With the U.S. inflation rate increasing at levels not seen in decades, many Americans are looking to save money, pinching pennies where they can. While some essentials cannot be cut out of the budget, certain goods and services in the U.S. are way overpriced or completely unnecessary.

In many cases, the American economy has, for whatever reason, made some products and services more expensive than they are in other countries with similar economies. (Of course, on the flip side, certain products and services are much cheaper in the U.S.) There are also goods and services that simply have significant markups over what they cost to make, yet lower-priced alternatives are not frequently used.

To determine the most unreasonably priced things Americans buy, 24/7 Wall St. reviewed information from consumer guides like the Federal Trade Commission and Consumer Reports to find items that either have significant markups or that cost much less in other countries.

Many of the most unreasonably priced products and services that Americans buy have cheaper alternatives, including homemade food and drinks instead of store or restaurant bought items. However, some are essential goods and services consumers simply have to find a way to afford, even at their high prices or if prices increase even more. These are the household items with prices that are soaring.

Click here to see the most unreasonably priced things that Americans buy

Insulin

> Pricing: $100-$300 per vial

Insulin is a necessary and life-saving treatment for diabetics. In the United States, insulin can cost anywhere between $100 and $300 per vial, with more than half of that money going to pharmacies, drugstores, wholesalers, and insurers. Though these costs can be defrayed by insurance, Americans still pay between three and nine times more for insulin than diabetics in countries like Canada, Australia, and Europe.

[in-text-ad]

Movie theater snacks

> Pricing: $7-$9

Though popcorn is relatively inexpensive to make, movie theaters can charge well over $7, $8, or even $9 for a bag. Since they are the only food provider, theaters can charge whatever they want for the buttery snack, and moviegoers either have to pay those elevated prices or forgo the fun. The same goes for other snacks like candy, hot dogs, or fountain drinks sold in theaters. Buying snacks outside of the theater would cost two to five times less.

Soda

> Pricing: $2-$3

Though a fountain drink at a restaurant or a bottle of soda at a convenience store is just a few dollars, this still represents an enormous markup from what it costs to make. Soft drinks are almost all water with a bit of syrup, coloring, and carbonation. This combination costs just over a penny per ounce to produce, plus packaging. Americans can save money by making their own soda, or simply cutting out the sugary drinks altogether.

Credit monitoring

> Pricing: up to $30 per month

Americans with poor credit may have to pay much higher interest rates for their homes or cars, so people may be inclined to use a credit monitoring service so they know what to expect.

But these services, which can cost as much as $30 per month, do not actually benefit your credit.

Credit checking services like Equifax, Experian, and TransUnion all must provide you with a free annual credit report, so it is best to just make sound financial decisions and use your free check when you really need it.

[in-text-ad-2]

Coffee shop drinks

> Pricing: $2.70

Many Americans start their day with a cup of coffee or tea from their local coffee shop. Though the average cost of a cup of joe is $2.70, this adds up over time. If a morning cup of coffee is a daily occurrence, it is much more cost efficient to brew your own.

College

> Pricing: $20,000-$44,000

According to the most recent Department of Education data, the average annual cost of attending a four-year college is over $28,000 — a little over $20,000 at public schools and more than $44,000 at private institutions. This includes tuition, fees, and room and board. The cost of going to college in America has more than tripled in the last two decades.

European schools typically charge students less than $2,500 per year, and even the priciest schools charge under $10,000, and some countries provide free higher education. When you factor in the fact that rent tends to be less expensive in Europe as well, getting an education abroad is much less expensive. While education in America is expensive, it is still generally considered a good investment with respect to future earnings and job prospects.

[in-text-ad]

Greeting cards

> Pricing: 200% markup

Greeting cards are a simple and thoughtful gesture to get someone to wish them a happy birthday, holiday greeting, or offer your sympathy. But these pre-made and written cards are just pieces of paper that often come marked up by around 200% of what they cost to make.

The recipient may hold onto them for a bit, but the cards typically end up in the trash sooner rather than later. Getting someone a gift they can actually use will provide them with more benefits, and hand writing your own card will be much more personalized and touching than buying one in a store.

Name brand drugs

> Pricing: 80%-85% markup

Pharmacies carry over-the-counter medicine to alleviate allergies, cold and flu symptoms, aches and pains, digestive issues, and more. Generally, right next to name brand medications that you might see advertisements on TV are the generic brands, packaged in the pharmacy chain or store brand.

These generic medicines have the same active ingredient, dosage, and safety profile, and they work equally as well. Typically, the only difference is the price — generics are much cheaper, about 80%-85% less.

Food delivery

> Pricing: 17%-40% markup

Ordering delivery is undoubtedly convenient, but the fees, taxes, and tip make it much more expensive than dining in or picking up the order yourself. TechCrunch looked at how much more you pay for your food through a delivery app than the restaurant’s listed price. On the low end, Seamless delivery increases restaurant list price by 17%, while Postmates costs over 40% more than list price, with other apps like Uber Eats and Doordash falling in between.

Not only are the delivery apps overpriced, they can sometimes be harmful to restaurants because of the high fees they charge — 15%-30% commission. It is much more cost effective for both you and the restaurants if you order delivery directly from them, if possible.

