The number of companies filing for liquidation or reorganization was more than double in the first three months of this year compared to the first quarter of last year, according to S&P Global Market Intelligence – and marked the highest number of corporate bankruptcies in any comparable quarter since 2010.

Among the largest publicly traded U.S. companies to enter into bankruptcy so far this year are retailer Party City and business communications provider Avaya. Investors are watching to see if the writing will soon be on the wall for home goods seller Bed Bath & Beyond, movie chain AMC, and pharmacist Rite Aid, among others.

But by far the most notable public company to hit the skids this year is SVB Financial Group, aka Silicon Valley Bank. The 40-year-old Santa Clara, Calif.-based bank was the 16th largest in the country when it became the third-biggest bankruptcy of a U.S. public company in March.

To determine the nation’s 25 biggest public company bankruptcies of all time, 24/7 Tempo reviewed data on bankruptcy filings from BankruptcyData’s 2021 Bankruptcy Yearbook, Almanac & Directory and the Administrative Office of the United States Courts. Public companies that have filed for Chapter 11 or Chapter 7 bankruptcy were ranked based on their total assets at the time of their bankruptcy. (Figures have not been adjusted for inflation.)

At the time they filed for bankruptcy, these companies had assets of between $25.8 billion (for The Hertz Corporation, which emerged from bankruptcy in October 2021) and a staggering $691.1 billion for the defunct New York investment bank Lehman Brothers.

Click here to read about the 25 biggest bankruptcies in American history.

