The American housing market took off during the early months of the COVID-19 pandemic. The homeownership rate – or the share of housing units occupied by their owner – jumped by 2.6 percentage points from the first quarter to the second quarter of 2020, by far the largest increase ever recorded. By the end of 2020, there were 2.1 million more homeowners in the United States than there were a year earlier.

The surge in home sales was fueled by several factors, including historically low mortgage rates, and, as some experts speculate, the pandemic, which led many Americans to re-evaluate where and how they live. Here is a look at the mortgage rate in America every year since 1972.

Nationwide, the homeownership rate stands at 64.4%, according to the latest American Community Survey data from the U.S. Census Bureau. This rate varies substantially across the country, however, and in some counties, the homeownership rate is well above the national average.

Using census data, 24/7 Wall St. identified the 50 counties with the highest homeownership rates. Counties and county equivalents are ranked by the share of housing units occupied by their owners.

Among the counties on this list, homeownership rates range from 85.7% to 96.5%. The largest share of counties on this list are in the South, though Michigan alone is home to nine, the most of any state.

Home values are generally relatively low in the counties on this list, making homeownership more affordable for larger shares of the population. In all but 16 counties on this list, the median home value is below the $229,800 value of the typical American home. Here is a look at the 20 cities where the middle class can no longer afford housing.

Click here to see counties with the highest homeownership rates

Click here to read our detailed methodology

50. Botetourt County, Virginia

> Homeownership rate: 85.7%

> Median home value: $230,500 — 457th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,464 — 537th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $386 — 1,130th lowest of 3,072 counties (tied)

> Median household income: $72,719 — 295th highest of 3,072 counties

[in-text-ad]

49. Chambers County, Texas

> Homeownership rate: 85.8%

> Median home value: $224,400 — 493rd highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,837 — 206th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $518 — 505th highest of 3,072 counties (tied)

> Median household income: $95,989 — 63rd highest of 3,072 counties

48. Lake of the Woods County, Minnesota

> Homeownership rate: 85.9%

> Median home value: $179,500 — 825th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,177 — 1,440th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $479 — 783rd highest of 3,072 counties (tied)

> Median household income: $50,669 — 1,248th lowest of 3,072 counties

47. Grand Isle County, Vermont

> Homeownership rate: 85.9%

> Median home value: $287,200 — 246th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,917 — 165th highest of 3,071 counties

> Median monthly housing costs (no mortgage): $782 — 75th highest of 3,072 counties

> Median household income: $81,667 — 175th highest of 3,072 counties

[in-text-ad-2]

46. Oscoda County, Michigan

> Homeownership rate: 85.9%

> Median home value: $96,800 — 627th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $913 — 205th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $346 — 613th lowest of 3,072 counties (tied)

> Median household income: $43,457 — 585th lowest of 3,072 counties

45. Floyd County, Virginia

> Homeownership rate: 86.0%

> Median home value: $170,000 — 943rd highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,160 — 1,531st highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $296 — 130th lowest of 3,072 counties (tied)

> Median household income: $51,250 — 1,320th lowest of 3,072 counties (tied)

[in-text-ad]

44. Greene County, Mississippi

> Homeownership rate: 86.1%

> Median home value: $83,100 — 300th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $977 — 470th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $327 — 376th lowest of 3,072 counties (tied)

> Median household income: $47,033 — 888th lowest of 3,072 counties

43. Twiggs County, Georgia

> Homeownership rate: 86.2%

> Median home value: $71,800 — 111th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $941 — 301st lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $360 — 783rd lowest of 3,072 counties (tied)

> Median household income: $43,477 — 586th lowest of 3,072 counties

42. Sabine County, Texas

> Homeownership rate: 86.4%

> Median home value: $99,900 — 709th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,098 — 1,175th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $387 — 1,147th lowest of 3,072 counties (tied)

> Median household income: $38,917 — 287th lowest of 3,072 counties

[in-text-ad-2]

