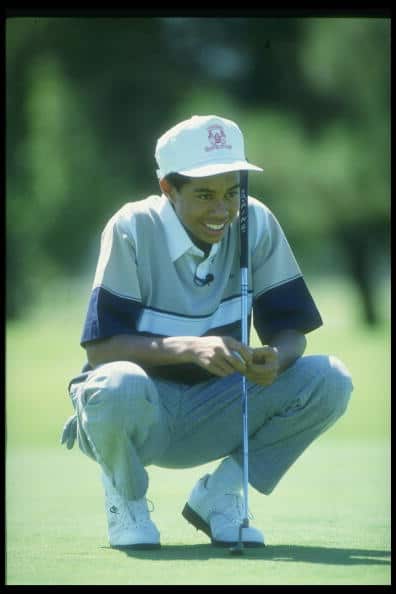

Tiger Woods is without dispute one of the most well-known and accomplished athletes in history. His talent has won him fame on and off the golf course, and a current net worth of over $1 billion. Looking at his career over the past 30 years shows how his wealth has grown exponentially, and will likely continue to do so long after he retires through sponsors and endorsements. If you’re a business owner, maybe you’ll consider sponsoring a young athlete who could be the next Tiger Woods.

24/7 Wall St. Insights

- Tiger Woods earned only a portion of his wealth in prize money from golf tournaments.

- Product sponsorships have brought him most of his fortune, with half of it coming from deals with Nike alone.

- Also: 2 Dividend Legends To Hold Forever

- Also: Discover “The Next NVIDIA

Beginnings

It’s very little exaggeration to say that Tiger Woods has been playing golf all his life. He started playing at 2 years old and became so good by 7 that he regularly appeared on t.v. shows. He won the Junior World Championship 6 times. He was heavily recruited by colleges and ultimately attended Stanford, where he was voted out of all athletes on campus as Freshman of the Year. Having won the 1995 Masters as an amateur, he left college after two years and turned professional in 1996. By the end of that year, he had already earned nearly $800,000.

Early Career (1997-2009)

Tiger won The Masters in 1997, and this opened the floodgates of the big bucks. At just 21 years old, he signed three mega-deals in the same year: Nike ($40 million), Titleist ($20 million), and American Express ($30 million). Nike turned out to be Woods’ biggest cash cow. He re-signed sponsorship deals with the company in 2000 ($100 million) and 2005 ($320 million). He married Swedish model Elin Nordegren in 2004 and they had two children over the next 5 years.

2009 Earnings

- On course: $21,015,196

- Off course: $72,000,000

- Total: $74,294,116

- Net Worth: $500 million

Mid-Career (2010-2017)

This period of Tiger’s life was turbulent. Unfortunately, Tiger and Elin divorced in 2010. Elin received $100 million in the settlement. In 2013 Tiger signed his final deal with Nike: $200 million for a 10-year contract. But in 2017 he was arrested for driving under the influence. All of this tarnished his public image but not his bottom line, financially, which continued to grow.

2017 Earnings

- On course: $1,300,000

- Off course: $42,000,000

- Total: $43,300,000

- Net Worth: $800 million

Late Career (2018-present)

Tiger’s trouble with cars came back with a vengeance in 2021 when he was involved in a severe car accident that caused him to go through surgery for serious leg injuries. In 2022 Forbes certified Woods as a billionaire, only the second athlete (after LeBron James) to reach that milestone. Since then, Michael Jordan and Magic Johnson have also joined that elite club. In January 2024, Nike and Tiger announced that they would end their partnership, with Tiger having pocketed $700 million over 27 years.

2024 Earnings

- On course: $12 million

- Off course: $55 million

- Total: $67 million

- Net Worth: $1.8 billion

Tiger’s Endorsements

Tiger earned “only” about $118 million in golf prize money, but the other 92% of his $1.8 billion fortune came from business ventures and brand endorsements.

Business Ventures

Some of his investments include two houses on Jupiter Island in Florida, a business that designs golf courses, and a chain of mini golf courses called Popstroke. He co-founded TMRW Sports with golfer Rory McIlroy and partnered with Justin Timberlake and Joe Lewis (a British billionaire) in a high-end real estate firm named Nexxus.

Brand Endorsements

Some of the brands Tiger has endorsed are Accenture, American Express, Asahi, AT&T, Buick, EA Sports, Gatorade, General Mills, Gillette, Golf Digest, NetJets, Nike, Rolex, Tag Heuer, TLC Laser Eye Centers, and Upper Deck.

The Average American Is Losing Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4% today, and inflation is much higher. Checking accounts are even worse.

Every day you don’t move to a high-yield savings account that beats inflation, you lose more and more value.

But there is good news. To win qualified customers, some accounts are paying 9-10x this national average. That’s an incredible way to keep your money safe, and get paid at the same time. Our top pick for high yield savings accounts includes other one time cash bonuses, and is FDIC insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes and your money could be working for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.