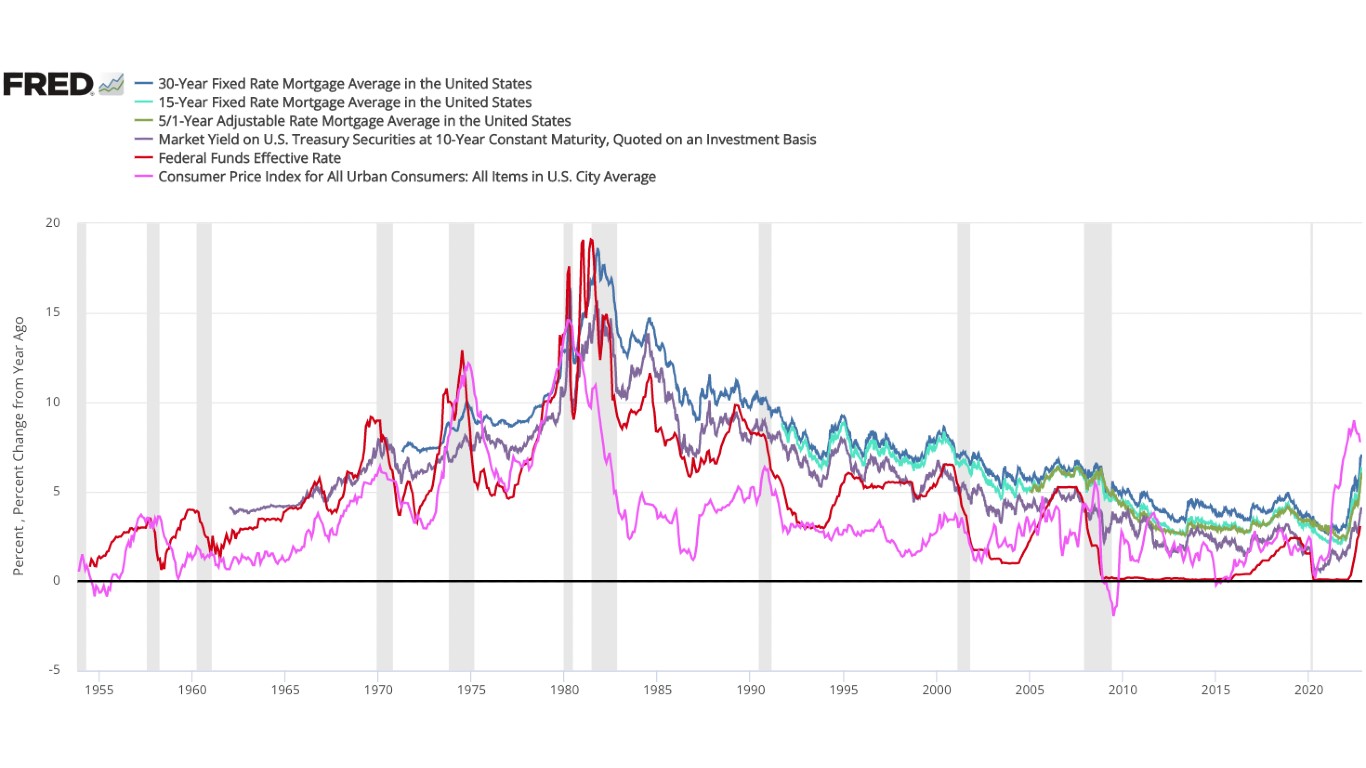

Eight companies on this list filed for bankruptcy in 2008 and 2009 during the peak of the global credit crisis instigated by the collapse of the U.S. subprime mortgage market. (Here’s a look at every year’s mortgage rate since 1972.)

Only three of these bankruptcies took place before 2000, two of them as a result of the massive savings and loan crisis of the 1980s. The earliest bankruptcy on this list was filed by Texaco, once a major U.S. global oil and gas concern that’s been reduced to a brand of fuel and some gas stations owned by Chevron. (See the price of gas every year since 1990.)

25. The Hertz Corporation

> Assets at time of bankruptcy: $25.8 billion

> Date of filing: May 22, 2020

The coronavirus pandemic tipped one of the world’s largest car rental companies into bankruptcy in May 2020 as the global viral outbreak grounded business and tourism travel, exacerbating the Estero, Florida-based company’s debt problems. The company, which also owns Dollar, Thrifty, and Firefly car rental brands, emerged from bankruptcy in October 2021 amid a strong rebound in travel that invigorated efforts to revive the company. The New York Times reported that a group of investors led by Knighthead Capital Management and Certares Management, tossed Hertz a $5.9 billion lifeline.

[in-text-ad]

24. New Century Financial Corporation

> Assets at time of bankruptcy: $26.1 billion

> Date of filing: April 2, 2007

The former Irvine, California-based subprime mortgage lender was a canary in the coalmine for impending troubles in the U.S. mortgage and housing market. It filed for bankruptcy eight months before the U.S. fell into the Great Recession in December 2007. In 2010, several former company officials agreed to pay $90 million to settle lawsuits stemming from the company’s collapse, according to the Los Angeles Times.

23. Calpine Corporation

> Assets at time of bankruptcy: $27.2 billion

> Date of filing: December 20, 2005

Calpine emerged from bankruptcy in January 2008 after years of mounting debt in the wake of the collapse of energy company and commodities trader Enron Corp. at the end of 2001 and a crisis in the wholesale energy market. Amid its bankruptcy, Calpine was forced to sell assets in the U.S. and Canada, driving down its total generating capacity by more than 5,000 megawatts, according to Natural Gas Intelligence. Today, Calpine is in a better position and is a leader in U.S. electricity production from natural gas and geothermal sources

22. Lyondell Chemical Company

> Assets at time of bankruptcy: $27.4 billion

> Date of filing: January 6, 2009

LyondellBasell is a major global petrochemical company incorporated in the Netherlands. Amid mounting debts and slumping demand, the company’s U.S. operations filed for bankruptcy during the Great Recession. Lyondell’s debt obligations mounted during a $12.7 billion leveraged buyout of Lyondell by Basell, led by Ukrainian-born U.S. and British billionaire Len Blavatnik, according to Reuters. The Lyondell Chemical Company is one of eight companies on this list that filed for bankruptcy in 2008 and 2009.

