A surge in demand for homes in the United States, in addition to limited housing inventory, has created a sellers market unlike anything seen in recent memory. Homes are now selling faster than ever before — and also for more money than ever before. Here is a look at the cities where the middle class can no longer afford housing.

Much of the country has long faced a housing affordability crisis, and rapidly rising home values are further exacerbating the problem. Despite the growing gap between income and housing costs, some parts of the country offer much more affordable housing than others.

According to the most recently available figures from the U.S. Census Bureau, the typical American home is worth $217,500, 3.5 times more than the national median household income of $62,843. In nearly every state, there is at least one community where the ratio of home value to income is lower than it is nationwide.

Using data from the Census’ American Community Survey, 24/7 Wall St. identified the most affordable place to live in every state. We ranked all cities, towns, villages, and unincorporated communities with populations of at least 10,000 by the median home value to median annual household income ratio.

With home values more affordable for the local incomes, the places on this list tend to have higher than average homeownership rates. In all but 10 communities on this list, the homeownership rate exceeds the homeownership rate across the state as a whole. Only four places on this list have a lower homeownership rate than the 64% rate nationwide. Here is a look at the states where the most people live with their parents.

Click here to see the least expensive place to live in every state.

Click here to see our methodology.

Alabama: Alabaster

> Home value to income ratio: 2.2-to-1 (state: 2.8-to-1)

> Median household income: $80,072 (state: $50,536)

> Median home value: $173,000 (state: $142,700)

> Home ownership rate: 83.6% (state: 68.8%)

> Location: Shelby County

> Population: 33,176

[in-text-ad]

Alaska: Badger

> Home value to income ratio: 2.8-to-1 (state: 3.5-to-1)

> Median household income: $81,111 (state: $77,640)

> Median home value: $224,900 (state: $270,400)

> Home ownership rate: 73.6% (state: 64.3%)

> Location: Fairbanks North Star Borough

> Population: 18,911

Arizona: Sahuarita

> Home value to income ratio: 2.7-to-1 (state: 3.8-to-1)

> Median household income: $80,525 (state: $58,945)

> Median home value: $214,100 (state: $225,500)

> Home ownership rate: 82.4% (state: 64.4%)

> Location: Pima County

> Population: 29,905

Arkansas: Marion

> Home value to income ratio: 2.1-to-1 (state: 2.7-to-1)

> Median household income: $73,459 (state: $47,597)

> Median home value: $153,900 (state: $127,800)

> Home ownership rate: 68.0% (state: 65.6%)

> Location: Crittenden County

> Population: 12,404

[in-text-ad-2]

California: Imperial

> Home value to income ratio: 2.8-to-1 (state: 6.7-to-1)

> Median household income: $85,654 (state: $75,235)

> Median home value: $239,900 (state: $505,000)

> Home ownership rate: 74.4% (state: 54.8%)

> Location: Imperial County

> Population: 17,454

Colorado: Johnstown

> Home value to income ratio: 3.4-to-1 (state: 4.7-to-1)

> Median household income: $100,025 (state: $72,331)

> Median home value: $336,100 (state: $343,300)

> Home ownership rate: 87.1% (state: 65.2%)

> Location: Weld County

> Population: 14,910

[in-text-ad]

Connecticut: Newington

> Home value to income ratio: 2.8-to-1 (state: 3.5-to-1)

> Median household income: $81,646 (state: $78,444)

> Median home value: $230,500 (state: $275,400)

> Home ownership rate: 78.3% (state: 66.1%)

> Location: Hartford County

> Population: 30,234

Delaware: Bear

> Home value to income ratio: 2.9-to-1 (state: 3.7-to-1)

> Median household income: $72,192 (state: $68,287)

> Median home value: $209,700 (state: $251,100)

> Home ownership rate: 57.9% (state: 71.2%)

> Location: New Castle County

> Population: 20,850

Florida: Gonzalez

> Home value to income ratio: 2.2-to-1 (state: 3.9-to-1)

> Median household income: $77,492 (state: $55,660)

> Median home value: $172,200 (state: $215,300)

> Home ownership rate: 84.0% (state: 65.4%)

> Location: Escambia County

> Population: 14,598

[in-text-ad-2]

Georgia: Martinez

> Home value to income ratio: 2.2-to-1 (state: 3.0-to-1)

