The recent arrest of cryptocurrency entrepreneur Samuel Bankman-Fried for allegedly misusing customer funds from his now-bankrupt FTX exchange put a spotlight on digital currencies as a potential avenue for business scams and financial crimes. If convicted of fraud, the 30-year-old former billionaire could face over a century in prison, joining a notorious group of white-collar criminals who have illegally enriched themselves at others’ expense.

24/7 Tempo compiled a list of the most infamous white-collar criminals of all time by consulting sites including King University, Investopedia, and Yahoo Finance. Our list was assembled based on the size and scope of the crime, and we used editorial discretion to make our final selections.

Some notable examples include Bernie Madoff, who died in jail in 2021 while serving 150 years for running an elaborate Ponzi scheme, and Nick Leeson, whose unauthorized trading caused the collapse of Britain’s oldest merchant bank in the 1990s. (Here’s a look at the worst corruption scandal in every state.)

Other notorious white-collar criminals include a preacher who defrauded his churchgoers, businessmen who took out millions in fraudulent loans before fleeing to Israel, and a hedge fund manager who swindled investors out of $450 million.

Click here to learn about the most infamous white collar criminals of all time

Massive corporate fraud also led to the downfall of companies like Enron and WorldCom. Wells Fargo is still dealing with the impacts of its fake accounts scandal. Most white-collar criminals on the list are still alive, either free or in prison. The only woman named is Martha Stewart, who served five months in 2005 for insider trading.

Charles Ponzi

> Crime: Defrauding investors out of about $20 million

> When the crime took place: 1919

The original “Ponzi scheme” involved luring investors with the promise of doubling their money within 90 days through the arbitrage of international reply coupons – vouchers accepted by multiple countries that can be converted into local postage stamps. Instead of trading IRCs, Ponzi used new investors to fund returns to older ones while seeking legitimate investments, like the purchase of a macaroni company, to keep the scam rolling. Ponzi’s scheme eventually cost investors $20 million, or a quarter of a billion dollars in current terms, and would have required 160 million IRCs when there were only 30,000 in circulation. Ponzi served 42 months in prison for the scam. After a second prison sentence, Ponzi was deported back to his home country of Italy where he died in poverty.

[in-text-ad]

Michael Milken

> Crime: Insider trading and stock manipulation

> When the crime took place: 1980s

Milken was the head of the high-yield bond department at Drexel Burnham Lambert, a New York-based global investment bank that went belly up in 1990 (thanks to Milken’s illegal shenanigans). High-yield bonds are also called “junk bonds” because they have a very high risk of default but pay higher yields in order to attract investors. Milken was outed by a colleague for his illegal transactions and was sentenced to 10 years in prison for securities fraud in 1989. He served about two years before being released, and in 2020 was pardoned by President Donald Trump at the urging of conservative media mogul Rupert Murdoch, current House Majority Leader Kevin McCarthy, and other high-profile conservatives.

Ivan Boesky

> Crime: Insider trading

> When the crime took place: Mid- 1980s

“Ivan the Terrible,” as he was known during the peak of his career, was one of the country’s wealthiest stock traders in the late ’70s – until his arrest in 1986 for insider trading, Boesky epitomized the free-wheeling “greed is good” excesses of Wall Street in the 1980s, and partially inspired the character of Gordon Gekko in the 1987 Oliver Stone film “Wall Street.” Boesky served two years in prison, paid a $100 million penalty to the Securities and Exchange Commission, and was banned from the financial services industry for his actions. His light sentence came after he agreed to help convict his associate, junk bond trader Michael Milken. Boesky is reportedly living a private life in California after winning $20 million in a divorce settlement.

Martin Frankel

> Crime: Stole retirement savings from investors, embezzled $200 million from insurance companies

> When the crime took place: 1980s-1990s

This discredited Toledo stockbroker moved to Connecticut in the 1990s to become a brazen swindler, stealing more than $200 million from a network of small Southern insurance companies to fund his extravagant lifestyle at his Greenwich estate. When the law began to catch up with him, Frankel lit his mansion on fire to destroy evidence and fled the country with $10 million worth of diamonds and two girlfriends on a chartered flight to Rome. Months later, in September 1999, he was apprehended in Hamburg, Germany, where he was jailed for passport fraud. He was then extradited to the U.S., where he was found guilty of embezzling money from 11 insurers he’d acquired through aliases and shell corporations. Frankel served more than 16 years in prison, but returned to custody twice for parole violations.

