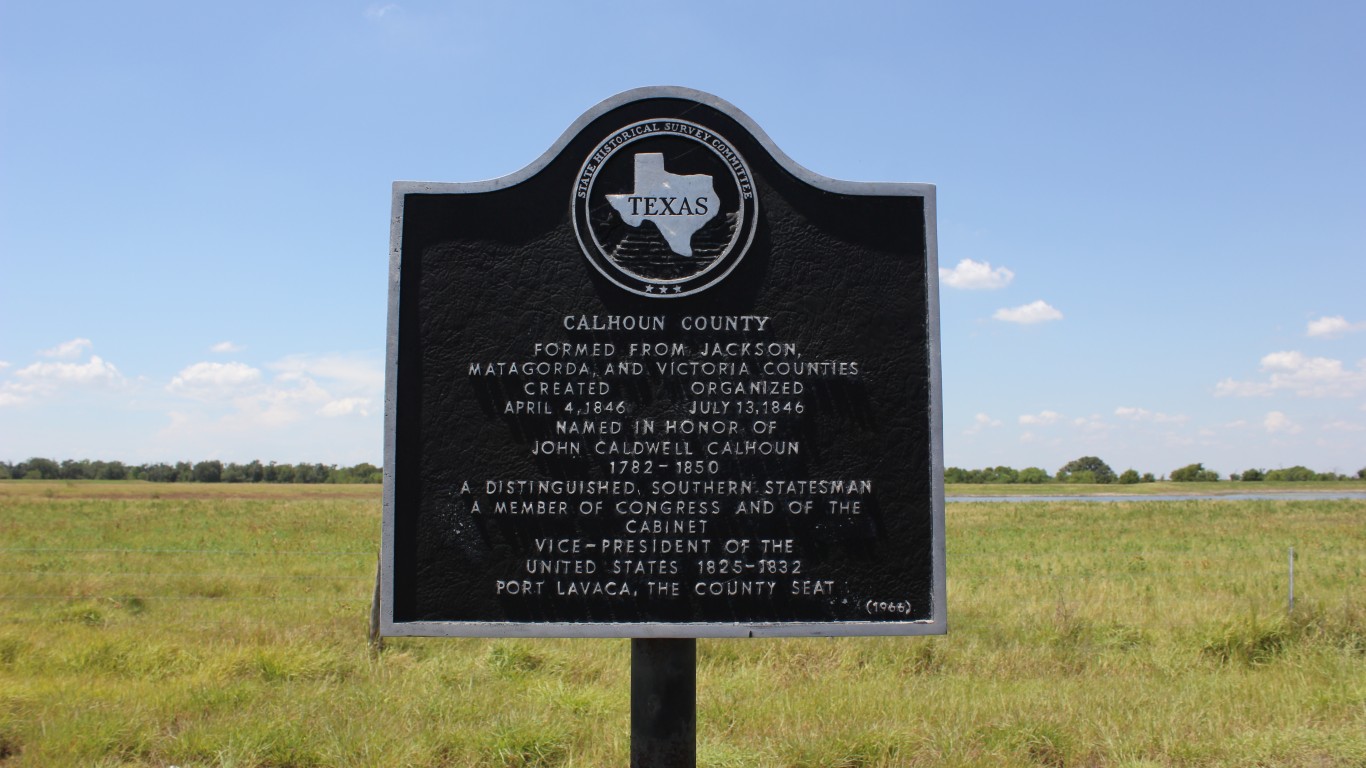

10. Calhoun County, Texas

> Median debt in collections: $3,650

> Adults with any debt in collections: 49.3% — #178 out of 2,934 counties

> Population: 21,668

[in-text-ad]

8. LaGrange County, Indiana

> Median debt in collections: $3,709

> Adults with any debt in collections: 18.7% — #2463 out of 2,934 counties

> Population: 39,193

8. Rush County, Indiana

> Median debt in collections: $3,709

> Adults with any debt in collections: 32.9% — #1246 out of 2,934 counties

> Population: 16,641

7. Lincoln County, Nebraska

> Median debt in collections: $3,738

> Adults with any debt in collections: 20.5% — #2343 out of 2,934 counties

> Population: 35,263

[in-text-ad-2]

6. Liberty County, Florida

> Median debt in collections: $3,775

> Adults with any debt in collections: 40.1% — #654 out of 2,934 counties

> Population: 8,345

5. Victoria County, Texas

> Median debt in collections: $4,151

> Adults with any debt in collections: 46.1% — #293 out of 2,934 counties

> Population: 92,109

[in-text-ad]

4. Pike County, Indiana

> Median debt in collections: $4,185

> Adults with any debt in collections: 25.6% — #1926 out of 2,934 counties

> Population: 12,378

3. Meade County, South Dakota

> Median debt in collections: $4,830

> Adults with any debt in collections: 14.9% — #2715 out of 2,934 counties

> Population: 27,717

2. Richland County, Montana

> Median debt in collections: $4,918

> Adults with any debt in collections: 28.1% — #1718 out of 2,934 counties

> Population: 11,199

[in-text-ad-2]

1. McKenzie County, North Dakota

> Median debt in collections: $4,972

> Adults with any debt in collections: 31.0% — #1429 out of 2,934 counties

> Population: 13,334

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.