Special Report

31 Billion-Dollar Weapons the US Military Will Invest in Next Year

Published:

Last Updated:

Tensions between the U.S. and its geopolitical rivals have been ratcheting up in recent years. Negotiations with Iran over its nuclear enrichment program have stalled. China’s continued military buildup is of a size and scope not seen since World War II, raising concerns over its designs on Taiwan. Meanwhile, the war in Ukraine has sunk U.S.-Russia relations to a post-Cold War low.

Whether or not some level of de-escalation is achievable in 2023 remains to be seen, though reasons for optimism appear scarce. In anticipation of potential future threats and challenges, the Department of Defense laid out $276 billion in planned spending on weapons systems alone for the coming fiscal year, which begins on Oct. 1, 2022 and ends Sept. 30, 2023.

According to the DoD, the investment will ensure “that U.S. military forces have a tactical combat advantage over any adversary in any environmental situation.”

24/7 Wall St. reviewed the DoD’s Fiscal 2023 Budget Request to identify the weapons the U.S. military is investing the most in for the coming year. Each of the weapon systems on this has a planned investment of over $1 billion in FY 2023. These systems include aircraft, surface naval vessels, submarines, missile defense systems, and nuclear weapons.

Many of these weapons are intended for use by multiple branches of service. Of the individual branches of the military, the Navy would receive the largest share of weapons spending, a total of $32.1 billion, much of which earmarked for aircraft and nuclear-powered vessels. Over 20% of all naval weapons spending in 2023 is designated for procurement and development of Virginia class attack submarines alone. (Here is a look at the U.S. Navy’s newest ships and submarines.)

The Air Force will receive the second highest amount of weapons investment, at $20.1 billion. Just over 25% of that funding is earmarked for the continued engineering and manufacturing of the B-21 Raider, a long-range stealth bomber that can carry both conventional and nuclear payloads. (Here is a look at the bombs and missiles used by the U.S. military.)

Click here to see 31 billion-dollar weapons the U.S. military will invest in next year.

31. PAC-3/Missile Segment Enhancement (MSE)

> Weapon type: Missile defense program

> Planned fiscal 2023 investment: $1.04 billion (up 34.4% from 2022)

> Service branch: Army (12.0% of FY 2023 Army weapons spending)

> Primary contractor(s): Lockheed Martin

[in-text-ad]

30. MQ-4C/ RQ-4 Triton/Global Hawk/NATO AGS

> Weapon type: Unmanned reconnaissance aircraft

> Planned fiscal 2023 investment: $1.05 billion (up 36.3% from 2022)

> Service branch: Joint Service (3.1% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Northrop Grumman

29. Joint Light Tactical Vehicle (JLTV)

> Weapon type: Armored vehicle replacing the Humvee

> Planned fiscal 2023 investment: $1.06 billion (up 1.0% from 2022)

> Service branch: Joint Service (3.2% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Oshkosh Defense

28. Chemical Demilitarization

> Weapon type: Program for the destruction of chemical weapons

> Planned fiscal 2023 investment: $1.06 billion (down 3.1% from 2022)

> Service branch: Joint Service (3.2% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Bechtel

[in-text-ad-2]

27. LHA America Class Amphibious Assault Ship

> Weapon type: Aircraft carrier ship

> Planned fiscal 2023 investment: $1.14 billion (up 1378.6% from 2022)

> Service branch: Navy (3.5% of FY 2023 Navy weapons spending)

> Primary contractor(s): Huntington Ingalls Industries

26. C-130J Hercules

> Weapon type: Tactical transport airlift aircraft

> Planned fiscal 2023 investment: $1.14 billion (down 71.0% from 2022)

> Service branch: Joint Service (3.4% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Lockheed Martin

[in-text-ad]

25. MQ-25 Stingray

> Weapon type: Unmanned aerial refueling and reconnaissance aircraft

> Planned fiscal 2023 investment: $1.15 billion (up 205.4% from 2022)

> Service branch: Navy & Marine Corps (20.7% of joint FY 2023 Navy & Marine Corps weapons spending)

> Primary contractor(s): Boeing, Lockheed Martin

24. B-1, B-2, and B-52 Bombers

> Weapon type: Long-range conventional legacy bomber fleet

> Planned fiscal 2023 investment: $1.21 billion (up 22.3% from 2022)

> Service branch: Air Force (6.0% of FY 2023 Air Force weapons spending)

> Primary contractor(s): Northrop Grumman, Boeing

23. FFG(X) Constellation Class Guided Missile Frigate

> Weapon type: Guided missile frigate ship

> Planned fiscal 2023 investment: $1.28 billion (up 7.4% from 2022)

> Service branch: Navy (4.0% of FY 2023 Navy weapons spending)

> Primary contractor(s): Fincantieri Marinette Marine

[in-text-ad-2]

