Special Report

The Town in Every State Where the Most People Own the Homes They Live In

Published:

The American housing market took off during the early months of the COVID-19 pandemic. The homeownership rate – or the share of housing units occupied by their owner – jumped by 2.6 percentage points from the first quarter to the second quarter of 2020, by far the largest increase ever recorded. By the end of 2020, there were 2.1 million more homeowners in the United States than there were a year earlier.

The surge in home sales was fueled by several factors, including historically low mortgage rates, and, as some experts speculate, the pandemic, which led many Americans to re-evaluate where and how they live. Here is a look at the mortgage rate in America every year since 1972.

Nationwide, the homeownership rate stands at 64.4%, according to the latest American Community Survey data from the U.S. Census Bureau. This rate varies substantially across the country, however, from state to state, and town to town.

Using census data, 24/7 Wall St. identified the town in every state with the highest homeownership rate. Towns – defined as places with populations between 2,500 and 25,000 – are ranked by the share of housing units occupied by their owners.

Among the towns on this list, homeownership rates range from 72.6% to 100% and are anywhere from 1.3 percentage points to 45.9 percentage points higher than the corresponding state homeownership rate.

In most towns on this list, median household incomes are higher than they are across the state. Higher incomes can help make homeownership more affordable for larger shares of the population and offset the higher than average housing costs that are common in many of the towns on this list. Here is a look at the 20 cities where the middle class can no longer afford housing.

Click here to see the town in every state where the most people own the homes they live in.

Click here to read our detailed methodology.

Alabama: Highland Lakes

> Homeownership rate: 98.2% (Alabama: 69.2%)

> Median home value: $450,500 (Alabama: $149,600)

> Median monthly housing costs (w/ a mortgage): $2,367 (Alabama: $1,196)

> Median monthly housing costs (no mortgage): $686 (Alabama: $367)

> Median household income: $155,200 (Alabama: $52,035)

> No. of towns considered in ranking: 180

[in-text-ad]

Alaska: Sterling

> Homeownership rate: 88.3% (Alaska: 64.8%)

> Median home value: $301,900 (Alaska: $275,600)

> Median monthly housing costs (w/ a mortgage): $1,767 (Alaska: $1,937)

> Median monthly housing costs (no mortgage): $486 (Alaska: $591)

> Median household income: $90,799 (Alaska: $77,790)

> No. of towns considered in ranking: 43

Arizona: Rio Verde

> Homeownership rate: 98.9% (Arizona: 65.3%)

> Median home value: $544,100 (Arizona: $242,000)

> Median monthly housing costs (w/ a mortgage): $2,226 (Arizona: $1,464)

> Median monthly housing costs (no mortgage): $684 (Arizona: $430)

> Median household income: $125,611 (Arizona: $61,529)

> No. of towns considered in ranking: 115

Arkansas: Cave Springs

> Homeownership rate: 94.6% (Arkansas: 65.8%)

> Median home value: $305,300 (Arkansas: $133,600)

> Median monthly housing costs (w/ a mortgage): $1,890 (Arkansas: $1,103)

> Median monthly housing costs (no mortgage): $559 (Arkansas: $353)

> Median household income: $133,981 (Arkansas: $49,475)

> No. of towns considered in ranking: 122

[in-text-ad-2]

California: North Shore

> Homeownership rate: 96.8% (California: 55.3%)

> Median home value: $140,700 (California: $538,500)

> Median monthly housing costs (w/ a mortgage): $1,173 (California: $2,422)

> Median monthly housing costs (no mortgage): $405 (California: $618)

> Median household income: $26,250 (California: $78,672)

> No. of towns considered in ranking: 542

Colorado: Todd Creek

> Homeownership rate: 98.7% (Colorado: 66.2%)

> Median home value: $640,100 (Colorado: $369,900)

> Median monthly housing costs (w/ a mortgage): $2,846 (Colorado: $1,808)

> Median monthly housing costs (no mortgage): $797 (Colorado: $488)

> Median household income: $156,953 (Colorado: $75,231)

