With inflation hitting its highest level in decades in late 2021, a dollar doesn’t stretch as far as it used to. Because of this, many American consumers are now careful how they spend their money. People can maximize their budget by cutting out unnecessary purchases or spending smarter on major buys.

Consumers must make their own choices about what to cut, though it’s not always easy to know what. But there are, however, a handful of common products that most people agree are often superfluous or way overpriced. Other products to avoid may be those that cause long-term damage to the environment.

To determine the things you should never buy, 24/7 Wall St. reviewed expert recommendations from sources like Consumer Reports and Eat This, Not That about products and services that are unnecessary, environmentally harmful, or generally not a good investment.

Many of the items you should probably never buy fit into several different categories — some are major purchases that will typically end up being a bad investment. Beware of any high-dollar items that quickly lose value or financial services that only serve to benefit the company offering them, rather than boosting your wealth.

Others are kitchen gadgets with limited use. These items are good for exactly one purpose that likely will not get much use in the kitchen or elsewhere, and whose purpose can easily be handled by something else you probably already have. These are the 35 pantry essentials you should never be without.

Click here to see 25 things you should never buy and what to buy instead

1. New car

“Avoid buying a new car” is a common piece of financial advice. Most drivers are aware that cars rapidly depreciate in value — dropping about 20%-30% in the first year, then 15%-18% per year in the next five years, according to NerdWallet.

If you’re trying to save or on a budget and need a car, used cars will get you from place to place just fine, at a much lower price. In November 2021, the average new car cost over $42,000, while the average used car cost nearly $10,000 less, according to iSeeCars. Used cars also hold their value better.

[in-text-ad]

2. Bread maker

Many kitchen gadgets like bread makers seem like useful and time-saving appliances, but the reality is that you can easily whip up loaves of bread in your oven. Bread makers tend to cost between $50 and $200.

You’d have to make quite a few loaves to turn a bread maker into a cost-effective investment compared to just buying bread at the grocery store or baking bread in your oven — not to mention all the counter or cabinet space you need to store it.

