The consumer price index surged by 7% in December of 2021, the fastest rate in four decades. Surging inflation is a troubling development for the millions of American retirees relying on fixed incomes and those whose savings are invested in equities markets – and should serve as a wake-up call for the one in every four American adults with no retirement savings.

While budgeting for retirement can be difficult, it is essential for those who want financial security throughout their retirement. Including a small financial cushion for unforeseen expenditures and economic challenges, the average 65-year-old American can expect to spend about $1,067,000 throughout retirement. Here are 19 things to do if you want to retire early.

Exactly how much Americans should plan on spending throughout retirement, however, varies based on where they live. Using data from the Bureau of Labor Statistics and the Bureau of Economic Analysis, 24/7 Wall St. calculated what it costs to retire in every state. Our calculations are based on average annual consumer spending, adjusted for regional cost of living and life expectancy.

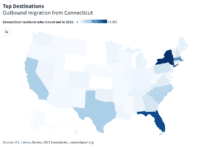

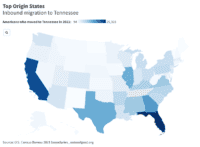

Depending on the state, average expected retirement spending ranges from less than $850,000 to nearly $1.3 million. States with the highest retirement costs are those with higher than average living expenses and where average life expectancy at age 65 exceeds the 19.5 additional years (to age 84.5) national average. This is the state where retirees are most likely to move.

Of course, estimated retirement spending is not synonymous with retirement savings. For example, once Americans reach age 62, they can start collecting Social Security retirement benefits, which amounts to an average monthly payment of $1,560 and can be as high as $3,240 per month. While this is not nearly enough to cover most spending, it is a significant source of income that should be considered when deciding on savings needs. Retirement spending and financial needs also vary considerably from one person to the next, depending on their lifestyle.

Click here to see what is costs to retire comfortably in every state

Click here for our detailed methodology

50. Mississippi

> Estimated total retirement spending: $840,470

> Avg. cost of living: 12.2% less than avg. (the lowest)

> Typical monthly housing costs, 65 and older pop.: $1,007 w/ mortgage; $345 w/o mortgage

> Avg. life expectancy at age 65: age 82.5 (2nd lowest)

> Population 65 and older: 16.4% (19th lowest)

[in-text-ad]

49. West Virginia

> Estimated total retirement spending: $847,044

> Avg. cost of living: 12.0% less than avg. (2nd lowest)

> Typical monthly housing costs, 65 and older pop.: $953 w/ mortgage; $313 w/o mortgage

> Avg. life expectancy at age 65: age 82.6 (5th lowest)

> Population 65 and older: 20.5% (3rd highest)

48. Alabama

> Estimated total retirement spending: $859,496

> Avg. cost of living: 10.7% less than avg. (4th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,069 w/ mortgage; $358 w/o mortgage

> Avg. life expectancy at age 65: age 82.6 (5th lowest)

> Population 65 and older: 17.4% (20th highest)

47. Kentucky

> Estimated total retirement spending: $859,649

> Avg. cost of living: 10.2% less than avg. (5th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,045 w/ mortgage; $373 w/o mortgage

> Avg. life expectancy at age 65: age 82.5 (2nd lowest)

> Population 65 and older: 16.9% (24th lowest)

[in-text-ad-2]

46. Arkansas

> Estimated total retirement spending: $873,451

> Avg. cost of living: 10.8% less than avg. (3rd lowest)

> Typical monthly housing costs, 65 and older pop.: $971 w/ mortgage; $348 w/o mortgage

> Avg. life expectancy at age 65: age 82.9 (8th lowest)

> Population 65 and older: 17.4% (22nd highest)

45. Oklahoma

> Estimated total retirement spending: $879,430

> Avg. cost of living: 8.7% less than avg. (8th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,112 w/ mortgage; $407 w/o mortgage

> Avg. life expectancy at age 65: age 82.6 (5th lowest)

> Population 65 and older: 16.1% (12th lowest)

[in-text-ad]

44. Tennessee

> Estimated total retirement spending: $902,530

> Avg. cost of living: 7.8% less than avg. (15th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,105 w/ mortgage; $388 w/o mortgage