> No. of towns considered in ranking: 127

[in-text-ad]

Connecticut: Crystal Lake

> Homeownership rate: 96.8% (Connecticut: 66.1%)

> Median home value: $319,500 (Connecticut: $279,700)

> Median monthly housing costs (w/ a mortgage): $2,184 (Connecticut: $2,127)

> Median monthly housing costs (no mortgage): $661 (Connecticut: $900)

> Median household income: $143,833 (Connecticut: $79,855)

> No. of towns considered in ranking: 89

Delaware: Bethany Beach

> Homeownership rate: 97.0% (Delaware: 71.4%)

> Median home value: $571,700 (Delaware: $258,300)

> Median monthly housing costs (w/ a mortgage): $1,991 (Delaware: $1,591)

> Median monthly housing costs (no mortgage): $454 (Delaware: $475)

> Median household income: $96,700 (Delaware: $69,110)

> No. of towns considered in ranking: 36

Florida: Rainbow Springs

> Homeownership rate: 99.2% (Florida: 66.2%)

> Median home value: $188,100 (Florida: $232,000)

> Median monthly housing costs (w/ a mortgage): $1,140 (Florida: $1,539)

> Median monthly housing costs (no mortgage): $428 (Florida: $513)

> Median household income: $49,775 (Florida: $57,703)

> No. of towns considered in ranking: 499

[in-text-ad-2]

Georgia: Heron Bay

> Homeownership rate: 96.9% (Georgia: 64.0%)

> Median home value: $222,500 (Georgia: $190,200)

> Median monthly housing costs (w/ a mortgage): $1,801 (Georgia: $1,449)

> Median monthly housing costs (no mortgage): $491 (Georgia: $435)

> Median household income: $101,888 (Georgia: $61,224)

> No. of towns considered in ranking: 222

Hawaii: Heeia

> Homeownership rate: 90.4% (Hawaii: 60.3%)

> Median home value: $910,400 (Hawaii: $636,400)

> Median monthly housing costs (w/ a mortgage): $2,965 (Hawaii: $2,443)

> Median monthly housing costs (no mortgage): $582 (Hawaii: $540)

> Median household income: $126,667 (Hawaii: $83,173)

> No. of towns considered in ranking: 75

[in-text-ad]

Idaho: Middleton

> Homeownership rate: 89.7% (Idaho: 70.8%)

> Median home value: $224,100 (Idaho: $235,600)

> Median monthly housing costs (w/ a mortgage): $1,221 (Idaho: $1,312)

> Median monthly housing costs (no mortgage): $403 (Idaho: $388)

> Median household income: $56,225 (Idaho: $58,915)

> No. of towns considered in ranking: 47

Illinois: South Barrington

> Homeownership rate: 100.0% (Illinois: 66.3%)

> Median home value: $855,700 (Illinois: $202,100)

> Median monthly housing costs (w/ a mortgage): $4,000+ (Illinois: $1,709)

> Median monthly housing costs (no mortgage): $1,500+ (Illinois: $650)

> Median household income: $183,750 (Illinois: $68,428)

> No. of towns considered in ranking: 393

Indiana: Shorewood Forest

> Homeownership rate: 100.0% (Indiana: 69.5%)

> Median home value: $379,500 (Indiana: $148,900)

> Median monthly housing costs (w/ a mortgage): $2,549 (Indiana: $1,155)

> Median monthly housing costs (no mortgage): $590 (Indiana: $416)

> Median household income: $135,750 (Indiana: $58,235)

> No. of towns considered in ranking: 173

[in-text-ad-2]

Iowa: Robins

> Homeownership rate: 96.8% (Iowa: 71.2%)

> Median home value: $304,400 (Iowa: $153,900)

> Median monthly housing costs (w/ a mortgage): $1,949 (Iowa: $1,279)

> Median monthly housing costs (no mortgage): $586 (Iowa: $495)

> Median household income: $132,188 (Iowa: $61,836)

