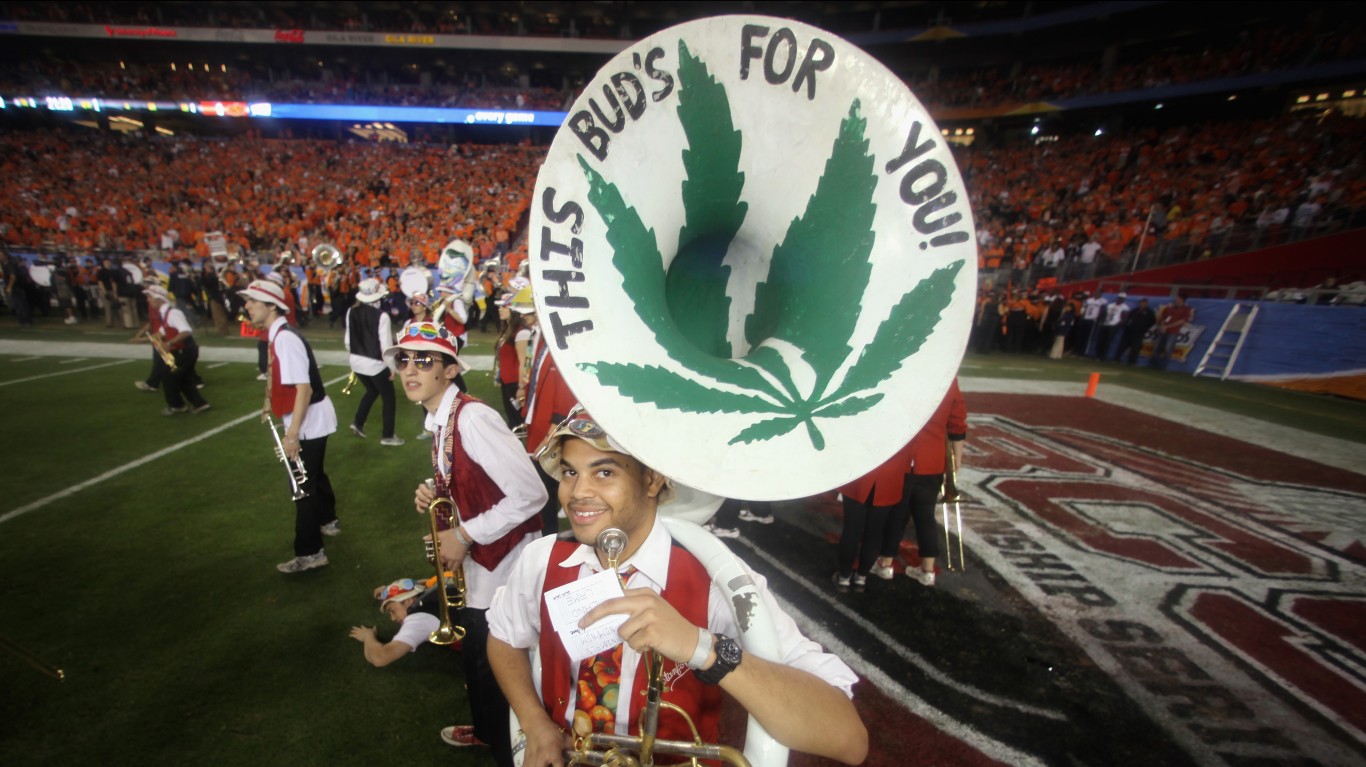

More and more states are finding recreational marijuana sales can boost their coffers. Since 2014, states with legal pot laws on the books have generated $8 billion in cannabis sales taxes, the Marijuana Policy Project estimates.

Just in 2020, taxes from adult recreational cannabis sales totaled $2.7 billion — a number sure to increase as more states decide to get in on the buzzy market of legal marijuana, MPP reports. California’s tax revenues from cannabis sales soared to $1 billion in 2020, a 62% hike from 2019. MPP projects that Illinois could hit $1 billion in tax revenues this year, too. Of course, this could depend on how many smokers are per state. This state smokes the most pot: ranking use by state.

To determine how much money states made from marijuana in 2020, 24/7 Wall St. concentrated on legal state-level sales tax revenue collected by the Mariuana Policy Project’s 2021 report, “Marijuana Tax Revenue in States that Regulate Marijuana for Adult Use.” This estimate does not include local sales tax revenue.

