Special Report

From Wilson to Trump, US Presidents Who Oversaw the Largest Changes in the National Debt

Published:

Last Updated:

Calls for fiscal responsibility and debt reduction are common in Washington D.C., but a demonstrated commitment to achieving those goals is not. The federal government has not had a balanced budget in two decades, and partially as a result, American taxpayers are on the hook for more than $28.4 trillion in accumulated national debt.

The ability to accumulate debt is an important function of the federal government. Deficit spending can stimulate economic growth, strengthen social safety nets, and provide funding at times of national emergencies. However, keeping that debt at manageable levels often requires difficult and politically unpopular decisions — decisions that few U.S. presidents appear willing to make.

Using federal government data, 24/7 Wall St. determined the effect each U.S. president has had on total national debt in the last 100 years. Presidents were ranked by the change in the national debt from the beginning of their first fiscal year in office to the end of their last. Debt figures are not inflation adjusted.

While American presidents have mandatory spending obligations, such as Social Security and Medicare, they have some level of control over discretionary budgets, as well as taxes. Still, a president’s budget, as well as any proposed changes to the tax code, must receive congressional approval. As a result, when it comes to the balance between federal spending and revenue, a president’s relationship with lawmakers matters. Here is a look at the presidents with the best and worst relationships with congress.

Additionally, American presidents are often faced with unforeseen challenges that take priority over a balanced budget. Many of the largest increases in the national debt took place in times of a national crisis. The attack on Pearl Harbor and America’s entry into World War II is the ultimate example. More recent examples include economic stimulus during the 2008 financial crisis and the COVID-19 pandemic. Other factors, such as GDP growth, can either help or hinder a president’s budgetary goals. Here is a look at what the stock market did under every president in the last 100 years.

Click here to see the presidents who oversaw the largest changes in the national debt.

Click here to see our methodology.

18. Calvin Coolidge (1923-1929)

> Change in federal debt during presidency: -24.2% (-$5.4 billion)

> Total federal debt first year in office: $22.3 billion

> Total federal debt final year in office: $16.9 billion

> Party affiliation: Republican

> Americans today with a positive opinion of Coolidge: 35% of adults

The U.S. debt fell by 24.2%, or $5.4 billion, from the beginning of fiscal 1923 to the end of fiscal 1929, the years spanning Calvin Coolidge’s presidency. A rapidly growing economy in the wake of World War I, in addition to limited spending, allowed Coolidge to reduce the federal debt even while cutting taxes.

However, economic growth and deregulation under Coolidge also brought growing inequality and worsening economic hardship for American farmers — all factors that contributed to the stock market crash of 1929 and the Great Depression.

[in-text-ad]

17. Warren Harding (1921-1923)

> Change in federal debt during presidency: -6.8% (-$1.6 billion)

> Total federal debt first year in office: $24.0 billion

> Total federal debt final year in office: $22.3 billion

> Party affiliation: Republican

> Americans today with a positive opinion of Harding: 27% of adults

President Warren Harding is widely regarded by historians as one of the worst presidents in U.S. history. However, despite being plagued by corruption scandals, Harding is one of only two presidents in the last 100 years to reduce government debt. Decidedly pro-business, Harding’s policies included tax cuts and protective tariffs.

Harding took office in 1921, when the federal debt totalled $24.0 billion. Due in part to growing prosperity following World War I, U.S. debt stood at $22.3 billion at the end of fiscal 1923, the year he died of a heart attack while in office.

16. Harry S. Truman (1945-1953)

> Change in federal debt during presidency: +2.9% (+$7.4 billion)

> Total federal debt first year in office: $258.7 billion

> Total federal debt final year in office: $266.1 billion

> Party affiliation: Democratic

> Americans today with a positive opinion of Truman: 51% of adults

Serving as vice president for only a few short months before President Franklin Roosevelt died in office, Harry Truman took the oath of office on April 12, 1945, becoming the 33rd President of the United States. Presiding over Japan’s surrender and the end of World War II, Truman was tasked with transitioning the country to a peacetime economy in the face of organized labor strikes, rapid inflation, and congressional opposition to his progressive agenda. During Truman’s first full year in office, U.S. GDP fell by 11.6%, as the economy suddenly contracted after the war.

