Technology

Credit Suisse Adds Key Tech Stocks to Buy in Its Top Picks List

Published:

Last Updated:

Credit Suisse has made many key changes to its universe of Top Picks. This is the firm’s sector-by-sector report showing the three top picks from the firm’s analysts. For each stock that is added, usually one stock is removed.

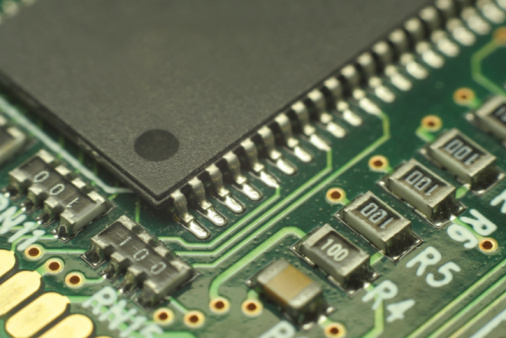

The first such group we are focusing on is the technology sector. The main focus by the firm was in semiconductors and in software. We would point out that some of Credit Suisse’s target prices were not shown and some are not as robust you might imagine. That being said, some were calling for substantial upside to the stock.

A summary for the Top Picks List has been provided, as has some basic commentary from the analysts covering each of the stocks. Avago Technologies Ltd. (NASDAQ: AVGO) and NXP Semiconductors N.V. (NASDAQ: NXPI) were added in semiconductors as the firm’s Top Picks. KLA-Tencor Corp. (NASDAQ: KLAC) and Teradyne Inc. (NYSE: TER) were added to the semiconductor equipment Top Picks list. The Ultimate Software Group Inc. (NASDAQ: ULTI) was added to the Top Picks list in small to mid-cap software stocks, and Citrix Systems Inc. (NASDAQ: CTXS) was added as the Top Pick for the software sector.

We did not get to see formal targets on each and every pick that was added. Lam Research Corp.’s (NASDAQ: LRCX) target price was $60.00, implying 11% upside. Avago was strange because its target price of $45.00 implies downside of 1%.

The firm was somewhat cautious on KLA-Tencor, making us wonder why it was added to the Top Picks list. It is more cautious on KLA-Tencor in near term due to its higher exposure to the foundry segment, which could potentially see a decline in near term, and it worried about KLA-Tencor benefiting once a 20 nanometer build-out starts in meaningful amounts.

Teradyne was given a positive bias as the firm sees the potential of litepoint to have higher-than-expected bookings. The firm also expects that Teradyne has won business from Agilent and Apple for cellular tests and thinks that this could potentially lead to litepoint revenues in excess of the guidance range.

On Avago the firm said, “Avago’s leverage to structural growth drivers including content increases in the Industrials/autos end-markets and accelerating demand for bandwidth, as well as, product cycles (4G/LTE wireless ramps at Apple and Samsung) should allow the company to outperform peers.” The firm’s upside on NXP Semiconductors is based on levered earnings growth and it sees the potential for long-term EPS power of $4.00 or higher.

Citrix Systems had an $85.00 price target, and that implies upside of close to 50% if the target price is hit. The firm’s Glen Santangelo said, “We believe the company’s growth profile, potential upside to synergy targets from the CHSI deal, and the chance to expand into the large employer market should drive outperformance in shares.”

The names removed from the Top Picks List were as follows:

Micron Technology Inc. (NASDAQ: MU) and Xilinx Inc. (NASDAQ: XLNX) in semiconductors, and ASML Holding N.V. (NASDAQ: ASML) in semiconductor equipment. Proofpoint Inc. (NASDAQ: PFPT) and Salesforce.com Inc. (NYSE: CRM) were both removed from the software section of the Top Picks List. And lastly, Jive Software Inc. (NASDAQ: JIVE) was removed from the small to mid-cap software list. The summary was effectively the same on all: “We see more upside elsewhere.”

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.