Gold prices jumped 13% in 2023 (spot gold price) — their first time closing higher on the year since 2020. What’s more, gold prices are expected to continue to rise in 2024, according to Reuters. Often considered a hedge against inflation and market turmoil, gold is also an important component of countries’ reserves. (See female trailblazers on global currency.)

Central banks hold gold in their reserves “because of its safety, liquidity and return characteristics — the three key investment objectives for central banks,” according to the World Gold Council. Holding gold allows central banks to trade it, diversify their holdings, and to use it as collateral, among other uses. Of course, not all countries have gold in their reserves.

To determine the countries that own the world’s gold, 24/7 Wall St. reviewed data on gold reserves from the World Gold Council. Countries were ranked based on their total gold reserves as of October 2023 (or the most recent date available). The WGC calculates the value of gold reserves using the LBMA (London Bullion Market Association) Gold Price, which for October 2023 the end of month price was $1,996.9 per oz. Gross domestic product and population data are from the World Bank except for Taiwan, where data is from the International Monetary Fund.

The United States owns, by far, the most gold reserves, at 8,133.5 metric tons, or 25.49% of the world total. With a GDP of over $25 trillion — accounting for over 25% of world GDP — the U.S. is the world’s leading economic power, and its significant gold reserves are therefore not surprising. Also holding significant gold reserves are Germany, Italy, and France, with Russia closing out the top five. (Also see: these countries are buying up the world’s gold.)

China follows immediately, holding the sixth most gold reserves, while India owns the ninth most gold reserves. Among the top 20 countries that have the most gold are several European countries, but also such countries such as Lebanon, Kazakhstan, Saudi Arabia, and Uzbekistan. The International Monetary Fund, which is not included in the countries’ ranking, holds 2,814 metric tons.

