Special Report

12 Companies That IPO-ed in 2009: The Best (and Worst) Performers

Published:

These 12 stocks are some of the best performing and some of the worst performing from the group that offered shares to be publicly traded for the first time, 14 years ago.

A few of these have gone on to become mainstream name brands and popular holdings — others have completely faded from the investment scene, forgotten and dismissed.

7 Days Group Holding Group, known at the time as 7 Days Inn, is a Guangzhou, China-based motel and hotel business that traded for 4 years on the New York Stock Exchange.

As part of a merger with Keystone Lodging Company, the shares were bought out at $4.60 on 2/28/2013 and the company taken private.

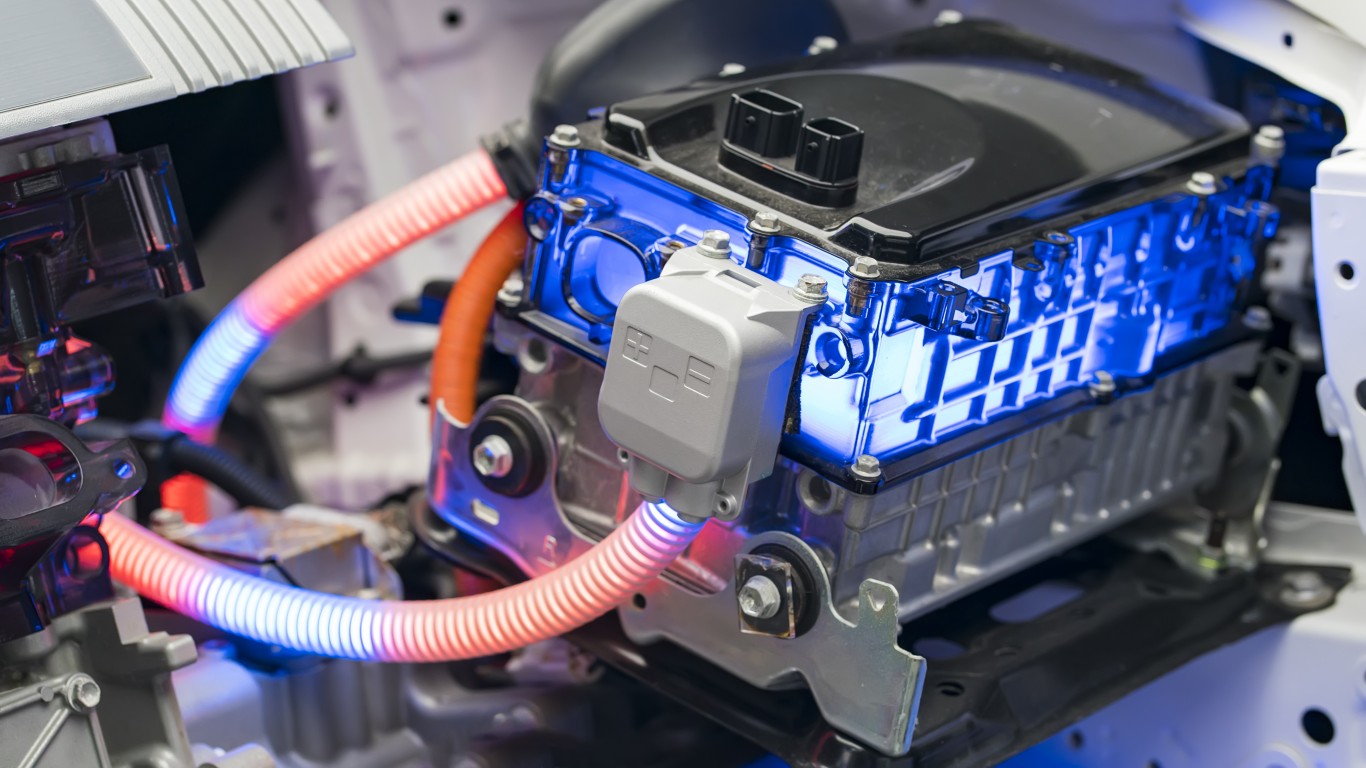

A123 Systems was a lithium iron phosphate battery (LFPs) maker whose products were designed for use in the growing electrical vehicle market. These are the types of batteries that Tesla, Ford and others were interested in for their EVs.