41. Gladwin County, Michigan

> Homeownership rate: 86.4%

> Median home value: $111,000 — 999th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,033 — 787th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $409 — 1,452nd lowest of 3,072 counties (tied)

> Median household income: $45,957 — 791st lowest of 3,072 counties

40. Chisago County, Minnesota

> Homeownership rate: 86.4%

> Median home value: $244,600 — 383rd highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,703 — 273rd highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $588 — 251st highest of 3,072 counties (tied)

> Median household income: $86,900 — 118th highest of 3,072 counties

[in-text-ad]

39. Oldham County, Kentucky

> Homeownership rate: 86.4%

> Median home value: $299,300 — 211th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,841 — 203rd highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $597 — 233rd highest of 3,072 counties (tied)

> Median household income: $103,761 — 38th highest of 3,072 counties

38. Bandera County, Texas

> Homeownership rate: 86.7%

> Median home value: $202,000 — 642nd highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,468 — 532nd highest of 3,071 counties

> Median monthly housing costs (no mortgage): $443 — 1,176th highest of 3,072 counties (tied)

> Median household income: $60,361 — 851st highest of 3,072 counties (tied)

37. Geauga County, Ohio

> Homeownership rate: 86.7%

> Median home value: $247,700 — 369th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,676 — 294th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $617 — 202nd highest of 3,072 counties (tied)

> Median household income: $83,730 — 147th highest of 3,072 counties

[in-text-ad-2]

36. Spencer County, Kentucky

> Homeownership rate: 86.9%

> Median home value: $227,000 — 480th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,383 — 713th highest of 3,071 counties

> Median monthly housing costs (no mortgage): $429 — 1,364th highest of 3,072 counties (tied)

> Median household income: $85,488 — 127th highest of 3,072 counties

35. Nance County, Nebraska

> Homeownership rate: 87.0%

> Median home value: $78,400 — 212th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $977 — 470th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $401 — 1,348th lowest of 3,072 counties (tied)

> Median household income: $53,147 — 1,506th highest of 3,072 counties (tied)

[in-text-ad]

34. Webster County, Georgia

> Homeownership rate: 87.2%

> Median home value: $69,700 — 92nd lowest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,024 — 737th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $368 — 875th lowest of 3,072 counties (tied)

> Median household income: $31,629 — 63rd lowest of 3,072 counties (tied)

33. Highland County, Virginia

> Homeownership rate: 87.3%

> Median home value: $161,000 — 1,076th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,133 — 1,353rd lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $336 — 470th lowest of 3,072 counties (tied)

> Median household income: $51,831 — 1,406th lowest of 3,072 counties

32. Wilson County, Texas

> Homeownership rate: 87.3%

> Median home value: $210,600 — 586th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,744 — 250th highest of 3,071 counties

> Median monthly housing costs (no mortgage): $514 — 526th highest of 3,072 counties (tied)

> Median household income: $80,082 — 192nd highest of 3,072 counties

[in-text-ad-2]

31. Catron County, New Mexico

> Homeownership rate: 87.5%

> Median home value: $162,400 — 1,049th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $978 — 475th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $331 — 413th lowest of 3,072 counties (tied)

> Median household income: $36,607 — 186th lowest of 3,072 counties

30. Florence County, Wisconsin

> Homeownership rate: 87.5%

> Median home value: $130,700 — 1,468th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,095 — 1,157th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $451 — 1,079th highest of 3,072 counties (tied)

> Median household income: $50,821 — 1,265th lowest of 3,072 counties

[in-text-ad]

29. Antrim County, Michigan

> Homeownership rate: 87.6%

> Median home value: $161,700 — 1,062nd highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,153 — 1,493rd lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $476 — 819th highest of 3,072 counties (tied)

> Median household income: $57,256 — 1,107th highest of 3,072 counties

28. Hanson County, South Dakota

> Homeownership rate: 87.8%

> Median home value: $139,900 — 1,440th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,130 — 1,337th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $481 — 763rd highest of 3,072 counties (tied)

