The federal government collected $3.7 trillion in tax revenue in fiscal 2020. That money was used to fund a wide range of basic public services, including infrastructure and social safety net programs as well as defense. Not all government entities are taxpayer funded, however.

There are currently over a dozen institutions in the United States that, though they were created by the federal government, operate like a for-profit corporation. Though the U.S. Congress created these government corporations, they are typically run by a board of directors or an executive, and exist to meet needs that have not been met by the free market and achieve specific goals.

Using publicly available government reports, 24/7 Wall St. identified 14 businesses run by the U.S. government. Each of these entities provides market-oriented products or services and is designed to be financially self sufficient.

Several of the wholly-owned government corporations on this list were formed during the Great Depression under President Franklin Roosevelt. They were established to foster economic growth and instill confidence in financial institutions during a tumultuous time in U.S. history. By and large, they serve the same purpose today as they did in the 1930s. Here is a look at some of the worst market collapses in U.S. history.

While each of these entities was designed to be self-sustaining, not all of them are. Year after year, institutions on this list, like the U.S. Postal Service and Amtrak, are operating at a loss. According to Postmaster General Louis DeJoy, without meaningful reform, the USPS will run out of money in 2022. Of course, accumulation of debt is by no means limited to companies created by Congress. Here is a look at the private sector companies with the biggest corporate debt.

Click here to see businesses run by the US government

1. Tennessee Valley Authority

> Year founded: 1933

> Industry: Energy

Established by President Franklin Roosevelt on May 18, 1933, the Tennessee Valley Authority, or TVA, is the oldest government corporation in operation. The TVA was created to control flooding in the Tennessee Valley, an area that spans seven states in the South, and provide affordable electricity — both goals critical for regional economic development.

Today, TVA is one of the largest power companies in the United States, serving about 10 million Americans. The company employs about 10,000 people — both in power generation as well as flood control and land management — and derives virtually all of its revenue from electricity sales, which totalled $11.2 billion in fiscal 2019. Less than half of the power generated by the TVA comes from fossil fuels.

[in-text-ad]

2. Federal Deposit Insurance Corporation

> Year founded: 1933

> Industry: Banking

The Federal Deposit Insurance Corporation, or FDIC, was established on June 16, 1933, under Roosevelt during the Great Depression. The FDIC was originally intended to be a temporary corporation to protect against bank runs stemming from the financial panic at the time. Today, the FDIC’s mission is still to maintain stability and public trust in U.S. financial institutions by insuring deposits and regulating banks to protect consumers.

The FDIC is funded entirely by premiums paid that banks pay for coverage of deposited funds. The federal company’s revenue totalled nearly $8.8 billion in 2020.