[in-text-ad-2]

Jordan Belfort

> Crime: Stock market manipulation and running of a long-term scam involving penny stocks

> When the crime took place: 1990s

Played by Leonardo DiCaprio in the 2013 Martin Scorsese film “The Wolf of Wall Street,” Jordan Belfort served 22 months in prison for a massive pump-and-dump scheme involving risky penny stocks and misleading statements used to lure unwitting investors to his Long Island brokerage firm Stratton Oakmont, which employed hundreds of traders until securities regulators shut it down in 1996. In 2003, Belfort was ordered to pay $110 million in restitution, but by 2018 he had only forked out about $13 million. Belfort’s net worth is a matter of speculation, but he makes significant money from his memoirs (including proceeds from the film adaptation of his first book) and motivational-speaking engagements.

Telemarketing fraudsters

> Crime: Hundreds of people defrauded out of life savings

> When the crime took place: 1991-1995

These days, many people are subjected to constant streams of fraudulent robocalls aimed at gathering enough details about individuals to commit identity theft and wire fraud. But the heyday of U.S. telemarketing scams took place in the 1990s, when scammers would use different methods to obtain bank information enabling them to steal the life savings of their targets – especially the elderly, perceived to be more gullible. The scams included posing as charity fundraisers; claiming the target had won a prize but needed to pay a fee; or even targeting previous fraud victims who were told they could recover their money, also for a fee. The FBI cracked down on these scams in the 1990s, including Operation Senior Sentinel, which led to about 1,200 arrests and hundreds of convictions.

[in-text-ad]

Richard Scrushy

> Crime: $4.6 billion in fraudulent accounting entries

> When the crime took place: 1992-2003

This well-known Alabama businessman and founder of Birmingham-based HealthSouth Corp. (now operating as Encompass Health Corp.) was put on trial in the early 2000s for conspiracy, securities fraud, wire fraud, and money laundering. Prosecutors said Scrushy directed underlings at the company to commit $2.7 billion worth of accounting fraud in financial reports from 1996 to 2002. Scrushy was acquitted of all charges in 2005 in an outlandish defense that convinced a jury. In 2007 he was convicted in another federal trial for bribery, conspiracy, and mail fraud, and was sentenced to nearly seven years in prison. In 2020, Scrushy’s high-profile case was featured in the Netflix documentary series “Trial by Media.”

Bernie Madoff

> Crime: Defrauding investors out of $65 billion

> When the crime took place: 1992-2008

The man behind the biggest financial fraud crime in U.S. history defrauded thousands of people and institutions out of billions of dollars over decades through his sham Wall Street firm Madoff Investment Securities. Madoff’s strategy was to exude an air of exclusivity to exploit the FOMO (fear of missing out) of his high-value targets, which included celebrities like Steven Spielberg and Larry King, as well as banks, colleges, churches, and charitable organizations. As early as 2003, a whistleblower exposed Madoff’s scheme but it wasn’t until the economic crash of 2009 that investigators began to look into his massive ruse. In 2021, Madoff died in prison while serving a 150-year sentence.

Nick Leeson

> Crime: Risky bets sank his company

> When the crime took place: 1995

In 1995, Japan’s Kobe earthquake illustrated how a natural disaster can destroy a bank when one of its derivatives traders goes rogue. In this case the bank was Barings, then the U.K.’s oldest merchant bank, and the trader was Nick Leeson, a rising young star derivatives trader at the bank’s Singapore-based futures operations. But his performance was a ruse. He hid his losses and kept doubling down to recover them, including a fateful bet on the performance of the NIKKEI stock market right before the earthquake sent markets plummeting. His losses had grown to $1.4 billion by the time he was caught, sending the 230-year-old bank into insolvency. After serving a six-and-a-half-year prison sentence, Leeson obtained a psychology degree, got married, and now spends his time on the speaking circuit.

[in-text-ad-2]

James McDermott Jr.

> Crime: Leaking secrets about five pending bank mergers to his mistress

> When the crime took place: 1999

In the 1990s, the CEO of Wall Street investment firm Keefe, Bruyette & Woods was earning millions of dollars a year and making regular appearances on cable news finance shows, dishing out sagely advice about the markets. But it all came tumbling down when McDermott was arrested in 1999 for providing insider information about bank mergers to his mistress, a Canadian adult movies actress with a lover of her own, who made $80,000 from the illegal trades. McDermott’s conviction was overturned on appeal but he chose to plead guilty to one count of insider trading instead of facing a new trial.

