Technology

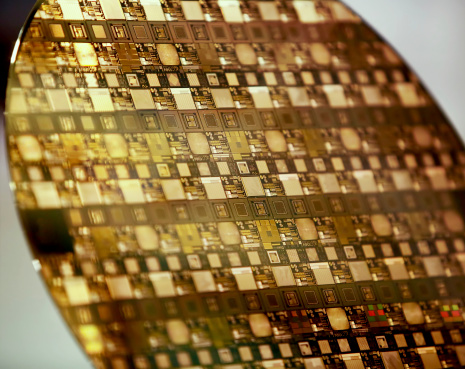

SunEdison Baffles Shorts, Trades Higher After Semiconductor IPO

Published:

Last Updated:

SunEdison Semiconductor is the silicon wafer-making business of SunEdison, and short sellers have been circling the parent company for a while now anticipating a drop in SunEdison’s share price as a result of the IPO. More than 58 million shares (about 22% of shares outstanding) were short as of April 30.

Underwriters include Deutsche Bank Securities, Goldman Sachs & Co., Wells Fargo Securities, Macquarie Capital and Citigroup. The underwriters have an option to purchase an additional 1.08 million shares at the IPO price.

SunEdison Semi will pocket net proceeds of about $85 million from the IPO. The company is also selling 7.1 million shares to a division of Samsung at the offering price, which would add about another $86 million to SunEdison Semi’s proceeds. The company will use the proceeds to repay about $18 million in indebtedness, and the rest will be retained as cash, which will be used for “liquidity and flexibility” in the company’s capital structure.

SunEdison Semiconductor’s shares traded up about 14% at $14.78 at 30 minutes before the noon hour.

SunEdison’s shares were up 2.7% at $19.05, in a 52-week range of $6.20 to $21.93.

ALSO READ: Earth Day’s Reckoning for Solar Power

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.