> Median household income: $63,750 — 639th highest of 3,072 counties (tied)

27. Grant County, North Dakota

> Homeownership rate: 87.9%

> Median home value: $75,600 — 160th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,029 — 773rd lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $356 — 750th lowest of 3,072 counties (tied)

> Median household income: $53,750 — 1,450th highest of 3,072 counties (tied)

[in-text-ad-2]

26. Mills County, Texas

> Homeownership rate: 88.2%

> Median home value: $141,700 — 1,406th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $908 — 188th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $438 — 1,251st highest of 3,072 counties (tied)

> Median household income: $50,198 — 1,194th lowest of 3,072 counties

25. Custer County, Colorado

> Homeownership rate: 88.2%

> Median home value: $249,900 — 359th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,632 — 332nd highest of 3,071 counties

> Median monthly housing costs (no mortgage): $416 — 1,529th highest of 3,072 counties (tied)

> Median household income: $60,361 — 851st highest of 3,072 counties (tied)

[in-text-ad]

24. Ontonagon County, Michigan

> Homeownership rate: 88.2%

> Median home value: $74,400 — 142nd lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $870 — 83rd lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $386 — 1,130th lowest of 3,072 counties (tied)

> Median household income: $41,776 — 452nd lowest of 3,072 counties

23. Alcona County, Michigan

> Homeownership rate: 88.2%

> Median home value: $118,700 — 1,180th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $903 — 167th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $369 — 891st lowest of 3,072 counties (tied)

> Median household income: $43,341 — 574th lowest of 3,072 counties

22. Mora County, New Mexico

> Homeownership rate: 88.4%

> Median home value: $104,300 — 818th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,039 — 824th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $307 — 205th lowest of 3,072 counties (tied)

> Median household income: $29,458 — 30th lowest of 3,072 counties

[in-text-ad-2]

21. King William County, Virginia

> Homeownership rate: 88.4%

> Median home value: $205,800 — 620th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,408 — 651st highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $421 — 1,460th highest of 3,072 counties (tied)

> Median household income: $73,284 — 284th highest of 3,072 counties

20. Cameron Parish, Louisiana

> Homeownership rate: 88.5%

> Median home value: $124,300 — 1,329th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,166 — 1,490th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $309 — 218th lowest of 3,072 counties (tied)

> Median household income: $56,902 — 1,151st highest of 3,072 counties

[in-text-ad]

19. Morgan County, Utah

> Homeownership rate: 88.5%

> Median home value: $417,600 — 78th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $2,035 — 122nd highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $464 — 932nd highest of 3,072 counties (tied)

> Median household income: $100,408 — 48th highest of 3,072 counties

18. Keweenaw County, Michigan

> Homeownership rate: 88.6%

> Median home value: $141,800 — 1,402nd highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,072 — 1,016th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $407 — 1,426th lowest of 3,072 counties (tied)