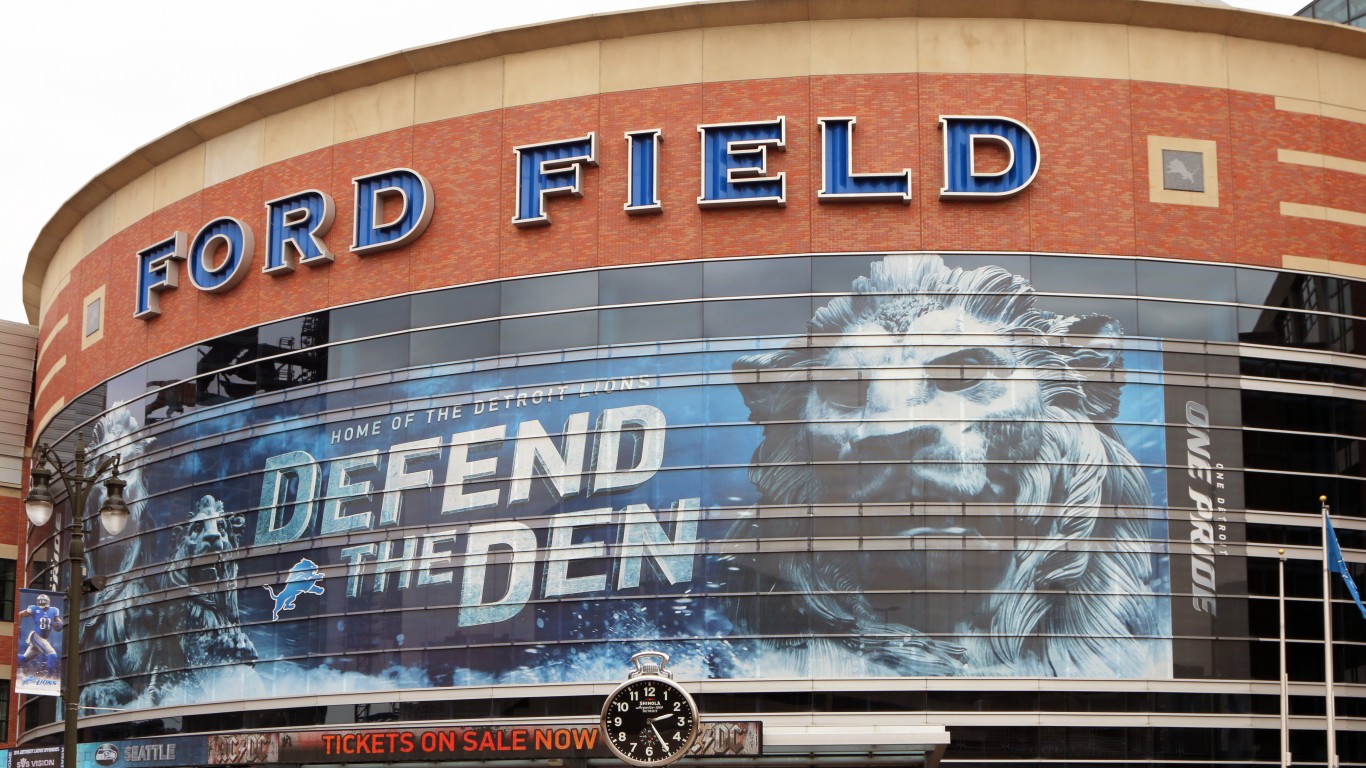

3. NFL tickets

NFL tickets average over $400 on the secondary market, according to TicketIQ — not to mention the money fans will spend on parking, food, souvenirs, and more once they are at the stadium. Yet games have about 11 minutes of game action throughout a three-hour game, according to the Wall Street Journal. Mostly, fans wait through timeouts and other stoppages, and even during the majority of the time the clock is running, players are readying for the next play.

Instead of spending thousands to bring a family of four to one game, it might make more sense for football fans to use that money on a brand new TV, where they can see all the action better than they ever could from nosebleed seats. Fans watching from home avoid the traffic getting to and from a game, rowdy fans, cold weather, and overpriced food and drinks in an NFL stadium.

4. Credit monitoring

Some Americans planning to make large purchases in the near future sign up for credit monitoring services so they can know what to expect when buying something like a home or car. Yet these services, which can run up to $30 per month, cannot actually prevent anything bad from happening to your credit, only letting you know once your credit has dropped.

The easiest solution is to get a free credit report from your credit card company or bank. Federal regulation also says that Equifax, Experian, and TransUnion all must provide you with a free annual credit report.

[in-text-ad-2]

5. Premium gas

While fueling up their cars, some drivers may want to buy the best for their vehicle and gas up with premium fuel. But chances are that the fuel will offer no added benefits despite being more expensive.

Engines with high compression ratios or turbochargers may benefit from premium gas, but these vehicles represent a small share of cars on the road. If you do not have one of these cars, there is virtually no difference between standard and premium fuel when it comes to your engine. The Federal Trade Commission wrote in a judgment against Exxon that “most cars don’t need and won’t benefit from hi-test gas, so paying extra for premium gas is wasting money.”

6. Disposable straws

In recent years, many restaurants have phased out disposable plastic straws in favor of more environmentally friendly options. Though they are small, Americans go through billions of these straws every week, and since they are not biodegradable, they simply sit in landfills or end up in oceans.

With plastic straws falling out of favor, many stores now carry glass or metal straws. If you like to use straws at home, these washable and reusable options should save you money long term.

[in-text-ad]

7. Pre-chopped produce

Grocery and convenience stores often offer pre-portioned and chopped produce like fruits and vegetables. While buying this produce may be slightly more convenient and save you a bit of time on chopping, it is probably not worth the extra money you will have to spend.

Food magazine Kitchn found that stores mark up pre-cut produce by an average of 40%. It is likely well worth the extra few minutes it takes to select and cut your own fruits and vegetables rather than buying the pre-portioned and packaged version.

