A surge in demand for homes in the United States, in addition to limited housing inventory, has created a sellers market unlike anything seen in recent memory. Homes are now selling faster than ever before — and also for more money than ever before.

While rapidly rising housing prices may discourage many would-be buyers, there are parts of the country where home values are relatively low and affordable to a wider range of budgets. In nearly every state, there is at least one county or county equivalent where the typical home costs less than the national median home value of $217,500.

Using data on median home value from the U.S. Census Bureau, 24/7 Wall St. identified the least expensive county to buy a home in every state. We included counties, county equivalents, and independent cities in our analysis.

Home values in a given area are often a reflection of what residents can afford, and in every county or county equivalent on this list, the median household income is lower than it is across the state as a whole. Here is a look at the poorest city in every state.

Despite the lower incomes, home values in these areas are often low enough to make it less likely that buyers would need to rely on a mortgage. In nearly every county or county equivalent on this list, homeowners are less likely to have a standing mortgage on their home than the typical homeowner across the state as a whole. This is the American city with the most foreclosures.

Click here to see the least expensive county to buy a home in every state.

Click here to see our detailed methodology.

Alabama: Perry County

> Median home value: $65,000 (Alabama: $142,700)

> Median monthly housing costs with a mortgage: $980 (Alabama: $1,186)

> Share of housing units with a mortgage: 31.3% (Alabama: 56.2%)

> Homeownership rate: 71.9% (Alabama: 68.8%)

> Median household income: $23,447 (Alabama: $50,536)

[in-text-ad]

Alaska: Kusilvak Census Area

> Median home value: $71,500 (Alaska: $270,400)

> Median monthly housing costs with a mortgage: $652 (Alaska: $1,933)

> Share of housing units with a mortgage: 20.7% (Alaska: 62.9%)

> Homeownership rate: 71.7% (Alaska: 64.3%)

> Median household income: $36,754 (Alaska: $77,640)

Arizona: Apache County

> Median home value: $59,900 (Arizona: $225,500)

> Median monthly housing costs with a mortgage: $971 (Arizona: $1,434)

> Share of housing units with a mortgage: 20.3% (Arizona: 63.8%)

> Homeownership rate: 78.9% (Arizona: 64.4%)

> Median household income: $32,508 (Arizona: $58,945)

Arkansas: Monroe County

> Median home value: $61,400 (Arkansas: $127,800)

> Median monthly housing costs with a mortgage: $894 (Arkansas: $1,089)

> Share of housing units with a mortgage: 33.5% (Arkansas: 54.5%)

> Homeownership rate: 59.9% (Arkansas: 65.6%)

> Median household income: $38,468 (Arkansas: $47,597)

[in-text-ad-2]

California: Modoc County

> Median home value: $140,600 (California: $505,000)

> Median monthly housing costs with a mortgage: $1,149 (California: $2,357)

> Share of housing units with a mortgage: 44.6% (California: 70.3%)

> Homeownership rate: 74.9% (California: 54.8%)

> Median household income: $45,507 (California: $75,235)

Colorado: Crowley County

> Median home value: $79,400 (Colorado: $343,300)

> Median monthly housing costs with a mortgage: $976 (Colorado: $1,744)

> Share of housing units with a mortgage: 48.3% (Colorado: 71.3%)

> Homeownership rate: 72.5% (Colorado: 65.2%)

> Median household income: $42,135 (Colorado: $72,331)

[in-text-ad]

Connecticut: Windham County

> Median home value: $204,400 (Connecticut: $275,400)

> Median monthly housing costs with a mortgage: $1,685 (Connecticut: $2,119)

> Share of housing units with a mortgage: 67.4% (Connecticut: 67.8%)

> Homeownership rate: 69.0% (Connecticut: 66.1%)

> Median household income: $66,550 (Connecticut: $78,444)

Delaware: Kent County

> Median home value: $220,600 (Delaware: $251,100)

> Median monthly housing costs with a mortgage: $1,472 (Delaware: $1,587)

> Share of housing units with a mortgage: 64.8% (Delaware: 65.0%)

> Homeownership rate: 69.1% (Delaware: 71.2%)

