No economy has generated as much wealth for as many people as that of the United States. According to the 2023 Global Wealth Report from the Swiss investment bank UBS, most adults worldwide have less than $10,000 in total wealth. Meanwhile, the typical American adult is worth nearly $108,000. The same report found that the U.S. is home to 38% of the world’s millionaires, many times more than any other country — and incomes in the U.S. are currently rising at a historic pace.

The latest data from the U.S. Census Bureau’s American Community Survey shows that the typical American household earned nearly $75,000 in 2022, up from about $69,700 in 2021. The 7.2% increase was the largest recorded year-over-year since at least the mid-1990s.

In California, a state home to 53 Fortune 500 companies, the typical household earns $91,905 annually. And in some parts of the state, household incomes exceed that amount by tens of thousands of dollars.

Using five-year estimates from the U.S. Census Bureau’s 2022 American Community Survey, 24/7 Wall St. identified the 18 richest counties in California. Counties in the state are ranked on median household income. Supplemental data on population, unemployment, and median home values are also five-year estimates from the 2022 ACS.

Among the counties on this list, median household incomes are anywhere from about $400 to $61,900 higher than what the typical California household earns. In many of these counties, high incomes are underpinned by a strong job market. According to the ACS, the five-year average jobless rate in each of California’s richest counties is below the 6.4% statewide average.

Home values are often a reflection of what residents can afford, and high incomes in these counties are often evidenced by the local real estate markets. In all but four counties on this list, the typical home is worth more than the $659,300 median home value across the state.

These are the richest counties in California.

