With the ongoing COVID-19 pandemic, rising inflation, simmering geopolitical tensions, and a widening ideological and cultural chasm in the United States, one could be forgiven for having a less than an optimistic outlook for 2022.

According to a recent report from the political risk consulting agency Eurasia Group, misgivings about the state of the world in the coming year are well founded. The report, titled Top Risks 2022, offers detailed predictions of what it anticipates will be the largest threats to global stability, peace, and prosperity in the coming year.

24/7 Wall St. reviewed Eurasia Group’s report to identify the top 10 risks of 2022. The risks on this list are global in scope and cover issues related to countries, companies, the environment, public health, and the economic concerns.

Despite the foreseeable nature of the risks detailed on this list, many seem all but inevitable – the predictable results of a chain of events that began long before Jan. 1, 2022.

Of course, many of the most difficult challenges humanity has faced in years past have caught the world largely off guard. Indeed, this list offers only the best guesses of what we face in 2022 – and which of them actually materialize, if any, remains to be seen.

Click here for the top 10 biggest risks to global security in 2022

10. Turkey

Turkey, an ostensible U.S. ally home to over 84 million people over parts of eastern Europe and western Asia, is in the midst of an economic crisis. Inflation has surged by over 20% in recent months, and flaunting conventional economic wisdom, President Recep Erdogan has eased monetary policy, making matters considerably worse.

Erdogan is posturing aggressively internationally to distract his constituency from the weakening Turkish lira and rising unemployment. Experts are concerned that U.S. sanctions over the country’s dealings with Iran could push Turkey, a NATO ally, towards Russia for future arms deals and lead to the country’s taking increasingly erratic and belligerent geopolitical moves

[in-text-ad]

9. Corporations balancing business with cultural demands

Multinational corporations will likely face a growing set of political and cultural challenges in the coming year. Through social media, organized walkouts, and other means, consumers and employees alike are demanding corporations take a stand on certain issues, such as workplace diversity, voting rights, free speech, and human rights – and meeting such demands can prove a charged and an expensive endeavor.

For example, recent polls have shown that 65% of millennials say they have boycotted brands with positions on social issues that differ from their own, and 75% of millennial workers expect their employer to take a stand on important issues that affect the country. This puts companies in the difficult position of appeasing one group, potentially at the expense of angering another. Multinationals operating in China have the added challenge of doing business in the world’s most populous country while grappling with that country’s human rights abuses.

8. Global power vacuum

Major powers, most notably the United States, are less willing than in past years to intervene in global affairs. The most recent and glaring example of this was the messy withdrawal of the American military from Afghanistan. Places like Afghanistan, as well as Burkina Faso, Chad, Mali, and Niger – where France and the U.S. have scaled back their presense in recent years – will likely become breeding grounds for terrorism, according to the Eurasia Group.

In other parts of the world that struggle with ongoing economic and political crises, such as Venezuela and Haiti, refugees are fleeing by the millions creating new problems along international borders.

7. Faltering transition to clean energy

The transition to clean energy is necessary to avert the worst possible global warming outcomes, but that transition appears as though it will be a long and painful one. Supply chain disruptions and demand fluctuations attributable to the COVID-19 pandemic are contributing to spikes in energy prices and putting governments in the position of choosing between meeting green energy targets and delaying climate goals in an attempt to keep costs lower and appeasing their constituents in the short term.

Balancing a green transition while keeping energy prices low in the face of historically high inflation will likely be a challenge for governments this year, particularly in the United States, where it could lead to increased instability.

[in-text-ad-2]

6. Iranian nuclear ambitions

Since President Donald Trump withdrew from the Iran nuclear deal negotiated during the Obama Administration, Iran continued unchecked in its pursuit of developing nuclear weapons. Talks between Washington and Tehran have faltered during the Biden Administration, leaving the U.S. with limited options going into 2022.

Iran is now in a position to produce enough enriched uranium to develop a nuclear bomb in as little as one month, leaving some experts to suspect a looming unilateral Israeli strike on Iran’s nuclear facilities. Such an outcome could foreseeably lead to an Iranian response that may target U.S. interests, push oil prices higher, and destabilize commerce across the Middle East.

5. Russia

Heading into 2022, Russia is poised to precipitate multiple crises – both internationally and within the United States. Late last year, Russian President Vladimir Putin began building up troops along the border of Ukraine, a former republic of the Soviet Union. As of mid-January, Putin has amassed over 127,000 troops in the region with Washington saying Russia is poised to invade its neighbor at any point. Such an outcome would mean a failure in diplomatic talks between Washington and Moscow would likely result in economic sanctions and NATO forces pushing closer to Russia – potentially straining the already fraught U.S.-Europe relations.

Other threats posed by Russia include cyber attacks targeting U.S. infrastructure, the dissemination of misinformation in the lead up to the 2022 midterm elections, and Russia’s strengthening alliance with China.

