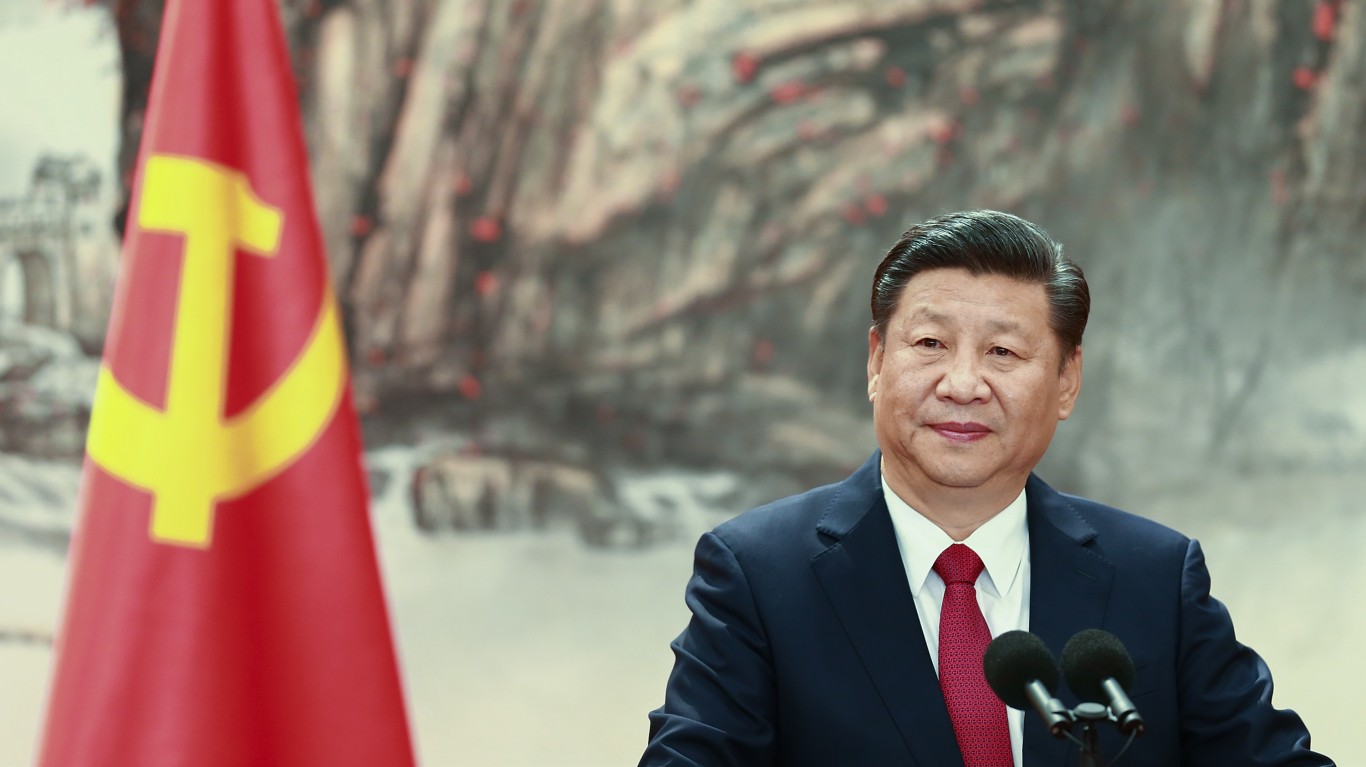

The rise of China has been one of the most consequential macroeconomic trends of the last half century. China’s economy — now the second largest in the world — expanded at an average annual rate of 11.1% between 1980 and 2022, more than double the 5.2% global average. Domestically, China’s ascent has lifted millions out of poverty and dramatically improved living standards. But internationally, China’s growing economic influence is fueling an ambitious foreign policy agenda that has already reshaped the geopolitical landscape.

China has poured over a trillion dollars into infrastructure and development projects across Africa, Asia, Europe, Latin America, and Oceania in recent decades. Much of this spending has fallen under President Xi Jinping’s Belt and Road Initiative, a long-term investment strategy aimed at increasing the country’s international trade, maintaining strong GDP growth, and strengthening its global sway. (Here is how U.S.-China trade wars threaten national security.)

Under the BRI, China has built railways, roads, energy pipelines, ports, airports, hospitals, and schools across more than 140 countries. It is also extracting valuable resources, including rare earth elements like cobalt, copper, and lithium — essential for producing electronics and renewable energy technology — from land holdings in Africa.

Using data from AidData, a research lab at the College of William & Mary, 24/7 Wall St. identified the countries China is investing in the most. Countries were ranked based on the inflation-adjusted value of all development projects funded, often through loans, by the Chinese government and state-owned institutions from 2000 to 2017.