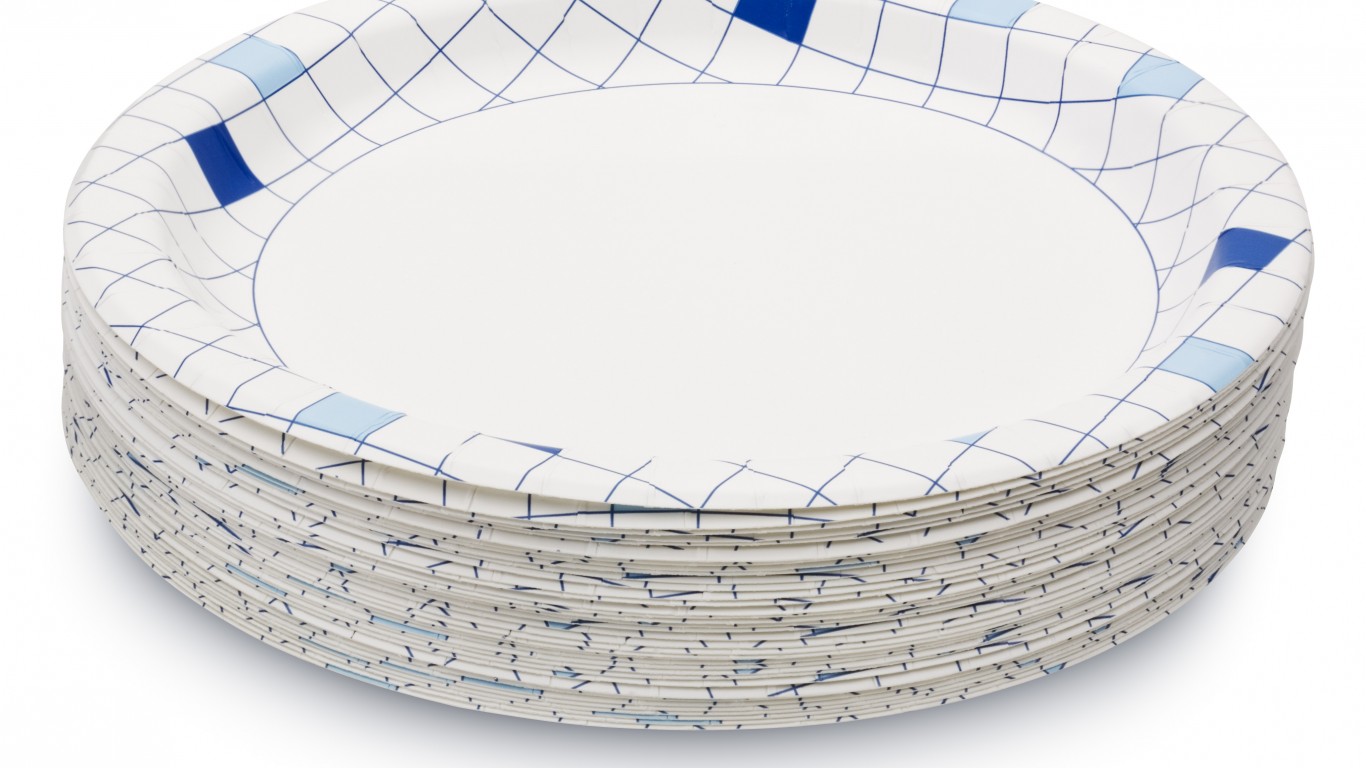

8. Paper plates

Like plastic straws, paper plates are meant to be thrown away after just one use. Though they are small and flat, they stack up over time and are not environmentally friendly. Despite being a paper product, these plates are not recyclable, as they are contaminated with food.

Aside from the environmental impact, single-use items are generally not a good investment when compared to reusable items. Investing in a good dinnerware set will likely only cost around $50, depending on where you shop, and will probably last years. But if you only use paper plates, you will have to keep buying them over and over again.

9. New formalwear

When preparing for a big event like a wedding or senior prom, people want to look their best. Since it is a once-in-a-lifetime event, many brides and grooms are willing to spend top dollar on their dress, tuxedo, or other pieces of formalwear. But the reality is that you will likely only wear the formalwear once.

Men’s suits may be reusable for many occasions, but tuxedos are seldom used. For women, dress styles shift quickly, and there is virtually no event where you can reuse your wedding dress. For special occasions, renting formal wear or buying it used can look just as good at a fraction of the price.

