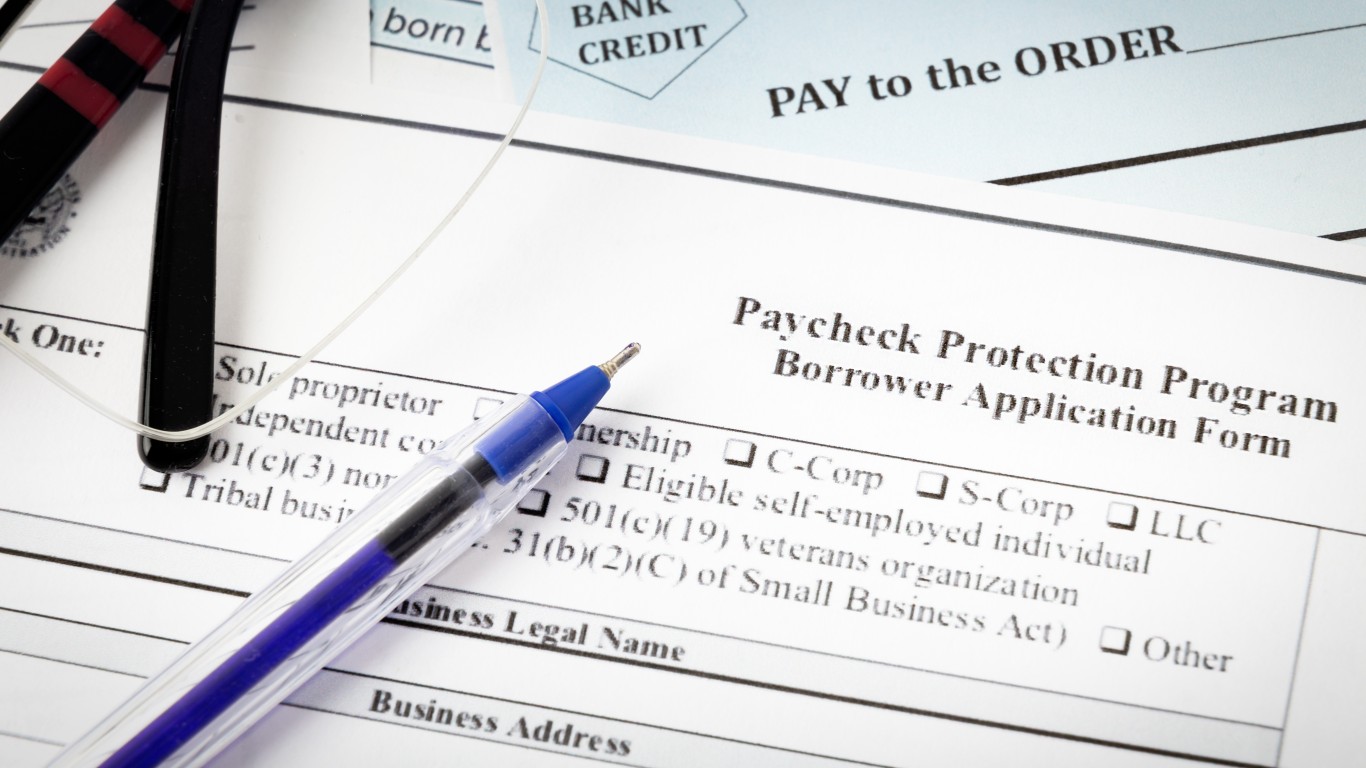

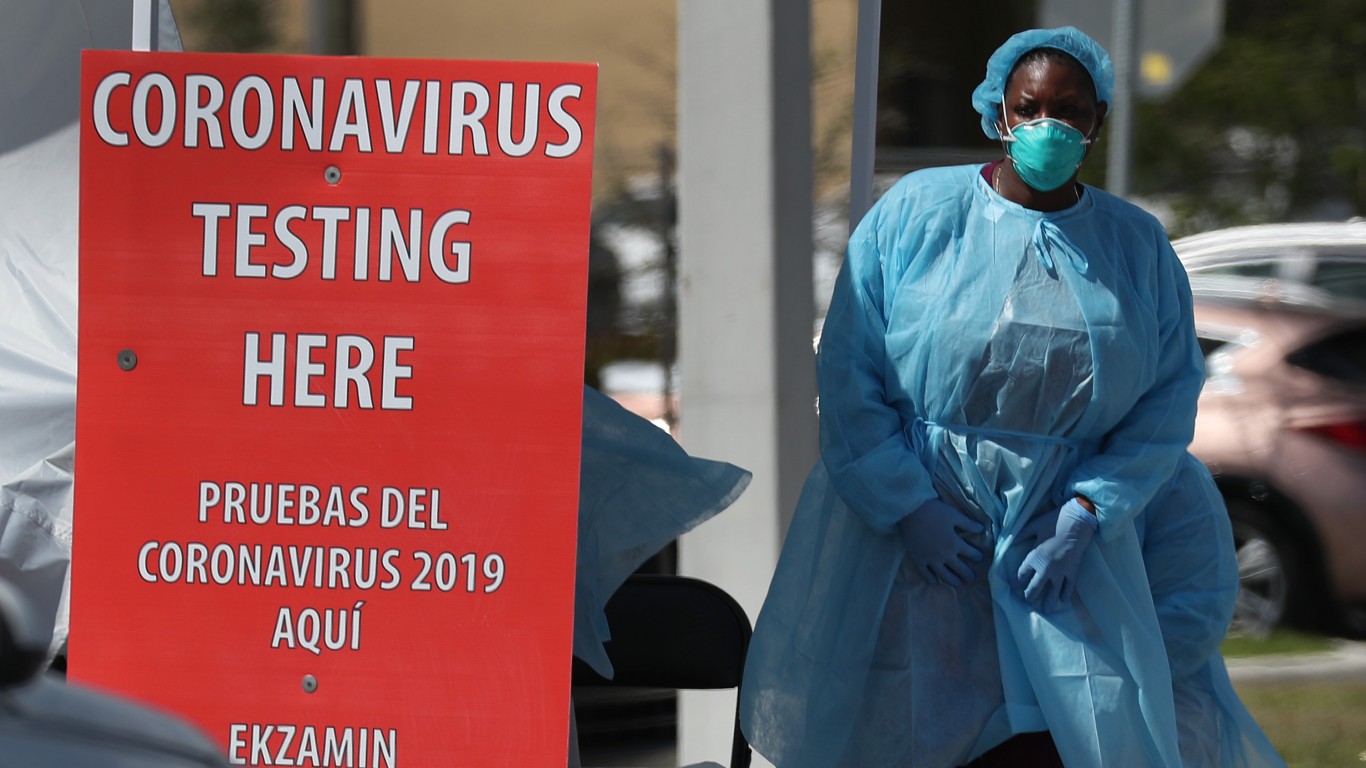

In a hurry to get COVID-19 relief funds into the hands of those who needed it, the federal government provided less robust security measures than those applied in usual spending programs, trusting applicants to tell the truth about who they are and how much help they are eligible for. This led to large scale fraud perpetrated by individuals, organized crime, and international fraudsters. The total amount of the theft may never be known, but experts say it could approach $600 billion.

To date, the Justice Department has filed 1,000 criminal cases and opened civil investigations against another 1,800 individuals and companies for COVID-19-related fraud, ranging from multi-million dollar thefts to sales of fake vaccination cards. Officials say this represents only a fraction of the lost government money.

To determine the largest cases of COVID-19 relief fraud, 24/7 Wall St. reviewed U.S. Department of Justice news releases on arrests, indictments, and convictions related to COVID-19 relief fraud. Defendants and groups of co-defendants were ranked based on the total amount of relief funding they attempted to obtain from the U.S. government.

Fraud cases on this list include direct fraudulent applications to COVID-19 relief programs such as the Paycheck Protection Program and the Economic Injury Disaster Loan Program as well as federal programs that were expanded due to COVID-19 such as Medicare and state unemployment agencies. (2021 was also rife with other scams. Here are 20 of the biggest cryptocurrency scams of the past year.)

One of the most publicized examples of COVID-19 fraud was committed by Diamond Blue Smith, known as Baby Blue, a repentant Florida rapper, who falsified Paycheck Protection Program loan applications and assisted friends with other scams, to the tune of $35 million. His Farrari was seized upon his recent arrest.

