The American housing market took off during the early months of the COVID-19 pandemic. The homeownership rate – or the share of housing units occupied by their owner – jumped by 2.6 percentage points from the first quarter to the second quarter of 2020, by far the largest increase ever recorded. By the end of 2020, there were 2.1 million more homeowners in the United States than there were a year earlier.

The surge in home sales was fueled by several factors, including historically low mortgage rates, and, as some experts speculate, the pandemic, which led many Americans to re-evaluate where and how they live. Here is a look at the mortgage rate in America every year since 1972.

Nationwide, the homeownership rate stands at 64.4%, according to the latest American Community Survey data from the U.S. Census Bureau. This rate varies substantially across the country, however, and in some U.S. cities, homeownership is far less common than it is nationwide.

Using census data, 24/7 Wall St. identified the 50 cities with the lowest homeownership rates. Cities, defined as places with populations of at least 25,000, are ranked by the share of housing units occupied by their owners.

Among the cities on this list, homeownership rates range from 12.5% to 34.0%. The largest share of these cities are in the Northeast, including 12 in New Jersey alone.

Homeownership can be expensive, and in most of the cities on this list, the typical home is worth more than the national median home value of $229,800, making homeownership less affordable for larger shares of the population. Here is a look at the 20 cities where the middle class can no longer afford housing.

Many of the cities on this list are home to major colleges or universities. Because a significant share of the population in college towns reside there temporarily, the transient population are more likely to rent a home than buy one. These places include New Haven, Connecticut, home to Yale University, Troy, New York, home to RPI, and Blacksburg, Virginia, home to Virginia Tech.

Click here to see the cities where the fewest people own their homes

Click here to read our detailed methodology

50. Glendale, California

> Homeownership rate: 34.0%

> Median home value: $821,500 — 76th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $3,138 — 100th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $808 — 282nd highest of 1,789 cities (tied)

> Median household income: $70,596 — 804th highest of 1,789 cities

[in-text-ad]

49. Troy, New York

> Homeownership rate: 33.8%

> Median home value: $149,900 — 318th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,452 — 611th lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $601 — 716th highest of 1,789 cities (tied)

> Median household income: $48,834 — 350th lowest of 1,789 cities

48. Blacksburg, Virginia

> Homeownership rate: 33.7%

> Median home value: $309,800 — 674th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,848 — 712th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $565 — 842nd highest of 1,789 cities (tied)

> Median household income: $41,711 — 137th lowest of 1,789 cities

47. Hackensack, New Jersey

> Homeownership rate: 33.7%

> Median home value: $306,700 — 680th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,494 — 279th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $1,127 — 82nd highest of 1,789 cities (tied)

> Median household income: $71,079 — 791st highest of 1,789 cities

[in-text-ad-2]

46. Greenville, North Carolina

> Homeownership rate: 33.6%

> Median home value: $159,400 — 374th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,288 — 390th lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $541 — 830th lowest of 1,789 cities (tied)

> Median household income: $42,612 — 162nd lowest of 1,789 cities

45. Urbana, Illinois

> Homeownership rate: 33.5%

> Median home value: $151,700 — 328th lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,377 — 507th lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $620 — 648th highest of 1,789 cities (tied)

> Median household income: $35,984 — 47th lowest of 1,789 cities

[in-text-ad]

44. Somerville, Massachusetts

> Homeownership rate: 33.5%

> Median home value: $709,800 — 113th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,610 — 235th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $865 — 212th highest of 1,789 cities

> Median household income: $102,311 — 258th highest of 1,789 cities

43. Jacksonville, North Carolina

> Homeownership rate: 33.0%

> Median home value: $157,000 — 363rd lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,264 — 363rd lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $473 — 517th lowest of 1,789 cities (tied)

> Median household income: $45,754 — 243rd lowest of 1,789 cities

42. National City, California

> Homeownership rate: 32.9%

> Median home value: $428,800 — 366th highest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $2,075 — 527th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $401 — 193rd lowest of 1,789 cities (tied)

> Median household income: $49,176 — 363rd lowest of 1,789 cities

[in-text-ad-2]

