Special Report

12 Companies That Had Their IPO in 1993: Best and Worst Performers

Published:

It’s been more than 30 years now since these initial public offerings hit the market.

Some have flourished enough to go on and become well-known name brands and some have disappeared from public view and no longer trade.

Here are 1993 IPOs that have performed the best since that year and a few that have performed the worst.

In what was the largest initial public offering of its time, Allstate came into creation as an equity when Sears spun it off 80% of ownership in 1993. The insurance unit had been in the business since 1931 with an “auto insurance by direct mail” concept that caught on.

Sears sold off its remaining 20% stake and Allstate became a completely independent firm. The current market capitalization for the New York Stock Exchange-traded company sits at $41.095 billion.

Allstate’s earnings this year are off by 13.86% but analysts are expecting growth next year of 1,169%. Investors receive a dividend of 2.30%.

Founded in 1981, Camden Property Trust is a real estate investment trust, went public in 1993 and traded on the New York Stock Exchange. The company’s current portfolio consists of 240,000 square feet of retail and office space, mostly in the South and Southeast United States. The Houston, Texas -based REIT now has a market capitalization of $10.14 billion and pays a 3.87% dividend.

Camden’s earnings this year are down by 64% but the record over the past 5 years shows earnings growth of 23.17%. The REIT pays a 3.85% dividend.

The footwear and accessories company is headquartered in Goleta, California, operates retail outlets globally and maintains a big online presence as well.

Deckers was founded in 1973 making simple flip-flops designed to reflect Southern California’s surf culture — and the idea took off. The shoe wear firm then expanded its product offerings far beyond just flip flips.

The company’s market cap comes to $19.70 billion now and shares are traded on the New York Stock Exchange.

Earnings this year are up by 24.83% and for the past 5 years by 40.16%. The debt-to-equity ratio is a relatively low .14.

Equity Residential is a Sam Zell-founded real estate investment trust with corporate headquarters in Chicago. Zell was well-known in the Windy City for his ability to purchase distressed assets and make them profitable again.

The company invests in apartments and owns more than 300 properties around the country including those in New York, New York, Boston, Massachusetts, Washington, D. C., Denver, Colorado and Southern California.

The REIT is NYSE-listed and has a market capitalization of $23.47 billion. This year’s earnings are down by 28.10% and the EPS record over the past 5 years shows growth at 15.55%. Equity Residential pays a 4.44% dividend.

A software maker based in Mountain View, California, the company trades on the Nasdaq with a market cap of $176.75 billion.

Intuit manufactures TurboTax, the popular online site for those filing taxes and who want to do so via the internet, without the use of paper.

Susquehanna International, a large investment management firm, in December initiated coverage of Intuit with a “positive” rating and a price target of $700.

The company began in 1966 with the manufacturing of circuit boards and is now a leading tech firm known for making all kinds of electronic components.

From headquarters in St. Petersburg, Florida, Jabil now describes itself as “a manufacturing solutions provider with over 250,000 employees across 100 locations in 30 countries.” The NYSE-listed firm has a market capitalization of $16 billion.