Among the countries on this list, China has spent anywhere from $5.0 billion and $125 billion since 2000. In the majority of these places, projects related to energy and industrial mining and construction have drawn the largest share of Chinese investment capital. Most of these countries are in Africa and Asia.

Over half of the countries ostensibly benefitting from the BRI are considered to be financially distressed and will likely have difficulty repaying their loans. Historically, China has rarely canceled debt, and some experts suspect that China may be pushing its borrowers into debt traps, which could be used for political leverage in the coming years.

Some analysts have described this potential outcome as a new form of colonialism. (Here is a look at the most corrupt countries in the world.)

40. Ghana

- Total Chinese investment since 2000: $5.0 billion

- Chinese investment per capita: $203.99 per resident

- Primary field of investment: Energy (52.2% of spending)

- Largest project: China Development Bank provides $850 million loan for Western Corridor Gas Infrastructure Development Project (2012)

39. Mozambique

- Total Chinese investment since 2000: $5.1 billion

- Chinese investment per capita: $224.61 per resident

- Primary field of investment: Transport And Storage (38.1% of spending)

- Largest project: China Eximbank provided Mozambique $681.6 million buyer’s credit loan for Maputo-Katembe Bridge Construction Project (2012)

38. Oman

- Total Chinese investment since 2000: $5.4 billion

- Chinese investment per capita: $1,749.69 per resident

- Primary field of investment: General Budget Support (84.6% of spending)

- Largest project: CDB, BoC, ICBC, and Bank of Communications contribute $3.2 billion to syndicated bullet loan to address Oman’s fiscal deficit (2017)

37. Equatorial Guinea

- Total Chinese investment since 2000: $5.4 billion

- Chinese investment per capita: $5,209.13 per resident

- Primary field of investment: Industry, Mining, Construction (9.4% of spending)

- Largest project: China Eximbank provides $2 billion oil-backed buyer’s credit loan facility for infrastructure projects (2006)

36. Cameroon

- Total Chinese investment since 2000: $5.8 billion

- Chinese investment per capita: $300.34 per resident

- Primary field of investment: Transport And Storage (34.3% of spending)

- Largest project: China Eximbank provides $678.3 million buyer’s credit loan for Project to Supply Potable Water to Yaoundé and its Outskirts from the River Sanaga (2015)

35. Papua New Guinea

- Total Chinese investment since 2000: $6.1 billion

- Chinese investment per capita: $838.33 per resident

- Primary field of investment: Industry, Mining, Construction (54.2% of spending)

- Largest project: China Eximbank provides $1.3 billion loan for PNG Liquefied Natural Gas (2009)

34. Congo

- Total Chinese investment since 2000: $6.6 billion

- Chinese investment per capita: $1,575.94 per resident

- Primary field of investment: Transport And Storage (42.5% of spending)

- Largest project: CMEC provides $551.5 million supplier’s credit for Power Transmission Network Associated with the Imboulou Hydropower Plant Project (2005)

33. Cuba

- Total Chinese investment since 2000: $6.7 billion

- Chinese investment per capita: $596.05 per resident

- Primary field of investment: Action Relating To Debt (43.2% of spending)

- Largest project: Chinese Government provides $2.83 billion of debt forgiveness (2016)

32. Turkey

- Total Chinese investment since 2000: $6.8 billion

- Chinese investment per capita: $94.19 per resident

- Primary field of investment: Communications (27.2% of spending)

- Largest project: China Eximbank provides $720 million of debt financing for Phase II of the Ankara-Istanbul High Speed Rail Project (2007)

31. India

- Total Chinese investment since 2000: $7.2 billion

- Chinese investment per capita: $05.91 per resident

- Primary field of investment: Communications (54.8% of spending)

- Largest project: CDB provides $1.33 billion loan to Reliance Communications (2011)

30. Democratic People’s Republic of Korea

- Total Chinese investment since 2000: $7.2 billion

- Chinese investment per capita: $287.98 per resident

- Primary field of investment: Energy (77.3% of spending)

- Largest project: Chinese Government donates 500,000 tons of crude oil in 2008 (2008)

29. Nigeria

- Total Chinese investment since 2000: $7.5 billion

- Chinese investment per capita: $47.91 per resident

- Primary field of investment: Transport And Storage (44.5% of spending)

- Largest project: China Eximbank provides $1.267 billion preferential buyer’s credit for Phase 2 (2017)

28. Uzbekistan

- Total Chinese investment since 2000: $7.8 billion

- Chinese investment per capita: $277.39 per resident

- Primary field of investment: Industry, Mining, Construction (44.2% of spending)

- Largest project: China Development Bank provides a $1.2 billion USD loan to Uzbekneftegaz for the Oltin Yo’l gas-to-liquid (2017)

27. Democratic Republic of the Congo

- Total Chinese investment since 2000: $7.9 billion

- Chinese investment per capita: $122.00 per resident

- Primary field of investment: Industry, Mining, Construction (50.5% of spending)

