This year, Grammy-winning singer, songwriter, and record producer Justin Timberlake agreed to sell his music catalog to Hipgnosis Song Management, a U.K.-based business backed by Stephen Schwarzman’s private-equity behemoth Blackstone.

The deal includes copyrights to about 200 songs written or co-written by the former boy-band pinup, including hits like “Can’t Stop the Feeling” and “Mirrors.” The deal was estimated to be worth about $100 million, according to sources cited by the Wall Street Journal. (Timberlake is a prime example of solo artists who were more successful than their bands.)

The Timberlake deal is part of a trend in highly successful recording artists, estates of deceased stars, or recording companies giving up their intellectual property rights for enormous payouts. These so-called publishing acquisitions have always been around, but they’ve gained popularity thanks to music-streaming subscription services and new technologies that make it easier and less costly to collect royalties globally, according to Billboard Insights. (These are the artists with the most No. 1 hits.)

To determine the most valuable song catalogs, 24/7 Tempo reviewed data on song catalog sales and valuations from Variety, Billboard, Forbes, and other sources. Songbooks were ranked based on the published purchase value of a disclosed songbook sale, the estimated value of an undisclosed songbook sale, or the current valuation of a songbook from an industry source. Only songbooks with available value estimates were included.

And some of these deals involve serious amounts of cash. In fact, Timberlake’s $100 million deal is only within the median of the top 35 most expensive music catalogs ever sold. Artists including New Orleans-born rapper Lil Wayne, Scottish DJ Calvin Harris, and Las Vegas pop rockers Imagine Dragons have all sold their catalogs for around the same price.

Click here to see the most valuable song catalogs

The catalogs of Barry Manilow, Mötley Crüe, and Prince, sold for more than $100 million, while the music of Bob Marely, James Brown, and Tina Turner sold for less.

Other deals have ranged from $25 million for the music rights belonging to Robbie Robertson, the 78-year-old former guitarist and songwriter for The Band, to a half-billion dollars for the songbooks of Bruce Springsteen and John Lennon and Paul McCarthey. Seven of the deals on this list closed at $300 million or higher.