With the goal of balancing the federal budget, Truman increased taxes and minimized spending — policies that were ultimately tweaked following a period of economic stagnation. The outbreak of the Korean War in 1950 also led to increased government spending and strong economic growth. Overall, U.S. debt climbed by 2.9%, or $7.4 billion, over the years of the Truman Administration — the smallest increase under any president in the last 100 years.

15. John F. Kennedy (1961-1963)

> Change in federal debt during presidency: +5.8% (+$16.9 billion)

> Total federal debt first year in office: $289.0 billion

> Total federal debt final year in office: $305.9 billion

> Party affiliation: Democratic

> Americans today with a positive opinion of Kennedy: 73% of adults

John F. Kennedy’s presidency was short and tumultuous. From Jan. 20, 1961, the day he was sworn in, to Nov. 22, 1963, the day he was assassinated, Kennedy’s time in office was defined not only by escalating Cold War tensions abroad, but also by an ambitious domestic agenda.

Taking office at a time of rising unemployment, falling corporate profits, and a stagnating stock market, Kennedy made turning the economy around a priority of his administration. Not only did he expand Social Security and unemployment benefits, increase the minimum wage, and invest in infrastructure, but he also pushed for reduced taxes, insisting that “a rising tide lifts all boats.” Though his tax cuts did not receive congressional approval until three months after his assassination, Kennedy’s policies led to a reduced federal deficit and strong returns on Wall Street. U.S. debt climbed by a relatively marginal 5.8% from fiscal 1961 to fiscal 1963.

[in-text-ad-2]

14. Dwight Eisenhower (1953-1961)

> Change in federal debt during presidency: +8.6% (+$22.9 billion)

> Total federal debt first year in office: $266.1 billion

> Total federal debt final year in office: $289.0 billion

> Party affiliation: Republican

> Americans today with a positive opinion of Eisenhower: 61% of adults

Dwight D. Eisenhower was not a typical politician. Before running a successful campaign for president in 1952, Eisenhower served as a four-star general in the U.S. Army and then as Supreme Commander of Allied Forces in Europe in WWII. As president, Eisenhower prioritized a balanced budget, resisting pressure from the right to cut taxes while not shying away from investing in the country’s future. During his presidency, Eisenhower built the St. Lawrence Seaway, started NASA, and most famously created the Interstate Highway system — investing $119 billion in the construction of 41,000 miles of roadway.

In addition, Eisenhower expanded Social Security, increased the minimum wage, and created the Departments of Health, Education, and Welfare. Even with these investments, federal spending as a share of GDP fell during Eisenhower’s presidency — a feat no president since can claim. Eisenhower is one of only five presidents in the last 100 years to oversee a U.S. debt growth of less than 10% during his time in office.

13. Lyndon Johnson (1963-1969)

> Change in federal debt during presidency: +15.7% (+$47.9 billion)

> Total federal debt first year in office: $305.9 billion

> Total federal debt final year in office: $353.7 billion

> Party affiliation: Democratic

> Americans today with a positive opinion of Johnson: 42% of adults

Few U.S. presidents have had a domestic policy platform as ambitious as that of Lyndon Johnson’s — and even fewer have implemented reforms of such size and scope. Taking office following the assination of John F. Kennedy and winning in a landslide election the following year, Johnson claimed a mandate for his “Great Society” agenda. The litany of new programs and initiatives under Johson included the National Endowment for the Arts, the Highway Safety Act, the Public Broadcasting Act, Medicare and Medicaid, consumer protections, the Civil Rights Act, and the Voting Rights Act.

Economic growth was strong during Johnson’s presidency, ranging between 2.7% to 6.6% annually. Despite the rapid expansion in the role of government — and a ramp up of combat operations in Vietnam — U.S. debt grew by 15.7% over the years Johnson was in the White House, a far smaller increase than during most modern presidents’ time in office.