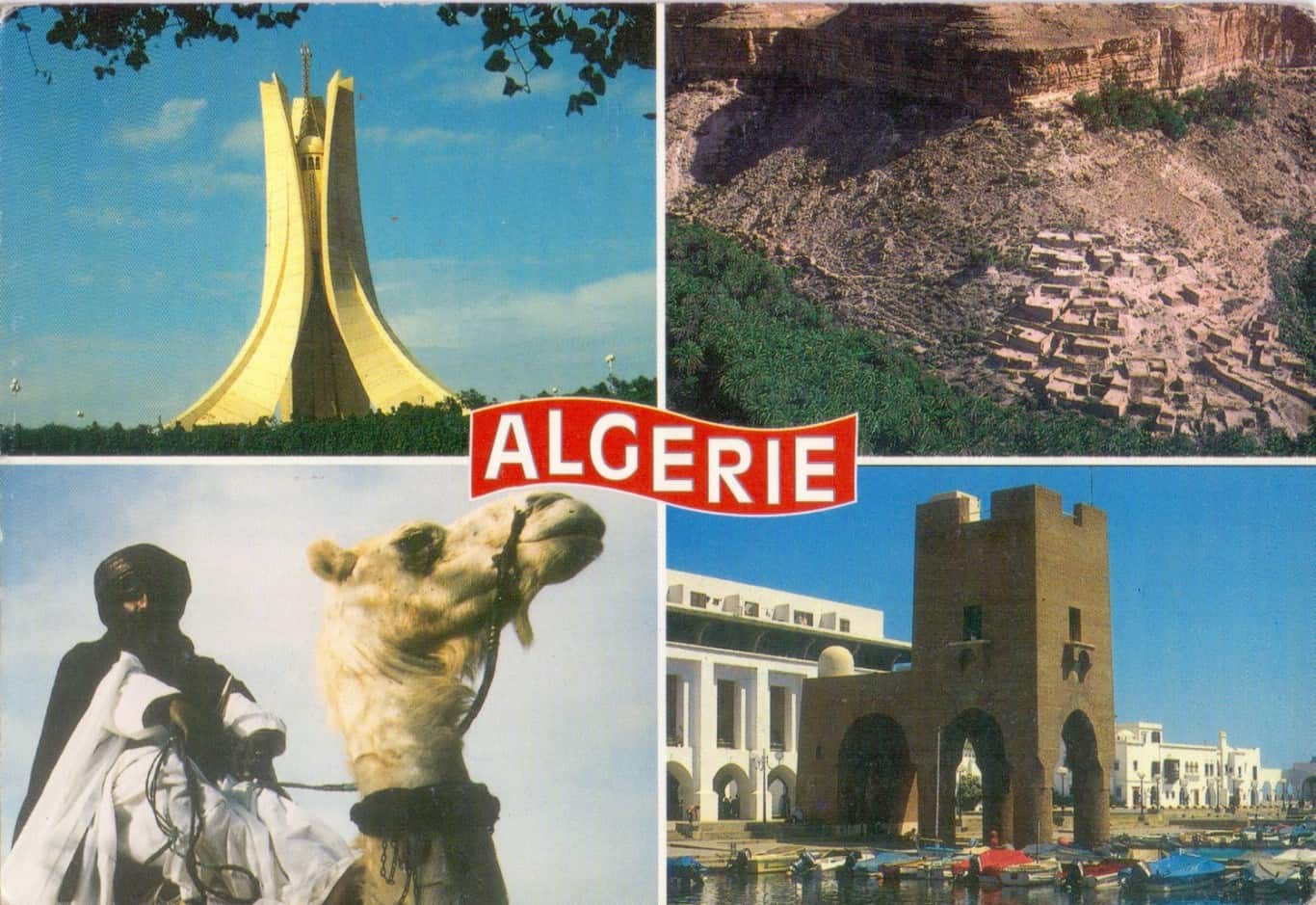

25. Algeria

- Gold reserves as of Oct 2023: 173.6 metric tons (0.54% of world total)

- Value of gold reserves: $10.4 billion

- GDP, 2022: $195.0 billion

- Population, 2022: 44,903,225

- Region: Middle East & North Africa

24. Belgium

- Gold reserves as of Oct 2023: 227.4 metric tons (0.71% of world total)

- Value of gold reserves: $13.7 billion

- GDP, 2022: $583.4 billion

- Population, 2022: 11,685,814

- Region: Western Europe

23. Singapore

- Gold reserves as of Oct 2023: 230.3 metric tons (0.72% of world total)

- Value of gold reserves: $13.8 billion

- GDP, 2022: $466.8 billion

- Population, 2022: 5,637,022

- Region: South East Asia

22. Thailand

- Gold reserves as of Jan 2023: 244.2 metric tons (0.77% of world total)

- Value of gold reserves: $14.2 billion

- GDP, 2022: $495.4 billion

- Population, 2022: 71,697,030

- Region: South East Asia

21. Austria

- Gold reserves as of Oct 2023: 280.0 metric tons (0.88% of world total)

- Value of gold reserves: $16.8 billion

- GDP, 2022: $470.9 billion

- Population, 2022: 9,041,851

- Region: Western Europe

20. Spain

- Gold reserves as of Oct 2023: 281.6 metric tons (0.88% of world total)

- Value of gold reserves: $16.9 billion

- GDP, 2022: $1,417.8 billion

- Population, 2022: 47,778,340

- Region: Western Europe

19. Lebanon

- Gold reserves as of Jul 2023: 286.8 metric tons (0.90% of world total)

- Value of gold reserves: $17.2 billion

- GDP, 2021: $23.1 billion

- Population, 2022: 5,489,739

- Region: Middle East & North Africa

18. Kazakhstan

- Gold reserves as of Oct 2023: 309.4 metric tons (0.97% of world total)

- Value of gold reserves: $18.6 billion

- GDP, 2022: $225.5 billion

- Population, 2022: 19,621,972

- Region: Central Asia

17. United Kingdom

- Gold reserves as of Oct 2023: 310.3 metric tons (0.97% of world total)

- Value of gold reserves: $18.7 billion

- GDP, 2022: $3,089.1 billion

- Population, 2022: 66,971,395

- Region: Western Europe

16. Saudi Arabia

- Gold reserves as of Aug 2023: 323.1 metric tons (1.01% of world total)