Sam Waksal

> Crime: Securities fraud, bank fraud, obstruction of justice, and perjury

> When the crime took place: 1999

The immunologist and founder of New York-based ImClone announced in 1999 the development of Erbitux, the brand name for cetuximab, a cancer-fighting drug. In 2001, when the drug failed to win FDA approval, the company’s stock plummeted. Waksal was arrested and charged with insider trading after he informed family and friends of the impending FDA decision that had yet to be made public. Waksal paid $4.3 million and served 87 months in prison before being released in February 2009. Among the people found to have benefitted from the insider trading was family friend Martha Stewart, who sold her ImClone shares days before the FDA announcement. (She was also jailed, though briefly; see below.) In 2021, the FDA approved Erbitux, which by then was owned by Eli Lilly, for the treatment of colon cancer.

[in-text-ad]

Barry Minkow

> Crime: Operating a Ponzi scheme and insider trading and fraud

> When the crime took place: 1990s and 2000s

Even before he became a crooked preacher, Minkow was conning investors through a carpet cleaning and restoration company that was a front for numerous criminal financial acts. Minkow and an associate had created a separate fake appraisal company to commit fraud through insurance claims adjustments. While serving a 25-year sentence beginning in 1989 for these offenses, Minkow earned a master’s degree in divinity from Virginia’s Liberty University. After his early release from prison in 1995, the newly minted minister began defrauding churchgoers and using his anti-fraud business to short stocks in companies he was investigating – for which he was sentenced to another five years in prison in 2014. Minkow later went on a reputation-rebuilding journey, in his case with the docuseries “King of the Con,” which premiered last year on Discovery+.

Kenneth Lay and Jeffrey Skilling

> Crime: Hiding true profit by taking advantage of lax accounting regulations, tax loopholes, and other practices

> When the crime took place: Late 1990s-early 2000s

The Houston-based energy and commodities firm Enron, one of the largest U.S. companies at the time, caused one of the most high-profile accounting scandals in U.S. history. At the center of one of the biggest frauds to occur during the irrational exuberance of the 90s dot-com era were company founder Kenneth Lay and C-suite executive Jeffrey Skilling. They and other top executives deceived regulators using fake holdings and illegal accounting practices to hide Enron’s mountain of debt and toxic assets from investors and creditors. In 2006, 64-year-old Lay died from a heart attack while vacationing in Aspen ahead of his sentencing. In 2019, Skilling was released early from a 24-year sentence and in 2021 established an energy trading company that has since become inactive.

John Rigas

> Crime: Personal misuse of corporate funds and hiding $2.3 billion in liabilities from investors

> When the crime took place: Late 1990s-early 2000s

Rigas grew a small stake in a small cable company into Adelphia Communications Corporation, which became one of the largest cable providers in the country, with 5.6 million subscribers in dozens of states. But the Rigas family company crashed in 2004, when Rigas and his son Timothy were convicted of securities and bank fraud designed to loot more than $3 billion from the company. John was released early in 2016 at the age of 91 after being diagnosed with cancer. He died in 2021. Timothy was released in 2019 after serving 12 years.

[in-text-ad-2]