22. F-22 Raptor

> Weapon type: Fifth-generation fighter jet

> Planned fiscal 2023 investment: $1.32 billion (up 25.5% from 2022)

> Service branch: Air Force (6.6% of FY 2023 Air Force weapons spending)

> Primary contractor(s): Lockheed Martin, Pratt & Whitney

21. E-2D Advanced Hawkeye

> Weapon type: Threat detection radar aircraft

> Planned fiscal 2023 investment: $1.35 billion (up 10.6% from 2022)

> Service branch: Navy & Marine Corps (24.2% of FY 2023 joint Navy & Marine Corps weapons spending)

> Primary contractor(s): Lockheed Martin, Rolls-Royce, Northrop Grumman

[in-text-ad]

20. NSSL & RSLP Launch Enterprise

> Weapon type: Launch services for satellite deployment

> Planned fiscal 2023 investment: $1.55 billion (down 9.4% from 2022)

> Service branch: Space Force (16.2% of FY 2023 Space Force weapons spending)

> Primary contractor(s): SpaceX, United Launch Alliance, Northrop Grumman, Rocket Lab, VOX Space

19. SATCOM Projects Satellite Communications

> Weapon type: Space based communication system

> Planned fiscal 2023 investment: $1.55 billion (up 58.6% from 2022)

> Service branch: Space Force (16.2% of FY 2023 Space Force weapons spending)

> Primary contractor(s): Lockheed Martin, Boeing, Northrop Grumman, General Dynamics

18. Aegis Sea-Based Weapons System

> Weapon type: Naval vessel based missile defense system

> Planned fiscal 2023 investment: $1.60 billion (down 4.3% from 2022)

> Service branch: Joint Service (4.8% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Lockheed Martin, Raytheon

[in-text-ad-2]

17. Trident II Ballistic Missile Modifications

> Weapon type: Submarine-launched nuclear ballistic missile

> Planned fiscal 2023 investment: $1.68 billion (up 7.1% from 2022)

> Service branch: Navy (5.2% of FY 2023 Navy weapons spending)

> Primary contractor(s): Lockheed Martin

16. LPD San Antonio Class Amphibious Transport Dock

> Weapon type: Personnel and aircraft transport and docking ship

> Planned fiscal 2023 investment: $1.77 billion (up 314.7% from 2022)

> Service branch: Navy (5.5% of FY 2023 Navy weapons spending)

> Primary contractor(s): Huntington Ingalls Industries

[in-text-ad]