> No. of towns considered in ranking: 133

Kansas: Mission Hills

> Homeownership rate: 100.0% (Kansas: 66.2%)

> Median home value: $966,200 (Kansas: $157,600)

> Median monthly housing costs (w/ a mortgage): $4,000+ (Kansas: $1,400)

> Median monthly housing costs (no mortgage): $1,500+ (Kansas: $517)

> Median household income: $250,000+ (Kansas: $61,091)

> No. of towns considered in ranking: 102

[in-text-ad]

Kentucky: Indian Hills

> Homeownership rate: 99.4% (Kentucky: 67.6%)

> Median home value: $581,200 (Kentucky: $147,100)

> Median monthly housing costs (w/ a mortgage): $2,541 (Kentucky: $1,191)

> Median monthly housing costs (no mortgage): $1,096 (Kentucky: $379)

> Median household income: $158,958 (Kentucky: $52,238)

> No. of towns considered in ranking: 138

Louisiana: Bourg

> Homeownership rate: 96.5% (Louisiana: 66.6%)

> Median home value: $164,100 (Louisiana: $168,100)

> Median monthly housing costs (w/ a mortgage): $1,370 (Louisiana: $1,310)

> Median monthly housing costs (no mortgage): $232 (Louisiana: $344)

> Median household income: $76,962 (Louisiana: $50,800)

> No. of towns considered in ranking: 165

Maine: Lake Arrowhead

> Homeownership rate: 96.6% (Maine: 72.9%)

> Median home value: $169,300 (Maine: $198,000)

> Median monthly housing costs (w/ a mortgage): $1,310 (Maine: $1,404)

> Median monthly housing costs (no mortgage): $407 (Maine: $500)

> Median household income: $72,488 (Maine: $59,489)

> No. of towns considered in ranking: 67

[in-text-ad-2]

Maryland: Hampton

> Homeownership rate: 98.0% (Maryland: 67.1%)

> Median home value: $487,700 (Maryland: $325,400)

> Median monthly housing costs (w/ a mortgage): $2,580 (Maryland: $2,038)

> Median monthly housing costs (no mortgage): $793 (Maryland: $633)

> Median household income: $153,268 (Maryland: $87,063)

> No. of towns considered in ranking: 203

Massachusetts: North Scituate

> Homeownership rate: 94.6% (Massachusetts: 62.5%)

> Median home value: $603,300 (Massachusetts: $398,800)

> Median monthly housing costs (w/ a mortgage): $3,094 (Massachusetts: $2,268)

> Median monthly housing costs (no mortgage): $1,087 (Massachusetts: $829)

> Median household income: $116,417 (Massachusetts: $84,385)

> No. of towns considered in ranking: 121

[in-text-ad]

Michigan: Canadian Lakes

> Homeownership rate: 97.4% (Michigan: 71.7%)

> Median home value: $194,800 (Michigan: $162,600)

> Median monthly housing costs (w/ a mortgage): $1,108 (Michigan: $1,312)

> Median monthly housing costs (no mortgage): $459 (Michigan: $495)

> Median household income: $62,328 (Michigan: $59,234)

> No. of towns considered in ranking: 257

Minnesota: Oak Grove

> Homeownership rate: 97.8% (Minnesota: 71.9%)

> Median home value: $309,700 (Minnesota: $235,700)

> Median monthly housing costs (w/ a mortgage): $1,938 (Minnesota: $1,606)

> Median monthly housing costs (no mortgage): $535 (Minnesota: $548)

> Median household income: $107,112 (Minnesota: $73,382)

> No. of towns considered in ranking: 206

Mississippi: Diamondhead

> Homeownership rate: 91.3% (Mississippi: 68.8%)

> Median home value: $179,200 (Mississippi: $125,500)

> Median monthly housing costs (w/ a mortgage): $1,378 (Mississippi: $1,161)

> Median monthly housing costs (no mortgage): $532 (Mississippi: $358)

> Median household income: $64,041 (Mississippi: $46,511)

> No. of towns considered in ranking: 98

[in-text-ad-2]