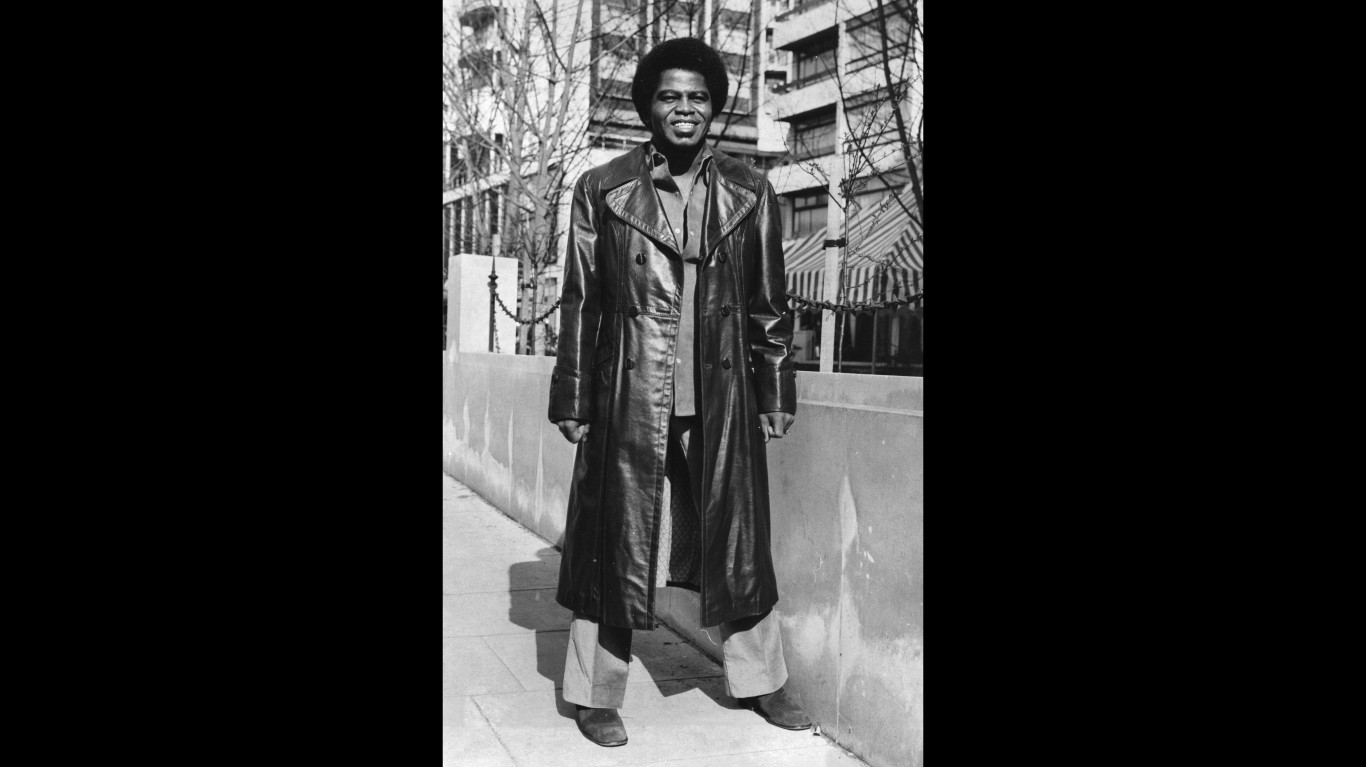

25. James Brown

> Est. songbook value: $90 million

[in-text-ad]