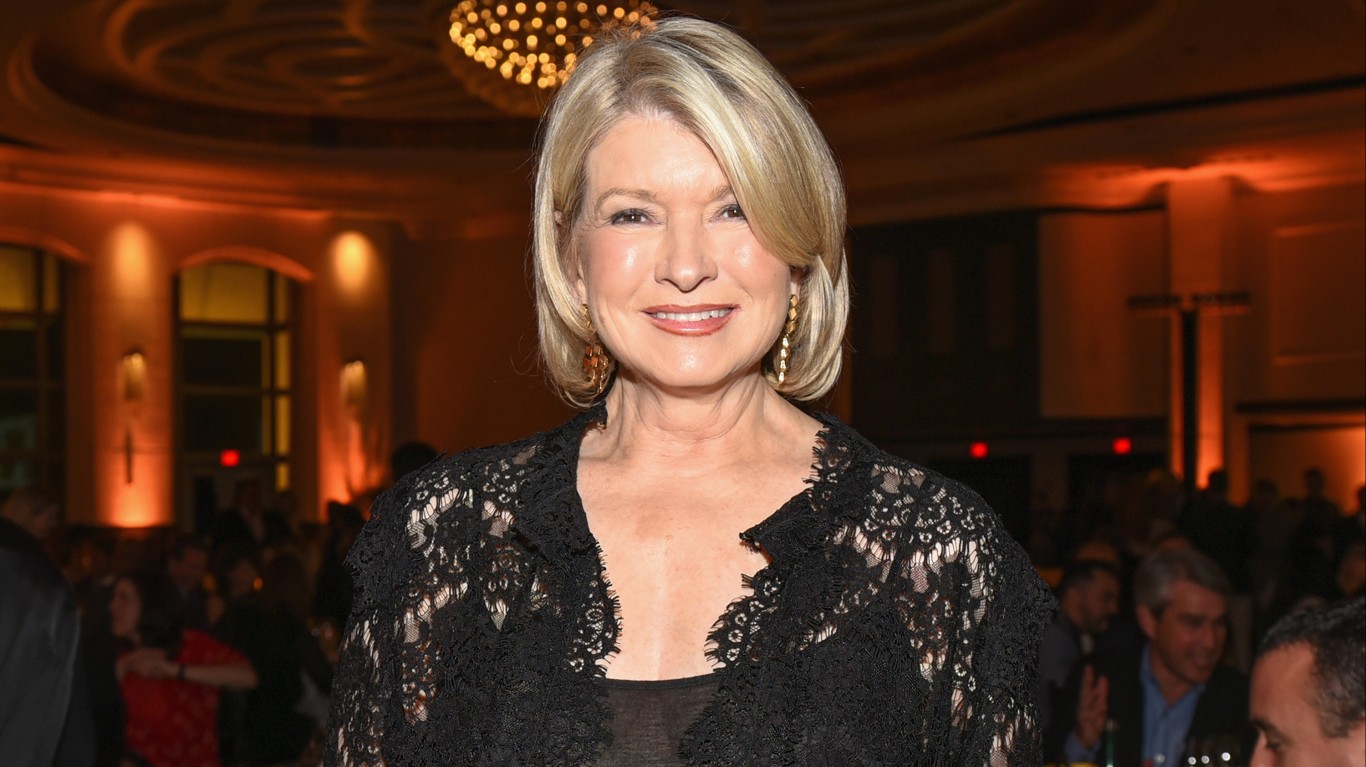

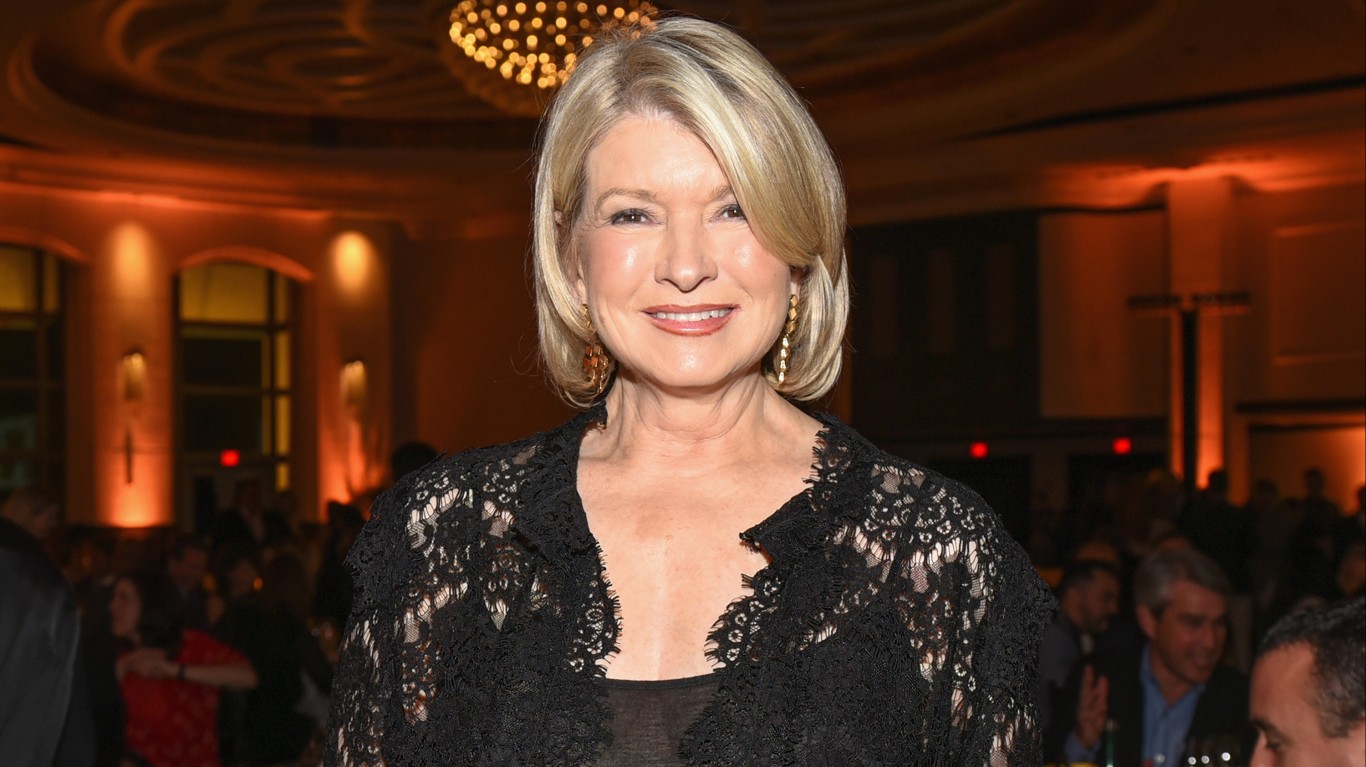

Martha Stewart

> Crime: Insider trading and obstruction of justice

> When the crime took place: Late 1990s-early 2000s

The homemaking entrepreneur and celebrity, and the only woman on this list, was convicted in March 2004 of obstructing justice, conspiracy, and lying to investigators regarding the sale of her stock in biotech firm ImClone days before a public announcement that a promising cancer drug had failed to receive FDA approval. She served five months in prison, though she maintains that she was unaware of the trade. ImClone was founded by friend Sam Waksal (see above), who served 87 months in prison for feeding insider information to family and friends ahead of the FDA announcement.

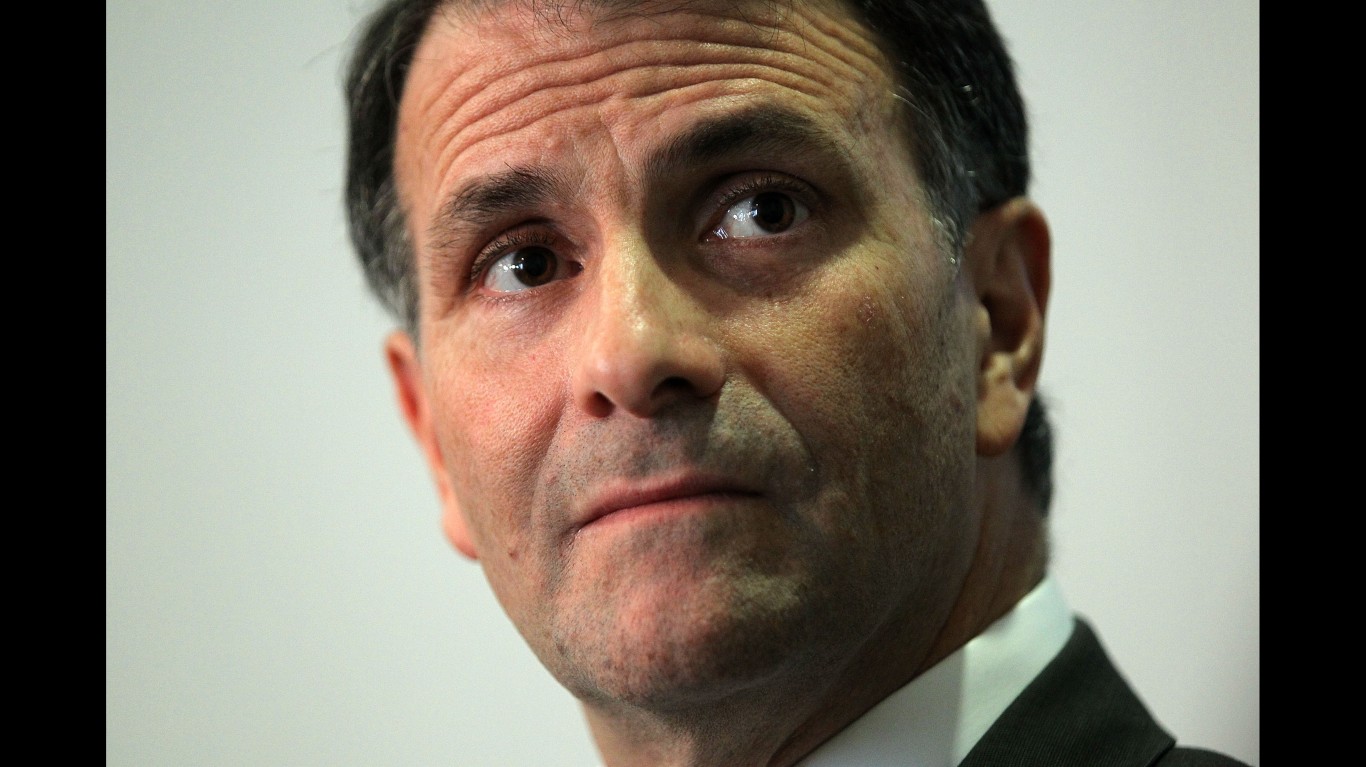

Joe Nacchio

> Crime: 19 counts of insider trading, illegally selling $52 million in stocks knowing the company was failing

> When the crime took place: 2001

The former CEO of Denver-based telecommunications company Qwest International was convicted in 2007 on numerous counts of insider trading. A trial court ruled that Nacchio illegally sold $52 million worth of company stock in 2001 as Qwest was struggling. The disgraced executive served nearly six years in prison. After his release he attempted to claim an $18 million tax refund on the $44 million he was ordered to pay in forfeiture for his crime. In 2017 the U.S. Supreme Court declined to hear Nacchio’s appeal of a lower court’s decision that he was not entitled to the refund. In 2011, Qwest completed its merger with CenturyLink and the company now does business under the name Lumen Technologies.

