Inflation, a measure of the rate of rising prices of goods and services in an economy, can be harmful in many ways. At its most virulent, inflation leads to higher prices on anything, erodes savings, and reduces living standards. When inflation becomes hyperinflation, people get angry and blame the government. It can put extremists on the road to power, as it did in the 1920s in Germany. Today the country with the worst inflation is Turkey.

Inflation in the U.S. had not been an issue since the late 1970s, when it helped oust President Jimmy Carter in 1980. Because of the effects of the pandemic, and more recently of Russia’s invasion of Ukraine, inflation has befallen the economy again, and it is hitting some countries harder than others.

To identify countries that have the worst inflation in the world, 24/7 Wall St. reviewed inflation data in the G20 economies — 19 major economies and the European Union — from OECD.stat. The rank is based on the annual percentage change of inflation in April 2022, or latest available.

For many of the countries on the list, the pace of inflation has not soared this much in decades. In the U.S., inflation following the Vietnam War was an albatross around the neck of the U.S. economy during the 1970s, before then Federal Reserve Chairman Paul Volcker hiked interest rates multiple times to bring it under control.

In 2022, the acceleration in inflation is forcing central banks around the world to tighten monetary policy faster than many anticipated. Earlier in May, the Fed lifted its benchmark rate by 50 basis points, the first time it has hiked interest rates by that much in 20 years as it attempted to bring inflation under control. Its 25 basis point rate increase in March was the first time it had done so in four years. (In the U.S. the price of this household item is soaring.)

Energy was the main inflation driver in France and Germany, and transportation costs hurt Italy. Turkey and Argentina are recording the highest inflation rates among the Group of 20 nations. (This is the country where gas prices are soaring.)

Click here to see the country that has the worst inflation in the world

20. China

> Percentage change of Inflation from previous year: 2.1%

> Main contributor to inflation: Rising food, energy prices

The country’s official gauges of producer and consumer prices increased in March by more than what economists predicted. Rising food and energy prices and pandemic-caused lockdowns in major cities are fueling inflation increases. Elevated inflation has limited the ability of China’s central bank to cut interest rates and help stoke economic expansion.

[in-text-ad]

19. Saudi Arabia

> Percentage change of Inflation from previous year: 2.3%

> Main contributor to inflation: Higher energy, wheat costs

Russia’s invasion of Ukraine has impacted the economy of Saudi Arabia. The kingdom imports roughly 45% of its wheat from those two warring nations, and Saudi Arabia reported a 40% surge in the cost of buying wheat thus far in 2022. Also, COVID-19 lockdowns in China are pressuring already taxed global supply chains, leading to higher import costs for trading partners like Saudi Arabia.

18. Japan

> Percentage change of Inflation from previous year: 2.5%

> Main contributor to inflation: Goods

Japan’s economic problem has historically been deflation, not inflation. Its central bank had set a target of 2% inflation a decade ago, hoping it would lead to higher wages and increased consumer spending. When consumer prices in April were up 2.5% from a year earlier, it was the first time since September 2008 that inflation topped 2%, excluding the impact of sales-tax increases, according to the Wall Street Journal. Japan is concerned about higher energy and raw-material costs.

17. Australia

> Percentage change of Inflation from previous year: 2.9% in 2021, 5.1% in Q1 2022

> Main contributor to inflation: Total less food, less energy

Reuters reported on April 27 that Australian consumer prices climbed at the fastest annual rate in two decades in the first quarter of the year as gasoline, home-building, and food costs all leaped. The inflation pace is pressuring Australia’s central bank to lift interest rates from emergency lows of 0.1% that it set in November 2020 to combat pandemic-triggered recession. Gas prices have soared 35% for the year thus far, while the cost of new homes climbed a record 13.7%. High transportation expenses, fertilizer prices, packaging, and ingredient costs boosted food prices in the first quarter.

[in-text-ad-2]

16. Indonesia

> Percentage change of Inflation from previous year: 3.5%

> Main contributor to inflation: Rising food prices

Consumer prices in Indonesia rose 0.95% in April from the previous month, the highest reading since January 2017, and 3.5% from April last year. Inflation was driven by faster increases in food prices. Consumers are pulling back on purchases in the Asian nation. Retail sales dropped 0.5% year over year in April, following a surge of 9.3% in the previous month.

15. South Korea

> Percentage change of Inflation from previous year: 4.8%

> Main contributor to inflation: Total less food, less energy

South Korea’s central bank boosted its benchmark interest rate to 1.75% on May 26, its highest level since the middle of 2019, to combat inflation, which is at a 13-year high. South Korean bank officials said slower global demand may hurt that country’s exports in the second half of the year. The bank forecasts the South Korean economy to grow 2.7% this year, down from its earlier forecast of 3.0%.

