Special Report

Celebrities With Significant Debts to the IRS

Published:

Last Updated:

During the 2020 financial year, the Internal Revenue Service issued almost 34 million penalties against individual and estate and trust income taxes, generating $14 billion in tax income. The most common penalties were for failure to pay, non- or underpayment of estimated tax, and delinquency. Half of the total amount generated by penalties was for failure to pay. (These are the 19 most common tax mistakes.)

To identify 34 celebrities from different fields of endeavor who got into trouble with the IRS, 24/7 Tempo reviewed the tax avoidance debt for individuals from the report The World’s Biggest Tax Offenders by Tipalti, an accounting software company. Tipalti used data for individuals taken from multiple online sources. We added several more offenders sourced from Insider and other business-focused websites.

Some of the tax cheats are rappers such as Busta Rhymes, MC Hammer, and Nelly. In Nelly’s case, his fans rallied to his side, streaming his music to generate money to help pay off his debt. Beloved singers such as Lionel Richie, Dionne Warwick, and Willie Nelson also got on the wrong side of the IRS and sought to make amends for their tax transgressions. Nelson cut an album “The IRS Tapes: Who’ll Buy My Memories” to help pay the tax debt.

Actors Lindsay Lohan, Val Kilmer, and Nicolas Cage allowed the bright lights of celebrity to obscure their tax obligations.

Some athletes were their own worst enemies when it came to tax debt, getting into tax trouble during and after their career. They included football players O.J. Simpson (whose tax issues were the least of his problems) and Ron Mix, baseball player Pete Rose, and boxer Floyd Mayweather. (These are the best-paid athletes and what they owed in taxes.)

Click here to see 34 celebrities who got in trouble with the IRS

The two top tax evaders are more infamous than famous, known for their tax-evading legerdemain rather than their ability to entertain.

*The article previously featured an incorrect image of Richard Hatch, which has now been rectified.

34. Richard Simmons

> Debt: $24,000

Fitness guru and television personality Richard Simmons owed the IRS about $24,000 covering the tax years 2007-2015. The IRS placed a tax lien on his businesses and property after the feds claimed he owed back taxes.

[in-text-ad]

33. Jon Gosselin

> Debt: $39,000

TV reality star Jon Gosselin of “Jon & Kate Plus 8” fame got a dose of reality in 2013 when the Pennsylvania Department of Revenue filed a $39,000 tax lien for taxes that he did not pay in 2009.

32. Dustin Diamond

> Debt: $94,000

Dustin Diamond, who starred in the sitcom “Saved by the Bell,” could not be saved from his tax obligations. He owed the state of Wisconsin $93,768 for an unspecified tax period.

31. Plaxico Burress

> Debt: $98,000

Plaxico Burress, a Super Bowl champion wide receiver with the New York Giants, had a federal tax lien filed against him in 2012. The IRS said he and his wife failed to pay income taxes in 2007 and 2009, leaving an outstanding bill of $98,064.76. That’s not the worst thing that happened in his life. In November 2008, he dropped a gun he was carrying at a nightclub and it discharged, wounding him in the leg.

[in-text-ad-2]

30. Chuck Berry

> Debt: $110,000

Rock ‘n’ roll pioneer Chuck Berry (“Johnny B. Goode,” “Roll Over Beethoven”) toured the nation in the 1970s and was paid in cash for his shows. The IRS charged him with failure to pay taxes on those earnings, with a tax debt totaling $110,000. He pled guilty to tax evasion in 1979 and was sentenced to four months in prison and 1,000 hours of community service, which he fulfilled by performing benefit concerts.

29. Ron Mix

> Debt: $155,000

Ron Mix, a pro football offensive lineman and Hall of Fame member, pled guilty in 2016 to a Missouri tax fraud charge. He agreed to pay the IRS about $50,000 for one count of making false statements on a tax return.

[in-text-ad]

28. O.J. Simpson

> Debt: $180,000

O.J. Simpson, one of the greatest pro football running backs of all time, had developed a career in television and motion pictures after he retired – but he’s been in a lot of trouble since then. He was accused of the murder of his wife and her friend, but acquitted in a high-profile trial. In 2008, he was sentenced to 33 years in prison for the robbery and kidnapping of a sports-memorabilia salesman. Simpson had not paid any taxes since 2007 according to the IRS, and owed almost $180,000.

27. AI Capone

> Debt: $215,000

Gangster Al Capone ran an incredibly profitable bootlegging business during Prohibition that made him a fortune, income that was not reported to the IRS. While he was never convicted of murder or other heinous crimes for which he was responsible, the most famous tax evader in American history received a sentence of 11 years in jail in 1931 for his tax evasion..

