Technology

After the Drops, Which 3D Printing Stock Is Best Now?

Published:

Last Updated:

3D Systems Inc. (NYSE: DDD) is the largest of the 3D printing firms based on its market value of $6.83 billion as of Friday’s close. Shares closed up about 2.6% at $66.44 in a 52-week range of $27.88 to $97.28. The consensus price target on the stock is $81.41 which implies a potential upside of about 22.6% to Friday’s closing price. The forward P/E ratio for 2015 is nearly 69. The company is scheduled to report 2013 results on February 28; analysts are looking for full-year earnings per share (EPS) of $0.89 on revenue of $513.66 million. Last week, 3D Systems lowered its EPS and revenue estimates for 2013 and forecast 2014 earnings below the consensus estimate.

Stratasys Ltd. (NASDAQ: SSYS) will report 2013 results on March 2. It is expected to post full-year earnings of $1.83 a share on revenue of $481.14 million. The company’s stock lost 6% on 3D Systems’ earnings warning. The stock closed at $112.43 on Friday in a 52-week range of $60.20 to $138.10. Stratasys’ consensus price target is around $143.20 implying a potential upside of 27% to Friday’s close. The forward multiple for the stock in 2015 is 50 based on an EPS estimate of $2.24. Stratasys has the second-highest market value of the 3D printing stocks at nearly $5.5 billion.

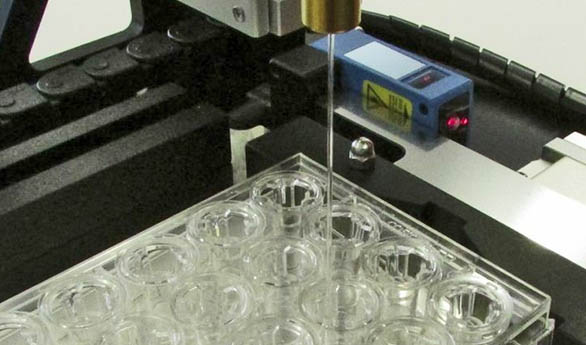

A unique 3D printing stock is Organovo Holdings Inc. (NYSEMKT: ONVO). Shares are down more than 15% in 2014 after rising about 325% in 2013. The company is developing a 3D bioprinting technology that can create functional human tissues on demand for research and medical use. Organovo announced a first delivery of liver tissue in late January, well ahead of schedule, and the stock gained back some of its year-to-date losses. The company has been publicly traded for about a year and a half, and the stock hit a post-IPO high of $13.65 in November. It closed on Friday at $9.35. There is no price target on the stock, and the company is not expected to post positive earnings at least through 2015. In terms of market cap, though, Organovo ranks fourth among the publicly traded 3D printing companies with a market value of nearly $728 million.

3D Systems has been chasing market share with more than 40 acquisitions over the past three years. Organovo is the current high-flyer, but with just over $1 million in revenues over the past four quarters, this is a highly speculative play.

Stratasys may be the best choice by default, but it too faces some headwinds. Some core patents expire this year, and tech giant Hewlett-Packard Co. (NYSE: HPQ) has said it will enter the industrial 3D printing business by mid-2014. If HP can make that happen, the shape of the 3D printing market could change dramatically.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.