41. New York, New York

> Homeownership rate: 32.8%

> Median home value: $635,200 — 149th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,791 — 171st highest of 1,789 cities

> Median monthly housing costs (no mortgage): $925 — 163rd highest of 1,789 cities

> Median household income: $67,046 — 880th highest of 1,789 cities

40. Imperial Beach, California

> Homeownership rate: 32.3%

> Median home value: $593,400 — 183rd highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,378 — 345th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $462 — 461st lowest of 1,789 cities (tied)

> Median household income: $59,795 — 701st lowest of 1,789 cities

[in-text-ad]

39. Newburgh, New York

> Homeownership rate: 32.1%

> Median home value: $159,500 — 375th lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,824 — 734th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $885 — 196th highest of 1,789 cities

> Median household income: $43,435 — 189th lowest of 1,789 cities

38. Bell, California

> Homeownership rate: 32.0%

> Median home value: $436,400 — 352nd highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,174 — 455th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $485 — 580th lowest of 1,789 cities (tied)

> Median household income: $47,740 — 311th lowest of 1,789 cities

37. Twentynine Palms, California

> Homeownership rate: 31.0%

> Median home value: $139,400 — 265th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,162 — 217th lowest of 1,789 cities

> Median monthly housing costs (no mortgage): $342 — 32nd lowest of 1,789 cities (tied)

> Median household income: $42,959 — 171st lowest of 1,789 cities

[in-text-ad-2]

36. Perth Amboy, New Jersey

> Homeownership rate: 30.5%

> Median home value: $270,500 — 802nd highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,219 — 425th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $1,019 — 118th highest of 1,789 cities (tied)

> Median household income: $54,188 — 531st lowest of 1,789 cities

35. Huntsville, Texas

> Homeownership rate: 30.4%

> Median home value: $168,800 — 450th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,300 — 401st lowest of 1,789 cities

> Median monthly housing costs (no mortgage): $484 — 575th lowest of 1,789 cities (tied)

> Median household income: $31,020 — 13th lowest of 1,789 cities

[in-text-ad]

34. Miami, Florida

> Homeownership rate: 30.4%

> Median home value: $344,300 — 564th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,043 — 545th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $634 — 610th highest of 1,789 cities (tied)

> Median household income: $44,268 — 209th lowest of 1,789 cities

33. Rexburg, Idaho

> Homeownership rate: 29.9%

> Median home value: $221,700 — 736th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,291 — 396th lowest of 1,789 cities

> Median monthly housing costs (no mortgage): $398 — 176th lowest of 1,789 cities (tied)

> Median household income: $33,278 — 26th lowest of 1,789 cities

32. Winchester, Nevada

> Homeownership rate: 29.7%

> Median home value: $172,300 — 479th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,195 — 268th lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $348 — 43rd lowest of 1,789 cities (tied)

> Median household income: $39,368 — 93rd lowest of 1,789 cities

[in-text-ad-2]

31. Lawrence, Massachusetts

> Homeownership rate: 29.7%

> Median home value: $280,800 — 764th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,872 — 681st highest of 1,789 cities

> Median monthly housing costs (no mortgage): $532 — 788th lowest of 1,789 cities (tied)

> Median household income: $45,045 — 225th lowest of 1,789 cities

30. Jersey City, New Jersey

> Homeownership rate: 29.6%

> Median home value: $406,200 — 406th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,735 — 191st highest of 1,789 cities

> Median monthly housing costs (no mortgage): $1,021 — 117th highest of 1,789 cities

> Median household income: $76,444 — 658th highest of 1,789 cities

[in-text-ad]

29. San Marcos, Texas

> Homeownership rate: 29.1%

> Median home value: $185,300 — 547th lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,530 — 734th lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $537 — 814th lowest of 1,789 cities (tied)

