There are an estimated 19 million veterans in the United States, according to the U.S. Department of Veterans Affairs. These former service men and women were members of the Army, Navy, Marines, Air Force, Coast Guard, Non-Defense (such as Public Health Service and National Oceanic and Atmospheric Administration), and Reserve Forces.

Veterans are entitled to certain benefits the U.S. provides. The VA offers a wide variety of programs to ensure that service members and their families have access to health care, housing, and the chance to succeed in their civilian career and life.

24/7 Wall St. reviewed information from the U.S. Department of Veterans Affairs to compile a list of the benefits that are available to U.S. military veterans. Benefits listed as open to veterans who have were active-duty service members, including Guard and Reserve, unless otherwise specified.

Many of the benefits open to veterans are financial. Active service members and veterans who were honorably discharged may receive grants, loans, or other aid to further their education, help their business, or provide them with retirement income. (These are the states where the military spends the most money.)

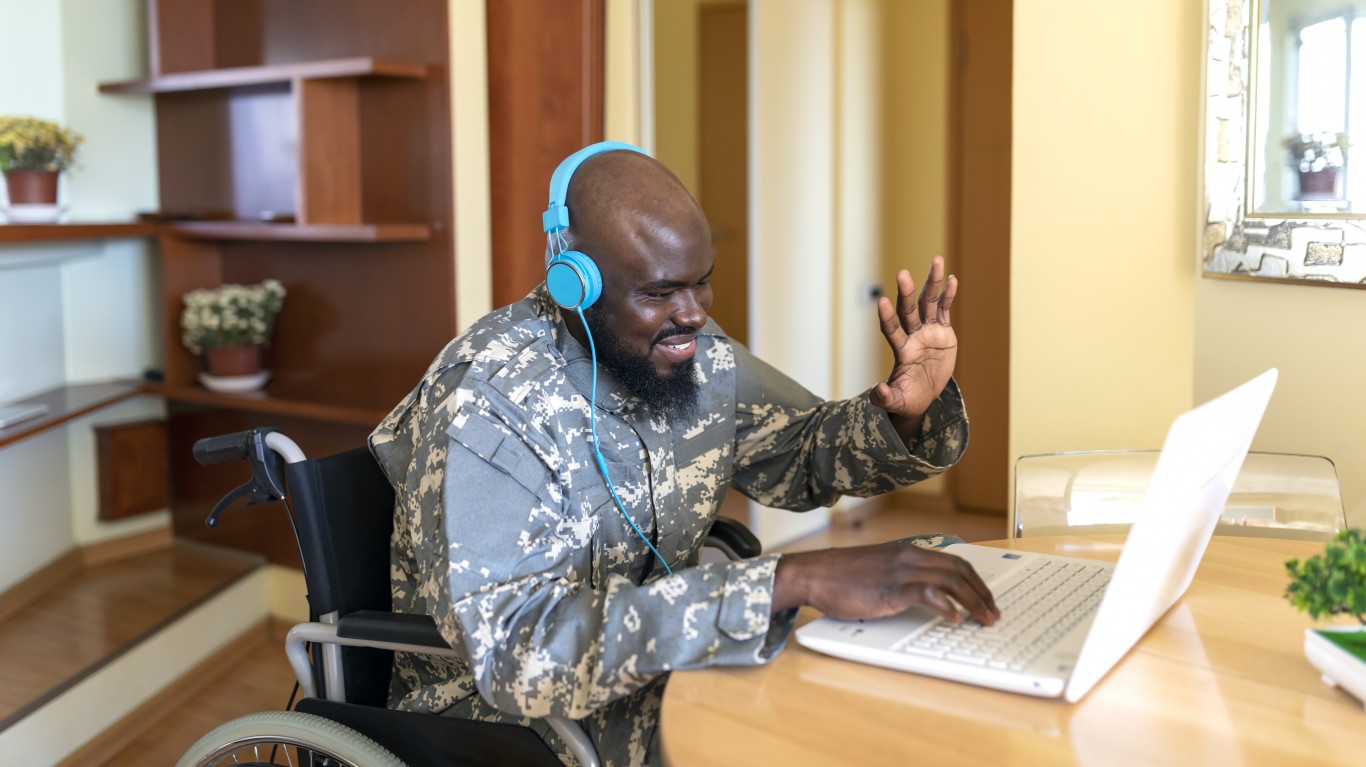

Veterans with a service-connected disability may receive additional benefits to help ease their transition into civilian life. Veterans who have a disability can access VA health care as well as receive higher pension payments and grants that help make their home more accessible.

Some active duty veterans may be eligible for burial at one of several VA national cemeteries. These are America’s largest military cemeteries.

Click here to see 13 benefits every veteran is entitled to.

1. Education

> Available for: Service members and veterans

Service members and veterans may qualify for aid through the GI Bill that provides funding for college education or vocational training programs.

[in-text-ad]

2. Home loan

> Available for: Service members and veterans

Veterans and service members looking to buy or refinance a home can qualify for VA-backed loans.

3. Insurance

> Available for: Service members, veterans, and their families

The VA offers life insurance coverage as well as injury, mortgage, and disability life insurance, among others. You can also convert your active-duty life insurance to civilian insurance.

4. Injury or disability claims

> Available for: Active-duty veterans

Before discharge, service members can file service-connected disability claims.

[in-text-ad-2]

5. Educational and career counseling

> Available for: Service members and veterans

The VA offers support for those transitioning to a civilian career.

6. Health care

> Available for: Service members and veterans

The VA provides health insurance options for service members and veterans.

[in-text-ad]

7. Veteran Readiness and Employment

> Available for: Service members and veterans with a service-connected disability

This program helps those with a service-connected disability gain employment.

8. Disability compensation

> Available for: veterans

The VA offers compensation for those with a service-connected disability.

9. Small business support

> Available for: veterans

Veterans can access resources and support for their businesses. They also have advantages when bidding for government contracts.

[in-text-ad-2]

10. Pension

> Available for: Active-duty veterans

Depending on their income bracket, veterans are eligible for pension benefits.

11. Disability housing grants

> Available for: veterans with a service-connected disability

Veterans with a service-connected disability can access a grant to help make their home accessible.

[in-text-ad]

12. Aid and attendance or housebound allowance

> Available for: Active-duty veterans

Housebound veterans and others in need can request increased aid to their pensions.

13. Burial in a VA national cemetery

> Available for: Active-duty veterans

Veterans can check eligibility to be buried in VA national cemeteries.

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.