Once those taxes are collected, each state earmarks those dollars for specific programs. For example, according to the think tank the Urban Institute, Arizona spreads its taxes from marijuana sales between its community colleges, law enforcement, fire departments, and its highways. Colorado directs the tax revenues to educational programs, as do Oregon and Vermont. Ironically, some states, like California and Connecticut, push those funds into drug recovery initiatives.

Would-be cannabis entrepreneurs should be warned that setting up shop won’t be easy. Marijuana is still considered a controlled substance by the federal government, so it’s up to the states to formulate the laws governing sales and tax collections. And states have strict guidelines on licensing, what products can be sold, and where weed can be consumed. Purchases are usually capped at around 1 ounce. But soon you will be able to order cannabis from a legal retailer with marijuana’s first delivery app. Read about it here: What’s up with apple: touch bar’s future, first marijuana delivery app and more.

Click here to see how much money states made from legal weed sales in 2020

Click here to read our detailed methodology

Alaska

> Estimated state sales tax revenue from adult-use cannabis in 2020: $27,205,435

> Tax rates: 50 per ounce wholesale

> Year legal status approved: 2015

> Adults who have used marijuana in the last 30 days: 92,000 or 19.8% — 5th lowest

> Population: 731,545

In 2014, 53% of voters approved the Alaska Marijuana Legalization Initiative, which went into effect the next year. Adults aged 21 and older can purchase and consume up to 1 ounce of cannabis, 7 grams of cannabis concentrate, or total cannabis with fewer than 5.6 grams of THC (tetrahydrocannabinol, the active, high-producing ingredient of cannabis). However, they can only consume cannabis on private property or in an establishment with a valid onsite consumption endorsement awarded by the local county government. Public use of cannabis is prohibited.

[in-text-ad]

Arizona

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates:

> Year legal status approved: 2020

> Adults who have used marijuana in the last 30 days: 611,000 or 13.6% — 15th highest

> Population: 7,278,717

Arizona voters approved the Smart and Safe Act, or Proposition 207 in November 2020. It allows adults 21 and older to possess 1 ounce (28 grams) of cannabis with no more than 5 grams of cannabis concentrates. Residents can also grow up to six marijuana plants at their homes. In January, the state kicked off retail sales, which marked the fastest ramp up between approval and sales in the U.S.

California

> Estimated state sales tax revenue from adult-use cannabis in 2020: $1,031,879,926

> Tax rates: 15% excise; 7.25% standard sales tax

> Year legal status approved: 2016

> Adults who have used marijuana in the last 30 days: 3,742,000 or 13.4% — the highest

> Population: 39,512,223

Proposition 64, or the Adult Use of Marijuana Act, was approved by voters in November 2016. Adults age 21 or older can buy and possess up to 1 ounce of cannabis or up to 8 grams of cannabis concentrate. Californians can also participate in the state’s home cultivation program.

Colorado

> Estimated state sales tax revenue from adult-use cannabis in 2020: $362,027,103

> Tax rates: 15% wholesale; 15% special retail

> Year legal status approved: 2012

> Adults who have used marijuana in the last 30 days: 779,000 or 20.6% — 9th highest

> Population: 5,758,736

Adult recreational use of cannabis got the seal of approval from Coloradorans in 2012. Up to 1 ounce (28 grams) of marijuana or cannabis-infused products are permitted as well as 8 grams of concentrates. In 2019, the state passed a law creating new commercial licenses for marijuana lounges, tasting rooms, and other cannabis-related hospitality businesses where residents can light up cannabis products purchased elsewhere.

[in-text-ad-2]

Connecticut

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved: 2021

> Adults who have used marijuana in the last 30 days: 347,000 or 14.4% — 25th highest

> Population: 3,565,287

Connecticut became the 19th state to legalize adult recreational marijuana use. Adults age 21 and older will be permitted to possess up to 1.5 ounces (42.5 grams) of marijuana once retail outlets are up and running. But that may not happen for another year.