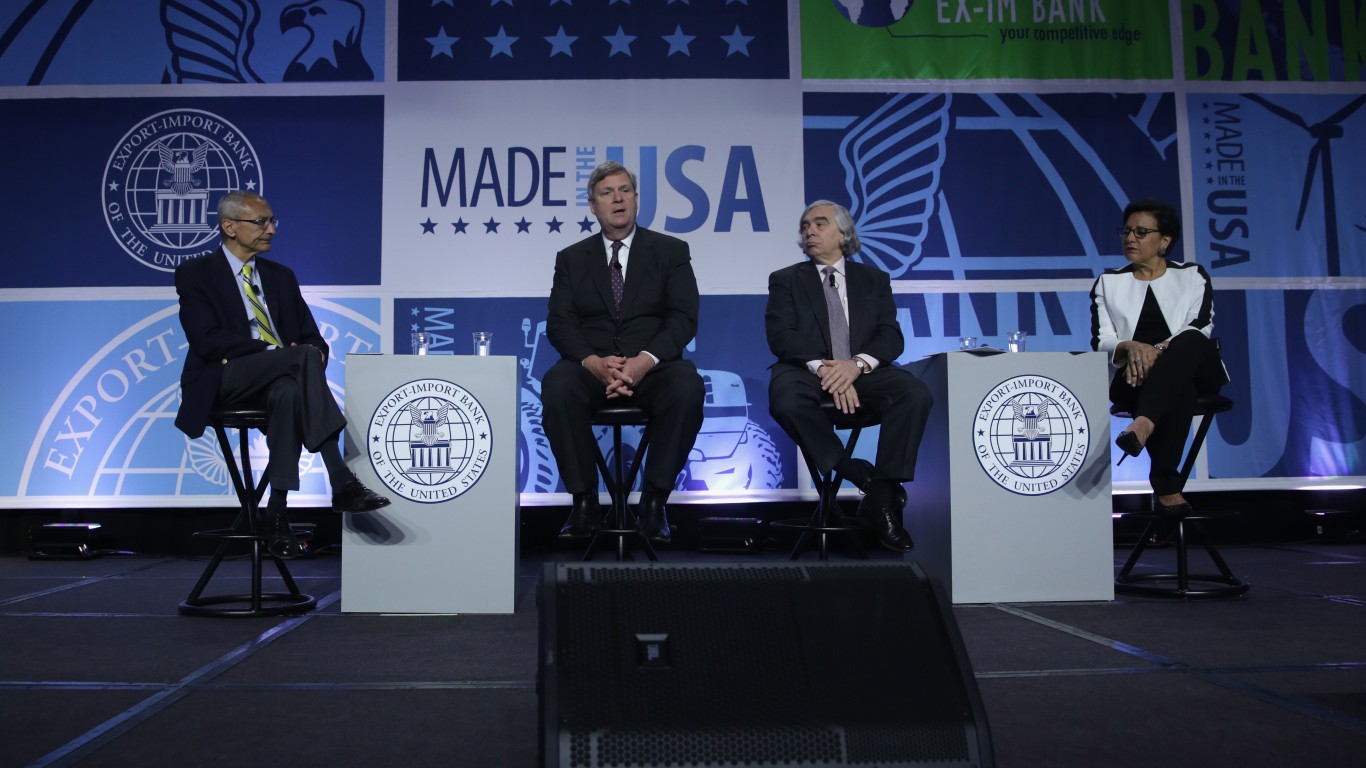

3. Export-Import Bank

> Year founded: 1934

> Industry: International trade

Founded on Feb. 2, 1934, by Roosevelt, the Export-Import Bank was established to facilitate international trade between the United States and foreign countries and assist American companies during the Great Depression. The bank’s first deal was a $3.8 million loan to Cuba to help the country buy silver from the United States.

Today, the company still effectively subsidizes U.S. exports by loaning money to foreign buyers and insuring those buyers against risk. The bank authorized a reported $5.4 million in loans and insurance in fiscal 2020 that will support an estimated $10.8 billion worth of American exports.

4. Federal Prison Industries (UNICOR)

> Year founded: 1934

> Industry: Inmate rehabilitation

Federal Prison Industries, known as UNICOR, was established by Congress on June 23, 1934, with the mission of offering prison inmates job training programs. According to research conducted by the Bureau of Prisons, the program reduces recidivism rates and increases the likelihood of a successful transition back into society.

Participating inmates are paid anywhere from 23 cents to $1.15 an hour for their work, which generates more than 80 services and products such as license plates and office furniture. The company is financially self sustaining and presents no burden on taxpayers.

[in-text-ad-2]

5. Federal Crop Insurance Corporation

> Year founded: 1938

> Industry: Insurance

The Federal Crop Insurance Corporation was founded in 1938, and, as its name suggests, provides American farmers with financial protection from crop loss or commodity price fluctuation. FCIC policies are often sold through private insurance companies.

In its early decades, farmers were required to purchase crop insurance, but that mandate was repealed in 1996, and farmers are now free to not participate and waive their right to benefits.

Currently, the FCIC provides risk protection for $113.2 billion in agricultural products.

6. Commodity Credit Corporation

> Year founded: 1948

> Industry: Agriculture

The Commodity Credit Corporation is a corporation with a mission that changes depending on Congressional direction. Currently, the CCC is involved in conservation programs, farm income and price stabilization, and foreign market development and is funded by federal budget appropriations. Though it was created in 1933, it did not become a wholly-owned government corporation until June 30, 1948.

Unlike many of the other companies on this list, the CCC does not have any employees. Rather, it is managed by a seven person board of directors who answer to the secretary of agriculture. To carry out its operations, the corporation uses employees of a range of federal agencies, including the Farm Service Agency, the Natural Resources and Conservation Service, and the Foreign Agricultural Service.

[in-text-ad]

7. St. Lawrence Seaway Development Corporation

> Year founded: 1954

> Industry: Transportation infrastructure

The St. Lawrence Seaway Development Corporation, or GLS, was created in 1954 to maintain and operate the waterway between the Port of Montreal and Lake Erie. The federally owned corporation is under the authority of the U.S. Department of Transportation and works in tandem with its Canadian counterpart, the St. Lawrence Seaway Management Corporation.

Over the past year, the GLS has spent tens of millions modernizing infrastructure, including replacing a more than 60-year-old tugboat with a new model that can break through up to 3 feet of ice. The GLS reported $26 million in revenue in fiscal 2020. The St. Lawrence Seaway directly serves eight U.S. states and two Canadian provinces and supports nearly a quarter million jobs.

8. Government National Mortgage Corporation

> Year founded: 1968

> Industry: Mortgage loans

The Government National Mortgage Corporation, or Ginnie Mae, is the primary financing mechanism for government-backed mortgage loans. Formed in 1968 under the Department of Housing and Urban Development, Ginnie Mae’s purpose is to guarantee affordable home loans and thereby make them more accessible.