[in-text-ad-2]

21. General Growth Properties

> Assets at time of bankruptcy: $29.6 billion

> Date of filing: April 16, 2009

At the time of its bankruptcy, General Growth Properties was the second largest owner of U.S. shopping malls. The global economic recession tanked U.S. consumer spending and ravaged the commercial real estate market, making GGP’s bankruptcy “the largest real estate failure in U.S. history,” according to Reuters. The Chicago-based company had a portfolio of valuable properties, like Manhattan’s South Street Seaport and Boston’s Faneuil Hall Marketplace. Brookfield Property Partners completed its acquisition of GGP in 2018 in a $9.25 billion deal.

20. Bank of New England

> Assets at time of bankruptcy: $29.8 billion

> Date of filing: January 7, 1991

By the time of its collapse, Boston-based Bank of New England had grown to become a major U.S. bank holding company under an aggressive expansion strategy spearheaded by long-time chairman and CEO Walter Connolly. The bank had “the most bad loans and the biggest losses” when the U.S. economy collapsed in 1989, according to the Washington Post. The federal government seized the bank and it filed for Chapter 7 bankruptcy. It should be noted that New Hampshire’s Bank of New England has no connection to the defunct bank.

[in-text-ad]

19. Global Crossing

> Assets at time of bankruptcy: $30.2 billion

> Date of filing: January 28, 2002

Global Crossing’s bankruptcy came weeks after the collapse of energy company and commodities trader Enron and amidst an accounting scandal in which the Bermuda-domiciled telecommunications company settled numerous lawsuits for alleged securities fraud, according to Investopedia. It was the fourth-largest bankruptcy in U.S. history at the time. In 2011, the company was acquired by Level 3 Communications in a $3 billion deal.

18. IndyMac Bancorp

> Assets at time of bankruptcy: $32.7 billion

> Date of filing: July 31, 2008

The Pasadena, California-based lender filed for bankruptcy after the Federal Deposit Insurance Corporation took over IndyMac Federal Bank FSB, the company’s banking unit, to protect depositors. At the time it was the biggest bank failure since the savings and loan crisis of the 1980s, Reuters reported. IndyMac’s bankruptcy was eclipsed weeks later with the collapse of Washington Mutual and Lehman Brothers, the biggest bankruptcies in U.S. history.

17. Refco

> Assets at time of bankruptcy: $33.3 billion

> Date of filing: October 17, 2005

New York City-based Refco was the largest U.S. independent commodities trader when it began closing its main business amid fraud charges against its former chairman and CEO Phillip Bennett. The British businessman pled guilty to conspiracy to commit securities fraud and was sentenced to 16 years in prison. Bennett was purchasing bad debt from Refco to hide it from quarterly reports and then paying for the loans with money that originated from a Refco subsidiary.

[in-text-ad-2]

16. Financial Corp. of America

> Assets at time of bankruptcy: $33.9 billion

> Date of filing: September 9, 1988

In February 1989 – after the federal government spent $2 billion bailing out the American Savings and Loan Association during the saving and loan crisis of the 1980s – the bank’s parent company, Irvine, California-based Financial Corp. of America, changed its 1988 Chapter 11 bankruptcy filing to Chapter 7, according to the Los Angeles Times. The move meant that the lender would be liquidated to pay creditors rather than restructured to pay off debt with future earnings.

15. Texaco

> Assets at time of bankruptcy: $34.9 billion

> Date of filing: April 12, 1987

What a long strange trip it’s been for Texaco, founded in 1902 in the oil fields of Beaumont, Texas. In 1928, it became the first company to sell gasoline nationwide in the U.S. and later went global to become one of the world’s largest oil companies. The company’s ill-fated acquisition of Getty Oil Company in 1984 led to its demise after the Pennzoil Company sued for contract interference, leading to a massive $10.5 billion penalty that drove Texaco to bankruptcy. Today, Texaco has been reduced to an eponymous brand of fuel and gas stations owned by Chevron.