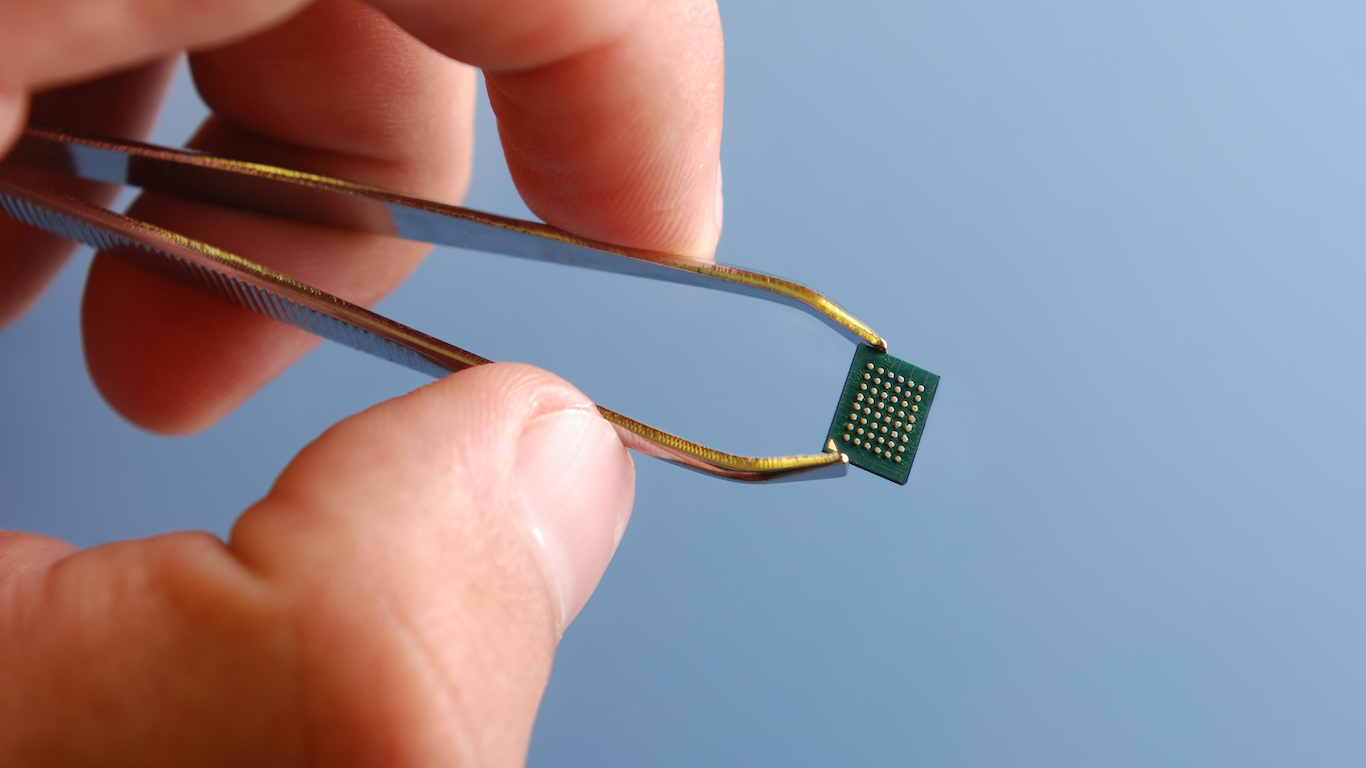

With a market cap of $46.07 billion, this semiconductor company is Nasdaq-traded and specializes in the areas of microcontrollers, FPGAs, silicon carbide and analog solutions.

The Chandler, Arizona-based Microchip Technology offers equity investors a $1.70 dividend which comes to a yearly 2.07%, a larger such payment than most tech outfits of similar size. Although earnings this year are off by 12%, the EPS over the past 5 years shows growth of 50.79%.

Microchip has benefitted recently from the rise in the semiconductor sector as a whole.

The health food company is no longer traded after suffering losses following an E-coli outbreak caused by its use of contaminated fruits. Originally based in Dinuba, California, the company moved to Half Moon Bay, California in 1995.

Odwalla was purchased by the Coca Cola Company in 2001 for $181 million and that company eventually sold the brand to Full Sail IP Partners in 2021.

The pizza-serving restaurant company continues to trade on the Nasdaq and sits with a market capitalization of $2.45 billion. Earnings are down this year by 14.04% — over the past 5 years, earnings were down by 7.80%.

Analysts expect growth for 2024 to come in at about 11%. The stock is relatively lightly traded with an average daily volume of 645,000 shares. Pizza John’s pays a 2.29% dividend.

The company no longer exists. After the 1993 initial public offering the company was taken private in 2007 in what was described as “a management-led buyout.”

Following a 2007 bankruptcy, the gaming group re-organized for another offering in 2011 now known as Red Rock Resorts. Its Las Vegas properties include 9 big resort/casinos and 10 smaller casinos (three of which are 50% owned), with about 19,500 slot machines, 300 table games and 4,000 hotel rooms.

Founded in 1946 by Rudolf and Nancy Talbot, the company describes itself as ” a dynamic women-led fashion brand offering” with 495 retail outlets and a significant online operation.

The Hingham, Massachusetts-based firm was taken over in 2012 by Sycamore Partners, a New York, New York private equity business, for $391 million.

The semiconductor company, operating from headquarters in Research Triangle Park, North Carolina (near the Raleigh/Durham/Chapel Hill area), is market capitalized at $4.24 billion. It focuses on the production and delivery of silicon carbide materials.

This year’s earnings are down by 244% and earnings are up over the past 5 years by 1.17%. Wolfspeed is relatively heavily leveraged with a debt-to-equity ratio of 4.25.

JP Morgan analysts on January 23rd 2023 named the stock as one of their “top hardware picks.”

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.