Special Report

Americans are Flocking to South Carolina From These States

Published:

Americans are more likely to move to a new state than they have been in years. According to the latest estimates from the U.S. Census Bureau’s American Community Survey, 8.2 million people moved between states in 2022, more than in any year in over a decade.

While reasons for moving vary from person to person, historically high rates of interstate mobility may be tied to recent changes in the labor market — specifically, the sweeping adoption of remote work policies in the wake of the COVID-19 pandemic. Census data shows that more than 24 million Americans worked from home in 2022, compared to fewer than 9 million in 2019, the year before the pandemic.

Without needing to be within commuting distance of their office, larger shares of the population are free to choose a place to live based on other factors, including housing, climate, cost of living, and family. Whatever the explanations may be, census data shows that some states are far more popular destinations than others — and South Carolina is drawing in more new residents from other parts of the country than most other states.

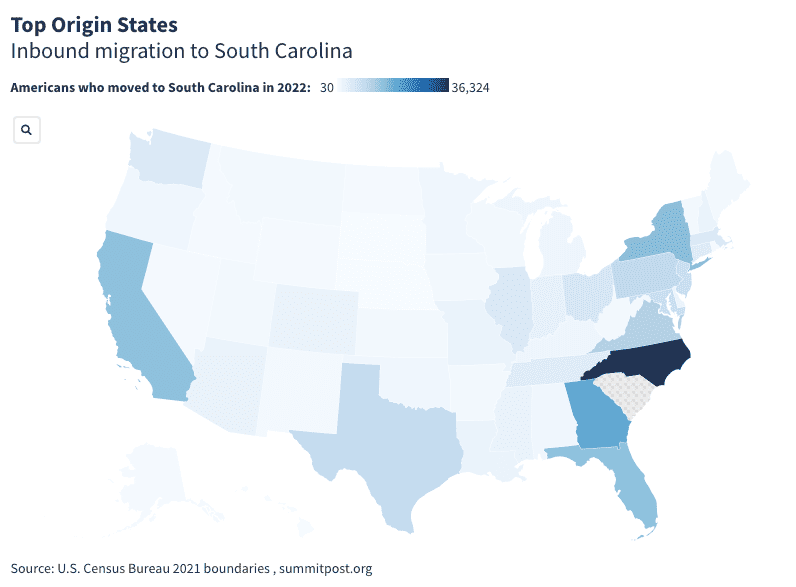

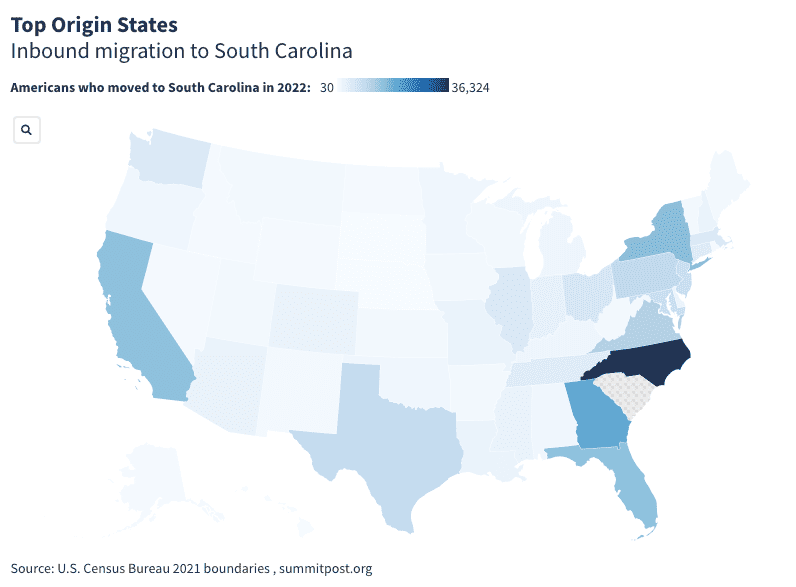

An estimated 219,700 Americans relocated to South Carolina in 2022, the 14th most of any state. Inbound moves to South Carolina originated from each of the 49 other states, as well as Washington, D.C. in 2022.

The number of Americans who moved to South Carolina in 2022 ranges from 30 to more than 36,300, depending on the state. Not surprisingly, the states reporting the largest outflow of residents to South Carolina include many of the most populous states in the country, as well as several states that share a border with South Carolina.

| Rank | Geography | Residents who moved to South Carolina in 2022 | Pct. all inbound moves to South Carolina |

|---|---|---|---|

| 50 | South Dakota | 30 | 0.01 |

| 49 | Nebraska | 54 | 0.02 |

| 48 | Hawaii | 191 | 0.09 |

| 47 | Alaska | 332 | 0.15 |

| 46 | Idaho | 387 | 0.18 |

| 45 | Nevada | 388 | 0.18 |

| 44 | Wyoming | 429 | 0.20 |

| 43 | North Dakota | 653 | 0.30 |

| 42 | Rhode Island | 720 | 0.33 |

| 41 | Montana | 778 | 0.35 |

| 40 | New Mexico | 804 | 0.37 |

| 39 | Arkansas | 819 | 0.37 |

| 38 | Kansas | 914 | 0.42 |

| 37 | Iowa | 973 | 0.44 |

| 36 | Wisconsin | 989 | 0.45 |

| 35 | Maine | 1,080 | 0.49 |

| 34 | Utah | 1,118 | 0.51 |

| 33 | West Virginia | 1,195 | 0.54 |

| 32 | Vermont | 1,206 | 0.55 |

| 30 | District of Columbia | 1,234 | 0.56 |

| 30 | Minnesota | 1,234 | 0.56 |

| 29 | Oklahoma | 1,338 | 0.61 |

| 28 | Alabama | 1,438 | 0.65 |

| 27 | Oregon | 1,561 | 0.71 |

| 26 | Michigan | 1,829 | 0.83 |

| 25 | Kentucky | 1,832 | 0.83 |

| 24 | Delaware | 2,007 | 0.91 |

| 23 | New Hampshire | 2,191 | 1.00 |

| 22 | Louisiana | 2,225 | 1.01 |

| 21 | Missouri | 2,362 | 1.08 |

| 20 | Colorado | 2,472 | 1.13 |

| 19 | Mississippi | 2,505 | 1.14 |

| 18 | Arizona | 2,628 | 1.20 |

| 17 | Indiana | 3,136 | 1.43 |

| 16 | Tennessee | 4,374 | 1.99 |

| 15 | Connecticut | 4,437 | 2.02 |

| 14 | Washington | 5,097 | 2.32 |

| 13 | Massachusetts | 5,109 | 2.33 |

| 12 | Illinois | 5,342 | 2.43 |

| 11 | Ohio | 6,059 | 2.76 |

| 10 | Maryland | 7,891 | 3.59 |

| 9 | New Jersey | 7,926 | 3.61 |

| 8 | Texas | 8,811 | 4.01 |

| 7 | Pennsylvania | 9,377 | 4.27 |

| 6 | Virginia | 11,446 | 5.21 |

| 5 | Florida | 14,769 | 6.72 |

| 4 | California | 15,035 | 6.84 |

| 3 | New York | 15,537 | 7.07 |

| 2 | Georgia | 19,121 | 8.70 |

| 1 | North Carolina | 36,324 | 16.53 |

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.