[in-text-ad]

14. India

> Percentage change of Inflation from previous year: 5.4%

> Main contributor to inflation: Food, transportation

Inflation in India, the world’s second-most populous nation, is running at the highest pace since May 2014, according to Trading Economics. Food inflation has risen every month since September 2021, fueled by the cost of oils and fats, vegetables, and spices. Upward pressure also came from the costs of transportation and communication, footwear, and clothes. Earlier this month, the Reserve Bank of India held an unscheduled meeting to lift its benchmark interest rate by 40 basis points to 4.40% in an effort to curb inflation.

14. France

> Percentage change of Inflation from previous year: 5.4%

> Main contributor to inflation: Energy

According to a report from Trading Economics, French inflation has reached highs not seen since October 1985. Prices accelerated for services, food, and manufactured goods. In France, the most important category in the consumer price index is services, which carries 48% of index weighting. Consumer confidence in France slipped to 86 in May 2022, the lowest reading since October 2014.

12. South Africa

> Percentage change of Inflation from previous year: 6.0%

> Main contributor to inflation: Fuel, food costs

Earlier in May, South Africa’s central bank took aggressive measures to combat inflation, running at 6.0%, by boosting its benchmark interest rate 50 basis points, the largest hike in more than six years, to 4.75%. It was the fourth time this year that the South African Reserve Bank had raised rates. Soaring fuel and food costs are driving inflation in South Africa.

[in-text-ad-2]

12. Italy

> Percentage change of Inflation from previous year: 6.3%

> Main contributor to inflation: Transportation, processed foods

Italy’s inflation rate has eased to about 6.3% in April from a 30-year high earlier this year, though that figure remains above the target rate of the European Central Bank, according to Trading Economics. Although prices declined for energy and services, costs for transportation services, processed foods, and durable goods accelerated.

10. Canada

> Percentage change of Inflation from previous year: 6.8%

> Main contributor to inflation: Total less food, less energy

A Reuters poll of 30 economists projects that the Bank of Canada will raise its overnight rate by 50 basis points to 1.50% at its meeting on June 1. This would follow a 50 basis point hike in April, its largest single increase in 22 years. Canada is trying to control a 6.8% inflation rate, the highest since January 1991. Rising costs of gas (36%), food (9.7%), and shelter (7.4%) fueled inflation. A tightening of rates may have a strong impact on Canada’s economy because Canadians borrowed heavily during the pandemic to buy houses.

[in-text-ad]

9. Euro Area

> Percentage change of Inflation from previous year: 7.4%

> Main contributor to inflation: Energy, food, industrial goods prices

In the euro area, energy had the highest annual rate of inflation among the components of the price index, followed by food, alcohol and tobacco, non-energy industrial goods, and services. European Central Bank President Christine Lagarde said on May 23 the bank plans to lift its deposit rate out of negative territory by the end of September. The ECB’s deposit rate is -0.5% and has been below zero since 2014, when the concern was that inflation was too low.

8. Mexico

> Percentage change of Inflation from previous year: 7.7%

> Main contributor to inflation: Goods

Mexico’s inflation rate of 7.7% in April was the highest it has been since January 2001, according to Trading Economics, stoked by food prices (9.33%), housing (2.86%), and energy (5.91%). The core inflation rate increased 7.2%, also the highest since January 2001. President Andres Manuel Lopez Obrador forged a price agreement with large Mexican companies in early May to limit price increases on basic goods for six months in exchange for tariff relief.

7. Germany

> Percentage change of Inflation from previous year: 7.8%

> Main contributor to inflation: Energy

Germany, haunted by the hyperinflation in the 1920s that led to the rise of the Nazi party and Adolf Hitler, has been vigorous in fighting inflationary pressures. Inflation in Europe’s biggest economy more than doubled from last year’s 3.1%, fueled by high energy and food prices that spiked after Russia’s invasion of Ukraine. Germany’s economic ministry said in April that it saw inflation running at 2.8% next year.

[in-text-ad-2]

6. United States

> Percentage change of Inflation from previous year: 8.3%

> Main contributor to inflation: Total less food, less energy

Supply-chain snafus, higher gasoline prices, and elevated food costs have contributed to a U.S. inflation rate of 8.3%, near a 40-year high. At that time, Fed Chairman Paul Volcker invoked stringent measures to bring inflation under control. Fed meeting minutes released on May 25 showed that policy makers agreed to half-percentage point increases in June and July. The stock market was apparently reassured that the central bank was not going to tighten more aggressively and rose after the minutes were released.

5. United Kingdom

> Percentage change of Inflation from previous year: 9.0%

> Main contributor to inflation: Total less food, less energy

Inflation in the U.K. leaped to a 40-year high of 9.0% in April, and the Bank of England has forecast it will climb into the double digits by the end of this year. Some British economic experts expect the Bank of England to hike interest rates to at least 2% by the end of the year, double what they are now. Rising energy and food prices are stoking inflation in the United Kingdom.

[in-text-ad]

4. Brazil

> Percentage change of Inflation from previous year: 12.1%

> Main contributor to inflation: Fuel

In Brazil, the price of gasoline drove inflation higher. Gas prices were up 27.5% year over year in March. In 2021, official inflation was 10.06%, the highest in six years. Brazil’s central bank has been tightening its benchmark interest rate, which is 11.75%.