> Avg. life expectancy at age 65: age 82.9 (8th lowest)

> Population 65 and older: 16.7% (22nd lowest)

43. Louisiana

> Estimated total retirement spending: $908,073

> Avg. cost of living: 7.3% less than avg. (21st lowest)

> Typical monthly housing costs, 65 and older pop.: $1,148 w/ mortgage; $346 w/o mortgage

> Avg. life expectancy at age 65: age 82.9 (8th lowest)

> Population 65 and older: 16.0% (11th lowest)

42. Ohio

> Estimated total retirement spending: $923,109

> Avg. cost of living: 8.3% less than avg. (12th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,109 w/ mortgage; $469 w/o mortgage

> Avg. life expectancy at age 65: age 83.4 (12th lowest)

> Population 65 and older: 17.5% (19th highest)

[in-text-ad-2]

41. Indiana

> Estimated total retirement spending: $926,213

> Avg. cost of living: 7.5% less than avg. (20th lowest)

> Typical monthly housing costs, 65 and older pop.: $996 w/ mortgage; $406 w/o mortgage

> Avg. life expectancy at age 65: age 83.3 (9th lowest)

> Population 65 and older: 16.1% (13th lowest)

40. Missouri

> Estimated total retirement spending: $931,203

> Avg. cost of living: 7.5% less than avg. (19th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,144 w/ mortgage; $452 w/o mortgage

> Avg. life expectancy at age 65: age 83.4 (12th lowest)

> Population 65 and older: 17.2% (23rd highest)

[in-text-ad]

39. South Carolina

> Estimated total retirement spending: $932,705

> Avg. cost of living: 8.4% less than avg. (11th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,152 w/ mortgage; $374 w/o mortgage

> Avg. life expectancy at age 65: age 83.6 (13th lowest)

> Population 65 and older: 18.2% (11th highest)

38. North Carolina

> Estimated total retirement spending: $939,694

> Avg. cost of living: 8.2% less than avg. (13th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,164 w/ mortgage; $402 w/o mortgage

> Avg. life expectancy at age 65: age 83.7 (15th lowest)

> Population 65 and older: 16.7% (23rd lowest)

37. Kansas

> Estimated total retirement spending: $950,110

> Avg. cost of living: 7.6% less than avg. (17th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,280 w/ mortgage; $512 w/o mortgage

> Avg. life expectancy at age 65: age 83.8 (16th lowest)

> Population 65 and older: 16.4% (20th lowest)

[in-text-ad-2]

36. Georgia

> Estimated total retirement spending: $951,812

> Avg. cost of living: 5.5% less than avg. (25th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,241 w/ mortgage; $409 w/o mortgage

> Avg. life expectancy at age 65: age 83.4 (12th lowest)

> Population 65 and older: 14.3% (4th lowest)

35. Wyoming

> Estimated total retirement spending: $959,105

> Avg. cost of living: 7.7% less than avg. (16th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,225 w/ mortgage; $415 w/o mortgage

> Avg. life expectancy at age 65: age 84.0 (19th lowest)

> Population 65 and older: 17.1% (24th highest)

[in-text-ad]

34. Iowa

> Estimated total retirement spending: $961,471

> Avg. cost of living: 9.0% less than avg. (6th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,132 w/ mortgage; $498 w/o mortgage

> Avg. life expectancy at age 65: age 84.3 (24th highest)

> Population 65 and older: 17.5% (17th highest)

33. Idaho

> Estimated total retirement spending: $963,044

> Avg. cost of living: 8.8% less than avg. (7th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,147 w/ mortgage; $384 w/o mortgage

> Avg. life expectancy at age 65: age 84.3 (24th highest)

> Population 65 and older: 16.2% (16th lowest)

32. Michigan

> Estimated total retirement spending: $972,547

> Avg. cost of living: 6.0% less than avg. (24th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,176 w/ mortgage; $482 w/o mortgage

> Avg. life expectancy at age 65: age 83.9 (18th lowest)

> Population 65 and older: 17.7% (14th highest)

[in-text-ad-2]

31. New Mexico

> Estimated total retirement spending: $976,982

> Avg. cost of living: 8.4% less than avg. (10th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,194 w/ mortgage; $355 w/o mortgage

