Special Report

Are Corporations Keeping Their Promise to Fight Climate Change?

Published:

Last Updated:

With the climate crisis looming larger, it is becoming ever more clear that humanity must radically change its habits to avoid devastating, irreversible consequences. As of March of 2021, 21% of the world’s 2,000 largest corporations have made commitments to be carbon neutral or achieve net zero emissions by a future date, usually 2050, in an attempt to be consistent with goals set by the Paris Agreement. (Here are 20 islands that will disappear in your lifetime.)

But how can we assess these pledges — is the touted climate consciousness about image or based on thoughtful analysis and planning for the future, with changes in operations designed to make a difference. New Climate Institute, a nonprofit organization that supports climate change research and action, in collaboration with Carbon Market Watch, a nonprofit that promotes climate action, has produced a report, Corporate Responsibility Monitor 2022, to provide insight into how some large corporations that have announced climate goals are actually working to reduce their carbon footprints.

The report assesses 25 companies that together represent $3.2 trillion in revenues and 5% of worldwide greenhouse gas emissions. (All data is from the report.) The assessment paints a dismal picture, with a good amount of corporate publicity about climate commitments amounting to bluster, referred to as “greenwashing.”

The researchers rated companies for “transparency” in terms of disclosures of their emission sources and data, and for the “integrity” of their planning, defined as quality and credibility, and found all companies lacking to a greater or lesser degree. Most companies were cited for incomplete or inconsistent data, reduction strategies that lack detail, and interim goals that do not legitimately create a path to net zero emissions.

Companies need to address not only the carbon output of their own operations, called scope1 emissions, and indirect emissions associated with their energy use, scope 2, but also the emissions from their upstream suppliers and downstream customers, scope 3. Many corporations failed to consider scope 3 emissions. While many companies appear to be sincere in their efforts, progress everywhere is very late coming and very slow playing out. (This company produces the most plastic waste in the world.)

Click here to see if corporations are making good on their promise to fight climate change

Maersk

> Pledge: Net-zero by 2040

> Quality and credibility of climate planning: Reasonable

> Revenue, 2020: $39.7 billion

> Emissions, 2020: 53.2 million metric tons of CO2 equivalent

> Major source of emissions: Shipping emissions from bunker fuels (63%)

Maersk is a Danish shipping company with the largest fleet of vessels in the world. Of the 25 companies assessed in the CCRM report, it had the best transparency and integrity when it came to its climate plan and was one of only three companies reviewed determined to have made a credible commitment to “deep decarbonization.” It has also set an example in working to reduce its future emissions attributable to energy use by investing in the development of clean energy solutions.

[in-text-ad]

Apple

> Pledge: Carbon neutral by 2030

> Quality and credibility of climate planning: Moderate

> Revenue, 2020: $274.5 billion

> Emissions, 2020: 23.5 million metric tons of CO2 equivalent

> Major source of emissions: Purchase of goods for product manufacturing (70%)

More than most companies, Apple has taken seriously its responsibility to consider upstream emissions when assessing its carbon footprint. This means it is taking steps to reduce emissions, not just from its own factories, but also those of its suppliers. Focusing on energy, Apple invests in alternative energy projects and works to find high quality clean energy solutions for the companies that make parts and materials for its products.

Sony

> Pledge: Zero GHG emissions by 2050

> Quality and credibility of climate planning: Moderate

> Revenue, 2020: $77.5 billion

> Emissions, 2020: 18.5 million metric tons of CO2 equivalent

> Major source of emissions: Use of sold products(62%); raw materials and parts for manufacturing of products (20%).

Since 2010, Sony, a producer of electronic products and media, has been setting detailed energy and climate targets at five-year intervals and using those targets to guide the employment of measures to meet its longer term goal of net zero emissions by 2050. The New Climate Institute also credits the Japanese multinational for its transparency. The company offers detailed information on its emissions by source, activity, and location, and makes the data readily available for download.

Vodafone

> Pledge: Net-zero emissions by 2040

> Quality and credibility of climate planning: Moderate

> Revenue, 2020: $44.9 billion

> Emissions, 2020: 12.0 million metric tons of CO2 equivalent

> Major source of emissions: purchased goods and services (31%); investments in joint ventures (24%); use of sold products (17%).

