Technology

Texas Instruments Earnings Are Solid as Free Cash Flow Grows

Published:

Last Updated:

The company’s net income of $826 million is 31% higher than last year’s net income of $629 million, and operating profit of $1.18 billion is 39% above the $844 million reported in the third quarter of last year.

For the fourth quarter, TI forecast revenue in a range of $3.13 to $3.39 billion and EPS of $0.64 to $0.746. The consensus estimate calls for $3.25 billion in revenue and EPS of $0.63. For the full year, the consensus estimates call for $12.99 billion in revenue and EPS of $2.41.

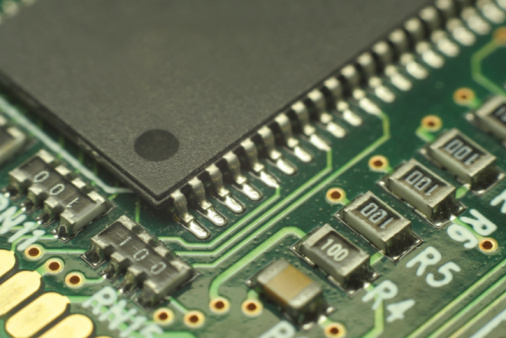

Gross margins hit a record-setting level of 58.4% and the company’s analog and embedded processing divisions are responsible for 82% of TI’s revenues.

Through dividends and stock buybacks, TI said it has returned $4.2 billion to shareholders in the past 12 months. During the quarter, the company raised its quarterly dividend to $0.34, and its dividend yield is 3.1%. Total cash returns to investors rose 9% year-over-year for the trailing 12 months.

Free cash flow in the third quarter totaled $1.28 billion, or 37% of revenues. For the trailing 12 months, free cash flow rose 20% compared with a similar period last year, from $2.87 billion to $3.45 billion.

Shares were up about 2.6% at $45.70 in after-hours trading, after closing the regular session at $44.41, up about 1.7% for the day. The 52-week range is $39.19 to $49.77. Prior to this release Thomson/Reuters had a consensus price target of around $50.40 on the company’s shares.

ALSO READ: Totally Rotten IBM Earnings, With Lower Backlog and Margins

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.