[in-text-ad-2]

10. Name-brand OTC meds

Pharmacies carry over the counter medicine to alleviate allergies, cold and flu symptoms, aches and pains, digestive issues, and more. Generally, there are name brand medications that you might see advertisements for on TV, and right next to them are the generic brands.

Pharmacy chains make their own version of the name brand medication. These generic medicines have the same active ingredient, dosage, and safety profile, and they work equally as well. Typically, the only difference is the price — generics are much cheaper.

11. Annuity

Annuities are an agreement in which an individual gives a company, usually an insurance company, their money, typically from a retirement savings account, and in return the company sends them regular payments for the rest of their life. If they feel that they can manage their own finances, there is no reason to get an annuity.

These agreements make it difficult to change retirement plans because you are locked into the payment stream. They are also costly, as the company managing the annuity typically takes a commission. People sometimes opt for annuities to insulate themselves from market volatility by receiving a fixed income stream instead of leaving their finances in investments, though index funds tend to perform well enough long term so they are considered a better bet than annuities.

[in-text-ad]

12. Multivitamins

Americans spend a lot of money on multivitamins — more than $12 billion per year. However, the benefits do not appear to justify taking these supplements. Johns Hopkins University reviewed studies that found that multivitamins do not reduce the chances of heart disease, cancer, or memory loss.

Instead of taking multivitamins, doctors recommend eating a healthy diet — fruits, vegetables, whole grains, and protein. These foods contain the necessary vitamins and minerals that can lower health risks.

13. Pasta maker

Fresh pasta makes for a delicious dinner, so it makes sense that at-home cooks may be tempted to get their own pasta maker to create their own noodles from scratch. These specialized contraptions, however, can be hard to use and even harder to clean, and the odds are you will not be making fresh pasta all that often.

Pasta makers can run anywhere between $40 and $200. When you factor in the cost of ingredients, you’d have to make oodles of noodles to turn the pasta maker into a worthwhile investment. Regular store bought dry noodles should work just fine for most recipes. If you are really that determined to make your own pasta, you can make it from scratch using just your hands and a knife.

14. Boats

There is a saying that “the two best days of a boat owner’s life are the day they buy their boat and the day they sell it.” While cruising around the water seems fun, boats can turn out to be a high-priced hassle. Owners must pay for fuel, fees, licenses, taxes, insurance, storage, and winterizing their boat, not to mention the extra supplies like life jackets, cleaning supplies, and accessories needed to haul a boat to and from the water. All this for a boat will likely only be used on warm and clear days.

It may be a better idea to rent a boat as needed, or join a boating club where you can use one of the many boats on site without worrying about maintenance or taking on all the hidden costs by yourself.

[in-text-ad-2]

15. Mobile home

Unlike traditional homes, mobile homes often do not appreciate in value. In fact, they often lose their value. These homes are considered personal property, not real property because they are not permanently attached to the land. Since they are personal property, the loans needed to buy a mobile home tend to have much higher interest rates. These mobile homes are often parked in mobile home parks, where owners must still pay rent to landlords.

Even though mobile homes seem less expensive from the outset, high interest rates and depreciation make them a poor long-term financial investment. Buying a traditional home is generally a better financial move.

16. Baby shoes

Parents of a newborn want to keep their baby warm. They may feel they need to get shoes for their child, but the reality is that if a baby is too young to walk then they are too young to need shoes.

By the time a child is old enough to start walking, they will be much larger and the baby shoes wouldn’t fit. To keep babies warm just put socks on their feet or keep them dressed in footy pajamas since you will be carrying them everywhere anyways.

[in-text-ad]

17. Purebred dogs

People who want to get a dog likely have specific qualities they are looking for in a dog — cute, obedient, hypoallergenic, or small enough to fit comfortably in an apartment. To find a dog that meets these criteria, prospective owners may seek out a breeder. Purebred, high-end dogs can cost thousands of dollars, depending on the breed.