Missouri: Glendale

> Homeownership rate: 96.7% (Missouri: 67.1%)

> Median home value: $415,900 (Missouri: $163,600)

> Median monthly housing costs (w/ a mortgage): $2,195 (Missouri: $1,287)

> Median monthly housing costs (no mortgage): $712 (Missouri: $449)

> Median household income: $141,622 (Missouri: $57,290)

> No. of towns considered in ranking: 219

Montana: Montana City

> Homeownership rate: 95.4% (Montana: 68.5%)

> Median home value: $359,300 (Montana: $244,900)

> Median monthly housing costs (w/ a mortgage): $1,909 (Montana: $1,456)

> Median monthly housing costs (no mortgage): $568 (Montana: $451)

> Median household income: $105,134 (Montana: $56,539)

> No. of towns considered in ranking: 42

[in-text-ad]

Nebraska: Waverly

> Homeownership rate: 79.8% (Nebraska: 66.2%)

> Median home value: $207,400 (Nebraska: $164,000)

> Median monthly housing costs (w/ a mortgage): $1,573 (Nebraska: $1,412)

> Median monthly housing costs (no mortgage): $556 (Nebraska: $539)

> Median household income: $81,818 (Nebraska: $63,015)

> No. of towns considered in ranking: 54

Nevada: Sandy Valley

> Homeownership rate: 94.7% (Nevada: 57.1%)

> Median home value: $195,000 (Nevada: $290,200)

> Median monthly housing costs (w/ a mortgage): $1,189 (Nevada: $1,574)

> Median monthly housing costs (no mortgage): N/A (Nevada: $433)

> Median household income: $83,713 (Nevada: $62,043)

> No. of towns considered in ranking: 31

New Hampshire: South Hooksett

> Homeownership rate: 81.2% (New Hampshire: 71.2%)

> Median home value: $289,200 (New Hampshire: $272,300)

> Median monthly housing costs (w/ a mortgage): $2,060 (New Hampshire: $1,967)

> Median monthly housing costs (no mortgage): $752 (New Hampshire: $812)

> Median household income: $78,733 (New Hampshire: $77,923)

> No. of towns considered in ranking: 40

[in-text-ad-2]

New Jersey: North Caldwell

> Homeownership rate: 99.3% (New Jersey: 64.0%)

> Median home value: $739,500 (New Jersey: $343,500)

> Median monthly housing costs (w/ a mortgage): $4,000+ (New Jersey: $2,476)

> Median monthly housing costs (no mortgage): $1,500+ (New Jersey: $1,062)

> Median household income: $188,750 (New Jersey: $85,245)

> No. of towns considered in ranking: 398

New Mexico: Sandia Heights

> Homeownership rate: 96.4% (New Mexico: 68.0%)

> Median home value: $490,500 (New Mexico: $175,700)

> Median monthly housing costs (w/ a mortgage): $2,386 (New Mexico: $1,293)

> Median monthly housing costs (no mortgage): $725 (New Mexico: $360)

> Median household income: $114,464 (New Mexico: $51,243)

> No. of towns considered in ranking: 71

[in-text-ad]

