Top athletes make top dollars, but they also pay top taxes. Because of differing tax rates from state to state, some athletes pay a much larger percentage of their earnings than others, and those who make the most money before taxes don’t always end up with more.

To determine gross income, tax liabilities, and after-tax income for 30 of America’s most prominent – and best-paid – athletes, 24/7 Tempo reviewed data collected by the sports news and betting site Bookies.com. The site considered state-specific tax laws and made its own calculations of the estimated amount each athlete paid in tax as well as net pay after tax, based on 2021 on- and off-field (or -court) earnings. The so-called Jock Tax – levied by some cities and states against visiting athletes who earn money within their jurisdiction – was not included in the computations.

Athletes who live or play for teams in high-tax states, not surprisingly, are paying a higher proportion of their salary in taxes than other athletes. Nine athletes on our list lost more than 50% of their earnings to the taxman.

California and New York, where many of these athletes live and play, are both notoriously high-tax states. The athletes in California include football players Joey Bosa, Jalen Ramsey, and Aaron Donald; basketball stars Stephen Curry, Russell Westbrook, and LeBron James; and golfers Tiger Woods and Phil Mickelson. Athletes playing for New York teams include Leonard Williams, Kyrie Irving, and Kevin Durant. (These are the states collecting the most income tax per person.)

No one on this list paid more taxes than LeBron James, whose tax bill amounted to an estimated $50,980,000. Don’t expect a crowdfunding site to be created for the Los Angeles Lakers forward, however; James still took home $45,520,000 after taxes. (See where he stands among the 100 most highly paid athletes in America.)

Click here to see the best paid athletes and what they owed in taxes

Dallas Cowboys quarterback Dak Prescott topped the list in two categories: 2021 earnings with $107,500,000 and after-tax earnings of $65,230,000. Tennis legend Serena Williams is the lone woman on the list, with after-tax earnings of $25,200,000.

30. Paul George

> Sport: Basketball

> 2021 earnings: $37,000,000

> Total tax paid: $19,520,000

> After-tax earnings: $17,480,000

[in-text-ad]

29. Chris Paul

> Sport: Basketball

> 2021 earnings: $40,000,000

> Total tax paid: $21,100,000

> After-tax earnings: $18,900,000

28. Matt Judon

> Sport: Football

> 2021 earnings: $36,000,000

> Total tax paid: $16,880,000

> After-tax earnings: $19,120,000

27. Phil Mickelson

> Sport: Golf

> 2021 earnings: $41,000,000

> Total tax paid: $21,630,000

> After-tax earnings: $19,370,000

[in-text-ad-2]

26. Jalen Ramsey

> Sport: Football

> 2021 earnings: $43,500,000

> Total tax paid: $22,950,000

> After-tax earnings: $20,550,000

25. Damian Lillard

> Sport: Basketball

> 2021 earnings: $40,500,000

> Total tax paid: $19,950,000

> After-tax earnings: $20,590,000

[in-text-ad]

24. Chris Jones

> Sport: Football

> 2021 earnings: $37,000,000

> Total tax paid: $16,630,000

> After-tax earnings: $20,370,000

23. Aaron Donald

> Sport: Football

> 2021 earnings: $36,000,000

> Total tax paid: $15,260,000

> After-tax earnings: $20,760,000

22. Leonard Williams

> Sport: Football

> 2021 earnings: $39,000,000

> Total tax paid: $18,180,000

> After-tax earnings: $20,820,000

[in-text-ad-2]

21. Klay Thompson

> Sport: Basketball

> 2021 earnings: $44,500,000

> Total tax paid: $23,480,000

> After-tax earnings: $21,020,000

20. Marlon Humphrey

> Sport: Football

> 2021 earnings: $37,500,000

> Total tax paid: $15,910,000

> After-tax earnings: $21,590,000

[in-text-ad]

19. Kyrie Irving

> Sport: Basketball

> 2021 earnings: $44,000,000

> Total tax paid: $21,620,000

> After-tax earnings: $22,380,000

18. DeAndre Hopkins

> Sport: Football

> 2021 earnings: $39,000,000

> Total tax paid: $16,370,000

> After-tax earnings: $22,630,000

17. David Bakhtiari

> Sport: Football

> 2021 earnings: $48,500,000

> Total tax paid: $25,600,000

> After-tax earnings: $22,900,000

[in-text-ad-2]

16. Jimmy Butler

> Sport: Basketball

> 2021 earnings: $38,500,000

> Total tax paid: $15,120,000

> After-tax earnings: $23,380,000

15. Myles Garrett

> Sport: Football

> 2021 earnings: $43,000,000

> Total tax paid: $19,100,000

> After-tax earnings: $23,900,000

[in-text-ad]