> Median household income: $51,750 — 1,393rd lowest of 3,072 counties

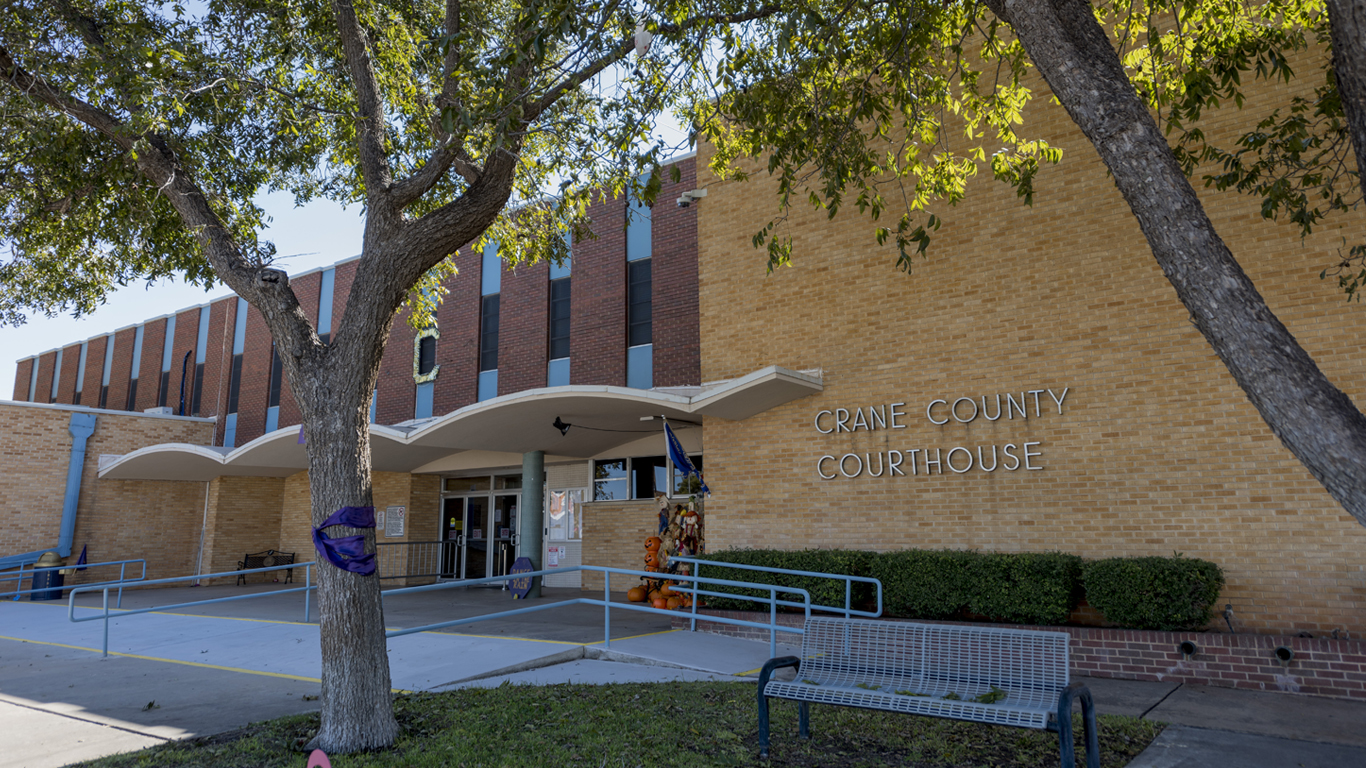

17. Crane County, Texas

> Homeownership rate: 88.6%

> Median home value: $89,000 — 448th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,063 — 966th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $341 — 535th lowest of 3,072 counties (tied)

> Median household income: $54,596 — 1,359th highest of 3,072 counties

[in-text-ad-2]

16. Sumter County, Florida

> Homeownership rate: 88.6%

> Median home value: $267,100 — 296th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,328 — 870th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $471 — 869th highest of 3,072 counties (tied)

> Median household income: $59,618 — 907th highest of 3,072 counties

15. Calhoun County, Illinois

> Homeownership rate: 88.7%

> Median home value: $131,800 — 1,492nd lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,324 — 887th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $550 — 351st highest of 3,072 counties (tied)

> Median household income: $66,602 — 495th highest of 3,072 counties

[in-text-ad]

14. Presque Isle County, Michigan

> Homeownership rate: 88.7%

> Median home value: $111,200 — 1,007th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $950 — 339th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $383 — 1,089th lowest of 3,072 counties (tied)

> Median household income: $48,734 — 1,040th lowest of 3,072 counties

13. Oliver County, North Dakota

> Homeownership rate: 88.8%

> Median home value: $202,400 — 640th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,450 — 566th highest of 3,071 counties

> Median monthly housing costs (no mortgage): $513 — 530th highest of 3,072 counties (tied)