A123 systems built a manufacturing plant and actually had a supply agreement with Chrysler — but entered bankruptcy in 2012.

What was left of the company became a part of China’s Wanxiang Group Holdings, Hangzhou-based conglomerate, presently benefitting from the internationalization of Asian business.

The idea for A123 originated within the Massachusetts Institute of Technology but the history of the company now is thought of as a way NOT to do it.

Broadcom is one of the very big semiconductor makers with a market capitalization of $572 billion. Founded 60 years ago and based in (where else) Palo, Alto, California, the global infrastructure technology business offers cybersecurity, VMware, mainframe software, wireless and a number of other related products.

Earnings this year are up by 10.36% and up over the past 5 years by 2.37%. With a price-earnings ratio of 37, the stock trades at about the p/e level of the market as a whole but at less than the level of some hot big cap tech companies on the Nasdaq 100.

Broadcom offers its investors a dividend of 1.71%.

Founded in 1939, the original idea for the family-owned store was that no item in the place would cost more than a dollar. This was a long time ago, but the Dollar General name stuck even as inflation took the prices of everything much higher. The business thrived as a place where consumers could easily find basic products at reasonable affordability.

Dollar General had been publicly traded many years earlier but in 2007 the company was taken private by investment giant Kohlberg, Kravis, Roberts for $7.3 billion.

Thus, the business remained privately held until the 2009 initial public offering which placed 34.1 million shares back into public hands.