CCRM is highly critical of companies that are relying heavily on offsets in their plans for meeting climate goals, as most offsets do not reliably reduce total global GHG emissions. U.K.-based telecommunication company Vodafone stands out as a company committed to deep decarbonization, with a mere 5% reliance on offsets. Still, the company gets “very low” marks for its lack of information about how emission reductions will be accomplished.

[in-text-ad-2]

Amazon

> Pledge: Net-zero carbon by 2040

> Quality and credibility of climate planning: Low

> Revenue, 2020: $386.0 billion

> Emissions, 2020: 60.6 million metric tons of CO2 equivalent

> Major source of emissions: Scope 3 emissions account for the majority, but the specific sources are unclear due to poor granularity of data.

E-commerce giant Amazon was a co-founder of the Climate Pledge, an organization created to inspire businesses to join in the fight against climate change by committing to carbon emission reduction goals. Amazon is criticized in the report, however, for a lack of clarity on how it will reach its own goals and for its reliance on offsets. The report acknowledges the company’s $100 million Right Now Climate Fund in support of nature-based climate measures as a positive, but admonishes that Amazon should not use its philanthropic investments for future offsets.

Deutsche Telekom

> Pledge: Net-zero emissions by 2040

> Quality and credibility of climate planning: Low

> Revenue, 2020: $114.0 billion

> Emissions, 2020: 16.4 million metric tons of CO2 equivalent

> Major source of emissions: Use of sold and leased products (38%) and purchased energy (14%).

Out of the 25 assessed companies, only Maersk, Vodafone, and Germany-based Deutsche Telekom commit to deep decarbonization for their entire value chain, but unlike the others, Deutsche scores low on integrity, meaning that the quality and credibility of the company’s climate plan are in question.

As an example, while the telecommunication company is committing to get all of its energy from renewables, about 43% of its energy currently comes from RECs and the alternative energy share of the grid mix, which may include some double-counting and a shift of responsibility for less environmentally friendly energy to other utility customers.

[in-text-ad]

Enel

> Pledge: Net zero by 2050

> Quality and credibility of climate planning: Low

> Revenue, 2020: $73.0 billion

> Emissions, 2020: 97.9 million metric tons of CO2 equivalent

> Major source of emissions: Generation of electricity (46%), retail of third party generated electricity (26%), downstream gas combustion (22%).

Multinational utility company Enel, which generates and distributes electricity and natural gas, owns a significant amount of high emission infrastructure. CCRM praises Enel’s use of 2023 and 2030 interim targets as offering a clearer pathway to net zero in 2050. However, the company provides neither the transparency (“moderate” rating) or a credible strategy (“low” rating) for meeting these goals. For example, the report casts a skeptical eye on Enel’s failure to provide sufficient data on its subsidiaries, where, it is suggested, utilities can shift their least climate friendly assets and thereby appear to be more green.

GlaxoSmithKline

> Pledge: Net-zero carbon by 2030

> Quality and credibility of climate planning: Low

> Revenue, 2020: $45.0 billion

> Emissions, 2019: 16.0 million metric tons of CO2 equivalent

> Major source of emissions: Purchase of goods and services (40%) and use of sold products (40%).

U.K.-based pharmaceutical company GlaxoSmithKline has set aggressive climate targets, committing to 100% renewables by 2025 and net zero emissions by 2030. CCRM found much to criticize in the company’s plan, however, citing incomplete and inconsistent data, lack of planning detail, delays in actions until just before the target dates, and benchmarks that give a false impression of real progress. The company also relies heavily on nature-based offsets to reach its goals.

The report gives special attention to medical inhalers, a major source of emissions as employed by end users of the products. GlaxoSmithKline proposes to begin distribution of much lower emitting devices in 2028 and 2029, in advance of the company’s 2030 net zero target date, though the technology may well be available much earlier.

Google

> Pledge: Carbon free and net zero by 2030

> Quality and credibility of climate planning: Low

> Revenue, 2020: $182.5 billion

> Emissions, 2020: 15.3 million metric tons of CO2 equivalent

> Major source of emissions: Electricity for data centers; use of products.