[in-text-ad]

Bernie Ebbers

> Crime: Fudging numbers and defrauding investors

> When the crime took place: 2002

The WorldCom accounting scandal came to light in 2002, just a year after the bankruptcy of Enron for a similar massive fraud. The founder and CEO of the second-largest long-distance telecommunications company at the time was found guilty of pressuring his subordinates to inflate the company’s value by $11 billion in order to entice investors and grow his own net worth. The Canadian businessman was sentenced to 25 years in prison in 2005. In 2020, Ebbers died at the age of 78 in Massachusetts from undisclosed severe medical problems a month after his compassionate release from a federal prison in Texas.

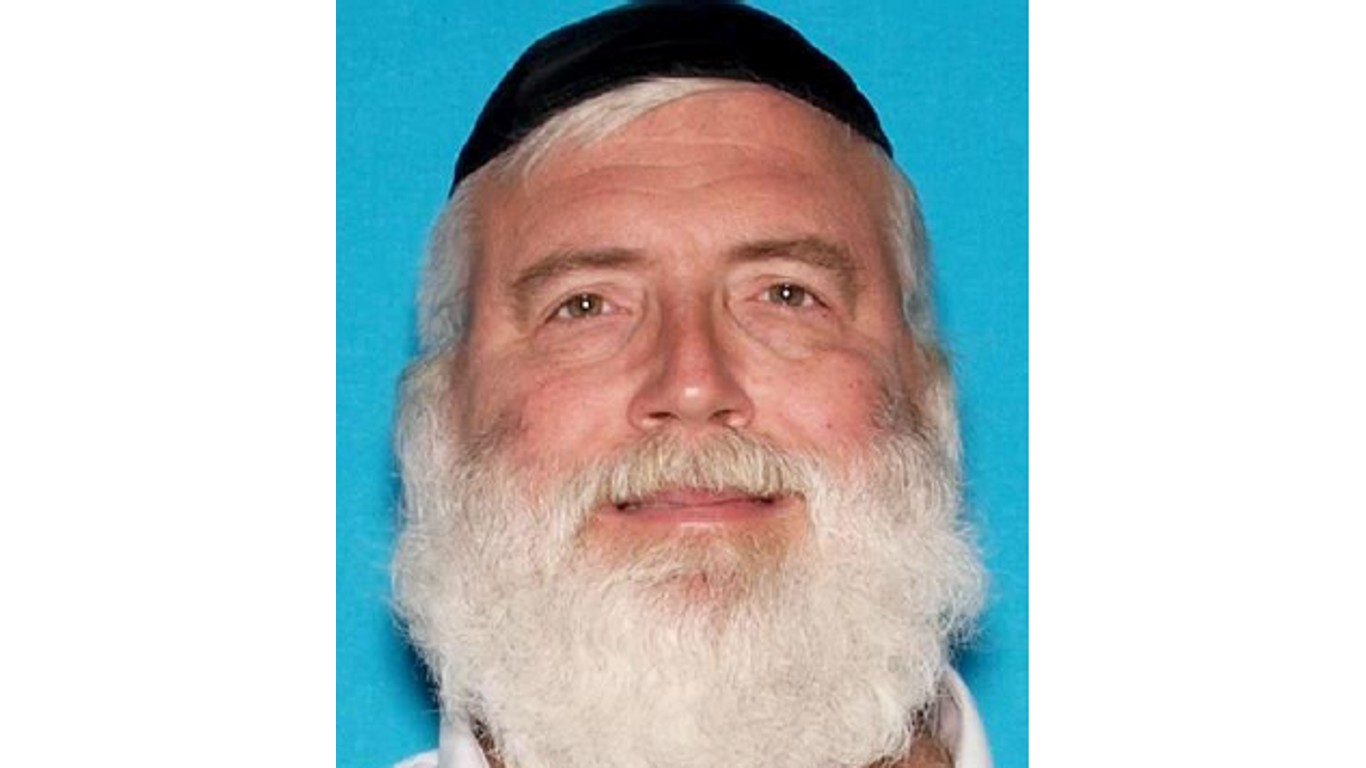

Aviv Mizrahi and Aryeh Greenes

> Crime: Defrauding banks out of $33 million

> When the crime took place: 2004-2008

Mizrahi owned several electronics wholesaling businesses and a retail store in California that he used to apply for bank loans using faked financial records that greatly exaggerated the value of his assets. The FBI estimates Mizrahi and an associate, Aryeh Greenes, defrauded the federally insured lenders of about $33 million from 2004 to 2008, and a warrant for their arrest was issued in 2012. While being investigated in 2009, Mizrahi fled to Israel, and Greenes followed his business partner there in 2012. The two men were arrested and extradited to the United States in 2021 to face trial.

Dennis Kozlowski and Mark Swartz

> Crime: Looting $600 million from the company

> When the crime took place: 2005

Kozlowski, the former CEO of security systems company Tyco International, and company CFO Mark Swartz, were found guilty and sentenced to prison in 2005 for paying themselves $150 million in illegal bonuses and defrauding investors. Kozlowski was known to have extremely ostentatious tastes, evidenced by goodies like a $6,000 shower curtain and a $15,000 umbrella holder in his $30 million New York City apartment. He also blew $2.1 million on a birthday party for his wife in Sardinia that featured an ice sculpture of Michelangelo’s David urinating vodka. Kozlowski served ten years in prison and was released on parole in 2014, the year after Swartz was also granted parole and released.

[in-text-ad-2]