> Median household income: $75,330 (state: $58,700)

> Median home value: $162,600 (state: $176,000)

> Home ownership rate: 75.6% (state: 63.3%)

> Location: Columbia County

> Population: 34,844

Hawaii: Waimea

> Home value to income ratio: 4.9-to-1 (state: 7.6-to-1)

> Median household income: $91,074 (state: $81,275)

> Median home value: $449,200 (state: $615,300)

> Home ownership rate: 56.0% (state: 58.9%)

> Location: Hawaii County

> Population: 11,908

[in-text-ad]

Idaho: Ammon

> Home value to income ratio: 3.0-to-1 (state: 3.8-to-1)

> Median household income: $67,545 (state: $55,785)

> Median home value: $199,400 (state: $212,300)

> Home ownership rate: 74.1% (state: 70.0%)

> Location: Bonneville County

> Population: 15,859

Illinois: Roscoe

> Home value to income ratio: 1.8-to-1 (state: 3.0-to-1)

> Median household income: $92,138 (state: $65,886)

> Median home value: $163,000 (state: $194,500)

> Home ownership rate: 77.4% (state: 66.1%)

> Location: Winnebago County

> Population: 10,757

Indiana: Franklin

> Home value to income ratio: 2.2-to-1 (state: 2.5-to-1)

> Median household income: $59,930 (state: $56,303)

> Median home value: $129,200 (state: $141,700)

> Home ownership rate: 67.0% (state: 69.1%)

> Location: Johnson County

> Population: 25,106

[in-text-ad-2]

Iowa: Marion

> Home value to income ratio: 2.3-to-1 (state: 2.4-to-1)

> Median household income: $72,150 (state: $60,523)

> Median home value: $168,700 (state: $147,800)

> Home ownership rate: 77.8% (state: 71.1%)

> Location: Linn County

> Population: 39,328

Kansas: Lansing

> Home value to income ratio: 1.9-to-1 (state: 2.5-to-1)

> Median household income: $89,213 (state: $59,597)

> Median home value: $173,000 (state: $151,900)

> Home ownership rate: 73.1% (state: 66.3%)

> Location: Leavenworth County

> Population: 11,900

[in-text-ad]

Kentucky: Erlanger

> Home value to income ratio: 2.1-to-1 (state: 2.8-to-1)

> Median household income: $64,460 (state: $50,589)

> Median home value: $136,100 (state: $141,000)

> Home ownership rate: 67.6% (state: 67.2%)

> Location: Kenton County

> Population: 18,967

Louisiana: Estelle

> Home value to income ratio: 2.3-to-1 (state: 3.3-to-1)

> Median household income: $68,051 (state: $49,469)

> Median home value: $157,700 (state: $163,100)

> Home ownership rate: 82.8% (state: 65.6%)

> Location: Jefferson Parish

> Population: 17,968

Maine: Saco

> Home value to income ratio: 3.7-to-1 (state: 3.3-to-1)

> Median household income: $70,517 (state: $57,918)

> Median home value: $258,900 (state: $190,400)

> Home ownership rate: 65.5% (state: 72.3%)

> Location: York County

> Population: 19,497

[in-text-ad-2]

Maryland: Friendly

> Home value to income ratio: 2.5-to-1 (state: 3.7-to-1)

> Median household income: $130,577 (state: $84,805)

> Median home value: $320,700 (state: $314,800)

> Home ownership rate: 94.0% (state: 66.9%)

> Location: Prince George’s County

> Population: 10,051

Massachusetts: Longmeadow

> Home value to income ratio: 2.8-to-1 (state: 4.7-to-1)

> Median household income: $122,035 (state: $81,215)

> Median home value: $343,700 (state: $381,600)

> Home ownership rate: 90.1% (state: 62.4%)

> Location: Hampden County

> Population: 15,791

[in-text-ad]

Michigan: Allen Park

> Home value to income ratio: 1.8-to-1 (state: 2.7-to-1)

> Median household income: $67,130 (state: $57,144)

> Median home value: $123,800 (state: $154,900)

> Home ownership rate: 84.0% (state: 71.2%)