Google gets low grades for its transparency and the credibility of its climate plan. The report finds Google’s claim to have been carbon neutral since 2007 to be highly misleading, since the company does not include much of its scope 3 impacts, particularly the downstream impacts of its products, including the electricity used by its customers. To the extent it claims neutralization of its emissions through offsets, these offsets are considered to be “highly contentious.”

On the other hand, Google is making significant and credible efforts in scrupulously and transparently increasing alternative energy use within its own operations, supported by hourly monitoring of its energy sources. Unlike other companies that rely heavily on RECs, Google is increasingly employing PPAs (power purchase agreements) and on-site generation in pursuit of its zero emission goals.

[in-text-ad-2]

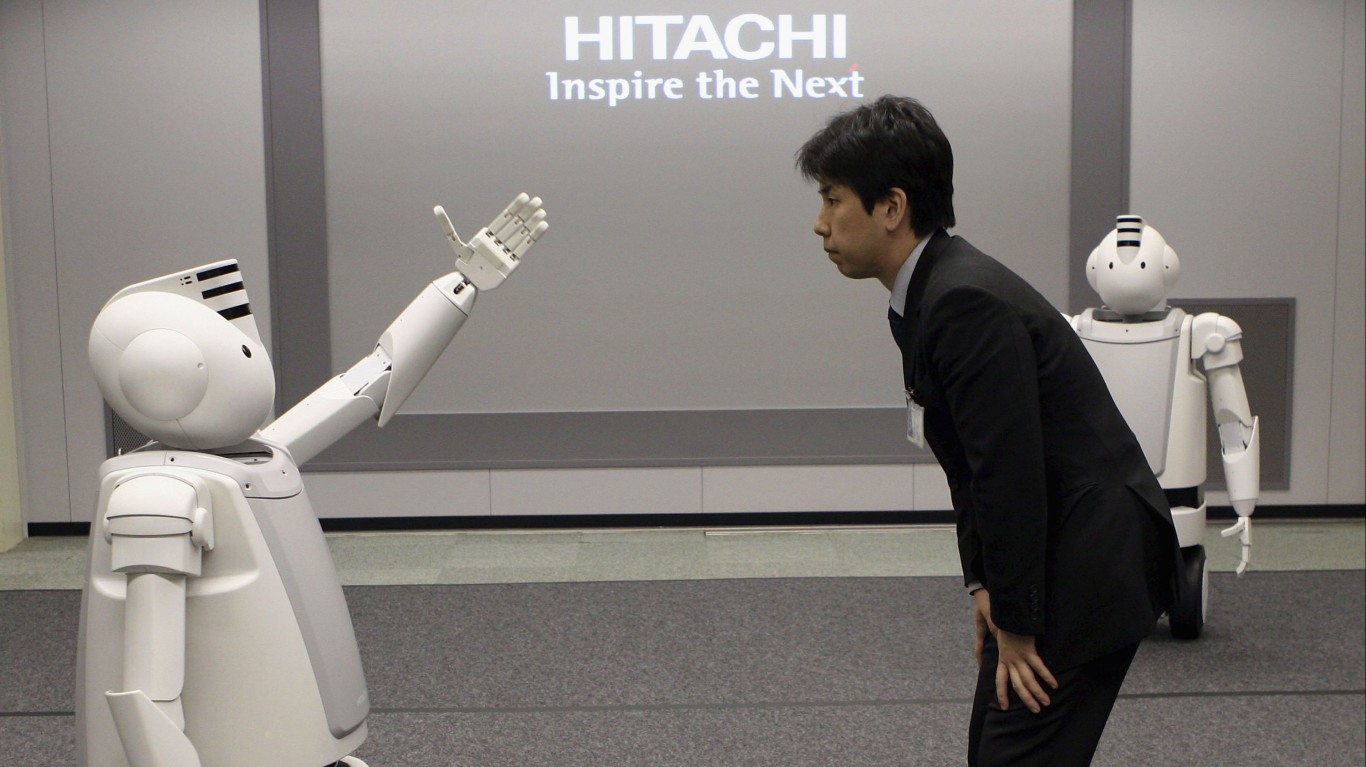

Hitachi

> Pledge: Carbon neutrality by 2050

> Quality and credibility of climate planning: Low

> Revenue, 2020: $75.6 billion

> Emissions, 2020: 60.8 million metric tons of CO2 equivalent

> Major source of emissions: Use of sold products (83%), Purchased goods and services (9%).