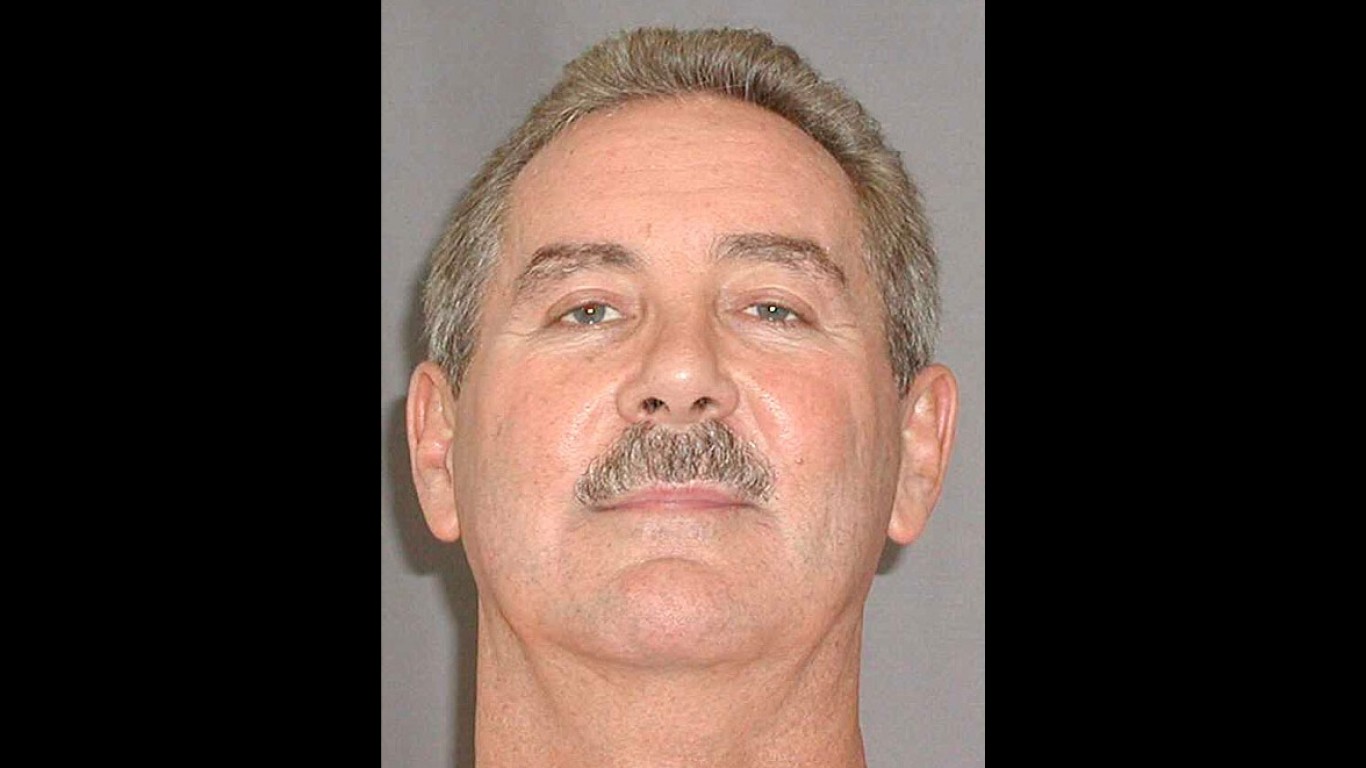

Sam Israel

> Crime: Defrauding investors of more than $450 million

> When the crime took place: 2008

In 2019, the Connecticut-based former hedge fund manager lost a bid for early compassionate release from prison based on his deteriorating health condition. Israel is currently serving a 22-year sentence for defrauding investors of more than $450 million from 1996 to 2005. Instead of reporting to prison in June 2008, Israel made a sloppy attempt to fake his suicide by parking his SUV on a bridge near New York City and leaving a message scrawled in dust on the hood of the vehicle that said “suicide is painless,” a reference to the title song in the 1970 Robert Altman film and the famous CBS television series “M*A*S*H.” Israel turned himself in at the urging of his mother and is serving time in the same prison that held another notorious Ponzi schemer, the late Bernie Madoff.

Allen Stanford

> Crime: His company was a Ponzi scheme

> When the crime took place: 2009

The financier and professional sports sponsor was busted in 2009 for running a massive Ponzi scheme posing as his Stanford Financial Group of companies. Stanford was convicted for misleading about 50,000 investors and selling $7 billion worth of fake certificates of deposit through his Antigua-based offshore bank, which at one point was the largest employer on the island. Stanford’s massive fraud earned him 110 years in prison, an unusually long sentence by the standards of punishment usually meted out to U.S. white-collar criminals. Stanford, 72, is serving his time at a federal penitentiary in Coleman, Florida.

[in-text-ad]

Wells Fargo bank

> Crime: Employees created million of unauthorized bank and credit card accounts

> When the crime took place: 2011-2016

The fourth-largest U.S. bank by assets was caught creating at least 3.5 million accounts without customers’ consent in a massive cross-selling scheme blamed on the company’s ruthless corporate culture. Company employees faced intense pressure from their managers to meet high sales quotas for lines of credit and savings accounts, which are more profitable to banks than checking accounts. In desperate bids to meet unachievable goals and earn bonuses, sales people opened fake accounts in the name of real customers. In 2020, the bank agreed to pay $3 billion to resolve its criminal and civil liabilities and in 2022 said it was still working to comply with a raft of government consent orders to clean up its act.

Jérôme Kerviel