> Location: Wayne County

> Population: 27,216

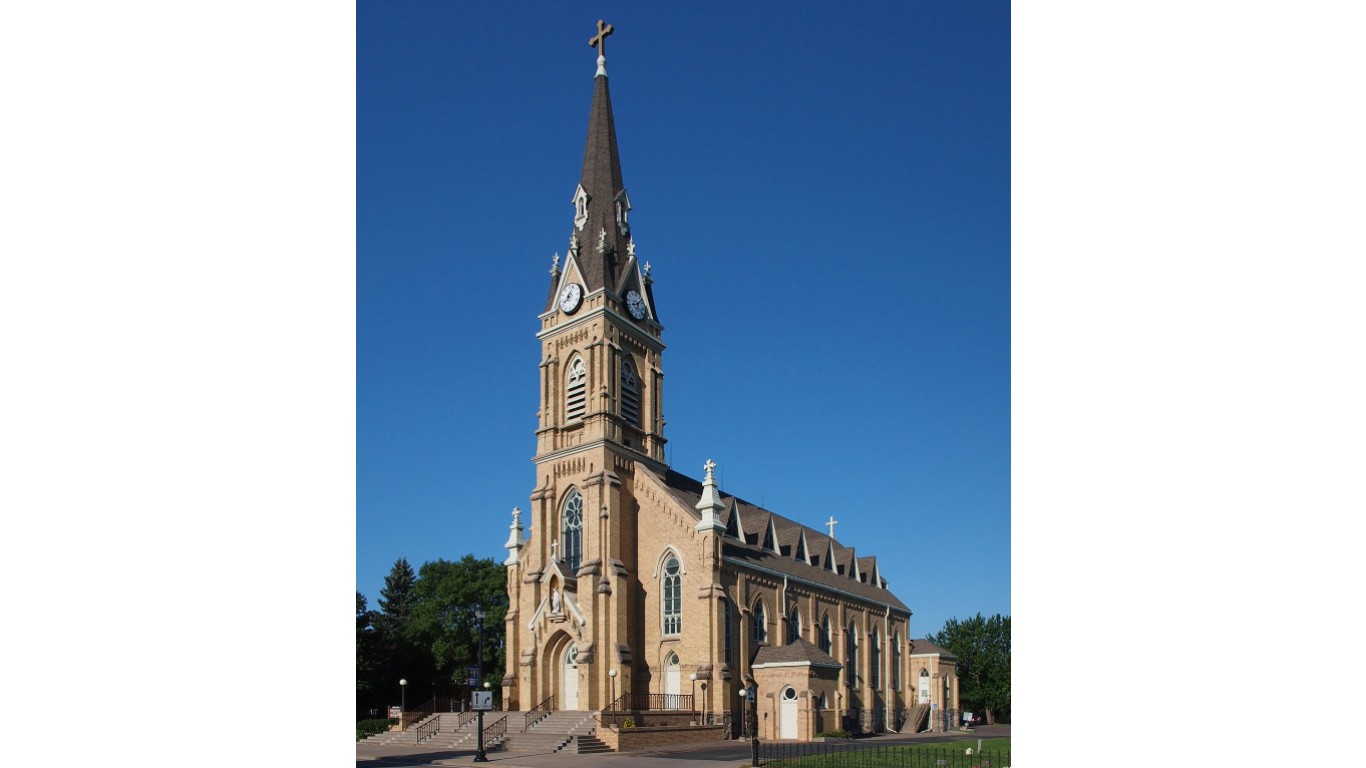

Minnesota: St. Michael

> Home value to income ratio: 2.4-to-1 (state: 3.1-to-1)

> Median household income: $114,015 (state: $71,306)

> Median home value: $270,600 (state: $223,900)

> Home ownership rate: 87.5% (state: 71.6%)

> Location: Wright County

> Population: 17,586

Mississippi: Byram

> Home value to income ratio: 2.1-to-1 (state: 2.6-to-1)

> Median household income: $66,641 (state: $45,081)

> Median home value: $141,700 (state: $119,000)

> Home ownership rate: 70.3% (state: 68.2%)

> Location: Hinds County

> Population: 11,578

[in-text-ad-2]

Missouri: Old Jamestown

> Home value to income ratio: 2.0-to-1 (state: 2.8-to-1)

> Median household income: $88,904 (state: $55,461)

> Median home value: $176,800 (state: $157,200)

> Home ownership rate: 92.1% (state: 66.8%)

> Location: St. Louis County

> Population: 19,777

Montana: Billings

> Home value to income ratio: 3.7-to-1 (state: 4.2-to-1)