[in-text-ad]

12. William J. Clinton (1993-2001)

> Change in federal debt during presidency: +31.6% (+$1.4 trillion)

> Total federal debt first year in office: $4.4 trillion

> Total federal debt final year in office: $5.8 trillion

> Party affiliation: Democratic

> Americans today with a positive opinion of Clinton: 41% of adults

Bill Clinton’s two terms in the White House marked an era of economic prosperity in the United States. Under the Clinton administration, unemployment hit its lowest level in decades, inflation declined to a 30 year low, homeownership soared to all-time highs — and he achieved a budget surplus in the four final fiscal years he held office.

Additionally, due in part to a budget surplus in Clinton’s four final years in office, the federal debt rose by 31.6% during the Clinton years, far less than most presidents in the last century. Clinton’s ability to balance the budget for several years of his presidency was due in part to policies that raised taxes and cut spending programs. Rapid economic growth also led to a surge in tax revenue, as the U.S. economy expanded each year Clinton was in office, from between 2.7% to 4.8%, depending on the year.

11. Herbert Hoover (1929-1933)

> Change in federal debt during presidency: +33.1% (+$5.6 billion)

> Total federal debt first year in office: $16.9 billion

> Total federal debt final year in office: $22.5 billion

> Party affiliation: Republican

> Americans today with a positive opinion of Hoover: 39% of adults

Herbert Hoover took office with the reputation of a great humanitarian and capable civil servant who, through his various roles in the Wilson administration, delivered much needed food to German occupied Belgium and fed Allied forces overseas during WWI. He also organized food shipments to tens of millions of people starving in Russia and central Europe after the war.

Hoover eventually won the presidency, but less than a year after taking office, the stock market crash of 1929 hit and the country entered the Great Depression. Even in the face of economic collapse, Hoover was committed to maintaining a balanced budget, yet he also reduced taxes and increased public spending in an attempt to stimulate the economy that proved insufficient. Though much of the groundwork for the Great Depression was laid by Calvin Coolidge, Hoover’s predecessor in the Oval Office, Hoover bore the blame and was not elected to a second term. During Hoover’s time in office, the U.S. debt climbed 33.1% from $16.9 billion to $22.5 billion.

10. Richard Nixon (1969-1974)

> Change in federal debt during presidency: +34.3% (+$121.3 billion)

> Total federal debt first year in office: $353.7 billion

> Total federal debt final year in office: $475.1 billion

> Party affiliation: Republican

> Americans today with a positive opinion of Nixon: 31% of adults

Presiding over the end of the war in Vietnam and becoming the only U.S. president to resign, Richard Nixon’s economic policies and budgetary priorities are often overshadowed in the history books. As president, Nixon was up against some of the most daunting economic challenges the country had faced in decades. With inflation and unemployment rising in his second year, Nixon reversed course on an earlier strategy and announced a wage-and-price freeze, tax cuts, and a 10% import tax.

These policies temporarily turned the economy around, but the recovery was short lived. By the time Nixon stepped down amid the Watergate scandal, the stock market was crashing and unemployment and inflation were soaring. During his time in office, Nixon continued funding a war in Vietnam and used the federal government to address problems that were going unchecked, creating the Occupational Safety and Health Administration and the Environmental Protection Agency. Over Nixon’s years in office, the federal debt increased by 34.3%, or $121.3 billion.

[in-text-ad-2]

9. Donald J. Trump (2017-2021)

> Change in federal debt during presidency: +37.1% (+$6.8 trillion)

> Total federal debt first year in office: $20.2 trillion

> Total federal debt final year in office: $27.8 trillion

> Party affiliation: Republican

> Americans today with a positive opinion of Trump: 39% of adults

Over Donald Trump’s single term in the White House, American debt increased by $6.8 trillion, a larger monetary increase than under any other president in U.S. history — with the exception of President Barack Obama, who was in office twice as long. Still, in relative terms, the national debt increase of 37.1% under Trump is close to the median among presidents in the last 100 years.

