Short sellers thought that they were going to rake in easy money betting against SunEdison Inc. (NYSE: SUNE). After all, the semiconductor wafer and solar player has made a massive bounce from its lows, and then its SunEdison Semiconductor Pte. Ltd. (NASDAQ: SEMI) spin-off was about as well telegraphed as any spin-off.

SunEdison Semiconductor began trading last Thursday morning at $14.37, after selling 7.2 million shares at an initial public offering price of $13 per share. This pricing was even at the low end of the expected range of $13 to $15 per share. Shares shot up to $15.25 immediately after trading began, but then the stock closed on Thursday at $15.00, and at $15.55 on Friday.

It appears as though the underwriters underestimated this one. Mispricing an IPO or other capital raising event can just wreck the ambition of short sellers, particularly those who may have thought there was a short-term chance to bet against the bulls.

This matter becomes even more puzzling when investors and traders alike remember that SunEdison is the old MEMC. That was a high-flyer that experienced a high-speed flame-out, dropping from a peak of close to $100 back in the solar and alternative energy bubble in 2007 to 2008 down to almost nothing before this recovery.

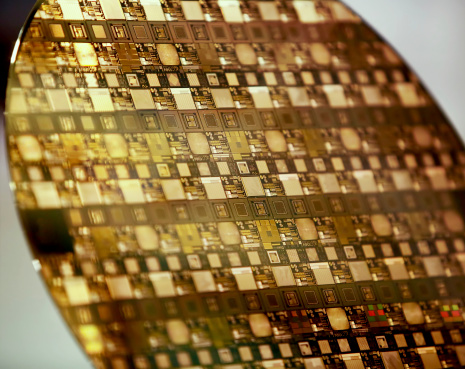

SunEdison Semiconductor is the silicon wafer-making business of SunEdison. If you look at the Nasdaq and NYSE short interest reports, you will see that short sellers have been circling the parent company for a while. Quite simply, they were anticipating a drop in SunEdison’s share price as a result of the IPO. This is a classic “sell the news” strategy used by traders.

ALSO READ: Last Week’s IPOs: Winners and Losers

It turns out that there were more than 58 million shares short in SunEdison as of April 30. That is close to 22% of shares outstanding. The underwriting syndicate included Deutsche Bank, Goldman Sachs, Wells Fargo Securities, Macquarie Capital and Citigroup. It seems likely that the underwriters exercised their greenshoe option, the overallotment option, to purchase an additional 1.08 million shares at the IPO price.

What was so interesting here was that the SEMI shares are very thin in trading. They generated only 2.2 million shares trading on their debut and barely another 200,000 shares in volume on the second day of trading.

SunEdison Semi pocketed net proceeds of about $85 million from the IPO, and maybe a tad more if that overallotment option was exercised by the underwriters. The company also sold 7.1 million shares to a division of Samsung at the IPO price. This effectively doubles its proceeds.

The company said in its filing that it plans to use the proceeds to repay about $18 million in debt and as cash retained for general corporate purposes and as a base of liquidity and flexibility in its capital structure.

ALSO READ: Short Interest in Solar Stocks Cools Off

SunEdison’s SUNE shares were at $18.55 the night before the SEMI shares began trading, but they had been at $16.74 as recently as two weeks earlier. The stock hit $20 at the start of May. It seems baffling that this stock rose into the IPO and then again that it increased to $19.03 by the close of the first day of the IPO, and then rose again to $19.52 on Friday.

Maybe some analyst research report support helped out. Regardless, the consensus analyst price target is now up to $22.58. One analyst even sees SunEdison’s shares above $30. The case of SunEdison is one seen dozens of times in recent years, but the post-event (spin-off IPO) reaction was not the norm by any means.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.