Technology

Is WhatsApp Simply an AIM Alternative for Millennials and Social Media?

Published:

Facebook Inc. (NASDAQ: FB) is getting a great company in the WhatsApp buyout. How much it paid for it is another matter, and a matter that is being highly debated at this moment.

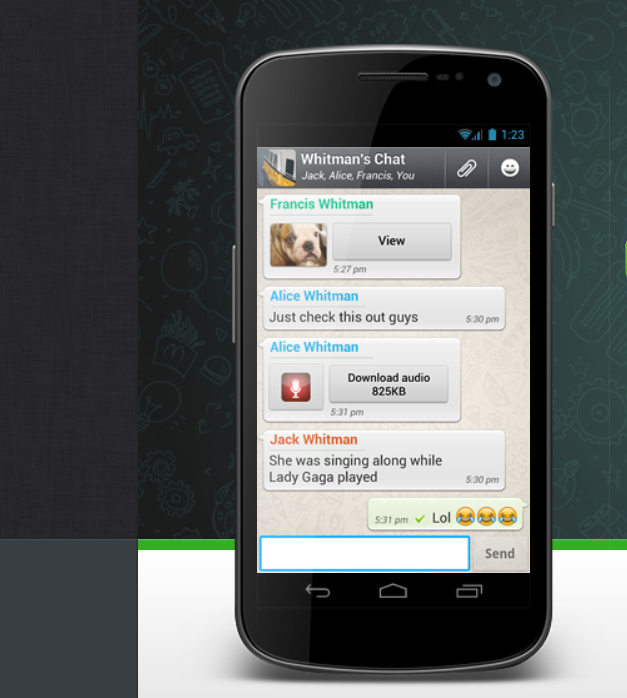

WhatsApp Messenger is a cross-platform mobile messaging app that allows you to exchange messages without having to pay for SMS. In short, this is just a revamped ICQ, AOL Instant Messenger and other chat services offered by Google, Yahoo! and even Facebook itself.

In short, it is textless texting, as far as what you have to pay your cellphone provider.

The notion that this was bought for $19 billion is hard to stomach. Can we dare compare 2014 dollars to 1990s money? Arguably not, but you have to recall that dot-com giants were starting to spring up with crazy multiples on revenue and no earnings. Many had no revenues, or at least limited revenues, because the online advertising world simply was not advanced enough nor widespread enough to support the valuations back then.

AOL Inc. (NYSE: AOL) acquired the Israel-based messaging solutions provider Mirabilis for some $287 million back in 1998. AOL’s AIM was already becoming well accepted at the time, but then AIM became perhaps the de facto communications service outside of phones and email for many years. AOL was also to make contingent payments thereafter, but what was ultimately paid in total is so long ago that it is almost immaterial. Still, at the time of the purchase ICQ claimed only about 12 million registered ICQ users at the time.

AOL still has AIM, but the actual ICQ instant messaging service was sold back in 2010 to Digital Sky Technologies Ltd. in Russia for close to $187.5 million — with close to 32 million registered users at the time. AIM has been around since about 1997, and you can run AIM on your smartphones.

So, what is WhatsApp really worth? The company’s blog post on the acquisition claims that the communication service now supports more than 450 million monthly active users worldwide and more than 320 million daily active users.

We won’t bother using the ICQ metrics with any crazy valuation comparisons, because anyone would say that it is simply a different metric entirely. The 450 million monthly active users comes to roughly $35.55 per user, and that is before the extra $3 billion markup on top of the $19 billion price tag.

We are just dealing with different metrics these days. Facebook shares are down only 2.5%, and its market cap is just shy of $170 billion after the drop, so it lost only about a fraction of the price tag being paid for WhatsApp. AOL’s market cap is only about $3.45 billion, but admittedly there is an age gap issue here.

Mark Zuckerberg is undeniably a visionary. How much this really worth requires a lot of vision — lots and lots of vision.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.