> Median household income: $60,910 (Delaware: $68,287)

Florida: Liberty County

> Median home value: $75,100 (Florida: $215,300)

> Median monthly housing costs with a mortgage: $1,003 (Florida: $1,503)

> Share of housing units with a mortgage: 36.9% (Florida: 56.8%)

> Homeownership rate: 75.4% (Florida: 65.4%)

> Median household income: $38,015 (Florida: $55,660)

[in-text-ad-2]

Georgia: Stewart County

> Median home value: $49,200 (Georgia: $176,000)

> Median monthly housing costs with a mortgage: $955 (Georgia: $1,417)

> Share of housing units with a mortgage: 27.3% (Georgia: 65.1%)

> Homeownership rate: 73.5% (Georgia: 63.3%)

> Median household income: $29,732 (Georgia: $58,700)

Hawaii: Hawaii County

> Median home value: $350,000 (Hawaii: $615,300)

> Median monthly housing costs with a mortgage: $1,689 (Hawaii: $2,418)

> Share of housing units with a mortgage: 57.8% (Hawaii: 65.1%)

> Homeownership rate: 67.7% (Hawaii: 58.9%)

> Median household income: $62,409 (Hawaii: $81,275)

[in-text-ad]

Idaho: Shoshone County

> Median home value: $127,900 (Idaho: $212,300)

> Median monthly housing costs with a mortgage: $1,028 (Idaho: $1,270)

> Share of housing units with a mortgage: 48.4% (Idaho: 64.6%)

> Homeownership rate: 70.0% (Idaho: 70.0%)

> Median household income: $39,386 (Idaho: $55,785)

Illinois: Alexander County

> Median home value: $56,000 (Illinois: $194,500)

> Median monthly housing costs with a mortgage: $940 (Illinois: $1,693)

> Share of housing units with a mortgage: 34.4% (Illinois: 63.3%)

> Homeownership rate: 73.7% (Illinois: 66.1%)

> Median household income: $36,806 (Illinois: $65,886)

Indiana: Blackford County

> Median home value: $70,600 (Indiana: $141,700)

> Median monthly housing costs with a mortgage: $920 (Indiana: $1,148)

> Share of housing units with a mortgage: 53.3% (Indiana: 65.5%)

> Homeownership rate: 74.7% (Indiana: 69.1%)

> Median household income: $43,505 (Indiana: $56,303)

[in-text-ad-2]

Iowa: Pocahontas County

> Median home value: $76,000 (Iowa: $147,800)

> Median monthly housing costs with a mortgage: $901 (Iowa: $1,260)

> Share of housing units with a mortgage: 42.3% (Iowa: 60.6%)

> Homeownership rate: 77.3% (Iowa: 71.1%)

> Median household income: $52,448 (Iowa: $60,523)

Kansas: Chautauqua County

> Median home value: $49,500 (Kansas: $151,900)

> Median monthly housing costs with a mortgage: $1,033 (Kansas: $1,378)

> Share of housing units with a mortgage: 30.5% (Kansas: 59.4%)

> Homeownership rate: 77.7% (Kansas: 66.3%)

> Median household income: $40,298 (Kansas: $59,597)

[in-text-ad]

Kentucky: Knott County

> Median home value: $51,500 (Kentucky: $141,000)

> Median monthly housing costs with a mortgage: $861 (Kentucky: $1,178)

> Share of housing units with a mortgage: 29.8% (Kentucky: 57.7%)

> Homeownership rate: 74.8% (Kentucky: 67.2%)

> Median household income: $31,198 (Kentucky: $50,589)

Louisiana: Tensas Parish

> Median home value: $66,400 (Louisiana: $163,100)

> Median monthly housing costs with a mortgage: $917 (Louisiana: $1,295)

> Share of housing units with a mortgage: 20.5% (Louisiana: 52.3%)

> Homeownership rate: 67.5% (Louisiana: 65.6%)

> Median household income: $27,500 (Louisiana: $49,469)

Maine: Aroostook County

> Median home value: $99,600 (Maine: $190,400)