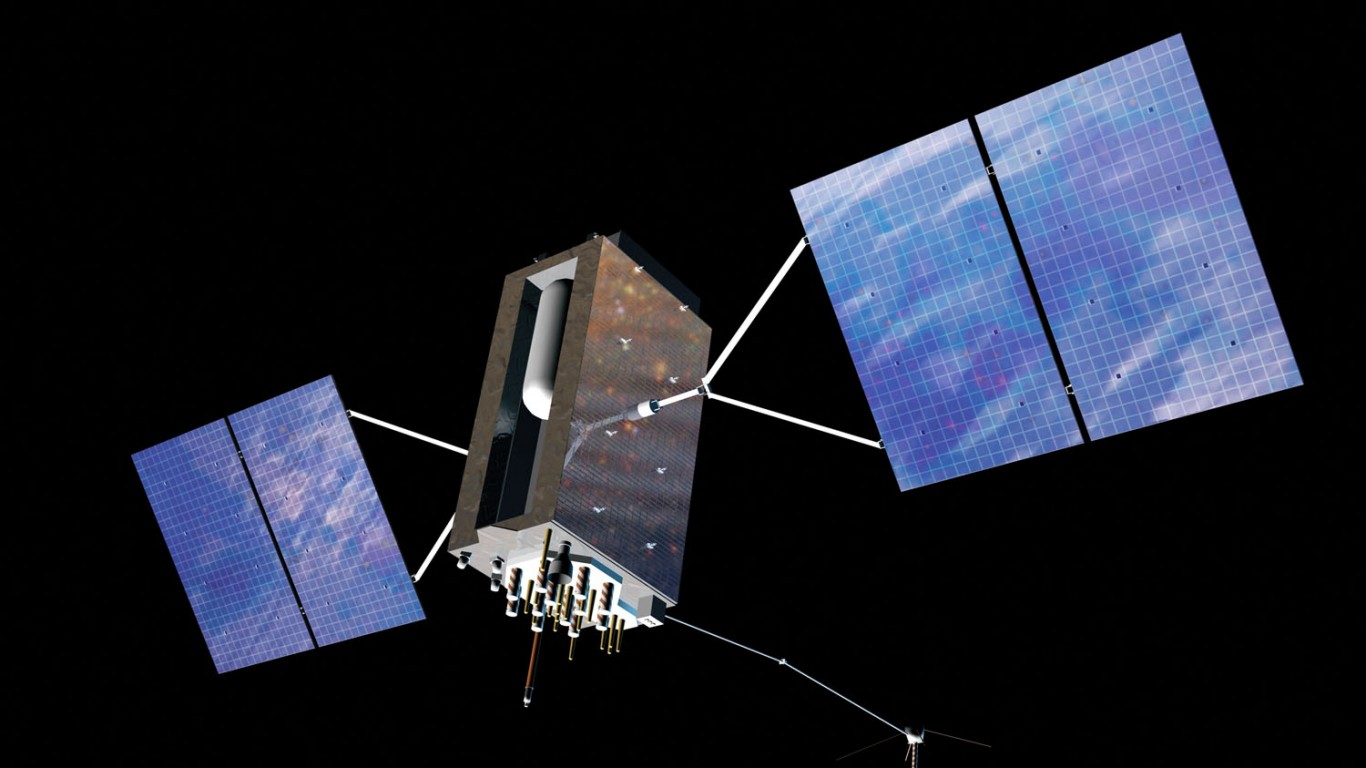

15. GPS III Global Positioning System Enterprise

> Weapon type: Space based, 3-dimensional GPS

> Planned fiscal 2023 investment: $1.84 billion (down 9.5% from 2022)

> Service branch: Space Force (19.2% of FY 2023 Space Force weapons spending)

> Primary contractor(s): Raytheon, Lockheed Martin, BAE Systems, L3Harris

14. CH-53K Heavy Lift Replacement Helicopter

> Weapon type: High-altitude, heavy lift helicopter

> Planned fiscal 2023 investment: $2.29 billion (up 12.4% from 2022)

> Service branch: Navy & Marine Corps (41.1% of joint FY 2023 Navy & Marine Corps weapons spending)

> Primary contractor(s): Sikorsky, General Electric

13. Ground-based Midcourse Defense (GMD)

> Weapon type: Missile defense system

> Planned fiscal 2023 investment: $2.60 billion (up 55.5% from 2022)

> Service branch: Joint Service (7.7% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Boeing, Northrop Grumman, Raytheon, Lockheed Martin

[in-text-ad-2]

12. KC-46A Tanker

> Weapon type: Aerial refueling aircraft

> Planned fiscal 2023 investment: $2.88 billion (up 22.3% from 2022)

> Service branch: Air Force (14.3% of FY 2023 Air Force weapons spending)

> Primary contractor(s): Boeing

11. CVN 78 Gerald R. Ford Class Nuclear Aircraft Carrier

> Weapon type: Nuclear-powered aircraft carrier ship

> Planned fiscal 2023 investment: $3.23 billion (up 13.2% from 2022)

> Service branch: Navy (10.1% of FY 2023 Navy weapons spending)

> Primary contractor(s): Huntington Ingalls Industries

[in-text-ad]

10. Cyberspace Activities

> Weapon type: Program to improve cyber-security and operations

> Planned fiscal 2023 investment: $3.35 billion (up 5.7% from 2022)

> Service branch: Joint Service (10.0% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Various

9. F-15 Eagle

> Weapon type: Fourth-generation fighter jet

> Planned fiscal 2023 investment: $3.51 billion (up 71.8% from 2022)

> Service branch: Air Force (17.4% of FY 2023 Air Force weapons spending)

> Primary contractor(s): Boeing

8. Ground Based Strategic Deterrent (GBSD)

> Weapon type: Nuclear intercontinental ballistic missiles

> Planned fiscal 2023 investment: $3.62 billion (up 41.1% from 2022)

> Service branch: Air Force (18.0% of FY 2023 Air Force weapons spending)

> Primary contractor(s): Northrop Grumman Corporation

[in-text-ad-2]

7. Ammunition

> Weapon type: Ammunition for small arms, artillery, etc.

> Planned fiscal 2023 investment: $4.60 billion (up 21.3% from 2022)

> Service branch: Joint Service (13.7% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Various