> Median household income: $59,656 (state: $54,970)

> Median home value: $221,100 (state: $230,600)

> Home ownership rate: 63.0% (state: 68.1%)

> Location: Yellowstone County

> Population: 109,595

[in-text-ad]

Nebraska: Chalco

> Home value to income ratio: 1.9-to-1 (state: 2.5-to-1)

> Median household income: $80,896 (state: $61,439)

> Median home value: $153,100 (state: $155,800)

> Home ownership rate: 75.3% (state: 66.1%)

> Location: Sarpy County

> Population: 10,952

Nevada: Spring Creek

> Home value to income ratio: 2.3-to-1 (state: 4.4-to-1)

> Median household income: $99,854 (state: $60,365)

> Median home value: $232,900 (state: $267,900)

> Home ownership rate: 88.7% (state: 56.3%)

> Location: Elko County

> Population: 13,671

New Hampshire: Londonderry

> Home value to income ratio: 3.2-to-1 (state: 3.4-to-1)

> Median household income: $97,596 (state: $76,768)

> Median home value: $310,200 (state: $261,700)

> Home ownership rate: 79.2% (state: 71.1%)

> Location: Rockingham County

> Population: 11,841

[in-text-ad-2]

New Jersey: Greentree

> Home value to income ratio: 2.4-to-1 (state: 4.1-to-1)

> Median household income: $137,346 (state: $82,545)

> Median home value: $325,600 (state: $335,600)

> Home ownership rate: 85.9% (state: 63.9%)

> Location: Camden County

> Population: 11,262

New Mexico: Carlsbad

> Home value to income ratio: 2.0-to-1 (state: 3.4-to-1)

> Median household income: $69,193 (state: $49,754)

> Median home value: $141,300 (state: $171,400)

> Home ownership rate: 67.8% (state: 67.7%)

> Location: Eddy County

> Population: 29,158

[in-text-ad]

New York: Fairmount

> Home value to income ratio: 1.9-to-1 (state: 4.6-to-1)

> Median household income: $69,875 (state: $68,486)

> Median home value: $130,400 (state: $313,700)

> Home ownership rate: 77.3% (state: 53.9%)

> Location: Onondaga County

> Population: 10,092

North Carolina: Lewisville

> Home value to income ratio: 2.5-to-1 (state: 3.2-to-1)

> Median household income: $78,464 (state: $54,602)

> Median home value: $195,400 (state: $172,500)

> Home ownership rate: 86.0% (state: 65.2%)

> Location: Forsyth County

> Population: 13,861

North Dakota: Williston

> Home value to income ratio: 2.8-to-1 (state: 3.0-to-1)

> Median household income: $84,710 (state: $64,894)

> Median home value: $238,700 (state: $193,900)

> Home ownership rate: 46.1% (state: 62.4%)

> Location: Williams County

> Population: 27,250

[in-text-ad-2]

Ohio: South Euclid

> Home value to income ratio: 1.6-to-1 (state: 2.6-to-1)

> Median household income: $61,078 (state: $56,602)

> Median home value: $100,200 (state: $145,700)

> Home ownership rate: 72.4% (state: 66.1%)

> Location: Cuyahoga County

> Population: 21,572

Oklahoma: Glenpool

> Home value to income ratio: 2.1-to-1 (state: 2.6-to-1)

> Median household income: $67,703 (state: $52,919)

> Median home value: $139,000 (state: $136,800)

> Home ownership rate: 73.8% (state: 65.6%)

> Location: Tulsa County

> Population: 13,666

[in-text-ad]

Oregon: Sandy

> Home value to income ratio: 3.8-to-1 (state: 5.0-to-1)

> Median household income: $73,443 (state: $62,818)

> Median home value: $281,300 (state: $312,200)

> Home ownership rate: 73.1% (state: 62.4%)

> Location: Clackamas County

> Population: 11,070

Pennsylvania: Plum

> Home value to income ratio: 2.0-to-1 (state: 2.9-to-1)

> Median household income: $78,709 (state: $61,744)

> Median home value: $153,700 (state: $180,200)

> Home ownership rate: 79.6% (state: 68.9%)

> Location: Allegheny County

> Population: 27,195

Rhode Island: Valley Falls

> Home value to income ratio: 2.9-to-1 (state: 3.9-to-1)