26. Martha Stewart

> Debt: $222,000

Daytime TV host and lifestyle maven Martha Stewart failed to pay $220,000 in taxes on an estate she owned, arguing that she wasn’t there enough, so she shouldn’t pay the tax. The IRS decided that was not a good thing and she eventually paid the amount in 2002.

[in-text-ad-2]

25. Lindsay Lohan

> Debt: $234,000

After a promising start to her acting career, Lindsey Lohan has encountered all manner of personal problems. Tax evasion is one of them. Lohan was hit by Uncle Sam with a tax lien on her 2010 income taxes in February 2012, one month after documents showed she also failed to file in 2009.

24. Trey Songz

> Debt: $250,000

The Grammy-nominated artist, whose real name is Tremaine Aldon Neverson, has had R&B/hip-hop hits that included “Say Aah,” and “Bottoms Up.” He got slammed with a federal tax lien in 2015 on his income from 2013.

[in-text-ad]

23. Pete Rose

> Debt: $366,000

Baseball’s all-time hits leader, who’s banned from baseball for life for betting on the national pastime, ran afoul with the IRS for failing to report income from autograph and memorabilia sales and personal appearances starting in 1984. Rose served a five-month stint in federal prison for tax evasion. He was hit with tax liens in 2004 and 2012.

22. Val Kilmer

> Debt: $498,000

The “Batman Forever” and “Top Gun” star had no sooner satisfied a $538,000 debt to the IRS in 2010 than the government hit him with a lien against his $18.5 million New Mexico ranch for unpaid 2008 taxes of $498,165.

21. Christie Brinkley

> Debt: $532,000

In 2011, the IRS placed a lien on the $30 million Hamptons estate of this supermodel and actress – and former wife of Billy Joel – charging her with a debt of $531,720 for back taxes. She paid off the amount owed the same year.

[in-text-ad-2]

20. MC Hammer

> Debt: $780,000

The taxman came after MC Hammer, the “U Can’t Touch This” rapper, for back taxes on his earnings in 1996 and 1997, seeking a total of $779,585. Hammer, born Stanley Burrell, was known for his large entourages, and they cost him so much money to maintain per month, that he filed a bankruptcy claim in 1996 listing $13 million in debts.

19. Busta Rhymes

> Debt: $789,000

The IRS slammed rapper Busta Rhymes, born Trevor George Smith Jr., with a two-lien tax bill totaling almost $800,000 in 2014. That bill was added to already existing tax bills he was slapped with in 2010 and 2012.

[in-text-ad]

18. Lauryn Hill

> Debt: $1.04 million

The Grammy-winning singer/rapper served three months in jail and another three in home confinement in 2013 for failing to pay taxes of $554,000 on more than $1.8 million from 2005 to 2007. She also owned about $500,000 in state and federal taxes for income not reported in 2008 and 2009. She eventually paid off the entire amount.

17. Lionel Richie

> Debt: $1.10 million

TMZ reported that prolific hitmaker Lionel Richie – who placed five No. 1’s on the Billboard Hot 100 in the 1980s – was hit with a tax lien in 2012 for failing to pay more than $1 million in income tax in 2010. He satisfied the debt and the lien was lifted.

16. John Travolta

> Debt: $1.10 million

The “Urban Cowboy” and “Pulp Fiction” star was socked with a bill of just over $1 million in back taxes and penalties for the period from 1993 to 1995. In 2000, he negotiated a deal with the feds to satisfy his debt with a payment of $607,400.

[in-text-ad-2]

15. Richard Hatch

> Debt: $2 million

Richard Hatch was the first winner on the television show “Survivor” in 2000, winning the $1 million prize through manipulating and playing mind games with opponents. He got in tax trouble after failing to pay tax on his “Survivor” winnings, and ended up serving 51 months in federal prison. He later served another nine months for violating the terms of his probation, which required him to amend his 2000 and 2001 returns. In addition, land he owned in Nova Scotia was seized by Canadian tax authorities because he failed to pay property taxes and eventually auctioned off.

14. Nelly

> Debt: $2.40 million

In 2016, TMZ reported that Grammy Award-winning hip-hop performer Nelly had been hit with an IRS tax lien of more than $2.4 million. TMZ also said Nelly, whose real name is Cornell Iral Haynes Jr., tried to work out a settlement with the IRS. Nelly’s fans came to his rescue. According to BET, fans on Twitter started a social-media campaign to help the rapper pay off his debts by streaming his songs.