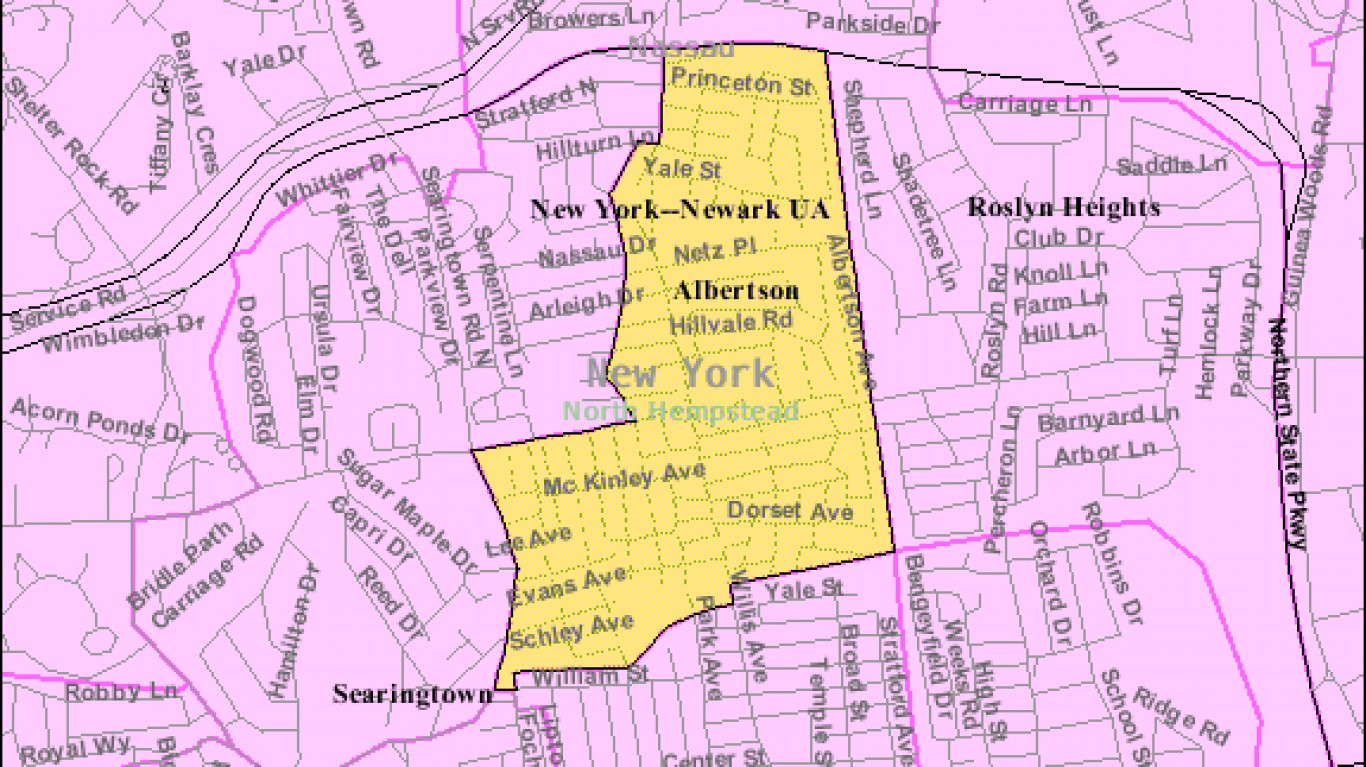

New York: Albertson

> Homeownership rate: 100.0% (New York: 54.1%)

> Median home value: $623,200 (New York: $325,000)

> Median monthly housing costs (w/ a mortgage): $3,563 (New York: $2,174)

> Median monthly housing costs (no mortgage): $1,483 (New York: $781)

> Median household income: $114,966 (New York: $71,117)

> No. of towns considered in ranking: 525

North Carolina: Marvin

> Homeownership rate: 98.8% (North Carolina: 65.7%)

> Median home value: $687,000 (North Carolina: $182,100)

> Median monthly housing costs (w/ a mortgage): $3,200 (North Carolina: $1,328)

> Median monthly housing costs (no mortgage): $876 (North Carolina: $402)

> Median household income: $209,950 (North Carolina: $56,642)

> No. of towns considered in ranking: 291

North Dakota: Horace

> Homeownership rate: 98.0% (North Dakota: 62.5%)

> Median home value: $381,500 (North Dakota: $199,900)

> Median monthly housing costs (w/ a mortgage): $2,296 (North Dakota: $1,457)

> Median monthly housing costs (no mortgage): $542 (North Dakota: $476)

> Median household income: $145,208 (North Dakota: $65,315)

> No. of towns considered in ranking: 18

[in-text-ad-2]

Ohio: Pepper Pike

> Homeownership rate: 98.9% (Ohio: 66.3%)

> Median home value: $443,000 (Ohio: $151,400)