> Median monthly housing costs with a mortgage: $986 (Maine: $1,398)

> Share of housing units with a mortgage: 51.9% (Maine: 61.7%)

> Homeownership rate: 72.0% (Maine: 72.3%)

> Median household income: $41,123 (Maine: $57,918)

[in-text-ad-2]

Maryland: Allegany County

> Median home value: $120,700 (Maryland: $314,800)

> Median monthly housing costs with a mortgage: $1,053 (Maryland: $2,017)

> Share of housing units with a mortgage: 54.5% (Maryland: 72.9%)

> Homeownership rate: 68.8% (Maryland: 66.9%)

> Median household income: $45,893 (Maryland: $84,805)

Massachusetts: Hampden County

> Median home value: $207,800 (Massachusetts: $381,600)

> Median monthly housing costs with a mortgage: $1,608 (Massachusetts: $2,225)

> Share of housing units with a mortgage: 66.1% (Massachusetts: 69.2%)

> Homeownership rate: 61.1% (Massachusetts: 62.4%)

> Median household income: $55,429 (Massachusetts: $81,215)

[in-text-ad]

Michigan: Gogebic County

> Median home value: $67,100 (Michigan: $154,900)

> Median monthly housing costs with a mortgage: $898 (Michigan: $1,298)

> Share of housing units with a mortgage: 41.3% (Michigan: 60.1%)

> Homeownership rate: 77.5% (Michigan: 71.2%)

> Median household income: $38,839 (Michigan: $57,144)

Minnesota: Traverse County

> Median home value: $81,400 (Minnesota: $223,900)

> Median monthly housing costs with a mortgage: $917 (Minnesota: $1,580)

> Share of housing units with a mortgage: 39.5% (Minnesota: 66.3%)

> Homeownership rate: 79.6% (Minnesota: 71.6%)

> Median household income: $51,957 (Minnesota: $71,306)

Mississippi: Quitman County

> Median home value: $50,900 (Mississippi: $119,000)

> Median monthly housing costs with a mortgage: $820 (Mississippi: $1,147)

> Share of housing units with a mortgage: 30.5% (Mississippi: 49.4%)

> Homeownership rate: 58.7% (Mississippi: 68.2%)

> Median household income: $25,283 (Mississippi: $45,081)

[in-text-ad-2]

Missouri: Worth County

> Median home value: $63,800 (Missouri: $157,200)

> Median monthly housing costs with a mortgage: $928 (Missouri: $1,277)

> Share of housing units with a mortgage: 41.8% (Missouri: 61.5%)

> Homeownership rate: 76.4% (Missouri: 66.8%)

> Median household income: $53,580 (Missouri: $55,461)

Montana: Blaine County

> Median home value: $94,300 (Montana: $230,600)

> Median monthly housing costs with a mortgage: $1,138 (Montana: $1,429)

> Share of housing units with a mortgage: 36.6% (Montana: 56.7%)

> Homeownership rate: 58.0% (Montana: 68.1%)

> Median household income: $41,279 (Montana: $54,970)

[in-text-ad]

Nebraska: Hitchcock County

> Median home value: $66,700 (Nebraska: $155,800)

> Median monthly housing costs with a mortgage: $872 (Nebraska: $1,386)

> Share of housing units with a mortgage: 28.6% (Nebraska: 60.5%)

> Homeownership rate: 73.9% (Nebraska: 66.1%)

> Median household income: $49,962 (Nebraska: $61,439)

Nevada: Mineral County

> Median home value: $98,900 (Nevada: $267,900)

> Median monthly housing costs with a mortgage: $909 (Nevada: $1,524)

> Share of housing units with a mortgage: 35.5% (Nevada: 68.0%)

> Homeownership rate: 70.6% (Nevada: 56.3%)

> Median household income: $35,806 (Nevada: $60,365)

New Hampshire: Coos County

> Median home value: $128,000 (New Hampshire: $261,700)

> Median monthly housing costs with a mortgage: $1,240 (New Hampshire: $1,948)

> Share of housing units with a mortgage: 47.8% (New Hampshire: 65.8%)

> Homeownership rate: 70.7% (New Hampshire: 71.1%)