[in-text-ad]

13. Ja Rule

> Debt: $3.10 million

The rapper (“Holla Holla”) and actor (“Half Past Dead”), born Jeffrey Atkins, is no stranger to legal troubles, with arrests on drug and gun possession charges, and a two-year prison sentence for attempted possession of a weapon. In 2011, he received an additional 28 months – to be served concurrently – for failing to pay taxes on his earnings from 2004 to 2006. In 2021, it was reported that Ja Rule and his wife, Aisha Atkins, owed the IRS a total of about $3 million for that tax period and also the period from 2012 to 2017. He is said to have struck a deal with the government to pay off the debt and avoid more jail time.

12. Rick Ross

> Debt: $4 million

Rapper Rick Ross settled a tax bill of more than $4 million in 2012. He was originally hit with a tax lien in 2016 and the IRS was threatening to seize his assets. Representatives of Ross told Billboard magazine that the “issue arose from an incorrect filing by a prior accountant for the 2012 tax year.”

11. Katt Williams

> Debt: $4.03 million

Besides an arrest and getting into fights in 2012, comedian Katt Williams had major tax problems that year. He owed the IRS $4 million in taxes, stretching back to 2008. Williams was in the hole for $3.2 million from 2008 and $825,392 from 2009. Those money totals did not include a 2010 lien in which the IRS demanded $284,000.

[in-text-ad-2]

10. Floyd Mayweather

> Debt: $5.60 million

Boxer Floyd Mayweather’s tax problems have been well-chronicled, with some news sources putting the amount owed at as much as $22 million. Mayweather’s tax issue is one of the reasons why he agreed to fight Irish martial-arts fighter Conor McGregor in a match in Las Vegas in 2017. Mayweather had asked the IRS for a reprieve on his taxes until after his bout with McGregor. “It’s the latest in a cycle for Mayweather,” said ESPN, “who paid $15.5 million in taxes for 2001, 2003-2007 and 2009 only after the IRS filed liens against him, according to documents filed to the Clark County Recorder in Las Vegas.”

9. Nicolas Cage

> Debt: $6.20 million

Academy Award-winning actor Nicolas Cage has appeared in such hits as “Leaving Las Vegas,” “Moonstruck,” and “National Treasure.” He needed the treasure he earned in movies to pay for such eclectic purchases as castles, an island, yachts, 15 homes, and a dinosaur skull. When he got into tax trouble, he sued his former business manager in 2009, who countersued. In 2012, Cage paid off his tax bill.

[in-text-ad]

8. Wesley Snipes

> Debt: $7 million

Actor Wesley Snipes had built an enviable acting résumé in the 1990s with hit films such as “Blade” and “White Men Can’t Jump.” His career was derailed in 2010, however, when he was convicted of tax evasion and sentenced to federal prison for three years. After he was released in 2013, Snipes was able to restart his career – most recently on the series “Paper Empire,” which, perhaps ironically, centers on a financial fraudster.

7. Leona Helmsley

> Debt: $7.10 million

Hotel owner Leona Helmsley, dubbed the “Queen of Mean,” was one of the most reviled boldfaced names in New York in the 1980s and 1990s because of her mistreatment of her employees. She lived up to her nickname during her tax-evasion case in 1989, when she was alleged to have said “only little people pay taxes.” She was convicted of tax evasion and spent 18 months in prison. In 2007, the year she died, Forbes ranked her as the 369th richest person in the world with an estimated net worth of $2.5 billion.

6. Dionne Warwick

> Debt: $10 million

Grammy Award-winning singer Dionne Warwick, whose hits included “I Say a Little Prayer,” declared bankruptcy in 2013 after she discovered she owed $10 million in taxes. Warwick claimed the tax debt occurred because of mismanagement of her finances in the late 1980s and early 1990s.

[in-text-ad-2]

5. Chris Tucker

> Debt: $11 million

The “Rush Hour” star owed back taxes dating from 2002 to 2010. Lawyers say Tucker entered several installment agreements in 2010, 2011 and 2016 to pay the IRS back in lump sums over 10 years. The IRS placed a lien on Tucker’s property in Henderson, Nevada.