> Median monthly housing costs (w/ a mortgage): $3,065 (Ohio: $1,286)

> Median monthly housing costs (no mortgage): $1,284 (Ohio: $480)

> Median household income: $182,743 (Ohio: $58,116)

> No. of towns considered in ranking: 399

Oklahoma: Piedmont

> Homeownership rate: 96.0% (Oklahoma: 66.1%)

> Median home value: $252,100 (Oklahoma: $142,400)

> Median monthly housing costs (w/ a mortgage): $1,599 (Oklahoma: $1,246)

> Median monthly housing costs (no mortgage): $628 (Oklahoma: $406)

> Median household income: $85,237 (Oklahoma: $53,840)

> No. of towns considered in ranking: 134

[in-text-ad]

Oregon: Beavercreek

> Homeownership rate: 94.5% (Oregon: 62.8%)

> Median home value: $511,500 (Oregon: $336,700)

> Median monthly housing costs (w/ a mortgage): $2,317 (Oregon: $1,741)

> Median monthly housing costs (no mortgage): $547 (Oregon: $553)

> Median household income: $96,875 (Oregon: $65,667)

> No. of towns considered in ranking: 132

Pennsylvania: Pocono Woodland Lakes

> Homeownership rate: 100.0% (Pennsylvania: 69.0%)

> Median home value: $218,100 (Pennsylvania: $187,500)

> Median monthly housing costs (w/ a mortgage): $1,692 (Pennsylvania: $1,505)

> Median monthly housing costs (no mortgage): $508 (Pennsylvania: $542)

> Median household income: $93,673 (Pennsylvania: $63,627)

> No. of towns considered in ranking: 588

Rhode Island: Charlestown

> Homeownership rate: 87.7% (Rhode Island: 61.6%)

> Median home value: $392,500 (Rhode Island: $276,600)

> Median monthly housing costs (w/ a mortgage): $1,845 (Rhode Island: $1,879)

> Median monthly housing costs (no mortgage): $669 (Rhode Island: $745)

> Median household income: $71,638 (Rhode Island: $70,305)

> No. of towns considered in ranking: 12

[in-text-ad-2]

South Carolina: Newport

> Homeownership rate: 98.0% (South Carolina: 70.1%)

> Median home value: $214,500 (South Carolina: $170,100)

> Median monthly housing costs (w/ a mortgage): $1,193 (South Carolina: $1,265)

> Median monthly housing costs (no mortgage): $452 (South Carolina: $377)

> Median household income: $80,000 (South Carolina: $54,864)

> No. of towns considered in ranking: 174

South Dakota: Colonial Pine Hills

> Homeownership rate: 100.0% (South Dakota: 68.0%)

> Median home value: $293,100 (South Dakota: $174,600)

> Median monthly housing costs (w/ a mortgage): $1,915 (South Dakota: $1,367)

> Median monthly housing costs (no mortgage): $877 (South Dakota: $495)

> Median household income: $85,213 (South Dakota: $59,896)

> No. of towns considered in ranking: 38

[in-text-ad]

Tennessee: Tellico Village

> Homeownership rate: 98.1% (Tennessee: 66.5%)

> Median home value: $406,800 (Tennessee: $177,600)

> Median monthly housing costs (w/ a mortgage): $1,604 (Tennessee: $1,272)

> Median monthly housing costs (no mortgage): $516 (Tennessee: $389)

> Median household income: $77,365 (Tennessee: $54,833)

> No. of towns considered in ranking: 161

Texas: Garden Ridge

> Homeownership rate: 100.0% (Texas: 62.3%)

> Median home value: $478,600 (Texas: $187,200)

> Median monthly housing costs (w/ a mortgage): $3,110 (Texas: $1,654)

> Median monthly housing costs (no mortgage): $861 (Texas: $526)

> Median household income: $140,453 (Texas: $63,826)

> No. of towns considered in ranking: 526

Utah: Elk Ridge

> Homeownership rate: 97.2% (Utah: 70.5%)