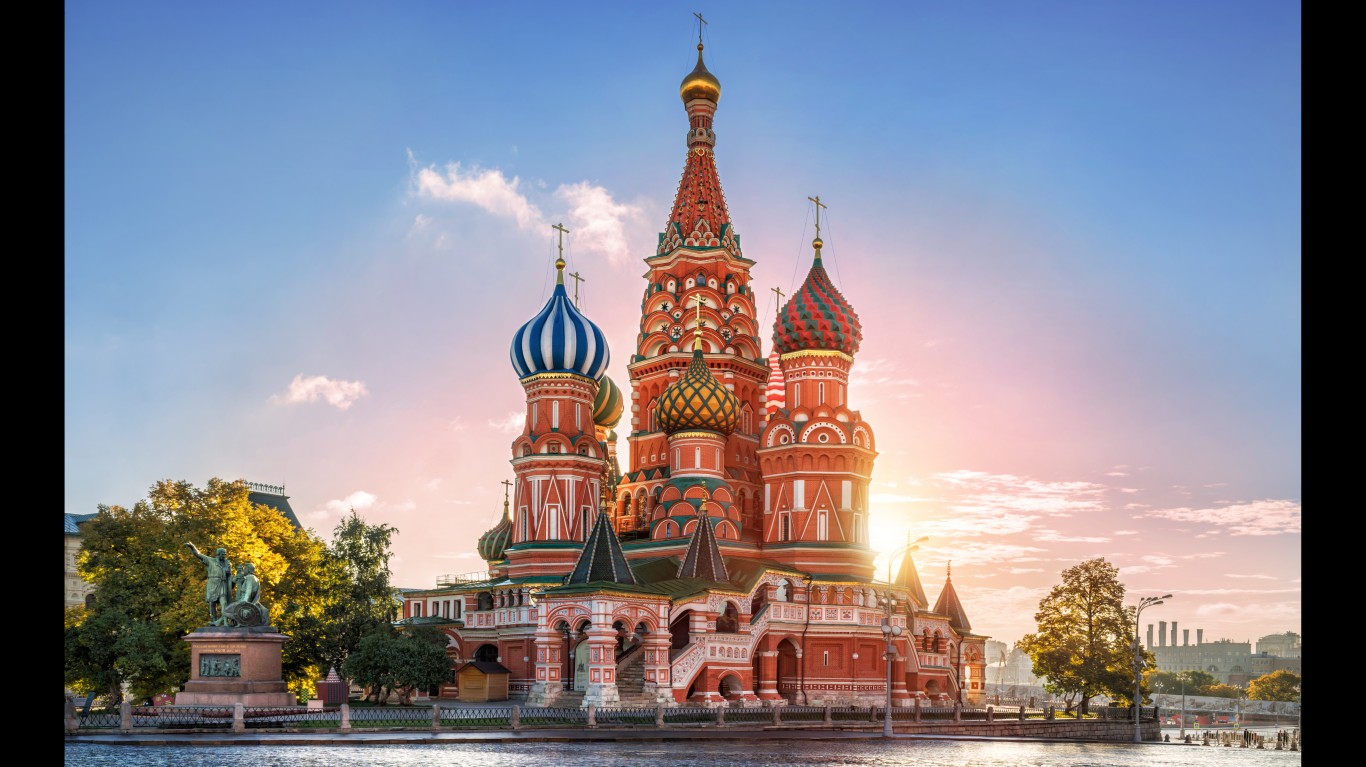

3. Russia

> Percentage change of Inflation from previous year: 16.7% (March 2022)

> Main contributor to inflation: Food, non-alcoholic beverages

Battered by sanctions from the West and volatility in the ruble following its invasion of Ukraine, Russia’s inflation rate soared to its highest level since January 2002. According to Trading Economics, prices surged for food and non-alcoholic beverages (30% of the consumer price index), non-food products, and services. Russian President Vladimir Putin announced on May 26 that he is raising the nation’s minimum wage and pensions by 10% to help Russians deal with inflation.

2. Argentina

> Percentage change of Inflation from previous year: 58.0%

> Main contributor to inflation: Clothes, restaurants, hotels

Argentina, which had ruinous inflation rates from 1975 to 1991, is experiencing soaring inflation in 2022. The annual inflation rate in the South American nation hit 58% in April, the steepest since January 1992, and a leap from a 55.1% pace the prior month. The categories that rose above average were clothes, restaurants and hotels, health care, and food and beverages.

[in-text-ad-2]

1. Turkey

> Percentage change of Inflation from previous year: 70.0%

> Main contributor to inflation: Total less food, less energy, monetary policy

Turkey is the country where inflation is hitting the hardest. The surge in energy and food prices, as well as ill-timed interest rate cuts, are endangering the government of President Tayyip Erdogan, who came to power as prime minister in 2003. The nation’s currency, the lira, slid after the interest rate cuts were implemented last September. Russia’s invasion of Ukraine has stoked inflation embers even more.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.