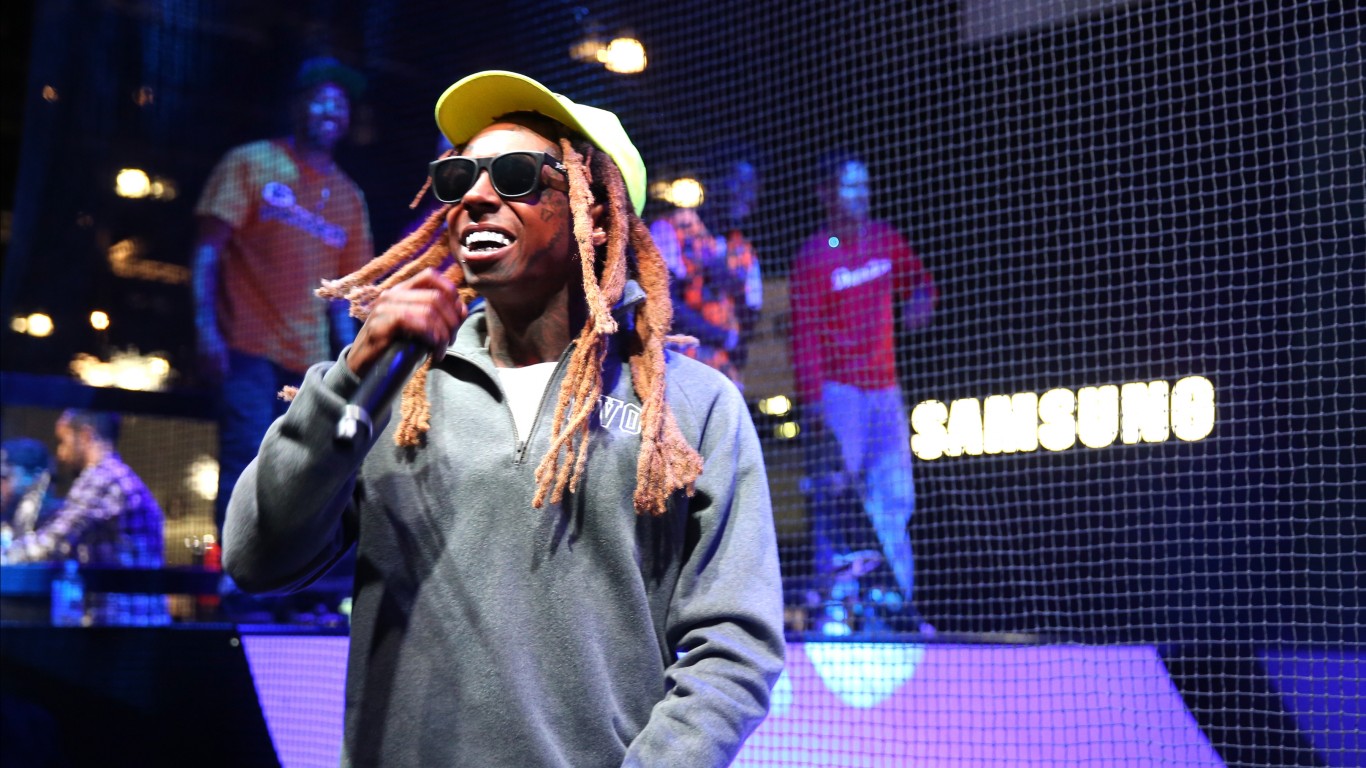

4. Lil Wayne

> Debt: $14 million

The IRS had imposed tax liens on rapper Lil Wayne, born Dwayne Carter Jr., dating back to 2002, before he settled his tax debt, estimated at $14 million, in 2019. IRS tax liens cover all property, even property acquired after the lien filing. Tax liens hurt one’s credit and reputation.

[in-text-ad]

3. Willie Nelson

> Debt: $32 million

Country music superstar Willie Nelson had well-publicized tax problems in the 1990s. The IRS seized much of his property to help pay off the $32 million debt. It is believed Nelson’s debt bill occurred because his accountant put his money in bogus tax shelters. Nelson reached a settlement with the IRS and paid off the debt. Nelson recorded the album “The IRS Tapes: Who’ll Buy My Memories” to help pay the tax bill.

2. Walter Anderson

> Debt: $200 million

Telecommunications mogul and space travel entrepreneur Walter Anderson received a nine-year prison sentence in 2007 for evading more than $200 million in federal taxes by creating offshore accounts to his income. A federal judge then ruled that an error in the government’s plea agreement with Anderson invalidated the conviction, though he was still required to pay about $23 million in taxes to the District of Columbia.

1. Paul Daugerdas

> Debt: $1.60 billion

Attorney Paul Daugerdas holds the dubious distinction of having committed the biggest tax fraud ever. He received a 15-year jail term after he was convicted of creating bogus tax shelters for his wealthy clients so they could avoid paying taxes. The fraudulent shelters were designed to create phony losses so the rich could reduce their tax bills.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.