> Median home value: $398,800 (Utah: $305,400)

> Median monthly housing costs (w/ a mortgage): $1,926 (Utah: $1,597)

> Median monthly housing costs (no mortgage): $497 (Utah: $437)

> Median household income: $103,875 (Utah: $74,197)

> No. of towns considered in ranking: 76

[in-text-ad-2]

Vermont: Swanton

> Homeownership rate: 72.6% (Vermont: 71.3%)

> Median home value: $173,300 (Vermont: $230,900)

> Median monthly housing costs (w/ a mortgage): $1,388 (Vermont: $1,630)

> Median monthly housing costs (no mortgage): $616 (Vermont: $686)

> Median household income: $57,250 (Vermont: $63,477)

> No. of towns considered in ranking: 26

Virginia: Lake of the Woods

> Homeownership rate: 99.0% (Virginia: 66.7%)

> Median home value: $284,500 (Virginia: $282,800)

> Median monthly housing costs (w/ a mortgage): $1,619 (Virginia: $1,822)

> Median monthly housing costs (no mortgage): $527 (Virginia: $481)

> Median household income: $83,845 (Virginia: $76,398)

> No. of towns considered in ranking: 220

[in-text-ad]

Washington: Three Lakes

> Homeownership rate: 96.5% (Washington: 63.3%)

> Median home value: $512,100 (Washington: $366,800)

> Median monthly housing costs (w/ a mortgage): $2,508 (Washington: $1,939)

> Median monthly housing costs (no mortgage): $872 (Washington: $605)

> Median household income: $122,073 (Washington: $77,006)

> No. of towns considered in ranking: 243

West Virginia: Williamstown

> Homeownership rate: 92.9% (West Virginia: 73.7%)

> Median home value: $145,200 (West Virginia: $123,200)

> Median monthly housing costs (w/ a mortgage): $1,172 (West Virginia: $1,058)

> Median monthly housing costs (no mortgage): $345 (West Virginia: $331)

> Median household income: $71,442 (West Virginia: $48,037)

> No. of towns considered in ranking: 73

Wisconsin: Lake Camelot

> Homeownership rate: 100.0% (Wisconsin: 67.1%)

> Median home value: $210,300 (Wisconsin: $189,200)

> Median monthly housing costs (w/ a mortgage): $1,511 (Wisconsin: $1,436)

> Median monthly housing costs (no mortgage): $538 (Wisconsin: $556)

> Median household income: $94,083 (Wisconsin: $63,293)

> No. of towns considered in ranking: 224

[in-text-ad-2]

Wyoming: Ranchettes

> Homeownership rate: 96.1% (Wyoming: 71.0%)

> Median home value: $406,900 (Wyoming: $228,000)

> Median monthly housing costs (w/ a mortgage): $2,083 (Wyoming: $1,474)

> Median monthly housing costs (no mortgage): $546 (Wyoming: $429)

> Median household income: $106,513 (Wyoming: $65,304)

> No. of towns considered in ranking: 31

Methodology

To determine the town with the highest homeownership rate in every state, 24/7 Wall St. reviewed five-year estimates of the share of housing units that are occupied by their owners from the U.S. Census Bureau’s 2020 American Community Survey.

Towns were ranked based on the percentage of housing units that are occupied by their owners. To break ties, we used the number of housing units that are occupied by their owners.

We used census “place” geographies — a category that includes incorporated legal entities and census-designated statistical entities. We defined towns based on population thresholds — having at least 1,000 people and less than 25,000 people.

Towns were excluded if homeownership rates were not available in the 2020 ACS, if there were fewer than 1,000 housing units, or if the sampling error associated with a town’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation — a statistical assessment of how reliable an estimate is — for a town’s homeownership rate was above 15% and greater than two standard deviations above the mean CV for all towns’ homeownership rates. We similarly excluded towns that had a sampling error too high for their population, using the same definition.

Additional information on median home value, median housing costs with and without a mortgage, and median household income are also five-year estimates from the 2020 ACS.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.