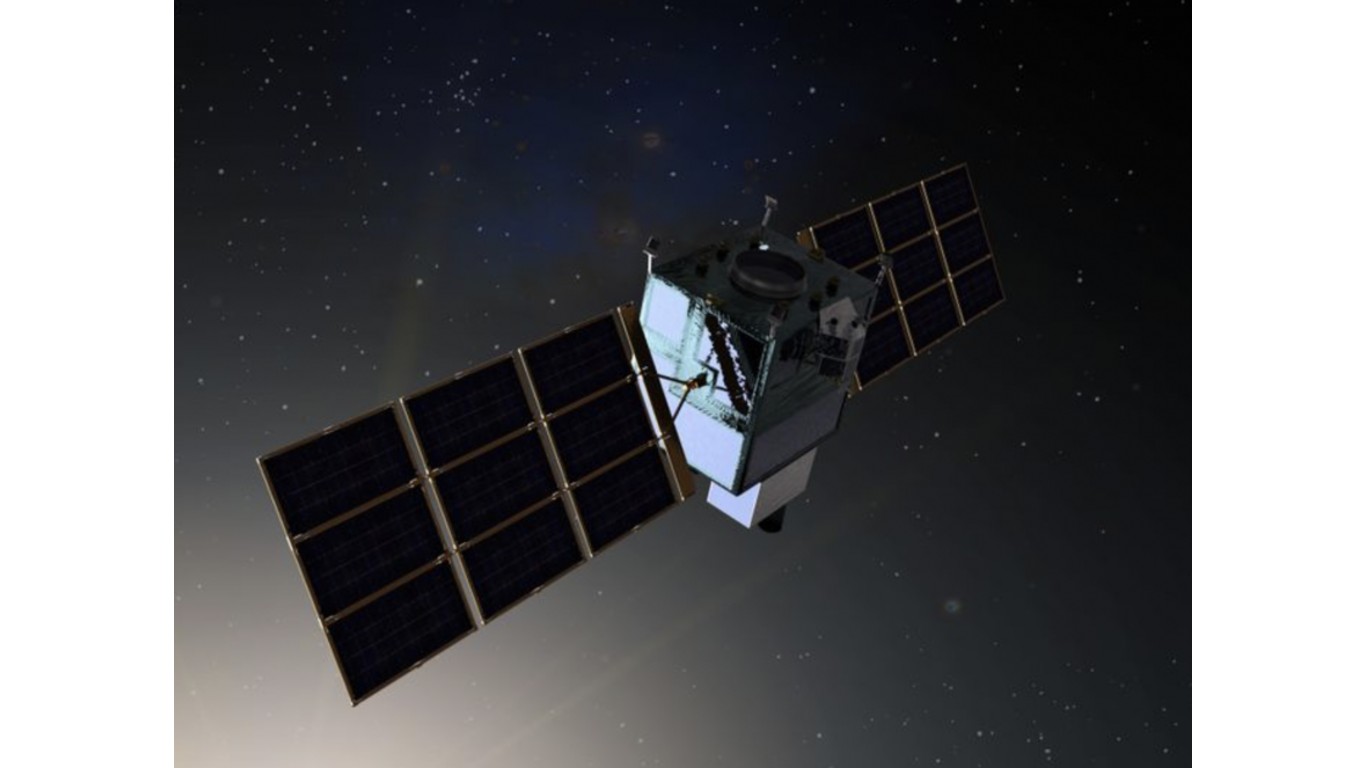

6. OPIR Space Based Missile Warning Systems

> Weapon type: Space-based missile defense

> Planned fiscal 2023 investment: $4.66 billion (up 86.8% from 2022)

> Service branch: Space Force (48.5% of FY 2023 Space Force weapons spending)

> Primary contractor(s): Lockheed Martin, Northrop Grumman, Raytheon

[in-text-ad]

5. B-21 Raider

> Weapon type: Long-range, nuclear-capable, stealth bomber

> Planned fiscal 2023 investment: $5.04 billion (up 69.1% from 2022)

> Service branch: Air Force (25.1% of FY 2023 Air Force weapons spending)

> Primary contractor(s): Northrop Grumman

4. DDG 51 Arleigh Burke Class Destroyer

> Weapon type: Guided missile destroyer ship

> Planned fiscal 2023 investment: $5.57 billion (up 32.2% from 2022)

> Service branch: Navy (17.4% of FY 2023 Navy weapons spending)

> Primary contractor(s): General Dynamics, Huntington Ingalls Industries

3. SSBN 826 Columbia Class Ballistic Missile Submarine

> Weapon type: Nuclear-powered strategic deterrence submarine

> Planned fiscal 2023 investment: $6.26 billion (up 21.1% from 2022)

> Service branch: Navy (19.5% of FY 2023 Navy weapons spending)

> Primary contractor(s): General Dynamics, Huntington Ingalls Industries

[in-text-ad-2]

2. SSN 774 Virginia Class Submarine

> Weapon type: Nuclear-powered attack submarine

> Planned fiscal 2023 investment: $7.25 billion (up 5.2% from 2022)

> Service branch: Navy (22.6% of FY 2023 Navy weapons spending)

> Primary contractor(s): General Dynamics, Huntington Ingalls Industries

1. F-35 Joint Strike Fighter

> Weapon type: Fifth-generation fighter jet

> Planned fiscal 2023 investment: $11.02 billion (down 7.7% from 2022)

> Service branch: Joint Service (32.8% of FY 2023 Joint Service weapons spending)

> Primary contractor(s): Lockheed Martin, Pratt & Whitney

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.