Illinois

> Estimated state sales tax revenue from adult-use cannabis in 2020: $174,884,334

> Tax rates: 7% wholesale; 10%-25% retail; 6.25% standard sales tax

> Year legal status approved: 2019

> Adults who have used marijuana in the last 30 days: 964,000 or 11.1% — 7th highest

> Population: 12,671,821

Unlike most states, Illinois legalized adult recreational marijuana use via legislation rather than a public referendum. The law was signed by Gov. JB Pritzker on June 25, 2019. Under the law, Illinois residents can possess a maximum of 30 grams of cannabis flower, 5 grams of cannabis concentrate, and up to 500 milligrams of THC in a cannabis-infused product. Out-of-state residents can possess about half those amounts.

[in-text-ad]

Maine

> Estimated state sales tax revenue from adult-use cannabis in 2020: $427,857

> Tax rates: 335 per pound; 10% sales tax

> Year legal status approved: 2016

> Adults who have used marijuana in the last 30 days: 183,000 or 19.6% — 18th lowest

> Population: 1,344,212

Although voters approved Maine’s legalization of recreational cannabis use in 2016, a series of legislative wranglings delayed retail sales until 2020. People 21 and older can now possess 2.5 ounces or less of cannabis, but they are not allowed to have more than 5 grams of cannabis concentrate. Residents can grow up to three mature cannabis plants at their homes or another adult’s property with the owner’s permission.

Massachusetts

> Estimated state sales tax revenue from adult-use cannabis in 2020: $118,455,230

> Tax rates: 10.75% excise; 6.25% standard sales tax

> Year legal status approved: 2016

> Adults who have used marijuana in the last 30 days: 761,000 or 16.1% — 11th highest

> Population: 6,892,503

Voters approved the Massachusetts Marijuana Legalization Initiative, which permitted adult cannabis use, in November 2016. However, retail sales didn’t start until 2018. Adults can purchase 1 ounce of cannabis or 5 grams of concentrate from a licensed retailer.

Michigan

> Estimated state sales tax revenue from adult-use cannabis in 2020: $81,705,350

> Tax rates: 10% excise; 6% standard sales tax

> Year legal status approved: 2018

> Adults who have used marijuana in the last 30 days: 1,008,000 or 14.3% — 5th highest

> Population: 9,986,857

When Michigan voters approved the Michigan Regulation and Taxation of Marihuana Act in November 2018, the state became the first Midwestern state to permit both medical and recreational cannabis use. The spelling of Marihuana is not a typo. The outdated spelling refers back to the Marihuana Tax Act of 1937, a federal law. Under the state’s law, adults can possess 2.5 ounces (71 grams) of cannabis with no more than 15 grams of that in concentrate form. Residents can grow up to 12 marijuana plants and harvest up to 10 ounces (284 grams) in their homes.

[in-text-ad-2]

Montana

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved:2020

> Adults who have used marijuana in the last 30 days: 121,000 or 17.0% — 10th lowest

> Population: 1,068,778

In November 2020, Montana voters green-lighted the Marijuana Legalization and Tax Initiative, which legalized the possession of up to 1 ounce of marijuana with no more than 8 grams in concentrate form. Users must be 21 or older. The law imposed a 20% sales tax on cannabis.

Nevada

> Estimated state sales tax revenue from adult-use cannabis in 2020: $123,683,509

> Tax rates:15% wholesale; 10% special retail

> Year legal status approved: 2016

> Adults who have used marijuana in the last 30 days: 358,000 or 18.1% — 24th highest

> Population: 3,080,156

Voters approved a ballot initiative on recreational marijuana use in November 2016, and the law went into effect the next year. Adults can possess up to 1 ounce (28 grams) or cannabis edibles, flower or topicals, in addition to 3.5 grams of cannabis concentrates. Residents can cultivate up to 12 plants per household, but only if they live more than 25 miles from a state-licensed dispensary.

[in-text-ad]

New Jersey

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved: 2020

> Adults who have used marijuana in the last 30 days: 559,000 or 9.4% — 16th highest

> Population: 8,882,190

On Nov. 3, 2020, New Jerseyans approved a ballot question on adult recreational cannabis use. Gov. Phil Murphy signed the bill into law in February of this year. Adults 21 and older can buy and possess up to 6 ounces (170 grams) of cannabis or 17 grams of hash. Finding a dispensary may be a problem for state residents. According to the USA Today Network, 71% of New Jersey towns â about 400 â have passed local ordinances banning adult-use marijuana businesses.

