Special Report

The Most High-Tech and Low-Tech Car Brands: Every Major Brand Ranked

Published:

Self-driving cars may be the ultimate goal in car technology, but for now new advanced vehicle technology features sometimes enhance the driving experience and other times are just a source for potential problems and do not satisfy drivers. For example, owners of electric vehicles experience more problems with advanced technology than owners of internal combustion engine vehicles, according to the J.D. Power 2023 U.S. Tech Experience Index (TXI) Study.

In fact, the study found that 17 of the 21 advanced features offered on both engine types have more quality problems per 100 vehicles for BEVs (excluding Tesla) than for ICE vehicles. The features with the largest gaps between the two types are remote parking assistance and interior gesture controls. Overall, the study analyzed 40 automotive technologies, divided into four categories: convenience; emerging automation; energy and sustainability; and infotainment and connectivity. (Also see, The 9 Worst Gasoline Brands in America.)

“Innovation through a strong advanced tech strategy is crucial for all vehicle manufacturers,” said Kathleen Rizk, senior director of user experience benchmarking and technology at J.D. Power. “Success will be dependent on those manufacturers that can execute flawlessly, while ensuring the user experience is the same for those who are tech savvy and those who are not.”

To find the most high-tech and low-tech car brand, 24/7 Wall St. reviewed the J.D. Power study, adding sales volume figures for each car brand from Goodcarbadcar. The J.D. Power 2023 U.S. Tech Experience Index (TXI) Study is based on responses from 82,472 owners of new 2023 model-year vehicles who were surveyed after 90 days of ownership from February through May 2023. Car brands are listed here from lowest tech innovation to highest except for Polestar and Tesla, which J.D. Power does not consider rank eligible.

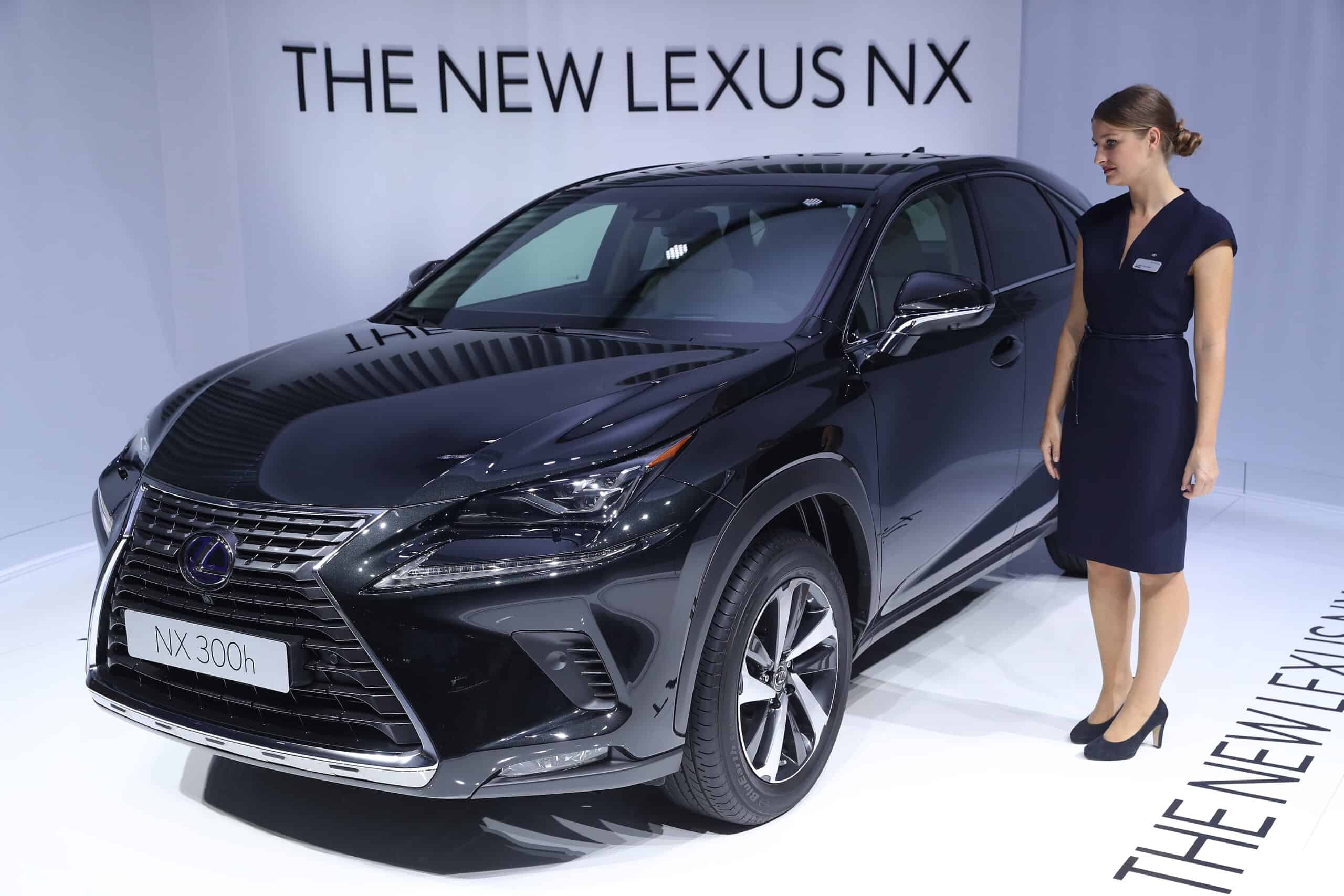

The car brands measured in the study have an average score of 588 out of 1,000 among premium brands and 478 among mass-market brands. Genesis ranks highest overall for tech innovation for the third consecutive year, with Cadillac and Lexus ranking second in a tie. Hyundai ranks highest among mass-market brands for the fourth consecutive year, with Kia and GMC ranking second and third, respectively, in the segment. (Here are The 15 Most Affordable SUVs for 2024.)

J.D. Power also gave specific car models awards in each of the four categories. In the convenience category, the Chevrolet Corvette received the award for its ground view camera technology, as did the Toyota Sequoia in the mass market segment for the same technology. The emerging automation award went to the Genesis GV80 in the premium segment for its front cross traffic warning and to the Hyundai Palisade in the mass market segment for its reverse automatic emergency braking. The one pedal driving technology won the award in the energy and sustainability category for the BMW iX and MINI Cooper. Finally, in the infotainment and connectivity category, the BMW 3 Series received the award, as did the Chevrolet Tahoe and Hyundai Sonata in the mass market segment.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.