> Median household income: $47,117 (New Hampshire: $76,768)

[in-text-ad-2]

New Jersey: Cumberland County

> Median home value: $162,500 (New Jersey: $335,600)

> Median monthly housing costs with a mortgage: $1,614 (New Jersey: $2,465)

> Share of housing units with a mortgage: 61.5% (New Jersey: 66.8%)

> Homeownership rate: 65.2% (New Jersey: 63.9%)

> Median household income: $54,149 (New Jersey: $82,545)

New Mexico: McKinley County

> Median home value: $64,800 (New Mexico: $171,400)

> Median monthly housing costs with a mortgage: $1,040 (New Mexico: $1,280)

> Share of housing units with a mortgage: 25.9% (New Mexico: 54.2%)

> Homeownership rate: 70.9% (New Mexico: 67.7%)

> Median household income: $33,834 (New Mexico: $49,754)

[in-text-ad]

New York: Allegany County

> Median home value: $76,400 (New York: $313,700)

> Median monthly housing costs with a mortgage: $997 (New York: $2,155)

> Share of housing units with a mortgage: 44.9% (New York: 60.8%)

> Homeownership rate: 76.2% (New York: 53.9%)

> Median household income: $48,412 (New York: $68,486)

North Carolina: Robeson County

> Median home value: $75,600 (North Carolina: $172,500)

> Median monthly housing costs with a mortgage: $1,003 (North Carolina: $1,314)

> Share of housing units with a mortgage: 38.7% (North Carolina: 63.2%)

> Homeownership rate: 65.6% (North Carolina: 65.2%)

> Median household income: $34,976 (North Carolina: $54,602)

North Dakota: Towner County

> Median home value: $70,200 (North Dakota: $193,900)

> Median monthly housing costs with a mortgage: $912 (North Dakota: $1,426)

> Share of housing units with a mortgage: 25.2% (North Dakota: 53.5%)

> Homeownership rate: 73.1% (North Dakota: 62.4%)

> Median household income: $52,300 (North Dakota: $64,894)

[in-text-ad-2]

Ohio: Crawford County

> Median home value: $88,400 (Ohio: $145,700)

> Median monthly housing costs with a mortgage: $941 (Ohio: $1,282)

> Share of housing units with a mortgage: 52.0% (Ohio: 62.9%)

> Homeownership rate: 69.7% (Ohio: 66.1%)

> Median household income: $44,971 (Ohio: $56,602)

Oklahoma: Cimarron County

> Median home value: $56,500 (Oklahoma: $136,800)

> Median monthly housing costs with a mortgage: $823 (Oklahoma: $1,234)

> Share of housing units with a mortgage: 29.2% (Oklahoma: 54.9%)

> Homeownership rate: 72.9% (Oklahoma: 65.6%)

> Median household income: $46,328 (Oklahoma: $52,919)

[in-text-ad]

Oregon: Gilliam County

> Median home value: $115,900 (Oregon: $312,200)

> Median monthly housing costs with a mortgage: $1,128 (Oregon: $1,699)

> Share of housing units with a mortgage: 51.3% (Oregon: 66.2%)

> Homeownership rate: 67.3% (Oregon: 62.4%)

> Median household income: $47,500 (Oregon: $62,818)

Pennsylvania: Cameron County

> Median home value: $78,500 (Pennsylvania: $180,200)

> Median monthly housing costs with a mortgage: $973 (Pennsylvania: $1,494)

> Share of housing units with a mortgage: 42.4% (Pennsylvania: 60.1%)

> Homeownership rate: 72.0% (Pennsylvania: 68.9%)

> Median household income: $41,165 (Pennsylvania: $61,744)

Rhode Island: Providence County

> Median home value: $233,500 (Rhode Island: $261,900)

> Median monthly housing costs with a mortgage: $1,779 (Rhode Island: $1,860)

> Share of housing units with a mortgage: 69.2% (Rhode Island: 68.4%)

> Homeownership rate: 54.2% (Rhode Island: 60.8%)

> Median household income: $58,974 (Rhode Island: $67,167)

[in-text-ad-2]