The only positive message about Japan-based Hitachi’s climate profile is that it is transparent about its emission sources, though detail is lacking for upstream and downstream sources. Otherwise, the industrial conglomerate has given the CCRM very little to go on in assessing its plans to achieve carbon neutrality. For its energy emissions it has largely relied on RECs, with the potential for double-counting, and it has failed to disclose how much of its neutrality will be achieved through offsets.

Ikea

> Pledge: Climate positive by 2030

> Quality and credibility of climate planning: Low

> Revenue, 2021: $47.0 billion

> Emissions, 2021: 26.8 million metric tons of CO2 equivalent

> Major source of emissions: Raw material extraction and processing (52%); product use (17%).

Earning a “reasonable” score for transparency and “low” for integrity, Ikea gets positive comments for the credibility of its 2050 net-zero goal and its support for suppliers in obtaining high-quality alternative energy. Its overall low score is mainly attributable to the company’s “climate positive by 2030” headline pledge, which CCRM cites as misleading.

In essence, the assertion that the company will be carbon positive – meaning that it will be removing more carbon from the atmosphere than it emits – is based on the idea that some parts of its value chain will offset the emissions of other parts. Wood products, it is argued, will capture carbon, making up for equivalent carbon emissions. The flaw in the equation is that Ikea is not able to show that the capture of carbon is permanent or how it will be verified. Similarly, photovoltaics sold by Ikea should not be used to neutralize its emissions because it is the ultimate user who gets credit for the clean energy produced.

[in-text-ad]

Volkswagen

> Pledge: CO2 neutral by 2050

> Quality and credibility of climate planning: Low

> Revenue, 2020: $252.0 billion

> Emissions, 2020: 376.1 million metric tons of CO2 equivalent

> Major source of emissions: Use-phase of vehicles sold (76%); purchased goods and services (17%)

Volkswagen is heavily invested in developing several models of electric vehicles and is supporting EV charging infrastructure and battery technology. On the other hand, it is not planning on phasing out vehicles with internal combustion engines on a schedule that is compatible with the Paris Agreement goal of limiting temperature rise to 1.5 degrees Celsius. Its own pledge is to actions compatible with a 2 degree increase. Volkswagen is also investing in nature-based offsets and is not providing details on its alternative energy commitment.

Walmart

> Pledge: Zero operational emissions by 2040

> Quality and credibility of climate planning: Low

> Revenue, 2020: $559.2 billion

> Emissions, 2019: 203.1 million metric tons of CO2 equivalent

> Major source of emissions: Procurement of goods(71%)

According to CCRM, Walmart has done a good job at showing how it will achieve its 2040 zero emission goal for its own operations and energy use, employing interim goals to mark progress. But this target does not include scope 3 emissions – those from the upstream and downstream ends of its value chain. In fact, the 2040 goal only accounts for 9% of its emissions, with 75% attributable to its upstream suppliers.

Walmart’s plan for addressing upstream emissions is currently centered around a program it calls Project Gigaton, which encourages and supports suppliers’ emission reduction efforts. Because the program is voluntary, less than a quarter of Walmart’s 10,000 suppliers have enrolled.

Vale

> Pledge: Carbon neutral by 2050 (scope 1 & 2)

> Quality and credibility of climate planning: Low

> Revenue, 2020: $40.0 billion

> Emissions, 2020: 490.8 million metric tons of CO2 equivalent

> Major source of emissions: processing, transport and use of sold products (95%).

Based in Brazil, Vale is one of the world’s largest mining companies. As such, carbon emissions reduction is an immense problem, with 98% of its value chain emissions attributable to the actions of upstream and downstream entities. Its 2050 pledge applies only to its own operations and energy use. For these, it is doing a fair job by, among other things, focusing on quality alternative energy sources. As for its scope 3 emissions, it has set an interim reduction target of 15% by 2035, with no plan for carbon neutrality. Still, Vale is credited for working on customer engagement and innovative approaches that hold potential for significant results.