14. Serena Williams

> Sport: Tennis

> 2021 earnings: $41,500,000

> Total tax paid: $16,300,000

> After-tax earnings: $25,200,000

13. Trent Williams

> Sport: Football

> 2021 earnings: $43,500,000

> Total tax paid: $17,080,000

> After-tax earnings: $26,420,000

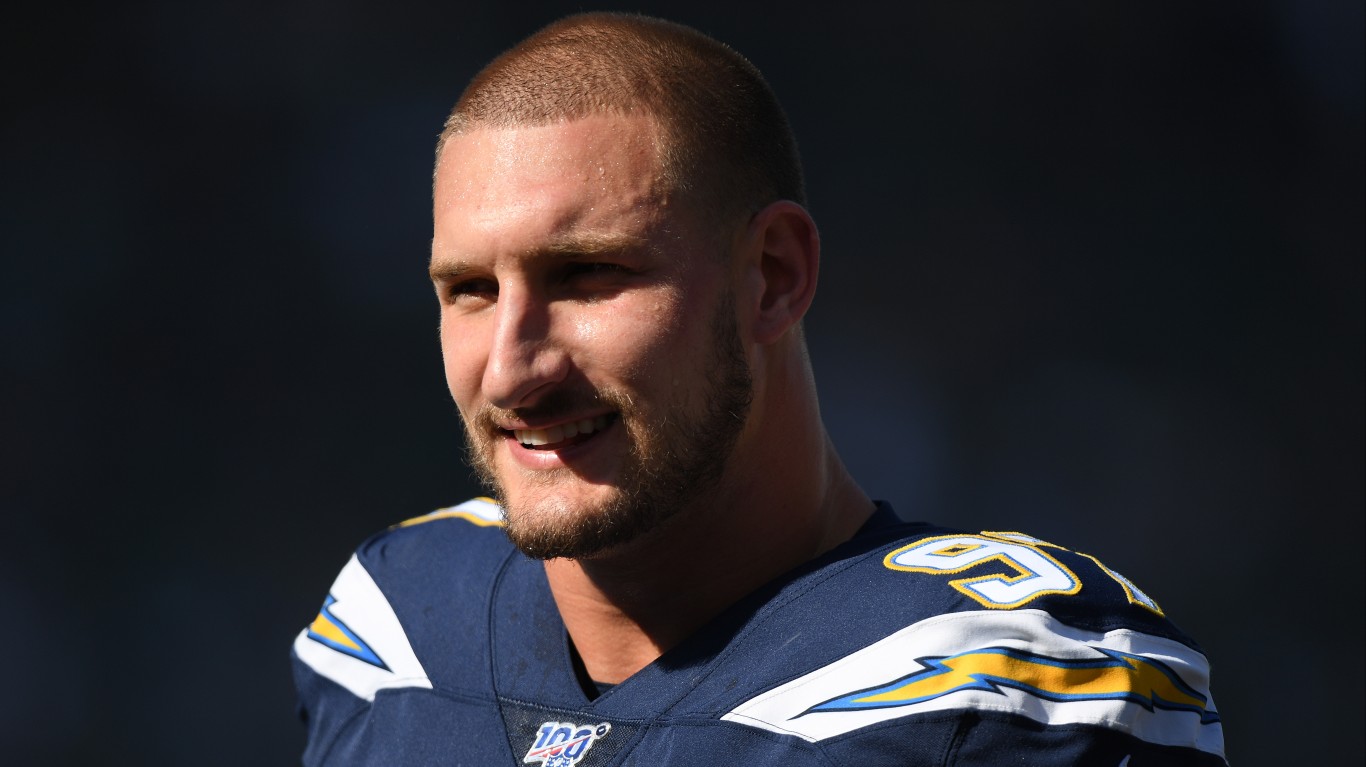

12. Joey Bosa

> Sport: Football

> 2021 earnings: $44,000,000

> Total tax paid: $17,280,000

> After-tax earnings: $26,720,000

[in-text-ad-2]

11. Dustin Johnson

> Sport: Golf

> 2021 earnings: $44,500,000

> Total tax paid: $17,480,000

> After-tax earnings: $27,020,000

10. Russell Westbrook

> Sport: Basketball

> 2021 earnings: $59,000,000

> Total tax paid: $31,150,000

> After-tax earnings: $27,850,000

[in-text-ad]

9. Ronnie Stanley

> Sport: Football

> 2021 earnings: $47,500,000

> Total tax paid: $18,660,000

> After-tax earnings: $28,840,000

8. Patrick Mahomes

> Sport: Football

> 2021 earnings: $54,500,000

> Total tax paid: $24,520,000

> After-tax earnings: $29,980,000

7. James Harden

> Sport: Basketball

> 2021 earnings: $51,000,000

> Total tax paid: $20,030,000

> After-tax earnings: $30,970,000

[in-text-ad-2]

6. Stephen Curry

> Sport: Basketball

> 2021 earnings: $74,500,000

> Total tax paid: $39,350,000

> After-tax earnings: $35,150,000

5. Tiger Woods

> Sport: Golf

> 2021 earnings: $60,000,000

> Total tax paid: $23,580,000

> After-tax earnings: $36,420,000

[in-text-ad]

4. Kevin Durant

> Sport: Basketball

> 2021 earnings: $75,000,000

> Total tax paid: $34,990,000

> After-tax earnings: $40,010,000

3. LeBron James

> Sport: Basketball

> 2021 earnings: $96,500,000

> Total tax paid: $50,980,000

> After-tax earnings: $45,520,000

2. Tom Brady

> Sport: Football

> 2021 earnings: $76,000,000

> Total tax paid: $29,870,000

> After-tax earnings: $46,130,000

[in-text-ad-2]

1. Dak Prescott

> Sport: Football

> 2021 earnings: $107,500,000

> Total tax paid: $42,270,000

> After-tax earnings: $65,230,000

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.