South Carolina: Allendale County

> Median home value: $49,200 (South Carolina: $162,300)

> Median monthly housing costs with a mortgage: $858 (South Carolina: $1,246)

> Share of housing units with a mortgage: 30.1% (South Carolina: 58.3%)

> Homeownership rate: 68.2% (South Carolina: 69.4%)

> Median household income: $27,185 (South Carolina: $53,199)

South Dakota: Jackson County

> Median home value: $52,500 (South Dakota: $167,100)

> Median monthly housing costs with a mortgage: $1,082 (South Dakota: $1,340)

> Share of housing units with a mortgage: 18.2% (South Dakota: 55.6%)

> Homeownership rate: 58.3% (South Dakota: 67.8%)

> Median household income: $33,295 (South Dakota: $58,275)

[in-text-ad]

Tennessee: Lake County

> Median home value: $81,300 (Tennessee: $167,200)

> Median monthly housing costs with a mortgage: $864 (Tennessee: $1,244)

> Share of housing units with a mortgage: 42.5% (Tennessee: 59.2%)

> Homeownership rate: 54.7% (Tennessee: 66.3%)

> Median household income: $35,191 (Tennessee: $53,320)

Texas: Hardeman County

> Median home value: $43,100 (Texas: $172,500)

> Median monthly housing costs with a mortgage: $938 (Texas: $1,606)

> Share of housing units with a mortgage: 31.8% (Texas: 57.4%)

> Homeownership rate: 67.9% (Texas: 62.0%)

> Median household income: $41,859 (Texas: $61,874)

Utah: San Juan County

> Median home value: $129,700 (Utah: $279,100)

> Median monthly housing costs with a mortgage: $1,238 (Utah: $1,551)

> Share of housing units with a mortgage: 31.1% (Utah: 70.5%)

> Homeownership rate: 80.6% (Utah: 70.2%)

> Median household income: $45,394 (Utah: $71,621)

[in-text-ad-2]

Vermont: Essex County

> Median home value: $136,600 (Vermont: $227,700)

> Median monthly housing costs with a mortgage: $1,162 (Vermont: $1,621)

> Share of housing units with a mortgage: 50.4% (Vermont: 62.6%)

> Homeownership rate: 81.2% (Vermont: 70.8%)

> Median household income: $44,349 (Vermont: $61,973)

Virginia: Buchanan County

> Median home value: $72,300 (Virginia: $273,100)

> Median monthly housing costs with a mortgage: $984 (Virginia: $1,799)

> Share of housing units with a mortgage: 25.9% (Virginia: 68.7%)

> Homeownership rate: 77.3% (Virginia: 66.3%)

> Median household income: $31,956 (Virginia: $74,222)

[in-text-ad]

Washington: Garfield County

> Median home value: $149,400 (Washington: $339,000)

> Median monthly housing costs with a mortgage: $1,071 (Washington: $1,886)

> Share of housing units with a mortgage: 52.7% (Washington: 68.5%)

> Homeownership rate: 71.5% (Washington: 63.0%)

> Median household income: $55,900 (Washington: $73,775)

