Palo Alto Networks Inc. (NYSE: PANW) had another stellar week. The company is in the right place at the right time in data security, and its earnings report drove analysts to chase their tails raising ratings and price targets this week. There is no doubt that the company is in a great spot at the moment. What may start to become a doubt though is how Wall Street is valuing this stock. Investors should be wondering if the implied upside ahead merits the risk versus reward when it comes to valuation for this hyper-growth outfit.

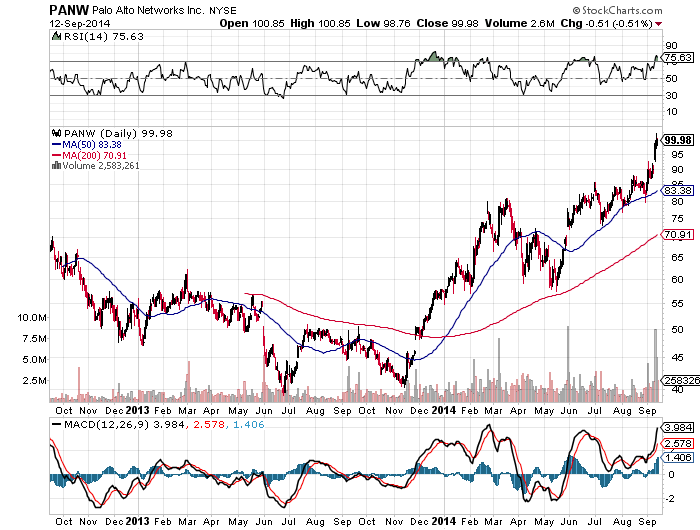

Before you hit any panic buttons without doing your own research, please understand that high-beta hot stocks can defy any normal valuation models for weeks, months and sometimes years. This stock was at $89.28 prior to its earnings report. It had a high close this week of $100.49, and it closed on Friday at $99.98. The consensus analyst price target is close to $108, and there are some targets as high as $120.

With its 52-week trading range of $40.36 to $102.45 and $7.7 billion market cap, what should investors expect from here for this automated detection and prevention provider for enterprises?

The quarterly revenue growth was a very impressive 59% to a record $178.2 million. The company posted a GAAP loss of $32.1 million (-$0.41 per share) and an adjusted operating earnings net income of $9.1 million ($0.11 per share), versus last year’s comparable period net income of $5.5 million ($0.07 per share).

READ ALSO: iPhone 6 eBay Auctions Reach Mega-Premium Price Craze

The company constantly comes up as the top provider for intrusion detection and prevention. It is substantially outpacing growth of its competitors, and the company claims to have an addressable market that is valued today at roughly $16 billion. The company even raised guidance to revenues of $178 million to $182 million and $0.12 in operating earnings per share. Palo Alto’s customer count rose by 40% to 19,000.

Investors should not take issue with the company’s growth nor its addressable market. With the Home Depot, Target and other high-profile credit card and data breaches, that addressable market conceivably could be even higher.

The problem that value investors will start having is that Palo Alto trades at 9.4 times expected 2015 revenue and about 7.2 times expected 2016 revenue. On expected earnings per share (operating, not GAAP), the stock is valued at about 145 times expected 2015 earnings and at about 73 times expected 2016 earnings. Admittedly, value investors are not the likely investors in Palo Alto Networks.

24/7 Wall St. tracks dozens of analyst reports each day of the week and hundreds of them each week. This is far from all the estimates out there, but here are some of the analyst upgrades and analyst price target hikes that we monitored this week:

- FBR maintained Outperform and raised the target to $105 from $90

- Topeka maintained Buy and raised the target to $120 from $100

- Nomura maintained Buy and raised the target to $110 from $90

- Stifel maintained Buy and raised the target to $110 from $100

- Credit Suisse maintained Outperform and raised the target to $110 from $88

- Morgan Stanley maintained Overweight and raised the target to $115 from $105

- Baird maintained Outperform and raised the target to $110 from $100

- Needham maintained Buy and raised the target to $110 from $95

Again, these were just some of the analyst calls that were made. There were many other boutique firms out there with higher analyst price targets. Still, some analysts are less aggressive in their ratings of companies trading at a blended earnings multiple of 100 times earnings in the next two years.

On September 10, Bank of America Merrill Lynch maintained a Neutral rating while raising its price target to $97 from $85. Its cautionary outlook was issued by Tal Liani and Michael Feldman in their investment thesis as follows:

We favor Palo Alto Networks’ technological and price disruption, creating a new product category of Next-Generation Firewalls and changing the pricing model for the industry. We highlight that the company is currently in a hyper-growth phase which we expect to stabilize at the 30% level on an annual basis. However, growing competition and valuation considerations keep us on the sidelines.

ALSO READ: 11 Analyst Stocks Under $10 With Massive Upside Potential

Again, calling a mega-growth outfit solely based on valuation in the midst of a game-changing landscape can be a dangerous game. The company has been public for just over two years. A two-year chart from StockCharts.com has been provided below.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.