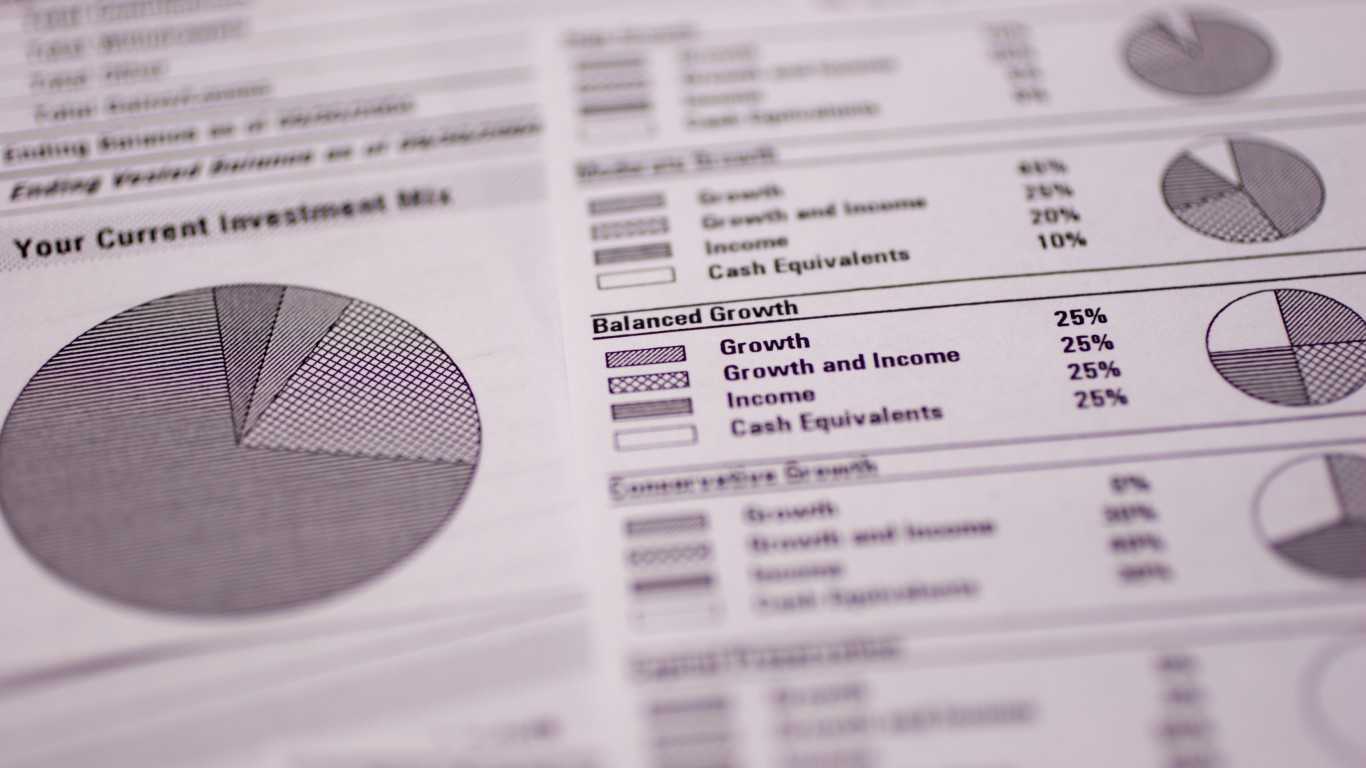

Looking to supplement your Social Security payments after you retire? A 401(k) or an annuity can provide you with the funds you need to live, with no financial worries in your golden years. But 401(k)s and annuities aren’t the only options for people planning their post-career lives. Here are 8 of the best investments for retirees.

Both vehicles are popular and oft-used retirement savings schemes. Yet each is quite different. 401(k)s are offered by your employer as a workplace benefit. You put money into your 401(k) each paycheck to have a nice nest egg when you leave the workforce. Annuities, on the other hand, are life insurance products. You give your money to a life insurer, watch the annuity grow, and then receive guaranteed monthly payments during retirement.

A financial advisor can help you decide which is better for you. There are many factors to consider. If you’re worried about fees, 401(k)s charge lower fees than annuities. Annuity payments continue until your death, but that means you can’t leave the investment to your heirs unless you add a death benefit to the contract. With 401(k), you can name a beneficiary.