18. Santa Barbara County

- Median household income: $92,332

- Median home value: $714,800

- 5-yr. avg. unemployment rate: 6.0%

- Population: 445,213

17. San Diego County

- Median household income: $96,974

- Median home value: $725,200

- 5-yr. avg. unemployment rate: 6.0%

- Population: 3,289,701

16. Solano County

- Median household income: $97,037

- Median home value: $549,100

- 5-yr. avg. unemployment rate: 5.8%

- Population: 450,995

15. El Dorado County

- Median household income: $99,246

- Median home value: $597,600

- 5-yr. avg. unemployment rate: 4.6%

- Population: 191,713

14. Sonoma County

- Median household income: $99,266

- Median home value: $748,500

- 5-yr. avg. unemployment rate: 5.2%

- Population: 488,436

13. Alpine County

- Median household income: $101,125

- Median home value: $463,900

- 5-yr. avg. unemployment rate: 4.9%

- Population: 1,515

12. Ventura County

- Median household income: $102,141

- Median home value: $719,100

- 5-yr. avg. unemployment rate: 5.3%

- Population: 842,009

11. Santa Cruz County

- Median household income: $104,409

- Median home value: $951,300

- 5-yr. avg. unemployment rate: 5.9%

- Population: 268,571

10. San Benito County

- Median household income: $104,451

- Median home value: $703,200

- 5-yr. avg. unemployment rate: 6.2%

- Population: 64,753

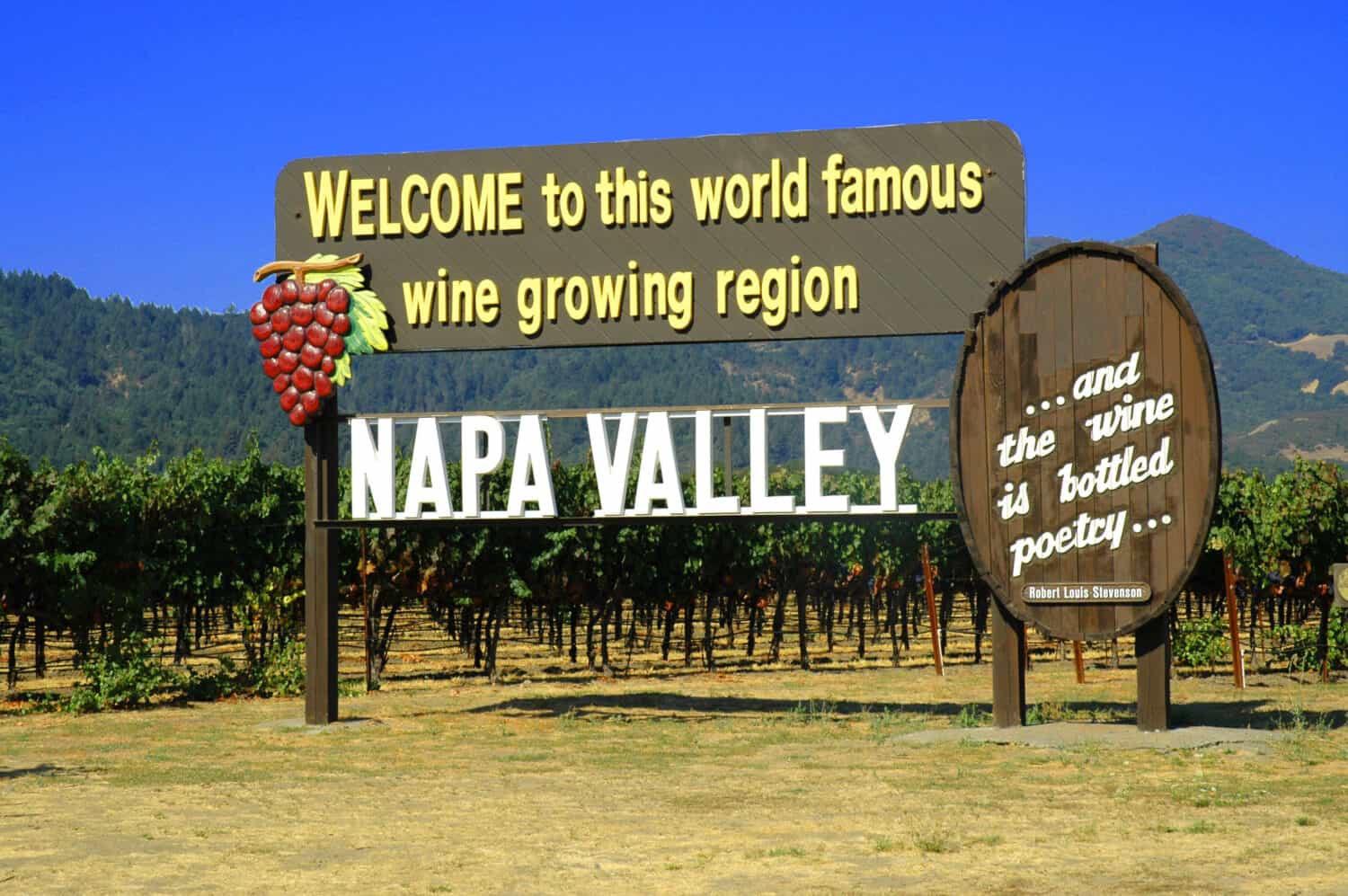

9. Napa County

- Median household income: $105,809

- Median home value: $794,500

- 5-yr. avg. unemployment rate: 5.2%

- Population: 137,384

8. Orange County

- Median household income: $109,361

- Median home value: $862,900

- 5-yr. avg. unemployment rate: 5.4%

- Population: 3,175,227

7. Placer County

- Median household income: $109,375

- Median home value: $627,100

- 5-yr. avg. unemployment rate: 4.2%

- Population: 406,608

6. Contra Costa County

- Median household income: $120,020

- Median home value: $787,300

- 5-yr. avg. unemployment rate: 5.8%

- Population: 1,162,648

5. Alameda County

- Median household income: $122,488

- Median home value: $999,200

- 5-yr. avg. unemployment rate: 4.9%

- Population: 1,663,823

4. San Francisco County

- Median household income: $136,689

- Median home value: $1,348,700

- 5-yr. avg. unemployment rate: 5.4%

- Population: 851,036

3. Marin County

- Median household income: $142,019

- Median home value: $1,291,800

- 5-yr. avg. unemployment rate: 5.8%

- Population: 260,485

2. San Mateo County

- Median household income: $149,907

- Median home value: $1,441,300

- 5-yr. avg. unemployment rate: 4.5%

- Population: 754,250

1. Santa Clara County

- Median household income: $153,792

- Median home value: $1,316,800

- 5-yr. avg. unemployment rate: 4.4%

- Population: 1,916,831

| Rank | County | Median household income ($) | Median home value ($) | Unemployment rate (%) |

|---|---|---|---|---|

| 1 | Santa Clara, California | 153,792 | 1,316,800 | 4.4 |

| 2 | San Mateo, California | 149,907 | 1,441,300 | 4.5 |

| 3 | Marin, California | 142,019 | 1,291,800 | 5.8 |

| 4 | San Francisco, California | 136,689 | 1,348,700 | 5.4 |

| 5 | Alameda, California | 122,488 | 999,200 | 4.9 |

| 6 | Contra Costa, California | 120,020 | 787,300 | 5.8 |

| 7 | Placer, California | 109,375 | 627,100 | 4.2 |

| 8 | Orange, California | 109,361 | 862,900 | 5.4 |

| 9 | Napa, California | 105,809 | 794,500 | 5.2 |

| 10 | San Benito, California | 104,451 | 703,200 | 6.2 |

| 11 | Santa Cruz, California | 104,409 | 951,300 | 5.9 |

| 12 | Ventura, California | 102,141 | 719,100 | 5.3 |

| 13 | Alpine, California | 101,125 | 463,900 | 4.9 |

| 14 | Sonoma, California | 99,266 | 748,500 | 5.2 |

| 15 | El Dorado, California | 99,246 | 597,600 | 4.6 |

| 16 | Solano, California | 97,037 | 549,100 | 5.8 |

| 17 | San Diego, California | 96,974 | 725,200 | 6.0 |

| 18 | Santa Barbara, California | 92,332 | 714,800 | 6.0 |

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.