> Median household income: $83,090 (state: $67,167)

> Median home value: $239,000 (state: $261,900)

> Home ownership rate: 67.7% (state: 60.8%)

> Location: Providence County

> Population: 11,882

[in-text-ad-2]

South Carolina: Irmo

> Home value to income ratio: 1.9-to-1 (state: 3.1-to-1)

> Median household income: $66,313 (state: $53,199)

> Median home value: $125,000 (state: $162,300)

> Home ownership rate: 76.2% (state: 69.4%)

> Location: Richland County

> Population: 12,215

South Dakota: Pierre

> Home value to income ratio: 2.8-to-1 (state: 2.9-to-1)

> Median household income: $62,192 (state: $58,275)

> Median home value: $175,600 (state: $167,100)

> Home ownership rate: 64.7% (state: 67.8%)

> Location: Hughes County

> Population: 13,961

[in-text-ad]

Tennessee: Bartlett

> Home value to income ratio: 2.2-to-1 (state: 3.1-to-1)

> Median household income: $84,688 (state: $53,320)

> Median home value: $185,100 (state: $167,200)

> Home ownership rate: 85.2% (state: 66.3%)

> Location: Shelby County

> Population: 59,102

Texas: Nederland

> Home value to income ratio: 1.7-to-1 (state: 2.8-to-1)

> Median household income: $79,903 (state: $61,874)

> Median home value: $132,700 (state: $172,500)

> Home ownership rate: 72.2% (state: 62.0%)

> Location: Jefferson County

> Population: 17,357

Utah: West Point

> Home value to income ratio: 2.7-to-1 (state: 3.9-to-1)

> Median household income: $92,655 (state: $71,621)

> Median home value: $254,500 (state: $279,100)

> Home ownership rate: 91.3% (state: 70.2%)

> Location: Davis County

> Population: 10,615

[in-text-ad-2]

Vermont: Essex Junction

> Home value to income ratio: 3.7-to-1 (state: 3.7-to-1)

> Median household income: $80,019 (state: $61,973)

> Median home value: $298,200 (state: $227,700)

> Home ownership rate: 65.4% (state: 70.8%)

> Location: Chittenden County

> Population: 10,603

Virginia: Brandermill

> Home value to income ratio: 2.5-to-1 (state: 3.7-to-1)

> Median household income: $101,426 (state: $74,222)

> Median home value: $257,000 (state: $273,100)

> Home ownership rate: 69.2% (state: 66.3%)

> Location: Chesterfield County

> Population: 13,836

[in-text-ad]

Washington: West Richland

> Home value to income ratio: 2.7-to-1 (state: 4.6-to-1)

> Median household income: $99,817 (state: $73,775)

> Median home value: $270,500 (state: $339,000)

> Home ownership rate: 84.1% (state: 63.0%)

> Location: Benton County

> Population: 14,495

West Virginia: Weirton

> Home value to income ratio: 1.9-to-1 (state: 2.6-to-1)

> Median household income: $49,496 (state: $46,711)

> Median home value: $94,800 (state: $119,600)

> Home ownership rate: 67.0% (state: 73.2%)

> Location: Hancock County

> Population: 18,670

Wisconsin: Harrison

> Home value to income ratio: 2.1-to-1 (state: 2.9-to-1)

> Median household income: $107,225 (state: $61,747)

> Median home value: $223,300 (state: $180,600)

> Home ownership rate: 96.6% (state: 67.0%)

> Location: Calumet County

> Population: 12,009

[in-text-ad-2]

Wyoming: Gillette

> Home value to income ratio: 2.7-to-1 (state: 3.4-to-1)

> Median household income: $79,789 (state: $64,049)

> Median home value: $216,400 (state: $220,500)

> Home ownership rate: 69.9% (state: 70.4%)

> Location: Campbell County

> Population: 32,857

Methodology:

To determine the least expensive place to live in every state, 24/7 Wall St. reviewed five-year data on median home value and median household income from the U.S. Census Bureau’s 2019 American Community Survey. Cities, towns, villages, and census-designated places were ranked based on the ratio of median home value to median household income. Places with the lowest ratio of median home value to median household income were considered the least expensive. Supplemental data on poverty rate, homeownership rate, and population also came from the 2019 ACS.

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.