[in-text-ad]

14. Pacific Gas and Electric Company

> Assets at time of bankruptcy: $36.2 billion

> Date of filing: April 6, 2001

The 2000-2001 California energy crisis caused rolling blackouts across the state and sent Pacific Gas and Electric Company into bankruptcy. The root cause was a spike in wholesale energy prices instigated by drought conditions, a slow rollout of new power-generating facilities, and sketchy energy-market manipulations by Enron. In a move criticized by consumer groups, Pacific Gas and Electric Corp., the parent company, “took steps to ensure that the assets of its other subsidiaries would not be seized in case of a Pacific Gas bankruptcy,” reported the New York Times.

13. Thornburg Mortgage

> Assets at time of bankruptcy: $35.5 billion

> Date of filing: May 1, 2009

The Santa Fe, New Mexico-based real estate investment trust specialized in jumbo and super-jumbo adjustable-rate mortgages – home loans for high-priced properties offering a fixed low-interest rate for a set period of time to well-credited buyers. Thornburg filed for bankruptcy as home sales and value plummeted during the Great Recession. In 2012, the Securities and Exchange Commission charged three of the company’s top executives “with hiding the company’s deteriorating financial condition at the onset of the financial crisis.”

12. Chrysler

> Assets at time of bankruptcy: $39.3 billion

> Date of filing: April 30, 2009

As with General Motors (see No. 5), the government bailed out Auburn Hills, Michigan-based Chrysler after it filed for bankruptcy protection during the global financial crisis. By the time Italian automaker Fiat completed its purchase of the U.S. manufacturer of Ram pickup trucks, Dodge Challengers, and Jeeps, the federal government had spent $1.3 billion rescuing the company from collapse. Today Chrysler is a U.S.-based division of Stellantis, formerly Fiat Chrysler Automobiles, the Netherlands-domiciled Italian-American auto giant.

[in-text-ad-2]