[in-text-ad]

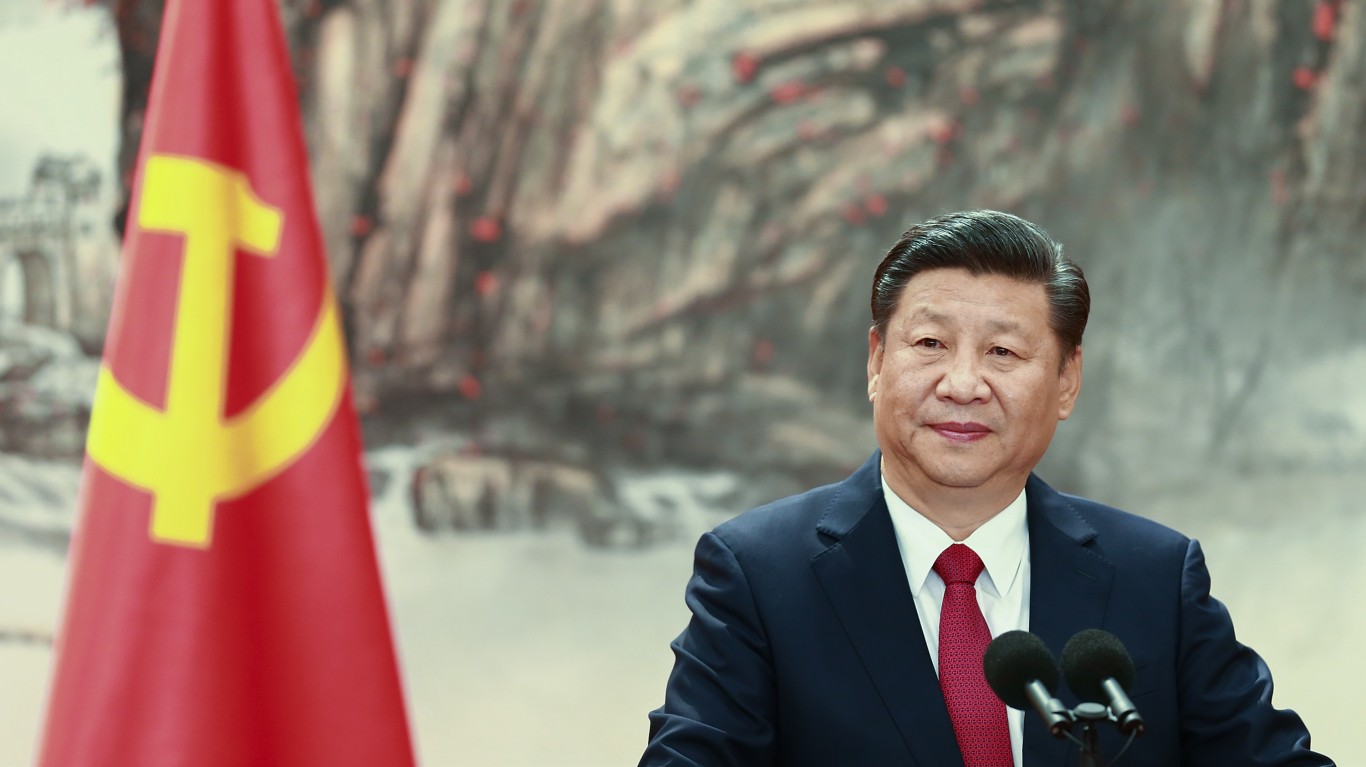

4. Instability in China

One of the largest markets in the world is facing a considerable set of challenges in 2022. These include what appear to be an exhausted model for economic growth, an unbalanced economy, an aging population, and a zero COVID-19 policy.

Tight controls wielded by President Xi Jinping will likely only exacerbate these problems, as the Chinese government undermines companies perceived to be too powerful. Such policies de-incentive smaller companies from scaling up, while reducing productivity growth and international competitiveness of the country’s most dynamic companies.

3. U.S. midterm elections

The 2022 midterm elections in the United States will likely exacerbate existing beliefs among millions of Americans that the U.S. electoral system is rigged or broken. If the Republican Party underperforms, political leaders on the right will likely claim widespread voter fraud and fraudulent ballot counting, in keeping with the GOP playbook following the 2020 presidential election. If the Democratic Party underperforms, leaders on the left will likely point to gerrymandered districts and new voting laws that are seen by many as a means of disenfranchising minority voters.

Both of these potential outcomes will likely further erode public trust in institutions and more deeply entrench divisive party narratives. The degree to which confidence in American democracy is undermined in this year’s election will have significant implications for the looming 2024 presidential election, and could set the stage for a constitutional crisis in a closely contested race.

2. Technology-driven polarization and data hacks

The growing digitization of nearly all aspects of life will not be without significant downsides in the coming year and beyond. What people do and see online, which impacts how people think and behave in the real world, is increasingly in the control of a handful of companies. Governments will be limited and likely incompetent in their ability to regulate online spaces. Tech companies themselves have little incentive – or even know-how – to competently self-regulate their own online platforms.

In the short-term, these conditions will likely manifest themselves in the increased spread of disinformation, data leaks, and disruptions to financial markets. What happens from there is anyone’s guess.

[in-text-ad-2]

1. China’s Zero COVID-19 policy

In the face of highly vaccinated populations and newly available viral treatments in much of the industrialized world, the COVID-19 pandemic may soon become endemic, according to Dr. Anthony Fauci, barring the emergence of a more elusive variant that is. The reality in China, the world’s second largest economy, is far different. The country’s zero COVID-19 policy has meant lockdowns for the last two years – and also a population with no antibodies against the omicron variant.

Ultimately, the zero COVID-19 policy that President Xi is keeping in place will fail, the Eurasia Group predicts, and larger outbreaks across the country will require larger lockdowns. These may lead to worsening supply chain disruptions, which will have ripple effects around the world.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.