Marvell’s share price tumbled from a peak of around $17 in February of 2012 to a low of around $7 by the end of the year. Since then the stock gained about $5 a share to close last night at $12.01.

Even before the $1.17 billion patent infringement case it lost to Carnegie Mellon University in November, the stock was taking a beating as sales of hard drives fell faster than the company’s solid-state drive revenues could match. Softer sales of its mobile and wireless chips also contributed to the stock price slide. In September, the company lost its appeal of the Carnegie Mellon verdict, and the court found that the company had acted willfully which could raise the award even further.

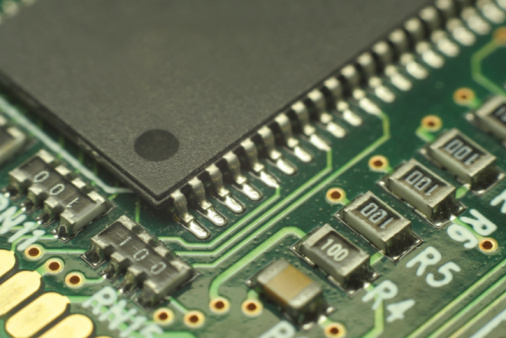

The company has scored a design win in the new iPad Air from Apple Inc. (NASDAQ: AAPL) and its chips are also a component in the new Xbox One from Microsoft Corp. (NASDQ: MSFT) and the PlayStation 4 from Sony Corp. (NYSE: SNE).

Perhaps KKR was waiting to see how Marvell handled adversity before jumping into the shares, if indeed it has (Bloomberg cites unnamed sources for its report). Greenlight Capital Inc., David Einhorn’s hedge fund, owns about 9% of Marvell and the company’s founders own another 20%. The only real question is why KKR waited so long.

Marvell’s share price is up more than 8% at $13.00 in a 52-week range of $6.98 to $13.51. The consensus target price on the stock is around $13.40.

“The Next NVIDIA” Could Change Your Life

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.