11. MF Global Holdings

> Assets at time of bankruptcy: $40.5 billion

> Date of filing: October 31, 2011

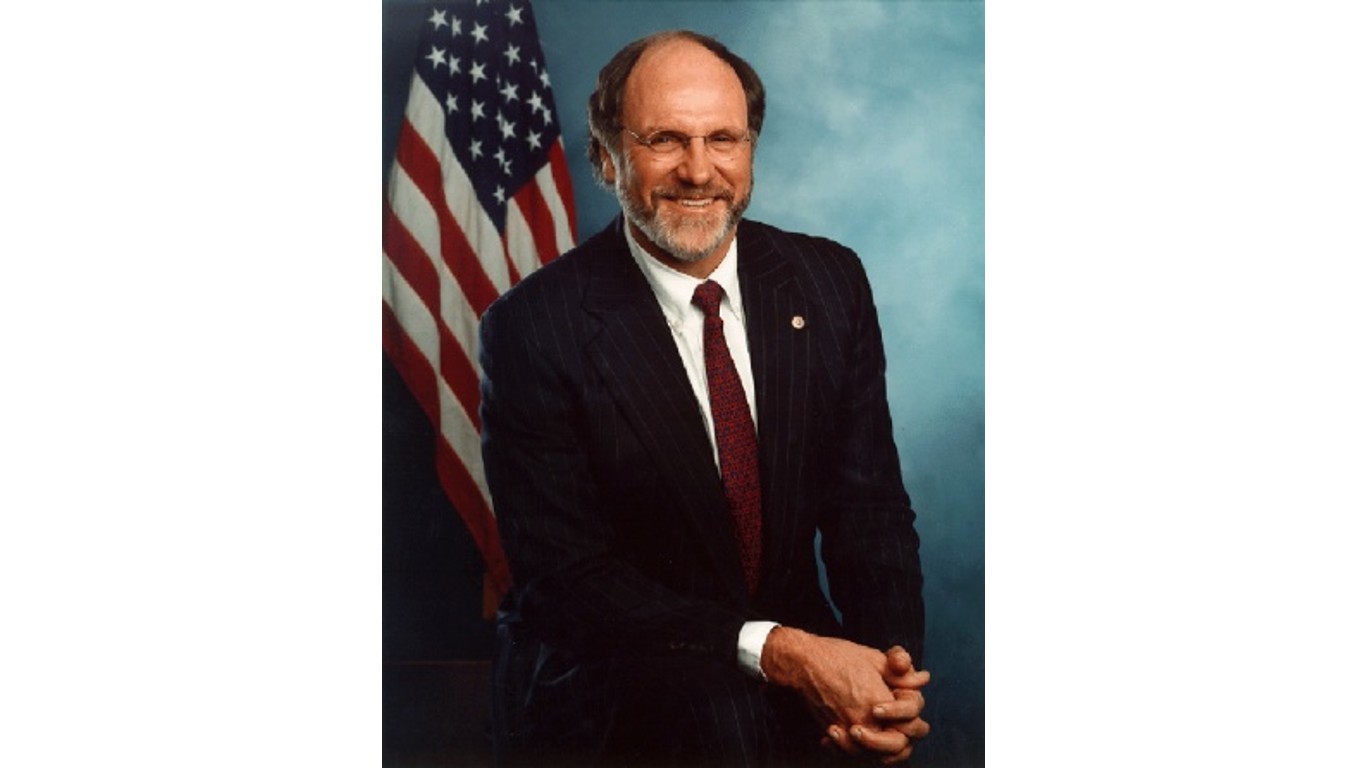

The New York City-based commodity futures broker is the first bankruptcy on this list to occur after 2009, though its origins took place in 2007 when it was spun off of Man Financial Group as turmoil in the global markets was starting to rumble. The company’s demise was attributed to “aggressive, even excessive risk-taking” related to using euro-denominated sovereign debt as collateral in return for credit, according to Investopedia. The bankruptcy came 19 months after former New Jersey governor Jon Corzine, a one-time Goldman Sachs manager, was appointed the company’s CEO and chairman.

10. Energy Future Holdings

> Assets at time of bankruptcy: $41.0 billion

> Date of filing: April 29, 2014

Laden with $40 billion in debt, the Dallas-based owner of Texas utility leaders Luminant and Oncor Electric filed for bankruptcy six years after KKR, Goldman Sachs, and TPG Capital acquired the company (formerly known as TXU Corp.) in a historic $45 billion leveraged buyout, EFH initially sought to spin off Luminant and allow creditors to take over Oncor, but the deal was later scrapped, according to Forbes. In 2017, San Diego-based Sempra Energy bought Oncor for $9.45 billion, beating out a bid by Warren Buffett’s Berkshire Hathaway to purchase EFH for $9 billion.

[in-text-ad]

9. Conseco

> Assets at time of bankruptcy: $61.4 billion

> Date of filing: December 17, 2002

The Carmel, Indiana-based financial services holding company fell into bankruptcy after amassing an insurmountable $6 billion in debt through an aggressive series of acquisitions. At the time, it was the third-largest Chapter 11 bankruptcy filing after Enron in December 2001 and WorldCom in July 2002, according to the Los Angeles Times. The company emerged from bankruptcy in 2003 and today operates as CNO Financial Group, an insurer.

8. Enron Corporation

> Assets at time of bankruptcy: $65.5 billion

> Date of filing: December 2, 2001

The Houston-based energy and commodities-trading company collapsed amid a massive criminal accounting scandal that led to the largest bankruptcy on record at the time. Enron’s fall came after whistleblowing insiders disclosed that company executives had been hiding debts and losses through limited partnerships the company controlled. Executives Kenneth Lay and Jeffrey Skilling were convicted for this scheme. Lay died in 2006 before his sentencing. Skilling’s sentence was later reduced. He was released from custody in February 2019 after serving 12 years.