New Mexico

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved: 2021

> Adults who have used marijuana in the last 30 days: 210,000 or 15.7% — 20th lowest

> Population: 2,096,829

On April 12, Gov. Michelle Lujan Grisham signed into law the Cannabis Regulation Act, making New Mexico the fifth state to legalize cannabis through legislative action. Adults 21 and older can purchase, possess, consume, and give away to other adults up to 2 ounces (56 grams) of flower, 16 grams of concentrate, and 800 milligrams of edibles. Growing up to 12 mature plants per household is also legal.

New York

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved: 2021

> Adults who have used marijuana in the last 30 days: 1,543,000 or 11.0% — 3rd highest

> Population: 19,453,561

New York state nearly legalized marijuana in 2019, but it wasn’t until March of this year that the Marihuana Regulation and Taxation Act was approved after some issues regarding social equity and impaired driving were resolved. The law legalized the purchase, possession, and transport of up to 3 ounces (85 ounces) of weed and up to 24 grams of concentrate.

[in-text-ad-2]

Oregon

> Estimated state sales tax revenue from adult-use cannabis in 2020: $158,336,274

> Tax rates: 17% retail

> Year legal status approved: 2014

> Adults who have used marijuana in the last 30 days: 640,000 or 22.1% — 13th highest

> Population: 4,217,737

Oregon voters approved recreational cannabis use in 2014. Adults 21 and older can buy: 1 ounce (28 grams) of cannabis flower; 16 ounces (454 grams) of a cannabis product in solid form; 72 ounces (2 liters) in liquid form; 5 grams intended for smoking or vaping; 5 grams of concentrates; and 4 immature plants.

South Dakota

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved: 2021

> Adults who have used marijuana in the last 30 days: 47,000 or 8.8% — 3rd lowest

> Population: 884,659

As of July 1, medical and adult recreational use of marijuana are both technically legal in South Dakota. However, state legislators are currently debating changes to the medical marijuana law, which would allow patients to possess 3 ounces of medical cannabis. Meanwhile, Gov. Kristi Noem opposes the recreational use amendment approved by voters, and its constitutionality is now being considered by the State Supreme Court.

[in-text-ad]

Vermont

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved: 2020

> Adults who have used marijuana in the last 30 days: 100,000 or 22.3% — 7th lowest

> Population: 623,989

Vermont legalized adult recreational marijuana use last year, with licensed outlets scheduled to open in 2022. When those businesses open, adults over 21 can purchase cannabis flower with no more than 30% THC and concentrates with no more than 60% THC. Edibles can have up to 50 milligrams of THC.

Virginia

> Estimated state sales tax revenue from adult-use cannabis in 2020: Not currently available

> Tax rates: Not currently available

> Year legal status approved: 2021

> Adults who have used marijuana in the last 30 days: 477,000 or 8.6% — 18th highest

> Population: 8,535,519

In 2021, Virginia became the first Southern state to legalize recreational marijuana use. However, until retail outlets open in 2024, residents can’t obtain marijuana unless they have a medical marijuana card or are gifted 1 ounce from someone else. Advocates are reportedly trying to get lawmakers to speed up the licensing process.

Washington

> Estimated state sales tax revenue from adult-use cannabis in 2020: $614,475,190

> Tax rates: 37% retail; 6.5% sales tax

> Year legal status approved: 2012

> Adults who have used marijuana in the last 30 days: 971,000 or 19.3% — 6th highest

> Population: 7,614,893

Washington state voters passed the Washington Legalization and Regulation Initiative by a margin of 55% in 2012. It gave adults 21 and older the right to purchase in one day: 1 ounce, or 28.35 grams, of usable marijuana; 16 ounces, or 454 grams, of cannabis-infused edibles in solid form; 72 fluid ounces, or 2.13 liters, of cannabis in liquid form; and 7 grams, or a quarter-ounce (0.25 oz), of cannabis concentrates.

Methodology

To determine how much money states made from marijuana in 2020, 24/7 Wall St. concentrated on legal state-level sales tax revenue collected by the MPP’s 2021 report, “Marijuana Tax Revenue in States that Regulate Marijuana for Adult Use.” This estimate does not include local sales tax revenue. Because each state tracks and collects marijuana tax revenue statistics differently, comparisons should be made carefully. We listed states alphabetically.

Additional data on the percentage of adults who have used marijuana in the last 30 days was obtained from the Substance Abuse and Mental Health Services Administration. Population figures are from the U.S. Census Bureau’s 2019 American Community Survey.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.