Over the course of 2020, Ginnie Mae issued an all-time annual high of $749 billion in mortgage-backed securities.

9. U.S. Postal Service

> Year founded: 1970

> Industry: Courier

The U.S. Postal Service was formed with the Postal Reorganization Act, which was signed into law on Aug. 12, 1970. The act transformed the nearly two centuries old Post Office Department into a government-owned corporation. Under the reorganization, the postmaster general was no longer a cabinet position in the executive branch, and authority over operations was transferred from the U.S. Congress to the Postal Service’s executive management. The creation of the USPS also granted wage-related collective bargaining rights to postal workers, making them the only federal employees with such rights.

With the advent of digital communications and a growing roster of private sector competitors, the USPS has struggled financially in recent decades. In fiscal 2020, USPS operating revenue totalled $73.1 billion, about $9.1 billion short of its operating expenses. Including employee retirement benefits, workers compensation liability, and other debts, the USPS has a net deficiency of about $80.7 billion — up from $71.5 billion in fiscal 2019 and $62.6 billion in 2019.

[in-text-ad-2]

10. National Railroad Passenger Corporation

> Year founded: 1970

> Industry: Transportation

The National Railroad Passenger Corporation, commonly known as Amtrak, was established in October of 1970 when Congress consolidated the 20 independent railroads in the United States into one. Amtrak’s board of directors is selected by the president of the United States and approved by the U.S. Senate. Amtrak’s fiscal 2019 revenue totalled $3.5 billion, and its operating and capital expenditures were $4.9 billion.

Amtrak currently serves 46 states and Washington D.C. as well as three Canadian provinces. In fiscal 2019, passengers made 32.5 million trips on Amtrak. Of the more than 500 destinations Amtrak serves, New York’s Penn Station is by far the busiest, with over 10.8 million trips in 2019, more than double the ridership in Washington D.C., the second busiest station.

11. Federal Financing Bank

> Year founded: 1973

> Industry: Finance

The Federal Financing Bank, of FFB, was created by congress in 1973 with the purpose of making it easier and cheaper for federal borrowing and federally-assisted borrowing while minimizing disruption to private financial markets and institutions.

As of the end of fiscal 2020, the FFB’s loan portfolio totalled $81.8 billion. New lending commitments in the past year include $6 billion to the Rural Utilities Service, $258 million to five Historically Black Colleges and Universities, and $421 million to the Department of Housing and Urban Development. Revenue from interest payments alone totalled $2.3 billion in fiscal 2020.

[in-text-ad]

12. Pension Benefit Guaranty Corporation

> Year founded: 1974

> Industry: Insurance

The Pension Benefit Guaranty Corporation was established through the Employee Retirement Income Security Act of 1974. The PBGC functions to protect worker pensions. Before its existence, workers had no recourse for receiving benefits if their former employer went out of business.

There are about 900,000 retired Americans who now receive their pension benefits through the PBGC, and about 37 million working Americans are protected by the company. The company’s operations are financed largely through employer-paid insurance premiums and investment income, and it receives no taxpayer support.

13. Presidio Trust of San Francisco

> Year founded: 1996

> Industry: Conservation and hospitality

The San Francisco Presidio is located in the northernmost section of the city where the Golden Gate Bridge extends out from. Once the northernmost Spanish fort in the New World, it became a U.S. Army post in the mid-19th century and later a historic landmark. The Presidio was included as a part of the Golden Gate National Recreation Area in 1972, and in 1996, the U.S. Congress created the Presidio Trust to preserve the cultural, scenic, and recreational value of the Presidio and the surrounding 700 plus buildings. The trust manages 1,191 acres of the area in tandem with the National Park Service, which manages 300 acres.

The Presidio Trust generates revenue through leasing area homes and offices as well as hotels and a golf course and does not rely on taxpayer funds. The area is home to some 3,000 residents and 200 organizations and draws in an estimated 10 million visitors annually.

14. U.S. International Development Finance Corporation

> Year founded: 2018

> Industry: International investment

The U.S. International Development Finance Corporation, or DFC, was established through the BUILD Act that was signed into law on Oct. 5, 2018, by President Donald Trump. DFC is a consolidation of the now dissolved government corporation, OPIC, and the Development Credit Authority. Working with private lenders, the DFC funds critical development projects around the world in a range of sectors, including energy, health care, infrastructure, and technology. The DFC is distinct from U.S. foreign aid and makes investments designed to generate returns for U.S. taxpayers.

So far in 2021, DFC has committed over $1.75 billion to countries in Africa, and over $100 million to countries in both Asia and Latin America.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.