Trump era economic policies were defined in large part by increases in defense and other spending, tax cuts, and a trade war with China. Under Trump, the federal government spent over $2 trillion to bolster the economy in the face of the COVID-19 pandemic in addition to previously budgeted spending.

8. Jimmy Carter (1977-1981)

> Change in federal debt during presidency: +42.8% (+$299.0 billion)

> Total federal debt first year in office: $698.8 billion

> Total federal debt final year in office: $1.0 trillion

> Party affiliation: Democratic

> Americans today with a positive opinion of Carter: 60% of adults

Jimmy Carter’s term in the Oval Office was marked by multiple economic hurdles that carried over from the Nixon-Ford era and were compounded by rising energy prices due in part to OPEC policies. Carter faced near record high inflation, at a time when unemployment was also approaching all-time highs. The Iranian hostage crisis of 1979 and resulting international tensions contributed to a 0.3% economic contraction in 1980, Carter’s final full-year in office.

Though he reduced the federal deficit as a share of gross national product, the national debt overall climbed by $299 billion, or 42.8%, during Carter’s four years in office.

[in-text-ad]

7. Gerald Ford (1974-1977)

> Change in federal debt during presidency: +47.1% (+$223.8 billion)

> Total federal debt first year in office: $475.1 billion

> Total federal debt final year in office: $698.8 billion

> Party affiliation: Republican

> Americans today with a positive opinion of Ford: 41% of adults

Vice President Gerald Ford moved into the Oval Office following the Watergate Scandal and the subsequent resignation of Nixon. Inheriting an economy suffering from stagflation — slow growth, high inflation, and high unemployment — Ford was able to successfully restore growth and jobs through deregulation and tax cuts. Inflation remained high, however.

During Ford’s tenure, New York City was facing a budget crisis, nearly going bankrupt. In a reversal of an earlier non-interventionist position, Ford authorized $2.3 billion in federal loans to the city. Still, minimal spending was a cornerstone of the Ford administration. With the goal of limiting the federal deficit, Ford vetoed multiple appropriations bills that came across his desk.

6. George H. W. Bush (1989-1993)

> Change in federal debt during presidency: +54.4% (+$1.6 trillion)

> Total federal debt first year in office: $2.9 trillion

> Total federal debt final year in office: $4.4 trillion

> Party affiliation: Republican

> Americans today with a positive opinion of H.W. Bush: 41% of adults

When President George H.W. Bush took office, reducing the federal deficit without raising taxes was a leading priority for his administration. As a result, he was limited in his willingness and ability to enact major new programs, opting instead to maintain the status quo left by the Reagan administration.

However, the savings and loan crisis led to a recession, reducing federal revenue. On top of that, to save the industry, the Bush White House issued a $100 billion bailout. Ultimately, in a move that many say cost him the 1992 election, Bush went back on his word and raised taxes to maintain a level of government revenue. During his single term in office, Bush added $1.6 trillion to the federal debt, a 54.4% increase.

5. Barack Obama (2009-2017)

> Change in federal debt during presidency: +70.0% (+$8.3 trillion)

> Total federal debt first year in office: $11.9 trillion

> Total federal debt final year in office: $20.2 trillion

> Party affiliation: Democratic

> Americans today with a positive opinion of Obama: 57% of adults

No American president added more monetarily to the U.S. debt than Barack Obama. Over his eight years in office, the federal debt climbed by $8.3 trillion. However, in relative terms, the 70% U.S. debt increase during the Obama administration was less than four other administrations in the last 100 years.

Obama took office in 2009, a time when the U.S. economy was in a virtual free fall as unemployment soared, the housing market collapsed, economic output fell, and financial institutions were on the brink of failure. In addition to the $700 billion relief program authorized under the Bush administration, Obama passed another $800 billion stimulus package. After contracting 2.5% in 2009, the U.S. economy grew every year of Obama’s presidency. Major policy changes during the Obama years included Medicaid expansion, the Affordable Care Act, strengthened regulations on financial institutions, and the end of the Iraq War.