> Crime: Made trades not approved by his employer

> When the crime took place: 2012

The former rogue trader of Société Générale, France’s third-largest bank, was sentenced in 2012 to three years in prison for initiating unauthorized trades that cost his employer billions of dollars in early 2008 shortly after the start of the 2007-2008 global financial crisis. His crime included hacking into the bank’s computer systems, fabricating positions, and executing about 1,000 illegal trades using about $1.4 billion worth of bank assets. By the time Kerviel was arrested, he had cost the bank more than $7 billion. Kerviel’s actions helped to expose the weak risk management in the global banking system that perpetuated the worldwide economic crash.

Samuel Bankman-Fried

> Crime: Looting billions of dollars from the now-bankrupt FTX exchange

> When the crime took place: 2019-2022

If there’s one person responsible for exposing the problems with a loosely regulated, decentralized form of stored value it’s the 30-year-old founder of failed cryptocurrency exchange FTX. The MIT alum was arrested in the Bahamas in December 2022 after he was indicted on numerous federal charges for diverting customers’ funds from FTX to his crypto-trading hedge fund Alameda Research. FTX, which was one of the most well-respected cryptocurrencies on the market, faced a liquidity crunch and fell into bankruptcy, cutting off at least a million depositors from their accounts. Cryptocurrency detractors point to the fact that the digital currency is subjected to wild swings in value, making it an unreliable form of payment for most transactions.

[in-text-ad-2]

Jack Abramoff

> Crime: Overbilling Native American casino owners

> When the crime took place: Early 2000s

The ignominious lobbyist and symbol of sketchy Washington influence-peddling was sent back to prison in 2020, becoming the first person charged under the Lobbying Disclosure Act after it was amended in 2007 in response to Abramoff’s previous lobbying activities. This time, he pled guilty to criminal conspiracy to commit wire fraud for hiding his work on behalf of cryptocurrency and cannabis-related interests without registering as a lobbyist. Previously, the disgraced insider had served nearly four years for bilking Native American tribes out of tens of millions of dollars in their effort to develop casinos on their reservations. Some of the money was used to purchase favors from federal lawmakers.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.