> Median household income: $42,030 — 148th lowest of 1,789 cities

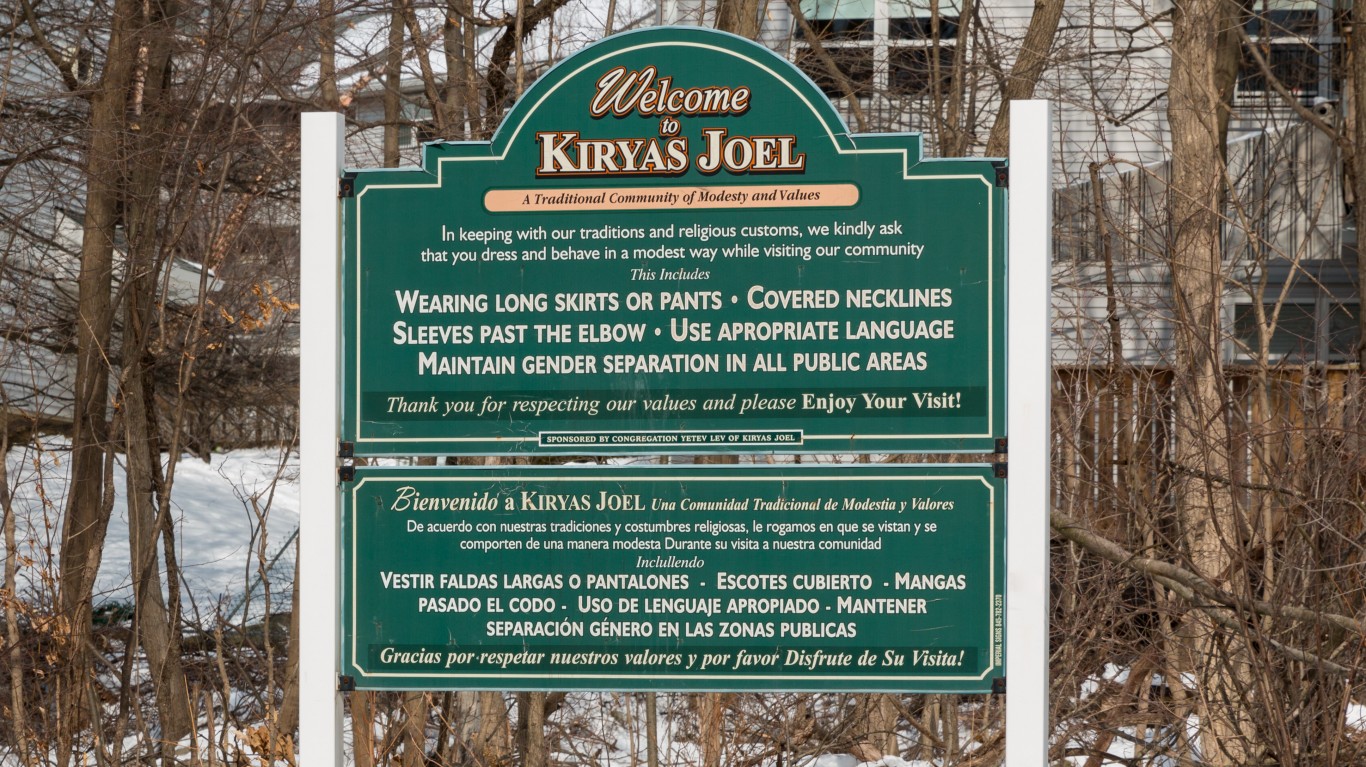

28. Kiryas Joel, New York

> Homeownership rate: 29.0%

> Median home value: $530,700 — 231st highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,535 — 267th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $991 — 128th highest of 1,789 cities

> Median household income: $35,437 — 44th lowest of 1,789 cities

27. Carbondale, Illinois

> Homeownership rate: 28.7%

> Median home value: $122,700 — 175th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,257 — 354th lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $541 — 830th lowest of 1,789 cities (tied)

> Median household income: $24,093 — 2nd lowest of 1,789 cities

[in-text-ad-2]

26. Westmont, California

> Homeownership rate: 28.6%

> Median home value: $460,700 — 304th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,141 — 485th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $411 — 226th lowest of 1,789 cities (tied)

> Median household income: $41,119 — 122nd lowest of 1,789 cities (tied)

25. Pullman, Washington

> Homeownership rate: 28.6%

> Median home value: $287,700 — 734th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,858 — 704th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $561 — 855th highest of 1,789 cities (tied)

