Special Report

These are the States Americans are Leaving for North Carolina

Published:

Americans are more likely to move to a new state than they have been in years. According to the latest estimates from the U.S. Census Bureau’s American Community Survey, 8.2 million people moved between states in 2022, more than in any year in over a decade.

While reasons for moving vary from person to person, historically high rates of interstate mobility may be tied to recent changes in the labor market — specifically, the sweeping adoption of remote work policies in the wake of the COVID-19 pandemic. Census data shows that more than 24 million Americans worked from home in 2022, compared to fewer than 9 million in 2019, the year before the pandemic.

Without needing to be within commuting distance of their office, larger shares of the population are free to choose a place to live based on other factors, including housing, climate, cost of living, and family. Whatever the explanations may be, census data shows that some states are far more popular destinations than others — and North Carolina is drawing in more new residents from other parts of the country than nearly every other state.

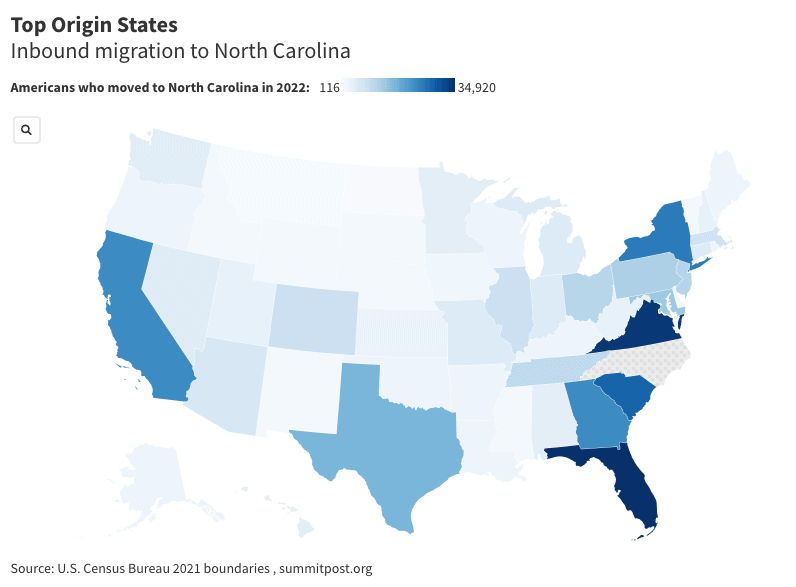

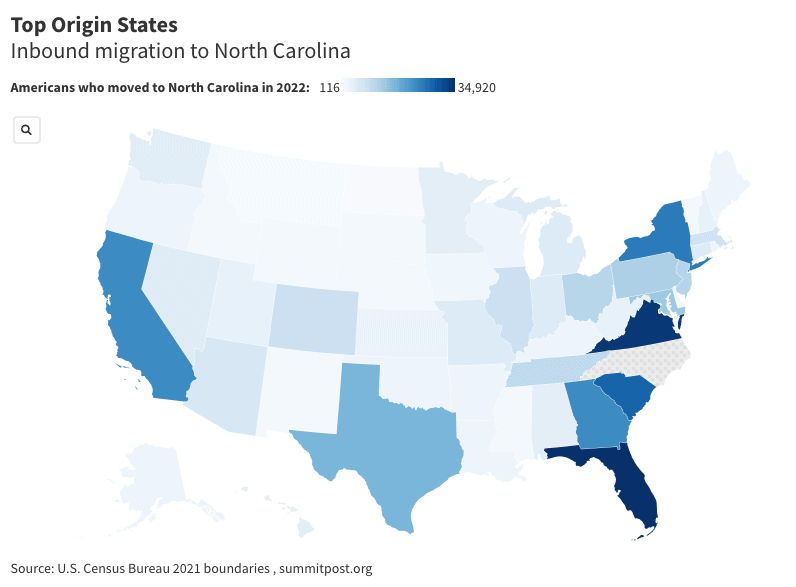

An estimated 341,600 Americans relocated to North Carolina in 2022, the fourth most of any state, trailing only California, Florida, and Texas. Inbound moves to North Carolina originated from each of the 49 other states, as well as Washington, D.C. in 2022.

The number of Americans who moved to North Carolina in 2022 ranges from about 120 to more than 34,900, depending on the state. Not surprisingly, the states reporting the largest outflow of residents to North Carolina include many of the most populous states in the country, as well as several states that share a border with North Carolina.

| Rank | Geography | Residents who moved to North Carolina in 2022 | Pct. all inbound moves to North Carolina |

|---|---|---|---|

| 50 | North Dakota | 116 | 0.03 |

| 49 | Montana | 231 | 0.07 |

| 48 | Vermont | 550 | 0.16 |

| 47 | Mississippi | 582 | 0.17 |

| 46 | Wyoming | 626 | 0.18 |

| 45 | Nebraska | 641 | 0.19 |

| 44 | Idaho | 734 | 0.21 |

| 43 | South Dakota | 742 | 0.22 |

| 42 | New Mexico | 936 | 0.27 |

| 41 | Delaware | 1,184 | 0.35 |

| 40 | District of Columbia | 1,399 | 0.41 |

| 39 | Iowa | 1,567 | 0.46 |

| 37 | Oklahoma | 1,736 | 0.51 |

| 37 | Rhode Island | 1,736 | 0.51 |

| 36 | Alaska | 1,900 | 0.56 |

| 35 | Oregon | 2,019 | 0.59 |

| 34 | Maine | 2,021 | 0.59 |

| 33 | Arkansas | 2,057 | 0.60 |

| 32 | Kentucky | 2,152 | 0.63 |

| 31 | Louisiana | 2,191 | 0.64 |

| 30 | Wisconsin | 2,294 | 0.67 |

| 29 | Kansas | 2,392 | 0.70 |

| 28 | New Hampshire | 2,698 | 0.79 |

| 27 | Utah | 2,942 | 0.86 |

| 26 | West Virginia | 3,016 | 0.88 |

| 25 | Minnesota | 3,518 | 1.03 |

| 24 | Hawaii | 3,685 | 1.08 |

| 23 | Alabama | 3,872 | 1.13 |

| 22 | Washington | 3,962 | 1.16 |

| 21 | Nevada | 4,196 | 1.23 |

| 20 | Connecticut | 4,250 | 1.24 |

| 19 | Michigan | 4,295 | 1.26 |

| 18 | Missouri | 4,786 | 1.40 |

| 17 | Indiana | 4,829 | 1.41 |

| 16 | Arizona | 5,619 | 1.64 |

| 15 | Massachusetts | 6,781 | 1.99 |

| 14 | Colorado | 7,298 | 2.14 |

| 13 | Illinois | 7,931 | 2.32 |

| 12 | Tennessee | 9,049 | 2.65 |

| 11 | Ohio | 10,094 | 2.96 |

| 10 | New Jersey | 10,750 | 3.15 |

| 9 | Pennsylvania | 11,683 | 3.42 |

| 8 | Maryland | 12,924 | 3.78 |

| 7 | Texas | 16,332 | 4.78 |

| 6 | Georgia | 22,551 | 6.60 |

| 5 | California | 22,891 | 6.70 |

| 4 | New York | 25,024 | 7.33 |

| 3 | South Carolina | 27,961 | 8.19 |

| 2 | Virginia | 33,919 | 9.93 |

| 1 | Florida | 34,920 | 10.22 |

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.