7. PG&E Corporation (Pacific Gas)

> Assets at time of bankruptcy: $71.4 billion

> Date of filing: January 29, 2019

In 2001, Pacific Gas and Electric Company filed for bankruptcy. This time it was its parent company, PG&E Corp., that filed for Chapter 11 bankruptcy protection after accumulating $30 billion in liability for destructive and fatal wildfires sparked by the utility’s poorly maintained equipment, according to the New York Times. It remains the largest bankruptcy of a U.S. utility on record, second to Pacific Gas and Electric Company’s bankruptcy nearly two decades earlier.

[in-text-ad-2]

6. CIT Group

> Assets at time of bankruptcy: $80.4 billion

> Date of filing: November 1, 2009

Founded in 1908 as a local small-business lender in St. Louis, CIT Group grew to become a major source of credit for small and medium-sized companies in Canada and the United States. Four months after the end of the Great Recession in June 2009, the company entered Chapter 11 bankruptcy, a particularly stinging reorganization for the federal government that in December 2008 approved $2.33 billion in Troubled Asset Relief Program funds to help keep the company solvent. Today CIT is a subsidiary of Raleigh, North Carolina-based First Citizens BancShares.

5. General Motors

> Assets at time of bankruptcy: $91.0 billion

> Date of filing: June 1, 2009

Detroit-based General Motors became a symbol of the “too big to fail” bailouts during the 2008-09 financial crisis. By the time the U.S. Treasury exited partial ownership of the automaker in 2013 following its 2009 bankruptcy, the federal government had spent $11.2 billion selling its GM shares at a loss. Today, the maker of the 9,000-pound Hummer electric truck and the 19-foot-long GMC Yukon XL is back to returning capital to shareholders through dividends and stock buybacks.

[in-text-ad]

4. WorldCom

> Assets at time of bankruptcy: $103.9 billion

> Date of filing: July 21, 2002

Two companies became symbols of corporate malfeasance at the turn of the last century: energy and commodities company Enron and WorldCom, which had once been the country’s second-largest long-distance telephone company. WorldCom collapsed after company vice-president of internal audits Cynthia Cooper discovered fraudulently inflated earnings statements. Several executives pled guilty to fraud and CEO Bernard Ebbers served 13 years of a 25-year sentence. He was granted compassionate release for health reasons in 2019.

3. SVB Financial Group

> Assets at time of bankruptcy: $211.8 billion

> Date of filing: March 17, 2023

Silicon Valley Bank is the newest entrant to the list of the 25 largest U.S. public company bankruptcies, coming in strong at third place. The 40-year-old Santa Clara, California-based bank was the 16th largest in the country, focused largely on venture-backed tech and healthcare startups. SVB’s collapse was due to its heavy reliance on long-term debt like Treasury bonds without anticipating the current high-interest rate climate aimed at cooling inflation, coupled with a financial downturn in the tech industry that increased withdrawals.

2. Washington Mutual

> Assets at time of bankruptcy: $327.9 billion

> Date of filing: September 26, 2008

Founded in Seattle in 1889, the bank grew to become the nation’s largest savings and loan company. The staggering failure of Washington Mutual to withstand the 2007-08 U.S. subprime mortgage meltdown gives it the dubious dual honor of being the second-largest bankruptcy and second-largest bank failure in U.S. history. The government took WaMu under control of the Federal Deposit Insurance Corporation after a run on the bank led to $16.7 billion in withdrawals over a 10-day period.

[in-text-ad-2]

1. Lehman Brothers

> Assets at time of bankruptcy: $691.1 billion

> Date of filing: September 15, 2008

The collapse of the New York City-based investment bank coincides closely in time with the fall of Washington Mutual: Both entered bankruptcy within two weeks of each other in September 2009 – two of eight companies on this list that fell during the 2008 or 2009 global financial collapse. Lehman’s assets at the time of its filing totaled more than the assets of the three next-largest U.S. bankruptcies combined.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.