Special Report

Companies That Have Ended Operations in Russia as of Mid-May

Published:

Since Russia’s invasion of Ukraine in late February, companies with commercial relationships with the world’s largest nation have been confronted with the decision of whether to stop doing business in Russia, cut back operations, or continue to operate there.

Jeffrey Sonnenfeld, senior associate dean for leadership studies at Yale School of Management, and a team of experts, research fellows, and students at the Yale Chief Executive Leadership Institute have been updating a list of companies doing (or not doing) business with Russia. (Russia is on the list of the most corrupt countries in the world.)

To identify the companies exiting Russia completely, 24/7 Wall St. reviewed the report “Over 450 Companies Have Withdrawn from Russia – But Some Remain” updated May 13, 2022 by researchers at the Yale School of Management. Of the 337 entities categorized in the Yale report under “Withdrawing,” 125 are U.S. companies and organizations. We selected the 50 largest public companies by market capitalization that have taken the strongest stance as of mid-May 2022, ordered by market cap on May 13, from smaller to larger.

All the public companies on this list have a market cap of $7 billion or above. Half of them fall into one of two categories: Information technology and industrials. Other categories where companies have suspended operations include financials, consumer discretionary, and communications services.

For many businesses choosing to suspend or even permanently end business in Russia, the decision follows decades of attempting to build a relationship with that country after the collapse of the Soviet Union in 1991. Those companies include Pepsi and McDonald’s.

Many companies, after at first taking temporary measures, have revised their plans and chose to exit Russia completely, under pressure from their shareholders and consumers.

Some of the notable companies taking these actions are the cruise-line company Carnival, the air carriers Delta and United, Uber, Netflix, eBay, and Live Nation Entertainment.

Click here to see companies that have ended or suspended operations in Russia as of mid-May

According to the Yale study, 26 U.S.-based firms appear to be doing business as usual in Russia. These include Amgen, Hard Rock Café, Koch Industries, Sbarro, and Stryker Corporation. (As of March 30, these were the companies refusing to leave Russia.)

Wex Inc.

> Action: Ending relationship with Lukoil and subsidiaries

> Industry: Information technology

> Market cap, May 13: $7.07 billion

[in-text-ad]

DXC Technology

> Action: Leaving Russia completely

> Industry: Information technology

> Market cap, May 13: $7.45 billion

Lincoln Electric

> Action: Ceasing all operations

> Industry: Industrials

> Market cap, May 13: $7.81 billion

Jabil

> Action: Closing its site

> Industry: Information technology

> Market cap, May 13: $8.22 billion

[in-text-ad-2]

Pentair

> Action: Exiting its business

> Industry: Industrials

> Market cap, May 13: $8.27 billion

Owens Corning

> Action: Expediting its exit

> Industry: Industrials

> Market cap, May 13: $9.05 billion

[in-text-ad]

FICO

> Action: Exiting all work

> Industry: Information technology

> Market cap, May 13: $9.38 billion

AECOM

> Action: Suspending operations

> Industry: Industrials

> Market cap, May 13: $9.41 billion

Alcoa

> Action: Suspending all business

> Industry: Materials

> Market cap, May 13: $10.76 billion

[in-text-ad-2]

American Airlines

> Action: No flying over Russian airspace/suspending Russian partnerships

> Industry: Industrials

> Market cap, May 13: $11.17 billion

GoDaddy

> Action: Discontinuing all Russian services

> Industry: Information technology

> Market cap, May 13: $11.69 billion

[in-text-ad]

Interpublic Group

> Action: Exiting Russian operations

> Industry: Communication Services

> Market cap, May 13: $12.64 billion

Take-Two Interactive

> Action: Suspending all sales

> Industry: Communication Services

> Market cap, May 13: $12.69 billion

United Airlines

> Action: No flying over Russian airspace

> Industry: Industrials

> Market cap, May 13: $14.14 billion

[in-text-ad-2]

Avery Dennison

> Action: Exiting Russian operations

> Industry: Materials

> Market cap, May 13: $14.24 billion

FMC Corporation

> Action: Discontinuing all business and operations

> Industry: Materials

> Market cap, May 13: $14.71 billion

[in-text-ad]