The most audacious fraud scheme uncovered to date was perpetrated by Rafael Martinez and his company, MBE, through which he submitted falsified documents to receive approval to be a non-bank distributor of PPP funds. Martinez collected $70 million in lender fees and rewarded himself with a villa, private jets, and a Ferrari. (Also see, companies that changed their names after scandals.)

In fact, the COVID-19 programs have funded many mansions, luxury vacations, and high-end automobiles, and, though many of these have been forfeited and some restitution has been collected, much of the loss will not be recovered.

The laxity in the COVID-19 relief programs, and the resultant fraud, was discovered early in the program and corrective action was taken in the second year of the pandemic, with new validation requirements imposed. The changes appear to be making a difference – an important difference, as there is still another $600 billion in COVID-19 aid to be spent.

Click here to see largest cases of COVID-19 relief fraud

25. Hunter VanPelt

> Amount: $7.9 million

> Program defrauded: PPP

> Charges: Bank fraud

> Location: Georgia

[in-text-ad]

24. Benjamin Hayford

> Amount: $8.0 million

> Program defrauded: Small Business Administration

> Charges: Wire fraud, bank fraud, making false statements to a financial institution, and making false statements to the SBA

> Location: Arkansas

23. Edwards family

> Amount: $8.4 million

> Program defrauded: PPP

> Charges: N/A

> Location: Florida

22. Benjamin Tifekchian

> Amount: $8.9 million

> Program defrauded: PPP, Economic Injury Disaster Loan Program

> Charges: Bank fraud, wire fraud

> Location: Oregon

[in-text-ad-2]