- Largest project: China Eximbank provides $2.0299 billion loan for Phase 1 and Phase 2 of Sicomines Copper and Cobalt Mining Project (2008)

26. Iraq

- Total Chinese investment since 2000: $8.2 billion

- Chinese investment per capita: $260.71 per resident

- Primary field of investment: Action Relating To Debt (99.3% of spending)

- Largest project: Chinese Government cancels $6.7 billion USD of the Government of Iraq’s outstanding debt obligations (2010)

25. Belarus

- Total Chinese investment since 2000: $8.3 billion

- Chinese investment per capita: $859.52 per resident

- Primary field of investment: Industry, Mining, Construction (45.0% of spending)

- Largest project: China Development Bank provides $1.4 billion buyer’s credit loan for Slavkaliy Potash Mine and Processing Plant Construction Project (2016)

24. Zambia

- Total Chinese investment since 2000: $8.6 billion

- Chinese investment per capita: $650.28 per resident

- Primary field of investment: Energy (34.5% of spending)

- Largest project: China Eximbank and ICBC provide $1.53 billion USD syndicated loan for 750MW Kafue Gorge Lower Hydro Power Plant Construction Project (2017)

23. Argentina

- Total Chinese investment since 2000: $8.8 billion

- Chinese investment per capita: $216.43 per resident

- Primary field of investment: Energy (65.3% of spending)

- Largest project: China Development Bank contributes $2.49 billion to $4.71 billion syndicated loan for Nestor Kichner and Jorge Cepernic Hydroelectric Dam Construction Project (2014)

22. Turkmenistan

- Total Chinese investment since 2000: $9.0 billion

- Chinese investment per capita: $1,723.52 per resident

- Primary field of investment: Industry, Mining, Construction (93.9% of spending)

- Largest project: China Development Bank provides $4.1 billion loan Galkynysh Gas Field Phase II Project (2013)

21. Myanmar

- Total Chinese investment since 2000: $9.7 billion

- Chinese investment per capita: $198.68 per resident

- Primary field of investment: Industry, Mining, Construction (53.7% of spending)

- Largest project: CDB lends $1.04 billion for Phases 2, 2A, and 3 of the Myingyan No. 1 Steel Mill Construction Project (2010)

20. Bangladesh

- Total Chinese investment since 2000: $9.8 billion

- Chinese investment per capita: $67.23 per resident

- Primary field of investment: Energy (56.3% of spending)

- Largest project: China Eximbank provides $1.984 billion loan for First Phase of 1320MW Payra Coal-Fired Thermal Power Plant Project (2016)

19. Cambodia

- Total Chinese investment since 2000: $10.0 billion

- Chinese investment per capita: $716.40 per resident

- Primary field of investment: Transport And Storage (32.7% of spending)

- Largest project: CDB, ICBC, and Bank of China provides $781 million debt financing package or 400MW Lower Sesan II Hydropower Plant Project (2013)

18. Kenya

- Total Chinese investment since 2000: $10.0 billion

- Chinese investment per capita: $252.30 per resident

- Primary field of investment: Transport And Storage (61.6% of spending)

- Largest project: China Eximbank provides $2.003 billion buyer’s credit loan for Phase 1 of Standard Gauge Railway Project (2014)

17. Malaysia

- Total Chinese investment since 2000: $10.1 billion

- Chinese investment per capita: $362.96 per resident

- Primary field of investment: Transport And Storage (52.7% of spending)

- Largest project: China Eximbank provides RM 39.1 billion preferential buyer’s credit for Phase 1 of East Coast Rail Link (2016)

16. Peru

- Total Chinese investment since 2000: $10.7 billion

- Chinese investment per capita: $368.52 per resident

- Primary field of investment: Industry, Mining, Construction (93.5% of spending)

- Largest project: CDB, China Eximbank, ICBC, and Bank of China provide $5.988 billion syndicated loan to repay debts and meet capital requirements of Las Bambas Copper Project (2014)

15. South Africa

- Total Chinese investment since 2000: $10.7 billion

- Chinese investment per capita: $209.15 per resident

- Primary field of investment: Energy (38.0% of spending)

- Largest project: Huarong Energy Africa provides $2 billion loan to Eskom for power plant upgrades (2017)

14. Sri Lanka

- Total Chinese investment since 2000: $12.2 billion

- Chinese investment per capita: $602.20 per resident

- Primary field of investment: Transport And Storage (59.1% of spending)

- Largest project: China Eximbank provides $891 million preferential buyer’s credit for Phase II of the Puttalam/Norochcholai Coal Power Project (2009)

13. Sudan

- Total Chinese investment since 2000: $13.3 billion

- Chinese investment per capita: $407.77 per resident

- Primary field of investment: Energy (36.6% of spending)