- Value of gold reserves: $19.9 billion

- GDP, 2022: $1,108.6 billion

- Population, 2022: 36,408,820

- Region: Middle East & North Africa

15. Poland

- Gold reserves as of Oct 2023: 333.7 metric tons (1.05% of world total)

- Value of gold reserves: $20.1 billion

- GDP, 2022: $688.1 billion

- Population, 2022: 36,821,749

- Region: Central and Eastern Europe

14. Portugal

- Gold reserves as of Oct 2023: 382.6 metric tons (1.20% of world total)

- Value of gold reserves: $23.0 billion

- GDP, 2022: $255.2 billion

- Population, 2022: 10,409,704

- Region: Western Europe

13. Uzbekistan

- Gold reserves as of Oct 2023: 383.8 metric tons (1.20% of world total)

- Value of gold reserves: $23.1 billion

- GDP, 2022: $80.4 billion

- Population, 2022: 35,648,100

- Region: Central Asia

12. Taiwan (POC)

- Gold reserves as of Sep 2023: 423.6 metric tons (1.33% of world total)

- Value of gold reserves: $25.5 billion

- GDP, 2022: $751.9 billion

- Population, 2022: 23,250,000

- Region: East Asia

11. Turkiye

- Gold reserves as of Nov 2022: 479.0 metric tons (1.50% of world total)

- Value of gold reserves: $28.8 billion

- GDP, 2022: $907.1 billion

- Population, 2022: 84,979,913

- Region: Central and Eastern Europe

10. Netherlands

- Gold reserves as of Oct 2023: 612.5 metric tons (1.92% of world total)

- Value of gold reserves: $36.8 billion

- GDP, 2022: $1,009.4 billion

- Population, 2022: 17,700,982

- Region: Western Europe

9. India

- Gold reserves as of Oct 2023: 800.8 metric tons (2.51% of world total)

- Value of gold reserves: $48.2 billion

- GDP, 2022: $3,416.6 billion

- Population, 2022: 1,417,173,173

- Region: South Asia

8. Japan

- Gold reserves as of Oct 2023: 846.0 metric tons (2.65% of world total)

- Value of gold reserves: $50.9 billion

- GDP, 2022: $4,232.2 billion

- Population, 2022: 125,124,989

- Region: East Asia

7. Switzerland

- Gold reserves as of Sep 2023: 1,040.0 metric tons (3.26% of world total)

- Value of gold reserves: $62.5 billion

- GDP, 2022: $818.4 billion

- Population, 2022: 8,775,760

- Region: Western Europe

6. China

- Gold reserves as of Oct 2023: 2,191.5 metric tons (6.12% of world total)

- Value of gold reserves: $131.8 billion

- GDP, 2022: $17,963.2 billion

- Population, 2022: 1,412,175,000

- Region: East Asia

5. Russian Federation

- Gold reserves as of Oct 2023: 2,332.7 metric tons (7.31% of world total)

- Value of gold reserves: $140.3 billion

- GDP, 2022: $2,240.4 billion

- Population, 2022: 144,236,933

- Region: Central and Eastern Europe

4. France

- Gold reserves as of Oct 2023: 2,436.9 metric tons (7.64% of world total)

- Value of gold reserves: $146.6 billion

- GDP, 2022: $2,779.1 billion

- Population, 2022: 67,971,311

- Region: Western Europe

3. Italy

- Gold reserves as of Oct 2023: 2,451.8 metric tons (7.68% of world total)

- Value of gold reserves: $147.4 billion

- GDP, 2022: $2,049.7 billion

- Population, 2022: 58,940,425

- Region: Western Europe

2. Germany

- Gold reserves as of Oct 2023: 3,352.7 metric tons (10.51% of world total)

- Value of gold reserves: $201.6 billion

- GDP, 2022: $4,082.5 billion

- Population, 2022: 83,797,985

- Region: Western Europe

1. United States of America

- Gold reserves as of Oct 2023: 8,133.5 metric tons (25.49% of world total)

- Value of gold reserves: $489.1 billion

- GDP, 2022: $25,439.7 billion

- Population, 2022: 333,287,557

- Region: North America

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.