GoDaddy Inc. has filed an amended S-1 form with the U.S. Securities and Exchange Commission (SEC) for its initial public offering (IPO). Depending on how many shares you really use after converting multiple classes and units, GoDaddy’s implied market cap appears to be in the neighborhood of $3 billion.

The offering is for 22 million shares, with an overallotment option for an additional 3.3 million shares. The shares were given a price range of $17 to $19 per share, which would value the offering at roughly $396 million, if priced at the mid-point and without considering the shares covered in the overallotment option. GoDaddy indicated that it will list on the New York Stock Exchange under the symbol GDDY.

The underwriters for the offering are Morgan Stanley, J.P. Morgan, Citigroup, RBC Capital Markets, Barclays, Deutsche Bank Securities, KKR, Stifel, Piper Jaffray, Oppenheimer and JMP Securities.

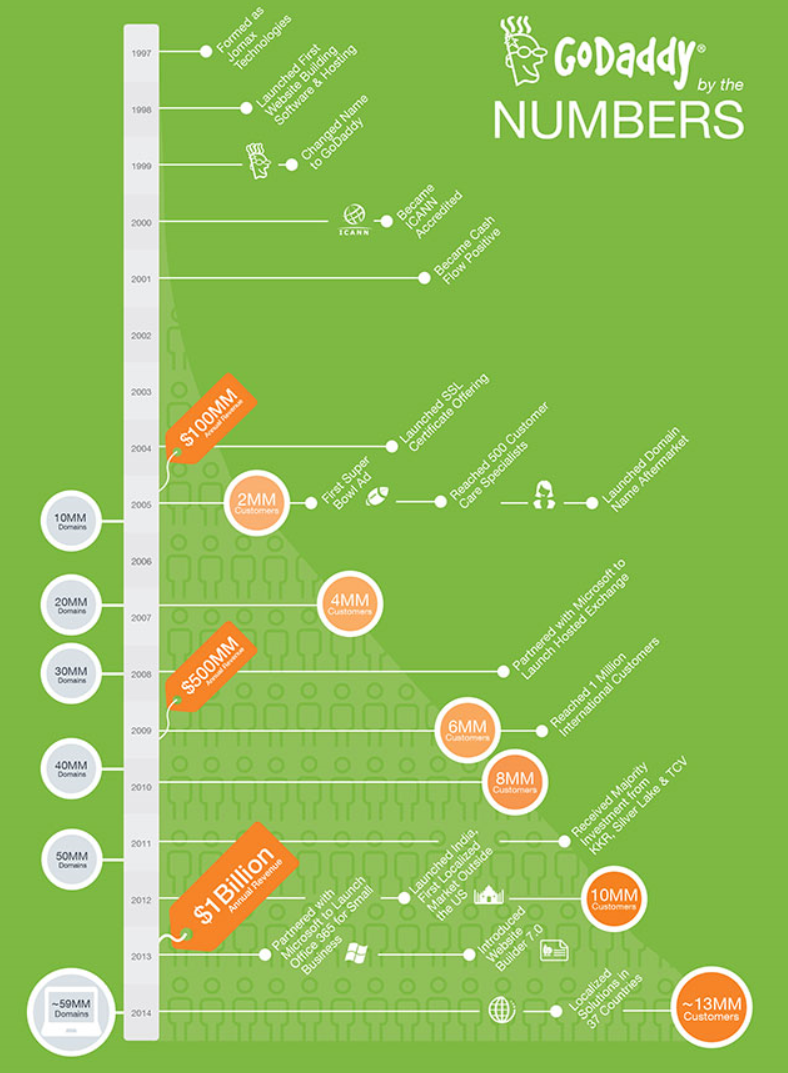

GoDaddy is a Web hosting and services provider to small businesses, Web design professionals and individuals. The company claims that it operates the world’s largest domain marketplace, which provides website building, hosting and security tools. GoDaddy serves approximately 13 million customers (see diagram below). The company believes that its addressable market extends beyond small businesses and includes individuals and organizations, such as universities, charities and hobbyists.

ALSOO READ: No Sizzle in Goldman BDC IPO

In terms of expansion, GoDaddy could look internationally as, according to the International Labor Organization Statistics Database, there were more than 200 million people outside the United States identified as self-employed in 2012, implying they could use a website. Domestically, as of January 2013, over 50% of small businesses in the United States still did not have a website, according to a study commissioned through Beall Research.

The class A common stock to be outstanding after this offering is “60,824,171 shares (or 151,221,770 shares if all then outstanding exchangeable LLC Units were exchanged for newly issued shares of Class A common stock on a one-for-one basis).” With over 151 million shares priced at $19, this is easily in the neighborhood of $3 billion.

The structure for this offering is complicated, but suffice it to say it leaves the shareholders buying in at the IPO with very little power within the company.

Some highlights from the filing include:

- As of December 31, 2014, GoDaddy had approximately 12.7 million customers, and in 2014, it added more than 1.1 million customers.

- In 2014, the company generated $1.7 billion in total bookings up from $939 million in 2010, representing a compound annual growth rate (CAGR) of 16%.

- In 2014, it had $1.4 billion of revenue up from $741 million in 2010, representing a CAGR of 17%.

- In the five years ended December 31, 2014, GoDaddy invested to support its growth with $976 million and $656 million in technology and development expenses and marketing and advertising expenses, respectively.

GoDaddy intends to contribute roughly $25 million of the proceeds from this offering to GD Subsidiary Inc. and to use the remaining proceeds, and to cause GD Subsidiary Inc. to use the proceeds contributed to it, to purchase newly-issued LLC Units from its subsidiary Desert Newco.

ALSO READ: Par Pharma Files for IPO

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.