> Avg. life expectancy at age 65: age 84.5 (16th highest)

> Population 65 and older: 18.0% (12th highest)

30. Nebraska

> Estimated total retirement spending: $980,933

> Avg. cost of living: 7.1% less than avg. (22nd lowest)

> Typical monthly housing costs, 65 and older pop.: $1,285 w/ mortgage; $532 w/o mortgage

> Avg. life expectancy at age 65: age 84.3 (24th highest)

> Population 65 and older: 16.1% (15th lowest)

[in-text-ad]

29. Montana

> Estimated total retirement spending: $986,329

> Avg. cost of living: 7.6% less than avg. (18th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,299 w/ mortgage; $445 w/o mortgage

> Avg. life expectancy at age 65: age 84.5 (16th highest)

> Population 65 and older: 19.5% (6th highest)

28. South Dakota

> Estimated total retirement spending: $986,475

> Avg. cost of living: 8.5% less than avg. (9th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,186 w/ mortgage; $493 w/o mortgage

> Avg. life expectancy at age 65: age 84.7 (12th highest)

> Population 65 and older: 17.4% (21st highest)

27. North Dakota

> Estimated total retirement spending: $992,112

> Avg. cost of living: 8.0% less than avg. (14th lowest)

> Typical monthly housing costs, 65 and older pop.: $1,251 w/ mortgage; $469 w/o mortgage

> Avg. life expectancy at age 65: age 84.7 (12th highest)

> Population 65 and older: 15.8% (7th lowest)

[in-text-ad-2]

26. Nevada

> Estimated total retirement spending: $993,064

> Avg. cost of living: 2.9% less than avg. (23rd highest)

> Typical monthly housing costs, 65 and older pop.: $1,392 w/ mortgage; $430 w/o mortgage

> Avg. life expectancy at age 65: age 83.7 (15th lowest)

> Population 65 and older: 16.2% (17th lowest)

25. Wisconsin

> Estimated total retirement spending: $994,278

> Avg. cost of living: 6.8% less than avg. (23rd lowest)

> Typical monthly housing costs, 65 and older pop.: $1,258 w/ mortgage; $538 w/o mortgage

> Avg. life expectancy at age 65: age 84.5 (16th highest)

> Population 65 and older: 17.5% (18th highest)

[in-text-ad]

24. Maine

> Estimated total retirement spending: $1,011,380

> Avg. cost of living: 3.2% less than avg. (24th highest)

> Typical monthly housing costs, 65 and older pop.: $1,274 w/ mortgage; $521 w/o mortgage

> Avg. life expectancy at age 65: age 84.1 (21st lowest)

> Population 65 and older: 21.3% (the highest)

23. Utah

> Estimated total retirement spending: $1,017,047

> Avg. cost of living: 4.7% less than avg. (25th highest)

> Typical monthly housing costs, 65 and older pop.: $1,332 w/ mortgage; $422 w/o mortgage

> Avg. life expectancy at age 65: age 84.5 (16th highest)

> Population 65 and older: 11.4% (the lowest)

22. Pennsylvania

> Estimated total retirement spending: $1,019,615

> Avg. cost of living: 2.4% less than avg. (22nd highest)

> Typical monthly housing costs, 65 and older pop.: $1,310 w/ mortgage; $530 w/o mortgage

> Avg. life expectancy at age 65: age 84.1 (21st lowest)

> Population 65 and older: 18.7% (8th highest)

[in-text-ad-2]

21. Delaware

> Estimated total retirement spending: $1,028,189

> Avg. cost of living: 2.1% less than avg. (21st highest)

> Typical monthly housing costs, 65 and older pop.: $1,375 w/ mortgage; $448 w/o mortgage

> Avg. life expectancy at age 65: age 84.2 (23rd lowest)

> Population 65 and older: 19.5% (5th highest)

20. Texas

> Estimated total retirement spending: $1,029,393

> Avg. cost of living: 0.5% less than avg. (17th highest)

> Typical monthly housing costs, 65 and older pop.: $1,407 w/ mortgage; $493 w/o mortgage

> Avg. life expectancy at age 65: age 83.9 (18th lowest)

> Population 65 and older: 12.9% (3rd lowest)