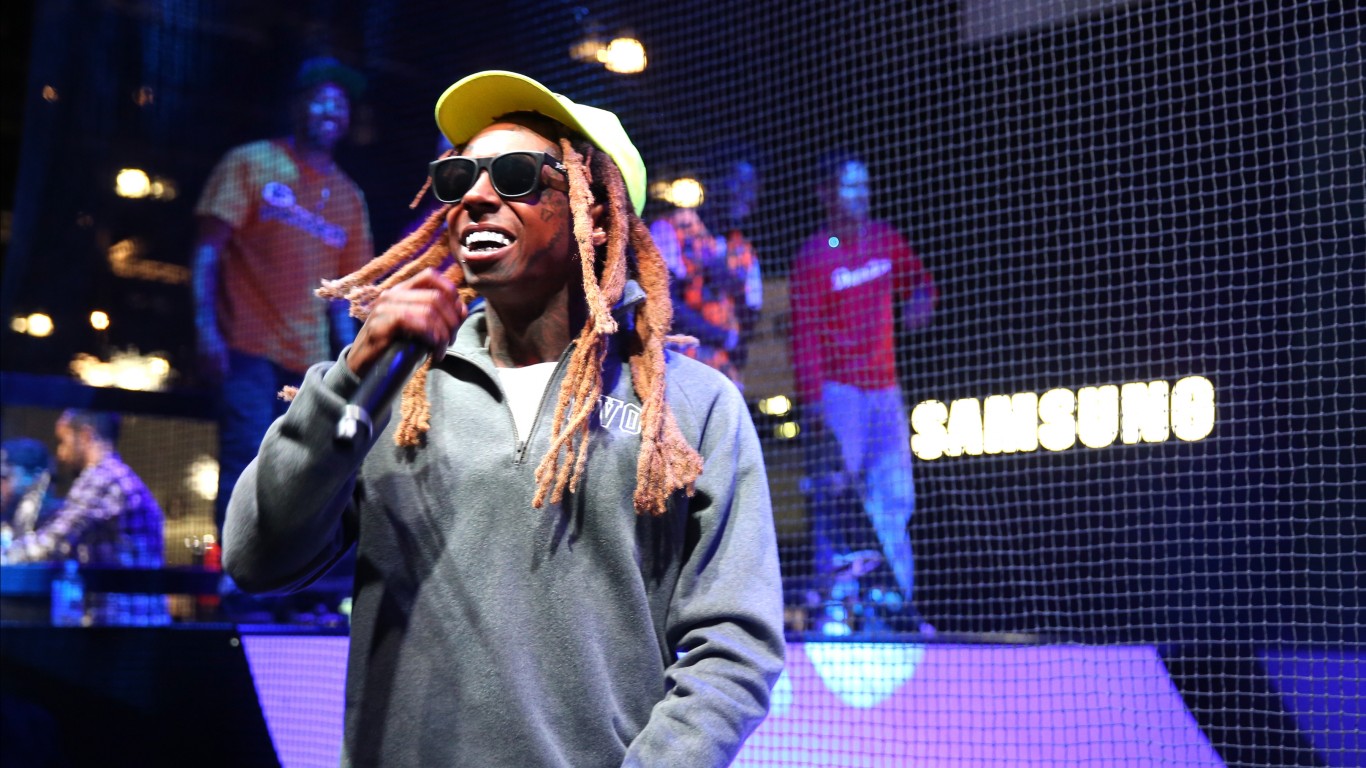

24. Lil Wayne (Young Money label)

> Est. songbook value: $100 million

23. Calvin Harris

> Est. songbook value: $100 million

22. Justin Timberlake

> Est. songbook value: $100 million

[in-text-ad-2]

21. Luis Fonsi

> Est. songbook value: $100 million

20. David Guetta

> Est. songbook value: $100 million

[in-text-ad]

19. Imagine Dragons

> Est. songbook value: $100 million

18. Stevie Nicks

> Est. songbook value: $100 million

17. Barry Manilow

> Est. songbook value: $139 million

[in-text-ad-2]

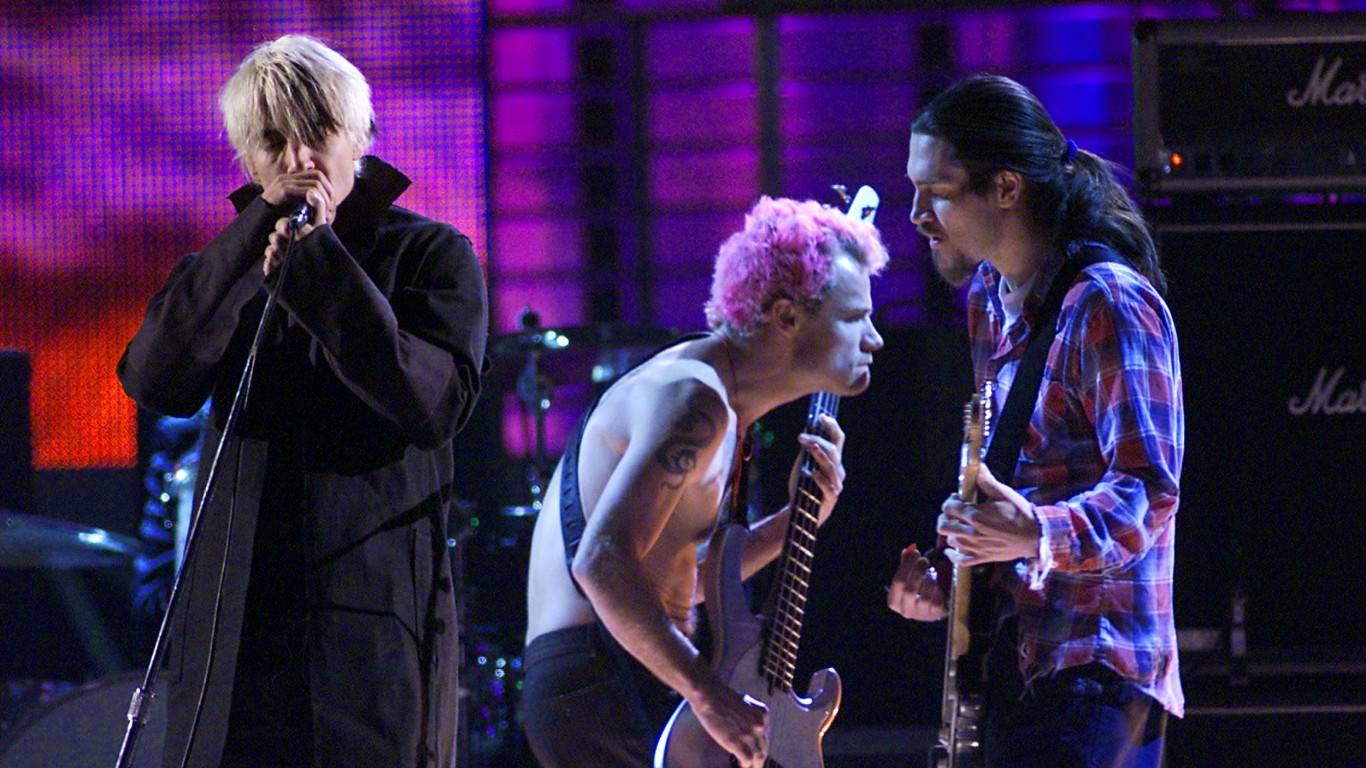

16. Red Hot Chili Peppers

> Est. songbook value: $140 million

15. Neil Diamond

> Est. songbook value: $145 million

[in-text-ad]