However, these designer dogs come with several issues. Many are bred and raised in unethical and inhumane conditions. Some breeds are also very prone to certain health issues. Those who want a dog should consider a mutt from the shelter — they tend to be even-tempered, much less expensive, housebroken, and you may be saving the dog from being euthanized.

18. Salt lamps

There is nothing wrong with buying a Himalayan pink salt lamp, per se. The issue is that many outlets who sell these lamps make a litany of unfounded claims about their supposed health benefits that do not hold up to scrutiny.

Some sellers claim these salt lamps can improve air quality by filling the room with negative ions, but there is little evidence that the lamps actually release negative ions. Others say the salt lamps can boost the mood of someone in the same room, but the evidence for this is scant as well. Really, the only reason to get one of these lamps is if you think they would look good in your home. Otherwise, save the expense.

19. Lottery tickets

The average American spends over $200 per year on lottery tickets, yet players lose an average of 47 cents for every dollar they spend. Even winning isn’t all it’s cracked up to be — winners are more likely to go broke or commit suiсide than regular people. The windfall can cause jealousy and resentment and strain existing relationships, not to mention the fact that a huge percentage of winnings must go to taxes. Winners are also more likely to be targeted by robbers, scammers, and other people.

Instead of playing the lottery, people will generally be much better off if they simply invested that money. There may not be the shock and joy of seeing your numbers win, but you will probably make a few thousand dollars over the course of several years.

[in-text-ad-2]

20. Cleanse kits

Some people have taken to using colonics or colon cleansing kits in an attempt to keep themselves healthy or supposedly free of toxins. But doctors say that these kits and pills are not rooted in medical science.

The human body can mostly take care of itself, and the idea that people need to artificially flush out their internal/digestive system is just not accurate, according to the Mayo Clinic. In fact, these cleanses can actually end up making you dehydrated. If you think you are having a medical issue, you should talk to your doctor before trying any at-home procedures.

21. Bottled water

Most bottled water is just regular tap water run through a filter. While some people may prefer the taste of water that is filtered, it is much easier and more cost-effective to get your own filtration system and run your own tap water through it.

In addition to being cheaper, filtering your own tap water instead of buying bottled water is also much better for the environment. All those plastic bottles add up over time, and since plastic is not biodegradable, they just sit on top of landfills or make their way to our oceans.

[in-text-ad]

22. Slicers

Many places that sell kitchen gadgets have an entire section for slicers — banana slicers, avocado slicers, hot dog slicers, etc. While these gadgets might be fun and save a bit of time, they are not worth getting.

The reality is that you already have a slicer in your kitchen — a knife. If you find you are struggling to quickly and efficiently chop up a piece of produce, the solution is not to spend money on a slicer, but to practice (and perhaps sharpen your knives). You’ll get the hang of it quickly, without having to spend money or sacrifice storage space for a slicer.

23. Sandwich bags

There is no reason to use a plastic sandwich bag when a reusable bag or container will do the trick. Using a tupperware container or a lunch box will save you money in the long term, as you won’t have to keep buying bags.

Just wash out the container and use it again the next time you take food somewhere. This also keeps some plastics out of the environment.

24. Extended warranties

Extended warranties are one of the dirty little secrets of the appliance, auto, and electronics industries. First, there is a good chance you will take good care of your major purchases. Even if you don’t or something unforeseen happens, many manufacturers are required to offer a standard warranty that will likely cover your item.

If your purchase is damaged outside of the initial warranty, there is a good chance that the manufacturer will fix or replace it if they are responsible for its issue, according to Consumer Reports. Even if not, repairs may be less expensive than the extended warranty, which may cost over $100.

[in-text-ad-2]

25. Dryer sheets

Dryer sheets leave laundry smelling nice and reduce static cling. Yet they are generally not good for either your clothes or the dryer. Dryer sheets are coated in acid that melts in the dryer and coats clothing, leaving them soft and smelling good. Yet this acid gets into the dryer as well, particularly the lint trap, which can make it difficult to clean properly.

Instead of using a dryer sheet with every load in the dryer, consider using balls of aluminum foil — they take out the static cling without the negative side effects.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: are you ahead, or behind on your retirement goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With SmartAsset’s free tool, you can connect with vetted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.