> Median household income: $66,641 — 494th highest of 3,072 counties

12. Leelanau County, Michigan

> Homeownership rate: 88.9%

> Median home value: $285,700 — 249th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,432 — 605th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $521 — 485th highest of 3,072 counties (tied)

> Median household income: $67,330 — 469th highest of 3,072 counties

[in-text-ad-2]

11. Wahkiakum County, Washington

> Homeownership rate: 89.0%

> Median home value: $228,600 — 472nd highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,433 — 600th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $459 — 984th highest of 3,072 counties (tied)

> Median household income: $54,524 — 1,366th highest of 3,072 counties

10. Harris County, Georgia

> Homeownership rate: 89.3%

> Median home value: $230,400 — 458th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,719 — 263rd highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $485 — 737th highest of 3,072 counties (tied)

> Median household income: $79,860 — 195th highest of 3,072 counties

[in-text-ad]

9. Northumberland County, Virginia

> Homeownership rate: 89.4%

> Median home value: $270,900 — 286th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,478 — 510th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $428 — 1,376th highest of 3,072 counties (tied)

> Median household income: $59,437 — 928th highest of 3,072 counties

8. Washington County, Alabama

> Homeownership rate: 89.5%

> Median home value: $88,100 — 428th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,135 — 1,363rd lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $338 — 490th lowest of 3,072 counties (tied)

> Median household income: $42,331 — 506th lowest of 3,072 counties

7. New Kent County, Virginia

> Homeownership rate: 90.0%

> Median home value: $296,700 — 216th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,764 — 240th highest of 3,071 counties

> Median monthly housing costs (no mortgage): $512 — 537th highest of 3,072 counties (tied)

> Median household income: $97,688 — 55th highest of 3,072 counties

[in-text-ad-2]

6. Benzie County, Michigan

> Homeownership rate: 90.9%

> Median home value: $195,400 — 695th highest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,164 — 1,502nd highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $460 — 972nd highest of 3,072 counties (tied)

> Median household income: $64,257 — 612th highest of 3,072 counties

5. Doddridge County, West Virginia

> Homeownership rate: 91.0%

> Median home value: $124,300 — 1,329th lowest of 3,072 counties (tied)

> Median monthly housing costs (w/ a mortgage): $1,035 — 798th lowest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $275 — 46th lowest of 3,072 counties (tied)

> Median household income: $51,300 — 1,327th lowest of 3,072 counties

[in-text-ad]

4. Park County, Colorado

> Homeownership rate: 91.0%

> Median home value: $367,400 — 116th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,654 — 313th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $403 — 1,375th lowest of 3,072 counties (tied)

> Median household income: $76,611 — 229th highest of 3,072 counties

3. Elbert County, Colorado

> Homeownership rate: 91.3%

> Median home value: $492,300 — 50th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $2,226 — 78th highest of 3,071 counties

> Median monthly housing costs (no mortgage): $578 — 278th highest of 3,072 counties (tied)

> Median household income: $104,231 — 34th highest of 3,072 counties

2. Powhatan County, Virginia

> Homeownership rate: 92.8%

> Median home value: $291,300 — 230th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,702 — 278th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $483 — 748th highest of 3,072 counties (tied)

> Median household income: $93,833 — 71st highest of 3,072 counties

[in-text-ad-2]