[in-text-ad-2]

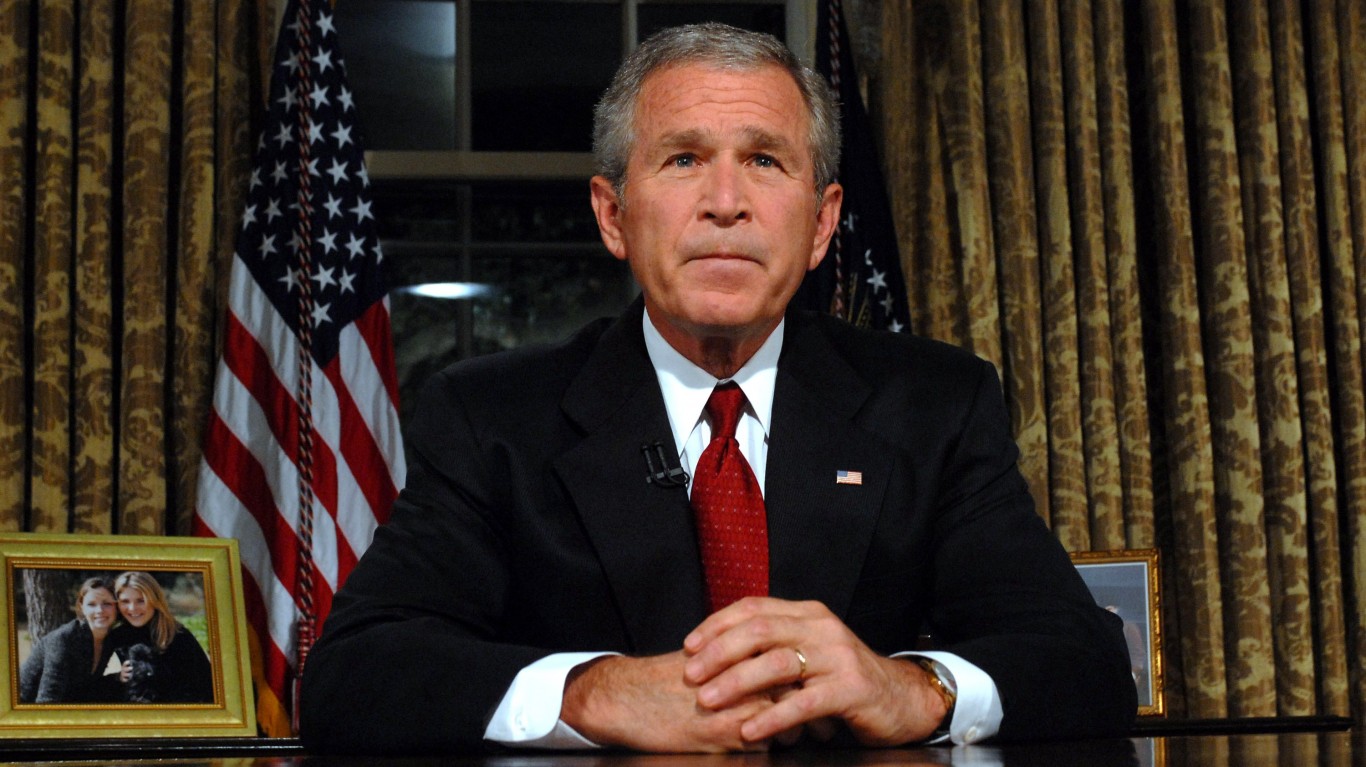

4. George W. Bush (2001-2009)

> Change in federal debt during presidency: +105.1% (+$6.1 trillion)

> Total federal debt first year in office: $5.8 trillion

> Total federal debt final year in office: $11.9 trillion

> Party affiliation: Republican

> Americans today with a positive opinion of W. Bush: 41% of adults

George W. Bush took the oath of office in January 2001, less than one year before the terrorist attacks of Sept. 11 — an event that shook the country. The terror attacks ultimately led to Bush’s administration’s war on terror and the creation of the U.S. Department of Homeland Security.