21. Andrew Marnell

> Amount: $9.0 million

> Program defrauded: PPP

> Charges: Bank fraud, money laundering

> Location: California

20. Jae Choi

> Amount: $9.0 million

> Program defrauded: PPP

> Charges: Bank fraud, money laundering

> Location: New Jersey

[in-text-ad]

19. Aditya Raj Sharma

> Amount: $9.6 million

> Program defrauded: PPP

> Charges: Wire fraud

> Location: Minnesota

18. Shashank Rai

> Amount: $10.0 million

> Program defrauded: PPP

> Charges: Wire fraud, bank fraud, false statements to a financial institution, false statements to the SBA

> Location: Texas

17. Darrell Thomas & 21 others

> Amount: $11.1 million

> Program defrauded: PPP

> Charges: Conspiracy to commit bank fraud and wire fraud, bank fraud, wire fraud, false statements to a federally insured financial institution, money laundering

> Location: Georgia, South Carolina, Florida, Michigan, Illinois, Ohio, California

[in-text-ad-2]

16. Marin Kao

> Amount: $12.8 million

> Program defrauded: PPP

> Charges: Bank fraud, money laundering

> Location: Hawaii

15. Elijah Majak Buoi

> Amount: $13.0 million

> Program defrauded: PPP

> Charges: Wire fraud, making a false statement to a financial institution

> Location: Massachusetts

[in-text-ad]

14. Apocalypse Bella, Mackenzy Toussaint, and Amos Munendi

> Amount: $14.0 million

> Program defrauded: PPP, Economic Injury Disaster Loan Program

> Charges: Conspiracy, major fraud against the United States, wire fraud, wire fraud conspiracy

> Location: Texas, Oregon

13. Amir Aqeel, Pardeep Basra, Rifat Bajwa, Mayer Misak, Mauricio Navia, Richard Reuth, and Siddiq Azeemuddin

> Amount: $16.0 million

> Program defrauded: PPP

> Charges: Conspiracy to commit wire fraud, money laundering

> Location: Texas

12. Andrew Aaron Lloyd

> Amount: $18.0 million

> Program defrauded: PPP, Economic Injury Disaster Loan Program

> Charges: Bank fraud, money laundering, aggravated identity theft

> Location: Oregon

[in-text-ad-2]

11. Richard Ayvazyan, Marietta Terabelian, Artur Ayvazyan, Manuk Grigoryan, Edvard Paronyan, Vahe Dadyan, Arman Hayrapetyan, and Tamara Dadyan

> Amount: $20.0 million

> Program defrauded: PPP, Economic Injury Disaster Loan Program

> Charges: Wire fraud, bank fraud, aggravated identity theft, conspiracy to commit bank fraud and wire fraud, conspiracy to commit money laundering

> Location: California

10. Muge Ma

> Amount: $20.0 million

> Program defrauded: PPP, Economic Injury Disaster Loan Program

> Charges: Bank fraud, aggravated identity theft

> Location: New York

[in-text-ad]

9. Steven Jalloul

> Amount: $23.0 million

> Program defrauded: PPP

> Charges: Engaging in monetary transactions using property derived from unlawful activity

> Location: Texas

8. Joshua Bellamy

> Amount: $24.0 million

> Program defrauded: PPP

> Charges: Conspiracy to commit wire fraud

> Location: Florida

7. Dinesh Sah

> Amount: $24.8 million

> Program defrauded: PPP

> Charges: Wire fraud, bank fraud, money laundering

> Location: Texas

[in-text-ad-2]

6. Daryol Richmond, Tevlin Breaux, Holly White, Cecelia Allen, Fantasia Brown, Tonisha Brown, Fantesia Davis, and Shanice White

> Amount: $25.0 million

> Program defrauded: California Employment Development Department

> Charges: Conspiracy, aggravated identity theft

> Location: California

5. Robert Benlevi

> Amount: $27.0 million

> Program defrauded: PPP

> Charges: Bank fraud, false statements to a financial institution, money laundering

> Location: California

[in-text-ad]

4. Peter Khaim & Arkadiy Khaimov

> Amount: $30.0 million

> Program defrauded: Medicare

> Charges: Conspiracy to commit health care fraud, conspiracy to commit money laundering

> Location: New York

3. Diamond Blue Smith, James Stote, and Phillip Augustin

> Amount: $35.0 million

> Program defrauded: PPP

> Charges: Conspiracy to commit wire fraud

> Location: Florida

2. Amanda Gloria

> Amount: $43.8 million

> Program defrauded: PPP

> Charges: Conspiracy to commit brank fraud, money laundering

> Location: New York

[in-text-ad-2]

1. Rafael Martinez

> Amount: $70.0 million

> Program defrauded: PPP, Small Business Administration

> Charges: Wire fraud, bank fraud, false statements to a financial institution, aggravated identity theft

> Location: New Jersey

The Average American Is Losing Momentum On Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%1 today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying more than 7x the national average. That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.