14. Neil Young

> Est. songbook value: $150 million

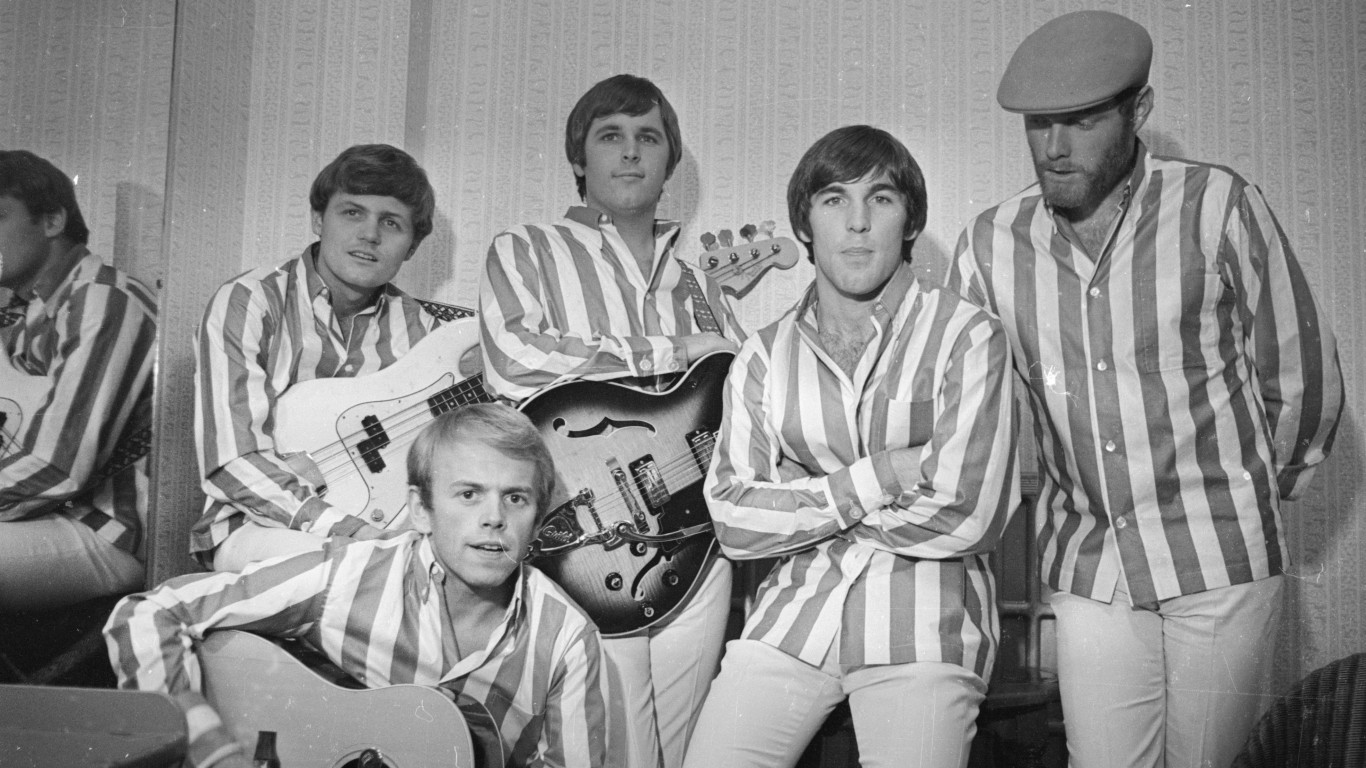

13. The Beach Boys

> Est. songbook value: $150 million

12. Mötley Crüe

> Est. songbook value: $150 million

[in-text-ad-2]