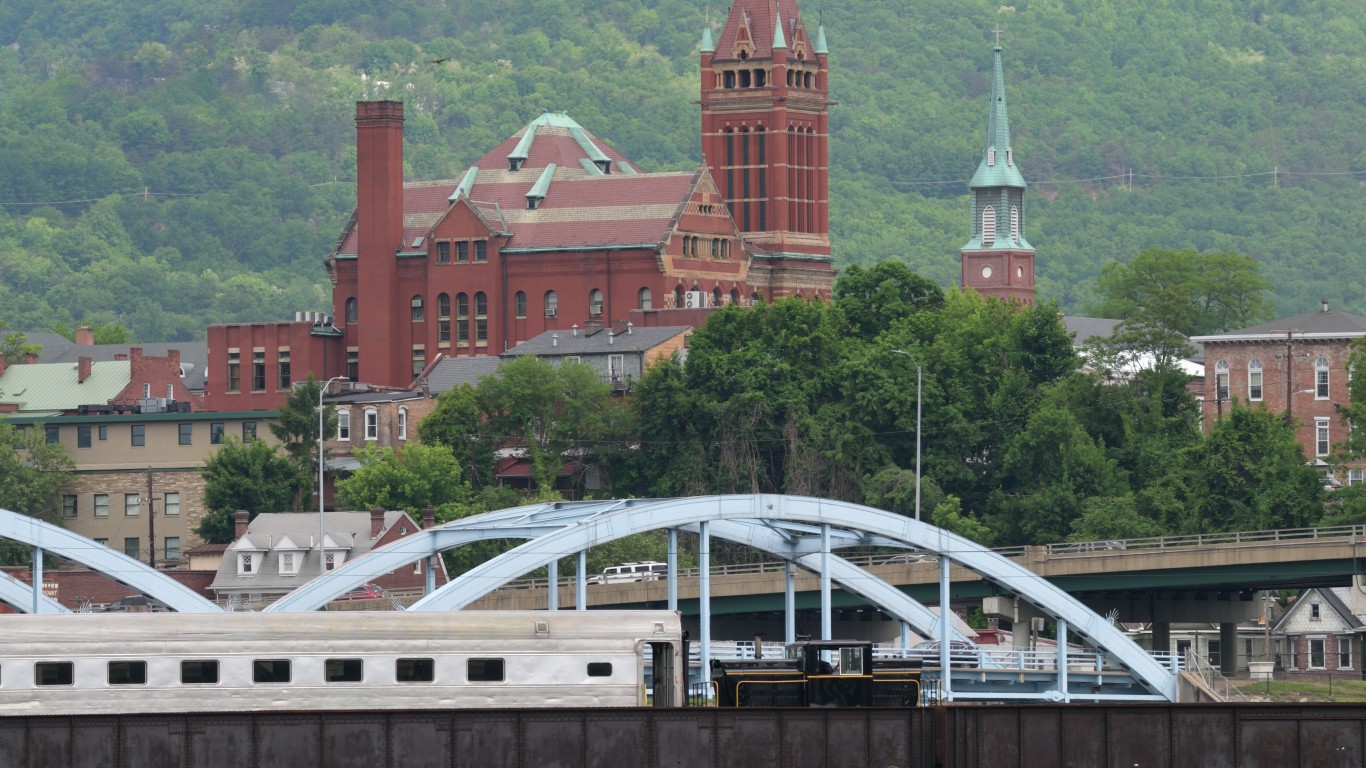

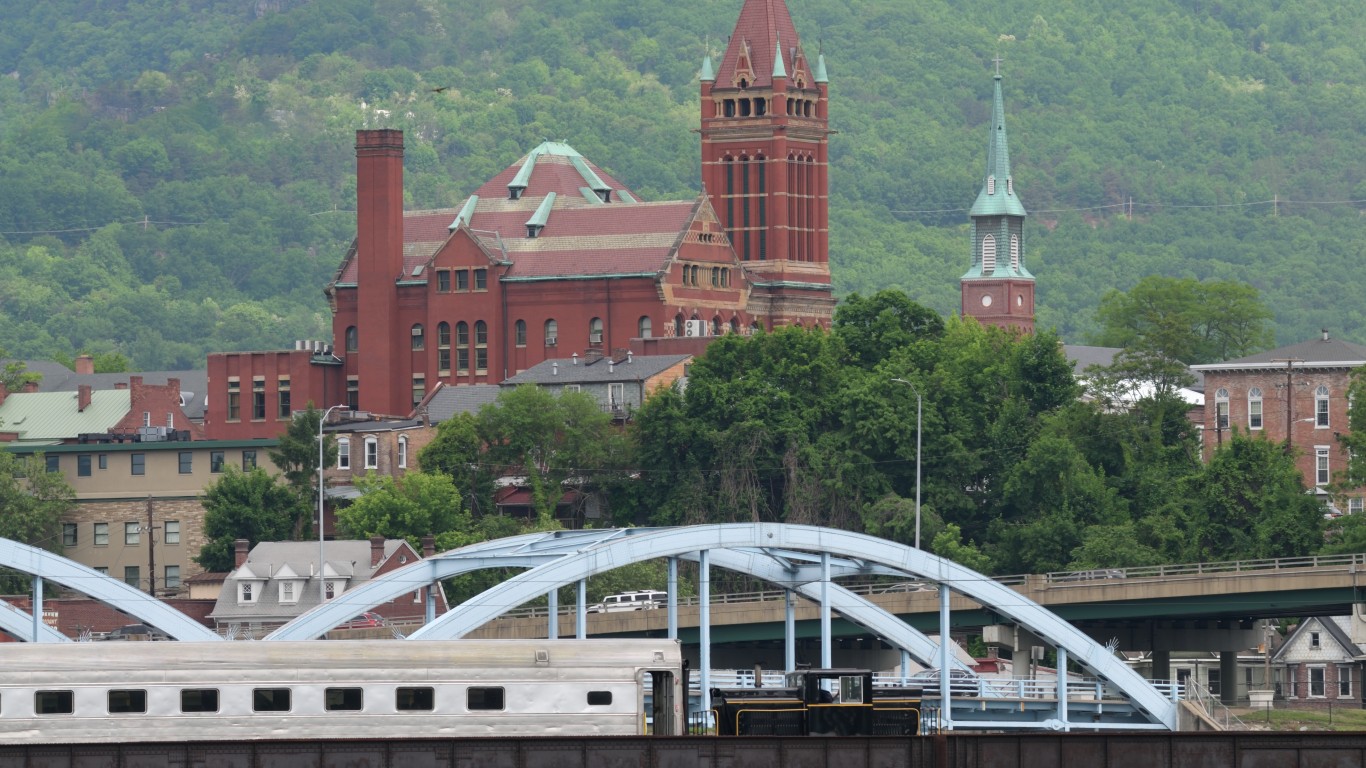

West Virginia: McDowell County

> Median home value: $35,000 (West Virginia: $119,600)

> Median monthly housing costs with a mortgage: $745 (West Virginia: $1,050)

> Share of housing units with a mortgage: 14.3% (West Virginia: 46.6%)

> Homeownership rate: 78.7% (West Virginia: 73.2%)

> Median household income: $27,682 (West Virginia: $46,711)

Wisconsin: Menominee County

> Median home value: $101,800 (Wisconsin: $180,600)

> Median monthly housing costs with a mortgage: $1,157 (Wisconsin: $1,430)

> Share of housing units with a mortgage: 37.8% (Wisconsin: 63.9%)

> Homeownership rate: 68.0% (Wisconsin: 67.0%)

> Median household income: $40,921 (Wisconsin: $61,747)

[in-text-ad-2]

Wyoming: Hot Springs County

> Median home value: $147,300 (Wyoming: $220,500)

> Median monthly housing costs with a mortgage: $1,204 (Wyoming: $1,459)

> Share of housing units with a mortgage: 46.8% (Wyoming: 58.3%)

> Homeownership rate: 75.2% (Wyoming: 70.4%)

> Median household income: $51,413 (Wyoming: $64,049)

Methodology

To determine the most affordable county to buy a home in every state, 24/7 Wall St. reviewed five-year estimates of median owner-occupied home values from the U.S. Census Bureau’s 2019 American Community Survey.

Of the 3,220 counties or county equivalents, 3,141 had boundaries that fell within one of the 50 states, while the rest were in the District of Columbia or Puerto Rico.

Counties were excluded if owner-occupied median home values were not available in the 2019 ACS, if there were fewer than 1,000 housing units, or if the sampling error associated with a county’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation — a statistical assessment of how reliable an estimate is — for a county’s owner-occupied median home value was above 15% and greater than two standard deviations above the mean CV for all counties’ owner-occupied median home values. We similarly excluded counties that had a sampling error too high for their population, using the same definition.

The remaining 3,043 places were ranked within their state based on their owner-occupied median home values. To break ties, we used median monthly housing costs with a mortgage.

Additional information on median monthly housing costs with a mortgage, the share of owner-occupied housing units that have a mortgage, rates of homeownership, and median household income are also five-year estimates from the 2019 ACS.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.