> Median household income: $32,073 — 18th lowest of 1,789 cities

[in-text-ad]

24. Atlantic City, New Jersey

> Homeownership rate: 28.2%

> Median home value: $150,000 — 319th lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,709 — 851st highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $898 — 184th highest of 1,789 cities (tied)

> Median household income: $29,526 — 7th lowest of 1,789 cities

23. New Haven, Connecticut

> Homeownership rate: 28.0%

> Median home value: $205,100 — 654th lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,944 — 615th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $939 — 148th highest of 1,789 cities

> Median household income: $44,507 — 213th lowest of 1,789 cities (tied)

22. Santa Monica, California

> Homeownership rate: 27.9%

> Median home value: $1,452,100 — 15th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $3,992 — 27th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $1,057 — 106th highest of 1,789 cities (tied)

> Median household income: $98,300 — 322nd highest of 1,789 cities

[in-text-ad-2]

21. Maywood, California

> Homeownership rate: 27.7%

> Median home value: $427,300 — 371st highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,157 — 467th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $400 — 190th lowest of 1,789 cities (tied)

> Median household income: $50,996 — 432nd lowest of 1,789 cities

20. Salisbury, Maryland

> Homeownership rate: 27.5%

> Median home value: $167,800 — 443rd lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,341 — 451st lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $558 — 874th highest of 1,789 cities (tied)

> Median household income: $44,474 — 212th lowest of 1,789 cities

[in-text-ad]

19. Hawthorne, California

> Homeownership rate: 27.5%

> Median home value: $602,100 — 171st highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,388 — 341st highest of 1,789 cities

> Median monthly housing costs (no mortgage): $473 — 517th lowest of 1,789 cities (tied)

> Median household income: $57,849 — 654th lowest of 1,789 cities

18. Huntington Park, California

> Homeownership rate: 27.4%

> Median home value: $426,700 — 372nd highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,936 — 624th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $478 — 541st lowest of 1,789 cities (tied)

> Median household income: $46,738 — 271st lowest of 1,789 cities

17. State College, Pennsylvania

> Homeownership rate: 26.9%

> Median home value: $332,100 — 603rd highest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $2,020 — 556th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $626 — 633rd highest of 1,789 cities

> Median household income: $38,076 — 78th lowest of 1,789 cities

[in-text-ad-2]

16. Chelsea, Massachusetts

> Homeownership rate: 26.9%

> Median home value: $369,900 — 484th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,229 — 421st highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $687 — 495th highest of 1,789 cities (tied)

> Median household income: $60,370 — 716th lowest of 1,789 cities

15. Paterson, New Jersey

> Homeownership rate: 26.0%

> Median home value: $257,700 — 872nd highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,243 — 410th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $1,050 — 109th highest of 1,789 cities

> Median household income: $45,141 — 229th lowest of 1,789 cities

[in-text-ad]

14. Elizabeth, New Jersey

> Homeownership rate: 25.9%

> Median home value: $291,300 — 724th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,451 — 301st highest of 1,789 cities

> Median monthly housing costs (no mortgage): $1,163 — 73rd highest of 1,789 cities

> Median household income: $50,647 — 420th lowest of 1,789 cities

13. Spring Valley, New York

> Homeownership rate: 25.6%

> Median home value: $312,100 — 667th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,277 — 388th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $1,064 — 102nd highest of 1,789 cities (tied)

> Median household income: $45,646 — 240th lowest of 1,789 cities

12. Ithaca, New York

> Homeownership rate: 25.1%

> Median home value: $261,900 — 848th highest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,919 — 640th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $835 — 245th highest of 1,789 cities (tied)

> Median household income: $38,019 — 76th lowest of 1,789 cities

[in-text-ad-2]

11. Hartford, Connecticut

> Homeownership rate: 24.9%

> Median home value: $170,200 — 461st lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,616 — 827th lowest of 1,789 cities

> Median monthly housing costs (no mortgage): $758 — 351st highest of 1,789 cities (tied)

> Median household income: $36,154 — 50th lowest of 1,789 cities

10. Statesboro, Georgia

> Homeownership rate: 24.6%

> Median home value: $115,100 — 141st lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $985 — 55th lowest of 1,789 cities