11. Prince

> Est. songbook value: $156 million

10. Ryan Tedder (OneRepublic)

> Est. songbook value: $200 million

[in-text-ad]

9. David Bowie

> Est. songbook value: $250 million

8. Paul Simon

> Est. songbook value: $250 million

7. Taylor Swift

> Est. songbook value: $300 million

[in-text-ad-2]

6. Sting

> Est. songbook value: $300 million

5. Bob Dylan

> Est. songbook value: $325 million

[in-text-ad]

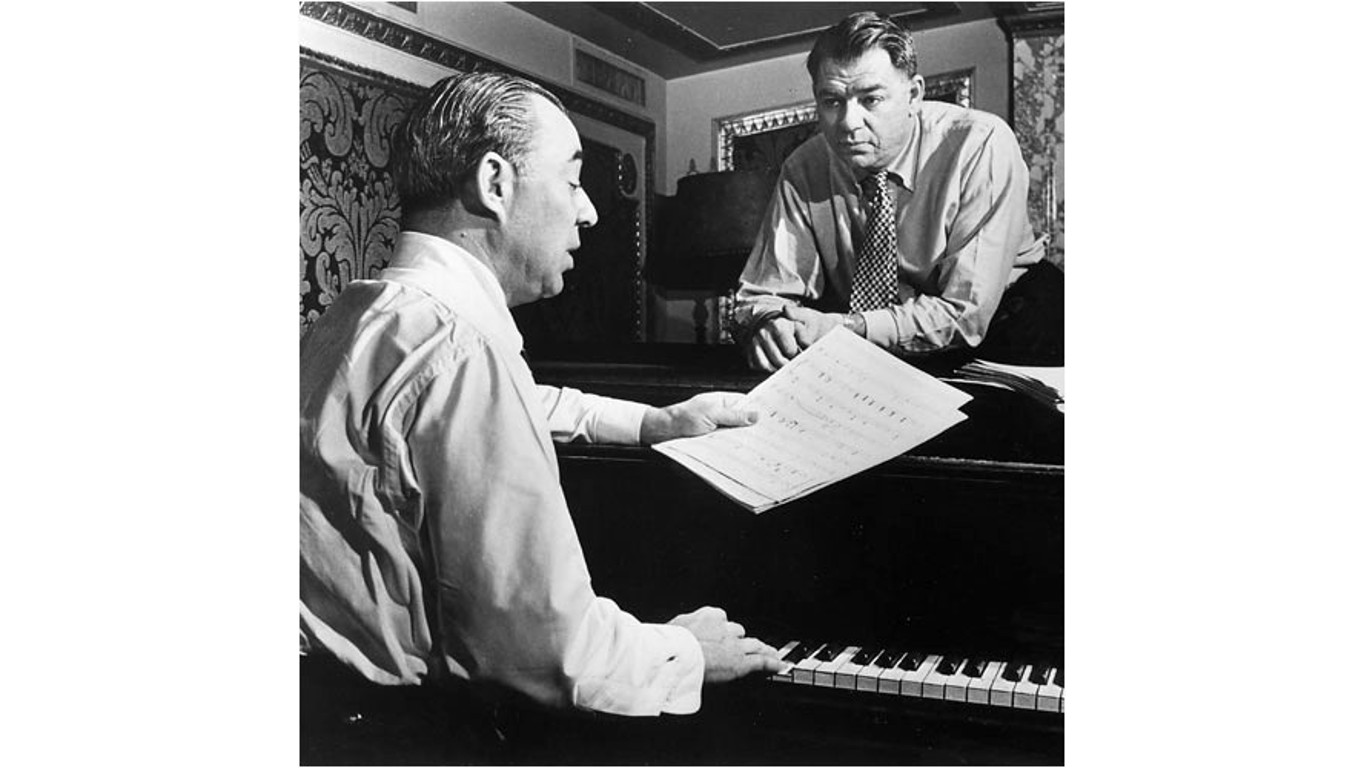

4. Richard Rodgers and Oscar Hammerstein II

> Est. songbook value: $350 million

3. Michael Jackson

> Est. songbook value: $375 million

2. Bruce Springsteen

> Est. songbook value: $500 million

[in-text-ad-2]

1. John Lennon and Paul McCartney

> Est. songbook value: $500 million

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.