Bush’s economic initiatives began with a $1.35 trillion tax cut that was accompanied by an increase in entitlement and discretionary spending, as well as massive military engagements in Afghanistan and the Middle East. More tax cuts followed in 2003 and 2006, and as a result, 2001 was the last time the U.S. government had a budget surplus. Under Bush’s leadership, government debt more than doubled from $5.8 trillion in 2001 to $11.9 trillion in 2009.

3. Ronald Reagan (1981-1989)

> Change in federal debt during presidency: +186.4% (+$1.9 trillion)

> Total federal debt first year in office: $1.0 trillion

> Total federal debt final year in office: $2.9 trillion

> Party affiliation: Republican

> Americans today with a positive opinion of Reagan: 53% of adults

Though he was elected to office on a platform of tax cuts and reduced government spending, Ronald Reagan was the first American president in history to increase the country’s total debt by more than a trillion dollars. During the Reagan years, federal debt ballooned by 186.4%, from $1.0 trillion to $2.9 trillion.

While Reagan did cut corporate income taxes, he increased payroll taxes — and while he marginally cut social welfare spending, he expanded defense spending considerably. Additionally, Reagan’s easing of banking regulations ultimately brought about the savings and loan crisis that the George H.W. Bush administration had to deal with. Reagan era policies ushered in a period of strong economic expansion that peaked with a 7.2% annual GDP growth rate in 1984 — a high no American president has achieved since.

[in-text-ad]

2. Woodrow Wilson (1913-1921)

> Change in federal debt during presidency: +722.2% (+$21.1 billion)

> Total federal debt first year in office: $2.9 billion

> Total federal debt final year in office: $24.0 billion

> Party affiliation: Democratic

> Americans today with a positive opinion of Wilson: 41% of adults

Elected to office in 1912 and again in 1916, President Woodrow Wilson led the United States through WWI while enacting a host of progressive reform policies at home. With the U.S. economy in recession and a diverse American population with roots in both Allied and Axis power countries, Wilson initially adopted a posture of neutrality at the outbreak of the war. Ultimately, however, he reversed course, sending millions of U.S. troops to fight in Europe and redirecting American industrial power to support the war effort.

Domestically, Wilson reduced tariffs, implemented an income tax, created the Federal Reserve, tightened banking regulations, and reformed antitrust laws. Despite achieving a balanced budget in his first three years in office and a $1 billion surplus in his final year, the war effort under Wilson sent U.S. debt soaring 722.2%, from $2.9 billion in 1913 to $24.0 billion in 1921.

1. Franklin D. Roosevelt (1933-1945)

> Change in federal debt during presidency: +1,047.7% (+$236.1 billion)

> Total federal debt first year in office: $22.5 billion

> Total federal debt final year in office: $258.7 billion

> Party affiliation: Democratic

> Americans today with a positive opinion of Roosevelt: 67% of adults

Franklin Roosevelt served as president of the United States for 12 years, longer than any other president in history. Leading the country through the Great Depression and WWII, his presidency also spanned some of the most trying times in U.S. history.

To address the economic crisis at home, Roosevelt enacted a set of progressive policies designed to restore growth and prosperity known as the New Deal. Social Security, the Tennessee Valley Authority, unemployment insurance, and agricultural subsidies are all New Deal components that remain intact today. While this host of progressive policies came with steep costs, WWII was by far the largest contributor to the national debt. During the fiscal years spanning Roosevelt’s time in office, federal debt increased by 1,047%, or $236.1 billion.

To determine the effect each U.S. president has had on total national debt in the last 100 years, 24/7 Wall St. reviewed annual national debt data from the federal government compiled by credit company Self. Presidents were ranked based on the change in the national debt from the beginning of their first fiscal year in office to the end of their last.

We also considered polling results on the share of American adults with a positive view of the former president in question during the second quarter of 2021 from YouGov, a British-based market research and data analytics firm.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.