Carnival

> Action: Discontinuing Russia itineraries

> Industry: Consumer discretionary

> Market cap, May 13: $16.79 billion

EPAM

> Action: Discontinuing servicing Russian customers

> Industry: Information technology

> Market cap, May 13: $18.25 billion

Avantor

> Action: Discontinuing all sales into Russia, direct and indirect

> Industry: Industrials

> Market cap, May 13: $18.35 billion

[in-text-ad-2]

Stanley Black & Decker

> Action: Suspending operations

> Industry: Industrials

> Market cap, May 13: $18.36 billion

Waters Corporation

> Action: Suspending all sales and services

> Industry: Health care

> Market cap, May 13: $19.30 billion

[in-text-ad]

Expedia

> Action: Suspending bookings

> Industry: Consumer discretionary

> Market cap, May 13: $20.70 billion

Live Nation Entertainment

> Action: Suspending all operations

> Industry: Information technology

> Market cap, May 13: $20.81 billion

Ball Corporation

> Action: Leaving Russia completely

> Industry: Materials

> Market cap, May 13: $22.29 billion

[in-text-ad-2]

Delta Air Lines

> Action: Suspending agreement with Aeroflot

> Industry: Industrials

> Market cap, May 13: $24.57 billion

State Street

> Action: Curtailing Russian access to capital markets

> Industry: Financials

> Market cap, May 13: $25.41 billion

[in-text-ad]

eBay

> Action: Suspend all shipments to Russia

> Industry: Consumer discretionary

> Market cap, May 13: $26.12 billion

Ametek

> Action: Closing TPM Russia subsidiary

> Industry: Industrials

> Market cap, May 13: $27.93 billion

Global Foundries

> Action: Suspending all shipments

> Industry: Information technology

> Market cap, May 13: $28.07 billion

[in-text-ad-2]