An annuity gives you a guaranteed income stream as long as you live. But those payments are pre-set and may not keep up with inflation. With a 401(k), you’ll have to make the money you get from your plan last throughout retirement.

24/7 Wall St. created this list of information needed to choose between an annuity or 401(k) for retirement investing, based on a report produced by financial technology company SmartAsset, entitled Annuity vs. 401(k): Which Is Better for Retirement?. Looking for a place to retire? Avoid the worst states to grow old in.

Click here to see how to decide between an annuity or a 401(k).

24/7 Wall St. created this list of information needed to choose between an annuity or 401(k) for retirement investing, based on a report produced by financial technology company SmartAsset, entitled Annuity vs. 401(k): Which Is Better for Retirement?.

1. What is a 401(k)

A 401(k) is an employer-based tax-deferred defined contribution retirement plan. Each pay period, your company deducts a predetermined amount from your paycheck to invest in a menu of options, such as mutual funds or exchange-traded funds (ETF)s. You set how much money you want deducted.

Some companies may offer a matching contribution. When you retire, you’ll receive your 401(k) in a lump sum to fund your leisure years. Because contributions are not taxed as you build up your account, you’ll have to pay taxes on the 401(k) funds when you withdraw.

[in-text-ad]

2. Roth 401(k)s

A Roth 401(k) is similar to a regular 401(k) except for one major difference: You put after-tax money into the Roth 401(k). Since you’ve already paid taxes on those funds, you don’t have to pay taxes when you withdraw.

3. What is an annuity

An annuity is a contract between you and an insurance company. To purchase an annuity, you hand over your money to an insurer, either in one large amount or a series of premium payments.

Like a 401(k), the annuity investment grows over many years. The insurer then sends you a check each month after you retire to your death. If you buy an annuity with pre-tax money, you will be taxed on withdrawals. One important fact to consider about annuity payments is that the amount doesn’t change with inflation.

4. 401(k) are only available if your employer has one

401(k) plans are increasing in popularity among employers. According to the Bureau of Labor Statistics, 65% of private industry employees had access to the benefit. If retirement savings are important to you, check to see if a potential employer offers a 401(k).

[in-text-ad-2]

5. Differences in fees

Both annuities and 401(k) deduct fees, but you may pay more with an annuity. Your plan administrator at your workplace can show you how much your 401(k) account is being charged. Annuity fees can be complicated. You may be paying sales commissions, benefit rider fees, and other charges.

6. Borrowing

Yes, you can borrow from your 401(k) account, although you should think hard before you do. An annuity, on the other hand, prohibits you from borrowing money from the account.

[in-text-ad]

7. Inheritance

A 401(k) allows you to name a beneficiary in the case of your death. Annuity payments end at your death, unless you purchase a death benefit. Similar to a life insurance policy, the death benefit pays to your designated heirs.

8. Making withdrawals

If you take money out of your 401(k) before age 59 and a half, you’ll pay a 10% early withdrawal penalty on top of the income tax due on the funds withdrawn. An early withdrawal from an annuity is called a surrender charge. But the surrender charge amount gradually reduces after several years.

9. Variable annuities

There are several types of annuities and one is a variable annuity. Its value grows from the performance of the underlying portfolio selected by the annuity owner. Although a variable annuity has the potential for higher returns in a market upturn, the product’s value could also plunge. With a fixed annuity, you receive a guaranteed return, making them less risky.

[in-text-ad-2]

10. Contribution limits

Contributions to a 401(k) are limited. If you are under 50, you can contribute a maximum of $20,500 in 2022. Over 50, you can make a $6,500 catch-up contribution. For matching contributions,the total allowed for an employee-employer pay-in is $61,000 per year for those under-50. If you are over 50 and add in the catch-up contribution, the limit is $67,500. No such limits apply to an annuity. You can invest as much as you want.

11. When should you choose an annuity or a 401(k)

Like most investments, choosing a 401(k) or an annuity is a personal decision based on your age, finances, and other individual factors. Both provide the advantage of long-term savings accumulation, tax-deferred growth, and beneficiary options.

If you are still working but haven’t hit your 401(k) contribution limits, you can buy an annuity as you near retirement. Or you can combine both. Some companies offer employees the option of putting part of their 410(k) into an annuity. By combining two you’ll receive a steady income stream in retirement from the annuity plus any upside from the 401(k) investments.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.