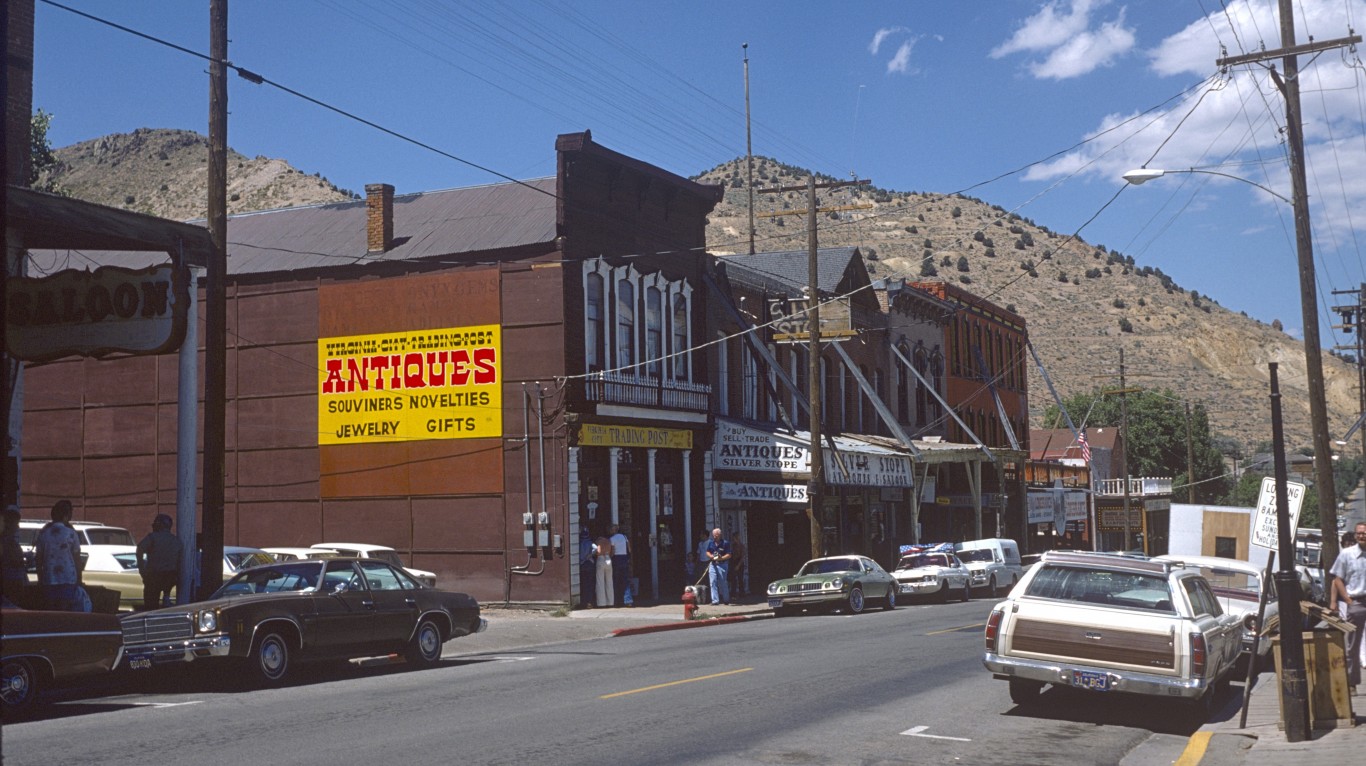

1. Storey County, Nevada

> Homeownership rate: 96.5%

> Median home value: $264,000 — 310th highest of 3,072 counties

> Median monthly housing costs (w/ a mortgage): $1,397 — 689th highest of 3,071 counties (tied)

> Median monthly housing costs (no mortgage): $434 — 1,299th highest of 3,072 counties (tied)

> Median household income: $64,000 — 625th highest of 3,072 counties

Methodology

To determine the counties and county equivalents with the highest homeownership rates, 24/7 Wall St. reviewed five-year estimates of the share of housing units that are occupied by their owners from the U.S. Census Bureau’s 2020 American Community Survey. Counties were ranked based on the percentage of housing units that are occupied by their owners. To break ties, we used the number of housing units that are occupied by their owners.

Counties were excluded if homeownership rates were not available in the 2020 ACS, if there were fewer than 1,000 housing units, or if the sampling error associated with a county’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation — a statistical assessment of how reliable an estimate is — for a county’s homeownership rate was above 15% and greater than two standard deviations above the mean CV for all counties’ homeownership rates. We similarly excluded counties that had a sampling error too high for their population, using the same definition.

Additional information on median home value, median housing costs with and without a mortgage, and median household income are also five-year estimates from the 2020 ACS.

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.