> Median monthly housing costs (no mortgage): $358 — 66th lowest of 1,789 cities (tied)

> Median household income: $32,790 — 21st lowest of 1,789 cities

[in-text-ad]

9. East Orange, New Jersey

> Homeownership rate: 24.0%

> Median home value: $226,000 — 755th lowest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,296 — 375th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $1,133 — 81st highest of 1,789 cities

> Median household income: $50,990 — 431st lowest of 1,789 cities

8. Newark, New Jersey

> Homeownership rate: 23.5%

> Median home value: $254,900 — 885th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,194 — 445th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $990 — 129th highest of 1,789 cities

> Median household income: $37,476 — 68th lowest of 1,789 cities

7. West New York, New Jersey

> Homeownership rate: 22.4%

> Median home value: $340,800 — 576th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $2,397 — 336th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $1,321 — 39th highest of 1,789 cities

> Median household income: $64,378 — 829th lowest of 1,789 cities

[in-text-ad-2]

6. Bell Gardens, California

> Homeownership rate: 21.6%

> Median home value: $402,600 — 413th highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $1,884 — 667th highest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $434 — 322nd lowest of 1,789 cities (tied)

> Median household income: $45,289 — 234th lowest of 1,789 cities

5. Passaic, New Jersey

> Homeownership rate: 21.5%

> Median home value: $348,000 — 553rd highest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $2,651 — 222nd highest of 1,789 cities

> Median monthly housing costs (no mortgage): $1,341 — 30th highest of 1,789 cities

> Median household income: $44,779 — 219th lowest of 1,789 cities

[in-text-ad]

4. West Hollywood, California

> Homeownership rate: 19.8%

> Median home value: $743,700 — 101st highest of 1,789 cities

> Median monthly housing costs (w/ a mortgage): $3,179 — 89th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $962 — 139th highest of 1,789 cities

> Median household income: $71,692 — 776th highest of 1,789 cities

3. Union City, New Jersey

> Homeownership rate: 19.8%

> Median home value: $360,000 — 511th highest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $2,886 — 145th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $1,258 — 47th highest of 1,789 cities

> Median household income: $49,457 — 376th lowest of 1,789 cities

2. New Brunswick, New Jersey

> Homeownership rate: 19.5%

> Median home value: $267,200 — 818th highest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,845 — 714th highest of 1,789 cities

> Median monthly housing costs (no mortgage): $934 — 154th highest of 1,789 cities (tied)

> Median household income: $43,930 — 201st lowest of 1,789 cities

[in-text-ad-2]

1. University (Hillsborough County), Florida

> Homeownership rate: 12.5%

> Median home value: $91,900 — 63rd lowest of 1,789 cities (tied)

> Median monthly housing costs (w/ a mortgage): $1,123 — 164th lowest of 1,789 cities (tied)

> Median monthly housing costs (no mortgage): $339 — 24th lowest of 1,789 cities (tied)

> Median household income: $29,380 — 6th lowest of 1,789 cities

Methodology

To determine the cities with the lowest homeownership rates, 24/7 Wall St. reviewed five-year estimates of the share of housing units that are occupied by their owners from the U.S. Census Bureau’s 2020 American Community Survey.

We used census “place” geographies — a category that includes incorporated legal entities and census-designated statistical entities. We defined cities based on a population threshold — census places needed to have a population of at least 25,000 to be considered.

Cities were excluded if homeownership rates were not available in the 2020 ACS, if there were fewer than 1,000 housing units, or if the sampling error associated with a city’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation — a statistical assessment of how reliable an estimate is — for a city’s homeownership rate was above 15% and greater than two standard deviations above the mean CV for all cities’ homeownership rates. We similarly excluded cities that had a sampling error too high for their population, using the same definition.

Cities were ranked based on the percentage of housing units that are occupied by their owners. To break ties, we used the number of housing units that are occupied by their owners.

Additional information on median home value, median housing costs with and without a mortgage, and median household income are also five-year estimates from the 2020 ACS.

“The Next NVIDIA” Could Change Your Life

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.