[in-text-ad]

19. Arizona

> Estimated total retirement spending: $1,062,468

> Avg. cost of living: 0.9% less than avg. (19th highest)

> Typical monthly housing costs, 65 and older pop.: $1,274 w/ mortgage; $419 w/o mortgage

> Avg. life expectancy at age 65: age 84.6 (15th highest)

> Population 65 and older: 18.0% (13th highest)

18. Virginia

> Estimated total retirement spending: $1,066,344

> Avg. cost of living: 1.0% more than avg. (14th highest)

> Typical monthly housing costs, 65 and older pop.: $1,534 w/ mortgage; $475 w/o mortgage

> Avg. life expectancy at age 65: age 84.3 (24th highest)

> Population 65 and older: 15.9% (10th lowest)

17. Illinois

> Estimated total retirement spending: $1,066,540

> Avg. cost of living: 0.5% more than avg. (16th highest)

> Typical monthly housing costs, 65 and older pop.: $1,437 w/ mortgage; $617 w/o mortgage

> Avg. life expectancy at age 65: age 84.4 (22nd highest)

> Population 65 and older: 16.1% (14th lowest)

[in-text-ad-2]

16. Vermont

> Estimated total retirement spending: $1,076,299

> Avg. cost of living: 0.7% less than avg. (18th highest)

> Typical monthly housing costs, 65 and older pop.: $1,447 w/ mortgage; $668 w/o mortgage

> Avg. life expectancy at age 65: age 84.8 (10th highest)

> Population 65 and older: 20.1% (4th highest)

15. Minnesota

> Estimated total retirement spending: $1,079,270

> Avg. cost of living: 1.4% less than avg. (20th highest)

> Typical monthly housing costs, 65 and older pop.: $1,376 w/ mortgage; $545 w/o mortgage

> Avg. life expectancy at age 65: age 85.0 (5th highest)

> Population 65 and older: 16.3% (18th lowest)

[in-text-ad]

14. Alaska

> Estimated total retirement spending: $1,084,571

> Avg. cost of living: 3.2% more than avg. (10th highest)

> Typical monthly housing costs, 65 and older pop.: $1,595 w/ mortgage; $536 w/o mortgage

> Avg. life expectancy at age 65: age 84.2 (23rd lowest)

> Population 65 and older: 12.4% (2nd lowest)

13. Rhode Island

> Estimated total retirement spending: $1,086,644

> Avg. cost of living: 1.8% more than avg. (13th highest)

> Typical monthly housing costs, 65 and older pop.: $1,642 w/ mortgage; $717 w/o mortgage

> Avg. life expectancy at age 65: age 84.5 (16th highest)

> Population 65 and older: 17.7% (15th highest)

12. Florida

> Estimated total retirement spending: $1,096,587

> Avg. cost of living: 0.7% more than avg. (15th highest)

> Typical monthly housing costs, 65 and older pop.: $1,338 w/ mortgage; $516 w/o mortgage

> Avg. life expectancy at age 65: age 84.9 (7th highest)

> Population 65 and older: 20.9% (2nd highest)

[in-text-ad-2]

11. Oregon

> Estimated total retirement spending: $1,106,165

> Avg. cost of living: 2.6% more than avg. (12th highest)

> Typical monthly housing costs, 65 and older pop.: $1,485 w/ mortgage; $554 w/o mortgage

> Avg. life expectancy at age 65: age 84.7 (12th highest)

> Population 65 and older: 18.2% (10th highest)

10. New Hampshire

> Estimated total retirement spending: $1,106,575

> Avg. cost of living: 3.7% more than avg. (8th highest)

> Typical monthly housing costs, 65 and older pop.: $1,708 w/ mortgage; $821 w/o mortgage

> Avg. life expectancy at age 65: age 84.5 (16th highest)

> Population 65 and older: 18.6% (9th highest)

[in-text-ad]

9. Colorado

> Estimated total retirement spending: $1,125,680

> Avg. cost of living: 2.9% more than avg. (11th highest)

> Typical monthly housing costs, 65 and older pop.: $1,547 w/ mortgage; $485 w/o mortgage

> Avg. life expectancy at age 65: age 85.0 (5th highest)