[in-text-ad-2]

Accenture

> Pledge: Net-zero emissions by 2025

> Quality and credibility of climate planning: Very low

> Revenue, 2021: $50.5 billion

> Emissions, 2020: 0.9 million metric tons of CO2 equivalent

> Major source of emissions: Purchased goods and services (48%), Business travel (31%)

Irish consulting company Accenture specializes in IT solutions. CCRM gives the company its highest rating – reasonable – for its transparency in that it gives a detailed accounting of its carbon profile, including its energy use and emission sources for its entire value chain. Accenture has also made a bold pledge to get to net zero by 2025, positioning itself as a climate leader.

Overall, however, CCRM is not impressed. There is little in the way of actual reductions in emissions in the company’s plan, even though the company’s emissions are not daunting to begin with, being a service organization. It appears that Accenture is going to rely on nature-based offsets, which cannot be guaranteed as permanent and may be subject to double counting.

BMW Group

> Pledge: Climate neutral along the entire value chain by 2050

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $112.4 billion

> Emissions, 2020: 67.0 million metric tons of CO2 equivalent

> Major source of emissions: Energy use of sold vehicles (70%); vehicle manufacturing (25%)

While BMW is committed to carbon neutrality by 2050 and to using high quality offsets, it doesn’t disclose how much actual emission reduction is part of its plan. Because about 70% of its value chain emissions is attributed to the energy used by its downstream automobile purchasers, it is important that it commits to a near-term transition to all electric vehicles. BMW does not seem prepared to do this, at least not at a pace consistent with Paris Accord goals. It has set an interim target of 50% reduction in emissions from its cars by 2030, the year in which 95%-100% of all light-duty vehicles sold in BMW’s main markets will need to have zero tailpipe emissions.

[in-text-ad]

Carrefour

> Pledge: Carbon neutral by 2040

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $82.0 billion

> Emissions, 2020: 95.7 million metric tons of CO2 equivalent

> Major source of emissions: Supply chain for products and packaging account for ~72% of emissions (upstream).

Carrefour, an international retailer based in France, is chided for its undisciplined approach to emission tracking, reduction, and planning. It comes late to the enterprise and appears naive in setting a 2040 goal for carbon neutrality with no credible plan for achieving it. CCRM gives the company some credit for committing to 100% quality alternative energy by 2030, including the installation of on-site sources, but calls the company’s effort “laggard” to date. Solar panels on selected stores around the country account for only 1.5% of Carrefour’s energy use in France.

CVS Health

> Pledge: Net-zero emissions by 2050

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $268.7 billion

> Emissions, 2020: 12.0 million metric tons of CO2 equivalent

> Major source of emissions: Purchased goods and services

Though CVS gets a high score for the transparency of its data across its value chain, it gives few clues as to how it intends to meet its emission reduction goals. The report also hints at a purposeful distortion in its goal setting. Without explanation, the company uses 2019 as its base year for measuring reductions, when it appears that its emissions that year were between 70% and 80% higher than in 2017, 2018, and 2020. This makes it possible to claim target reductions, in this case 47% by 2030, without making actual progress.

Deutsche Post Dhl

> Pledge: Unclear: Zero or net zero by 2050

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $75.5 billion

> Emissions, 2020: 39.1 million metric tons of CO2 equivalent

> Major source of emissions: Own and subcontractor transport, especially from aviation (64%).

Deutsche Post, along with Sony, Vodafone, and Unilever, gets high marks for transparency for its readily accessible, downloadable emissions data. Still, the company is faulted for its inconsistent and incomplete carbon profile, and for promoting its “carbon neutral” package and letter delivery when, in fact, only 1% of its emissions are offset. The company gets some credit for innovations in the area of electric transport, whereby it reduces energy emissions while also creating cost savings and efficiencies.

[in-text-ad-2]

E.On Se

> Pledge: Carbon neutral by 2040

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $69.0 billion

> Emissions, 2020: 116.3 million metric tons of CO2 equivalent

> Major source of emissions: retail gas (downstream gas combustion 36%) and third party generated electricity (downstream energy use 53%).