- Largest project: China Eximbank provides $1.098 billion USD buyer’s credit loan for Khartoum-Port Sudan Railway Construction Project (2007)

12. Lao People’s Democratic Republic

- Total Chinese investment since 2000: $14.5 billion

- Chinese investment per capita: $2,343.49 per resident

- Primary field of investment: Energy (54.6% of spending)

- Largest project: China Eximbank provides $3.54 billion of debt financing for China-Laos Railway Project (2016)

11. Ethiopia

- Total Chinese investment since 2000: $16.0 billion

- Chinese investment per capita: $184.74 per resident

- Primary field of investment: Transport And Storage (30.2% of spending)

- Largest project: CDB provides $1.5 billion seller’s credit to ZTE for on-lending to Ethiopian Telecommunications Corporation as supplier credit for first three phases of telecommunications infrastructure project (2007)

10. Ecuador

- Total Chinese investment since 2000: $16.9 billion

- Chinese investment per capita: $1,158.16 per resident

- Primary field of investment: Energy (30.2% of spending)

- Largest project: China Eximbank provides $1.68 billion buyer’s credit loan for Coca Codo Sinclair Hydroelectric Facility Project (2010)

9. Iran

- Total Chinese investment since 2000: $17.1 billion

- Chinese investment per capita: $230.46 per resident

- Primary field of investment: Transport And Storage (36.2% of spending)

- Largest project: China Eximbank provides $1.818 billion loan for Phase 2 of Abadan Refinery Upgrade Project (2017)

8. Viet Nam

- Total Chinese investment since 2000: $18.5 billion

- Chinese investment per capita: $214.01 per resident

- Primary field of investment: Energy (81.5% of spending)

- Largest project: CDB, CCB, ICBC, BoC, and BoComm provide $2 billion syndicated buyer’s credit loan for 1980MW Vinh Tan 3 Coal-Fired Power Plant Construction Project (2016)

7. Pakistan

- Total Chinese investment since 2000: $34.6 billion

- Chinese investment per capita: $184.81 per resident

- Primary field of investment: Energy (57.5% of spending)

- Largest project: China Eximbank provides $4.001 billion preferential buyer’s credit for Units 2 and 3 of the Karachi Nuclear Power Plant (2014)

6. Indonesia

- Total Chinese investment since 2000: $34.9 billion

- Chinese investment per capita: $145.75 per resident

- Primary field of investment: Energy (43.7% of spending)

- Largest project: CDB provides $2.3805 billion loan tranche for the Jakarta-Bandung High Speed Rail Project (2017)

5. Brazil

- Total Chinese investment since 2000: $41.5 billion

- Chinese investment per capita: $214.66 per resident

- Primary field of investment: Industry, Mining, Construction (53.2% of spending)

- Largest project: China Development Bank provides $10 billion line of credit for oil exploration in the Santos Basin (2009)

4. Kazakhstan

- Total Chinese investment since 2000: $42.3 billion

- Chinese investment per capita: $2,629.68 per resident

- Primary field of investment: Industry, Mining, Construction (69.6% of spending)

- Largest project: CDB and Bank of China provide a $7.5 billion USD syndicated loan for the Kazakhstani Section of Line A and B of the Turkmenistan-China Gas Pipeline (2008)

3. Angola

- Total Chinese investment since 2000: $52.7 billion

- Chinese investment per capita: $2,337.61 per resident

- Primary field of investment: Energy (40.5% of spending)

- Largest project: CDB provides $10 billion to Government of Angola to recapitalize Sonangol and prepay outstanding debts (2016)

2. Venezuela

- Total Chinese investment since 2000: $91.1 billion

- Chinese investment per capita: $3,256.99 per resident

- Primary field of investment: Industry, Mining, Construction (17.7% of spending)

- Largest project: China-Venezuela Joint Fund 20.3 Billion Long-Term Facility – 70 Billion RMB CDB Loan (2010)

1. Russia

- Total Chinese investment since 2000: $125.4 billion

- Chinese investment per capita: $871.08 per resident

- Primary field of investment: Industry, Mining, Construction (79.2% of spending)

- Largest project: CNPC disburses $33 billion loan — via oil prepayment facility — to Rosneft for unspecified purposes (2013)

Methodology

To determine the countries China is investing in the most, 24/7 Wall St. reviewed data on development projects financed by China in foreign countries from AidData, a research lab at the College of William & Mary. Countries were ranked based on the total, inflation-adjusted value of development projects funded by the Chinese government and state-owned institutions from 2000 to 2017.

Financial values were converted from original currencies to constant 2017 U.S. dollars and aggregated according to AidData recommendations. Supplemental data on primary investment sector and the largest project by amount invested were calculated from the AidData dataset. Investment per capita was calculated using population averages from 2000 to 2017 from the World Bank.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.