> Population 65 and older: 14.7% (5th lowest)

8. Maryland

> Estimated total retirement spending: $1,130,187

> Avg. cost of living: 6.5% more than avg. (7th highest)

> Typical monthly housing costs, 65 and older pop.: $1,741 w/ mortgage; $602 w/o mortgage

> Avg. life expectancy at age 65: age 84.4 (22nd highest)

> Population 65 and older: 15.9% (9th lowest)

7. Connecticut

> Estimated total retirement spending: $1,148,930

> Avg. cost of living: 3.4% more than avg. (9th highest)

> Typical monthly housing costs, 65 and older pop.: $1,880 w/ mortgage; $898 w/o mortgage

> Avg. life expectancy at age 65: age 85.3 (2nd highest)

> Population 65 and older: 17.6% (16th highest)

[in-text-ad-2]

6. Washington

> Estimated total retirement spending: $1,163,099

> Avg. cost of living: 7.4% more than avg. (6th highest)

> Typical monthly housing costs, 65 and older pop.: $1,631 w/ mortgage; $600 w/o mortgage

> Avg. life expectancy at age 65: age 84.8 (10th highest)

> Population 65 and older: 15.9% (8th lowest)

5. Massachusetts

> Estimated total retirement spending: $1,169,877

> Avg. cost of living: 7.4% more than avg. (5th highest)

> Typical monthly housing costs, 65 and older pop.: $1,915 w/ mortgage; $803 w/o mortgage

> Avg. life expectancy at age 65: age 84.9 (7th highest)

> Population 65 and older: 17.0% (25th highest)

[in-text-ad]

4. New Jersey

> Estimated total retirement spending: $1,210,393

> Avg. cost of living: 11.2% more than avg. (2nd highest)

> Typical monthly housing costs, 65 and older pop.: $2,074 w/ mortgage; $1,017 w/o mortgage

> Avg. life expectancy at age 65: age 84.9 (7th highest)

> Population 65 and older: 16.6% (21st lowest)

3. New York

> Estimated total retirement spending: $1,218,129

> Avg. cost of living: 10.2% more than avg. (4th highest)

> Typical monthly housing costs, 65 and older pop.: $1,911 w/ mortgage; $766 w/o mortgage

> Avg. life expectancy at age 65: age 85.2 (4th highest)

> Population 65 and older: 16.9% (25th lowest)

2. California

> Estimated total retirement spending: $1,226,026

> Avg. cost of living: 10.4% more than avg. (3rd highest)

> Typical monthly housing costs, 65 and older pop.: $2,048 w/ mortgage; $588 w/o mortgage

> Avg. life expectancy at age 65: age 85.3 (2nd highest)

> Population 65 and older: 14.8% (6th lowest)

[in-text-ad-2]

1. Hawaii

> Estimated total retirement spending: $1,292,872

> Avg. cost of living: 12.0% more than avg. (the highest)

> Typical monthly housing costs, 65 and older pop.: $2,187 w/ mortgage; $534 w/o mortgage

> Avg. life expectancy at age 65: age 86.1 (the highest)

> Population 65 and older: 19.0% (7th highest)

Methodology

To determine what it costs to retire comfortably in every state, 24/7 Wall St. calculated the amount of money the average retiree needs so it would last for the rest of his or her life using data from the Bureau of Labor Statistics, Bureau of Economic Analysis, and the Centers for Disease Control and Prevention. Our calculation was based on the average annual expenditure for U.S. residents 65 years and older in 2020 of $47,579, according to the BLS Consumer Expenditure Survey. We adjusted that figure by local cost of living, using state-level data on regional price parity in 2020 from the BEA and multiplied the result by 115% in order to reflect greater financial stability and comfort in retirement.

Finally, to determine the amount needed to last the average retiree for the rest of his or her life, we multiplied the adjusted annual expenditure figure by the average life expectancy in years at age 65, using state-level data from the CDC’s National Vital Statistics System for 2018.

Data on the share of the population that is 65 and over, the mean annual earnings for 65+ households, the share of 65+ households with earnings, the 65+ homeownership rate, and homeownership costs came from the U.S. Census Bureau’s 2019 American Community Survey. All data are for the most recent period available.

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.