[in-text-ad-2]

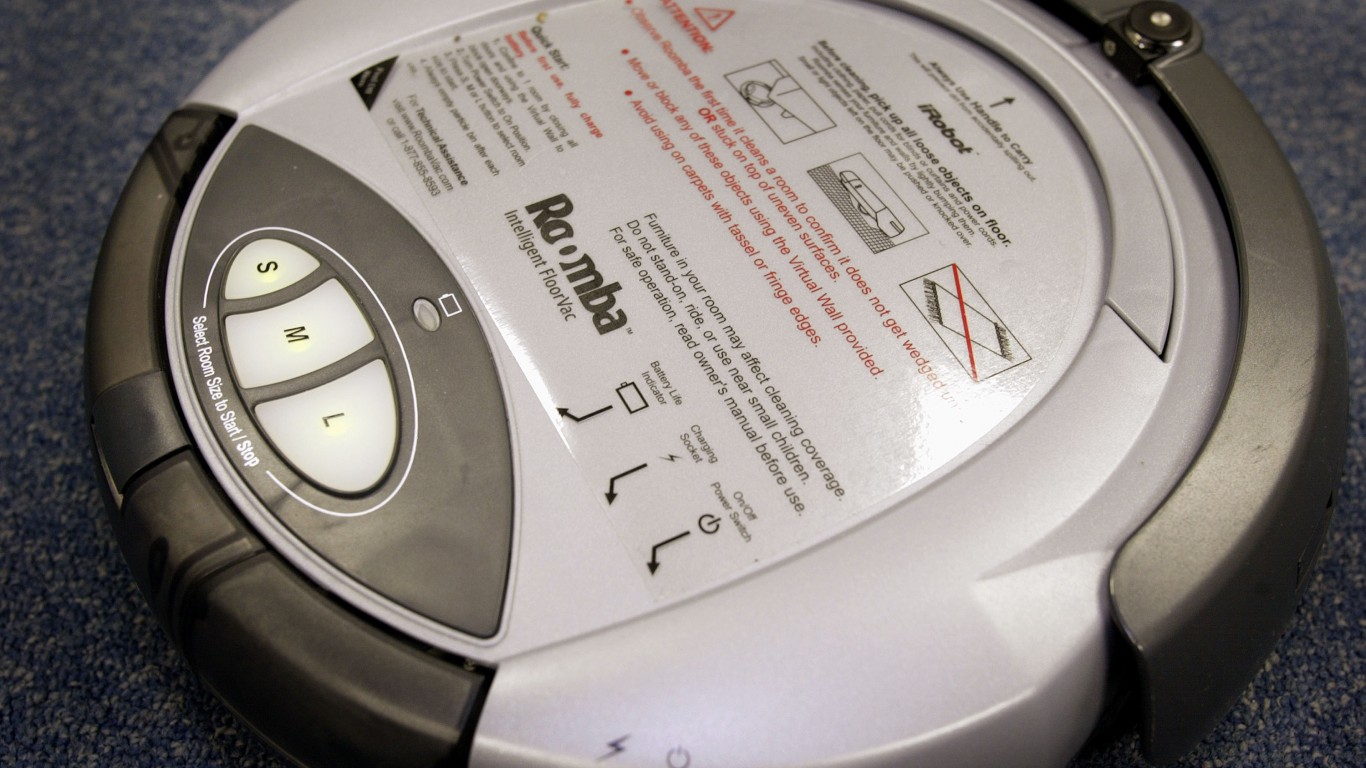

Robot vacuums

> Pricing: $177-$1,099

Many people who are tired of cleaning turn to robot vacuums like Roombas to take care of cleaning their floors automatically. These little robots cost anywhere from $177 to around $1,000, though unfortunately they are still no substitute for a human’s touch.

Robot vacuums often get stuck or miss a spot, meaning you still have to do some cleaning yourself. Many top of the line upright vacuum cleaners cost under $100 these days, so it is probably worth your money to vacuum yourself.

Extended warranties

> Pricing: around $100

It is natural to make sure that a major purchase like an appliance, car, or TV is protected. Yet extended warranties are almost never worth getting. Odds are nothing bad will happen. Even if it does, manufacturers are required to offer a standard warranty that will likely cover your item.

If your purchase is damaged outside of the initial warranty, there is a good chance that the manufacturer will fix or replace it if the company is responsible for its issue, according to Consumer Reports. Even if not, repairs may be less expensive than the extended warranty, which may cost over $100.

[in-text-ad]

Unlimited data plans

> Pricing: $60-$75 per line

Unlimited data plans are like the all-you-can-eat buffets of the technology world — they may sound appealing, but how much are you actually going to consume? Single-line unlimited data plans tend to run about $60-$75 a month per line at major carriers like Verizon, AT&T, and T-Mobile. But you can get a few gigabytes of data from discount carriers like Mint Mobile or Boost Mobile for a fraction of the price.

With many people working from home, the amount of data streaming is decreasing, as people rely more on their home internet service — not to mention the increasing prevalence of public Wi-Fi networks. It is also worth noting that “unlimited” data plans may be a misnomer. Often, providers will throttle down speeds of unlimited data plan users when the network is busiest.

Airport food

> Pricing: 50%-100% markup

Many Americans like to grab a drink or a snack at the airport while they wait for their flights. Since American airports no longer allow liquids through security, buying something at a shop in the airport may be the only option if you get thirsty — unless you want to keep getting up to go to a water fountain.

Food and drink at airports are generally not supposed to be marked up by more than 10%-15% from outside prices, but this is not well enforced, and water, chips, juices, and more can be 50% or even 100% more expensive at an airport compared to a convenience store.

Mattresses

> Pricing: 80% markup

Buyers may not be aware, but you can haggle on prices for mattresses the same way you can with a car. Mattresses are often sold with 100% markups to leave room for commissions and special discounts for holiday sales. With such significant markups, mattress sales people can afford to offer discounts.

[in-text-ad-2]

Bottled water

> Pricing:

Since it is essentially just filtered tap water, there is no reason to spend an exorbitant amount of money on bottled water. If the tap water in your area leaves a bad taste in your mouth, consider a water filter. That way, you can save money on water, and produce less plastic waste as well.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.