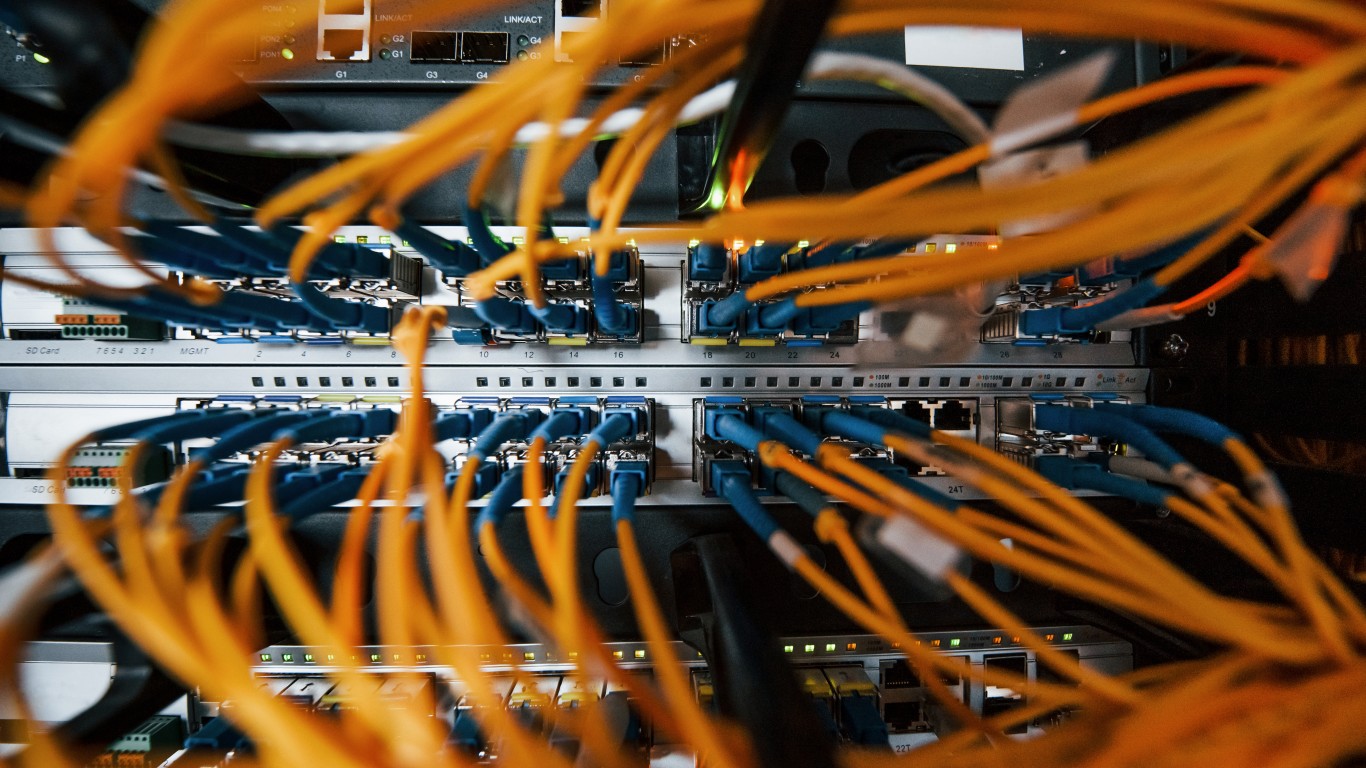

Fortinet describes itself as a “cybersecurity company” focused on intrusion detection systems, endpoint security and firewalls. Although its corporate headquarters sit in Sunnyvale, California, the big tech outfit maintains operations throughout the world.

Its “FortiClient” product is used to protect devices from phishing attacks, viruses, trojans and spyware.

Market capitalization comes to $50.45 billion, making it one of the really big caps of the tech industry and the Nasdaq 100. This year’s earnings are up by 30.93% and the past 5-years growth is a sizzling 97.64%.

Analysts at Bernstein on January 18th, 2024 initiated coverage of Fortinet with a “market perform” rating and a price target of $65. Daiwa Securities analysts on January 17th 2024 downgraded their opinion of the stock from “buy” to “neutral” with a price target of $62.

The stock peaked in July 2023 at $80, dropped to as low as $45 by late October 2023 and since rallied somewhat back up to the $65 level.

In business since 1957 with headquarters in Chicago, the Pritzker family-owned name brand hotel and lodging group is presently market capitalized at $13.25 billion.

The initial public offering had raised $1.15 billion in the deal underwritten by Deutsche Bank, Goldman Sachs & Company and J. P. Morgan. The company now operates more than 1,000 hotels globally.

Although earnings have shown growth of 5.84% over the past 5 years, this year’s EPS is down by 30.83%. Analysts as a group are expecting gains next year of 40%. Hyatt is relatively lightly traded for a New York Stock Exchange listed security with an average daily volume of 774,000 shares.

Hyatt pays a .35% dividend.

The stock traded below $30 during the March/April 2020 pandemic scare, recovered to $132.50 a few days ago and now goes for $127.

The Glenview, Illinois-based nutrition products company became a part of the Reckitt Benckiser Group after the latter purchased the former in 2017.

Mead Johnson then became a division of the much larger RB firm as its brand name Enfamil (baby formula) and Nutramigen (infant formula) health brands continued to be available under the new ownership.

The company enables customers to book online reservations at restaurants.

Verisk originally determined risks for insurance companies by using data to come up with analytics — and now provides similar, consultancy services to businesses in that and other sectors.

Market capitalization is $35.55 billion and average daily volume for the stock on the Nasdaq comes to 838,000 shares.

This year’s earnings are off by .21% and, over the past 5 years, they show growth of 12.78%. The price-earnings ratio of 72 is relatively high when compared, for example, to the Shiller p/e for the S&P 500, now at 27.

Verisk pays a .54% dividend.

It’s an example of the profitability of holding the right stock for a long period of time.

The Vitamin Shoppe is an online retailer of nutritional supplements. In a deal announced on May 10, 2023, CEO Brian Kahn and a group of investors took the company private.

In January 2024, Kahn stepped down from his position after the announcement of a probe by the Securities and Exchange Commission into his dealings with hedge fund B. Riley, a firm involved with the buyout.

The company sells vitamin supplements and other health-oriented products — it’s now a part of Kroger, the supermarkets chain.

Vitastock was suspended from trading on the Nasdaq upon discovery of significant, troubling issues with key portions of its financial statements. It had been trading at $5.70 just before the suspension.

The stock returned to the Nasdaq, after the company answered questions about finances, in June of 2011. Kroger bought Vitastock at $8 on 7/2/2014.

The Nasdaq on March 27, 2012 halted trading on the exchange in shares of ZST Digital Networks after accounting questions emerged following the resignation of the company’s outside auditors. Before the halt, the last price traded for the stock was $2.21 as the Nasdaq requested “additional information.”

On April 6, 2012, the company said it had “voluntarily” delisted from the Nasdaq.

Additional market analysis and commentary at John Navin’s Newsletter | Substack

Stats courtesy of FinViz.com. Not investment advice. For educational purposes only.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.