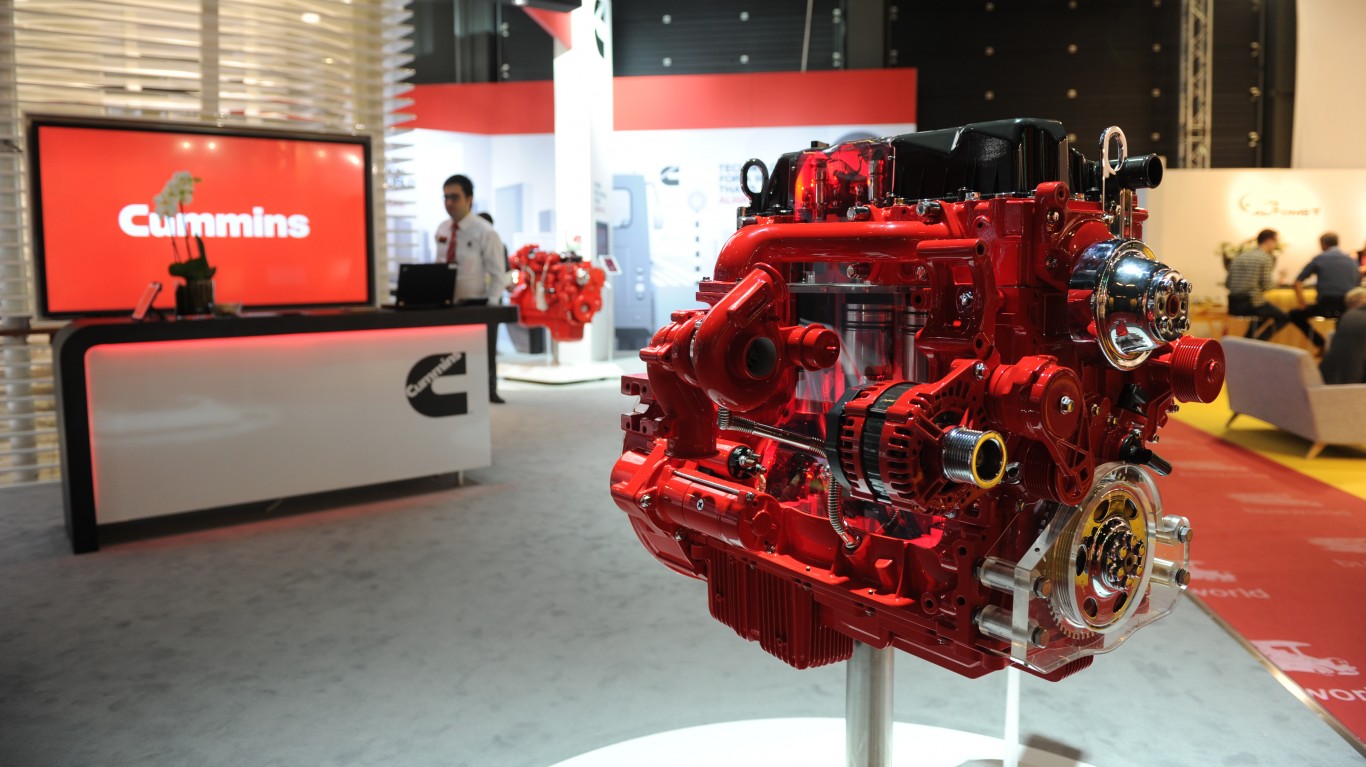

Cummins

> Action: Exiting Russian operations

> Industry: Industrials

> Market cap, May 13: $28.39 billion

MSCI

> Action: Curtailing Russian access to capital markets

> Industry: Financials

> Market cap, May 13: $33.17 billion

[in-text-ad]

Parker Hannifin

> Action: Closing Moscow office and warehouse facility and exiting Russian operations

> Industry: Industrials

> Market cap, May 13: $34.06 billion

Electronic Arts

> Action: Suspending operations

> Industry: Communication services

> Market cap, May 13: $35.14 billion

Autodesk

> Action: Suspending operations

> Industry: Information technology

> Market cap, May 13: $42.87 billion

[in-text-ad-2]

Fortinet

> Action: Suspending operations

> Industry: Information technology

> Market cap, May 13: $45.20 billion

Uber

> Action: Divesting from partnership with Yandex

> Industry: Information technology

> Market cap, May 13: $47.89 billion

[in-text-ad]

Air Products

> Action: Full divestiture from Russia

> Industry: Materials

> Market cap, May 13: $51.81 billion

Moody’s

> Action: Suspending operations

> Industry: Financials

> Market cap, May 13: $53.31 billion

Intercontinental Exchange

> Action: Curtailing Russian access to capital markets

> Industry: Financials

> Market cap, May 13: $54.86 billion

[in-text-ad-2]

Activision Blizzard

> Action: Suspending all sales

> Industry: Communication services

> Market cap, May 13: $60.78 billion

TJ Maxx

> Action: Divesting Familia subsidiary

> Industry: Consumer discretionary

> Market cap, May 13: $67.17 billion

[in-text-ad]

Airbnb

> Action: Suspending bookings

> Industry: Consumer discretionary

> Market cap, May 13: $78.42 billion

Marsh McLennan

> Action: Exiting operations

> Industry: Financials

> Market cap, May 13: $80.28 billion

Netflix

> Action: Suspending operations

> Industry: Communication Services

> Market cap, May 13: $83.36 billion

[in-text-ad-2]

Booking

> Action: Suspending bookings

> Industry: Consumer Discretionary

> Market cap, May 13: $85.39 billion

BlackRock

> Action: Curtailing Russian access to capital markets

> Industry: Financials

> Market cap, May 13: $93.36 billion

[in-text-ad]

S&P

> Action: Curtailing Russian access to capital markets

> Industry: Financials

> Market cap, May 13: $114.50 billion

AMD

> Action: Suspending all sales

> Industry: Information technology

> Market cap, May 13: $154.14 billion

Salesforce

> Action: Suspending operations

> Industry: Information technology

> Market cap, May 13: $165.90 billion

[in-text-ad-2]

Exxon

> Action: Exiting Rosneft partnership

> Industry: Energy

> Market cap, May 13: $376.20 billion

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.