European energy utility company E.On Se promotes a green image and sets ambitious targets for carbon emission reduction, but it does not clearly explain how it will meet these targets and is misleading in its public pronouncements. It does not make clear, for example, that its pledge of carbon neutrality only applies to its own operations and energy use, which total only 7% of its carbon output. The company has recently restructured and has stated that it will soon be defining concrete measures for meeting its goals, but CCRM sees a lack of ambition in taking the leadership role it claims, particularly in its failure to phase out the sale of gas.

JBS

> Pledge: Net-zero emissions by 2040

> Quality and credibility of climate planning: Very low

> Revenue, 2021: $47.0 billion

> Emissions, 2020: 287.0 million metric tons of CO2 equivalent

> Major source of emissions: Upstream scope 3 emissions, resulting from land-use change in the value chain. Illustrative volume based on 2016 estimates presented in figure.

Brazil-based JBS is a meat processor but has disclosed none of the emissions from the upstream deforestation and agricultural operations of its meat suppliers. This results in a false carbon profile, a small fraction of the size that should be reported. The selective data disclosure, which fails to include 97% of its emissions, calls into question the 2040 net-zero pledge that the company claims applies to all of its value chain emissions. CCRM’s dim view of JBS efforts is further bolstered by the company’s lack of any concrete plan for meeting its stated carbon reduction goals.

[in-text-ad]

Nestle

> Pledge: Net zero by 2050

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $91.8 billion

> Emissions, 2018: 113.0 million metric tons of CO2 equivalent

> Major source of emissions: Sourcing of ingredients(52%).

In addition to its overall very low scores for transparency and integrity, food and beverage company Nestle gets special attention in the CCRM report for its promotion and reliance on what it is calling “insetting.” This is an emissions neutralization strategy whereby the company uses offsets from within the company’s own value chain. Thus, Nestle might use the storage of carbon in the agricultural soils of suppliers to offset carbon emissions elsewhere in the company’s operational scope. CCRM authors are critical of this practice as possibly leading to double counting and avoidance of independent verification.

Novartis

> Pledge: Carbon neutral value chain by 2030

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $49.0 billion

> Emissions, 2019: 7.1 million metric tons of CO2 equivalent

> Major source of emissions: Purchased goods and services (upstream scope 3, 64%).

While giving Novartis some credit for its transparency, CCRM takes the American-Swiss pharmaceutical company to task on a number of fronts. It is particularly critical of the inconsistency of its reporting, being more forthright about its emissions for some reporting purposes but less open with its public declarations. Another negative is the use of impermanent, nature-based offsets as a major component of its climate strategy and the voluntary nature of proffered reduction guidance to its suppliers

Saint-Gobain

> Pledge: Net zero carbon by 2050

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $43.0 billion

> Emissions, 2020: 27.8 million metric tons of CO2 equivalent

> Major source of emissions: Product use and purchased goods and services (shares unclear due to limited reporting and variations in reported magnitude).

There is a small glimmer of praise for French company Saint-Gobain, which mainly produces building materials, in the CCRM report – the mention of innovation strategies for emission reductions and offsets, mainly involving carbon capture or reduction in its building materials. In the broad view, however, for much of the company’s disclosures and climate planning, details are severely lacking, inconsistent, or misleading.

[in-text-ad-2]

Unilever

> Pledge: Net zero by 2039

> Quality and credibility of climate planning: Very low

> Revenue, 2020: $57.4 billion

> Emissions, 2020: 32.0 million metric tons of CO2 equivalent

> Major source of emissions: Raw materials and manufacturing (upstream scope 3, ~35%).

Consumer goods company Unilever is one of the lowest performing companies in the study and is called out as a negative example for distancing itself from offsets for the parent company while encouraging the use of offsets for its individual products.

Unilever is also notable for overstating its scope 3 emissions by including indirect impacts of its products, by, for example, including the energy it takes to heat the water for washing machines using its soap products. Two-thirds of Unilever’s reported emissions are indirect. While this might be considered a positive practice, it can also be a distraction from the company’s actual ambit of responsibility and give it credit for the efforts of others, such as those of the washing machine manufacturer.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.