Green and renewable energy trends have been on the rise. They are expected to keep rising, even in the face of many tax credits set to expire. There have been a countless number of companies that have made the push toward using renewable energy. Some companies are very strong in renewable energy use, and some are very weak. A press release this week seemed odd considering that Amazon.com Inc. (NASDAQ: AMZN) announced that its Amazon Web Services (AWS), has teamed with Community Energy to support the construction and operation of an 80 megawatt solar farm in Accomack County, Va.

While some might question Amazon’s spending habits anyhow, 24/7 Wall St. could not help but wonder one thing here: is Amazon bowing its head to Greenpeace?

Several figures were used in Amazon’s press release about its new facility. The facility is to be called Amazon Solar Farm U.S. East. The company’s new solar farm is expected to start operating as early as October 2016, and it is expected to generate roughly 170,000 megawatt hours of solar power annually. Amazon even offered up a reference, noting that this is enough power for 15,000 U.S. homes in a year. Amazon Solar Farm U.S. East was also touted as being the largest solar farm in the state of Virginia.

Amazon’s press release said that AWS shared its long-term commitment to achieve 100% renewable energy usage for the global AWS infrastructure footprint back in November 2014, and that as of April about 25% of the power consumed by its global infrastructure comes from renewables. It further said that it plans to have a goal of at least 40% by the end of 2016.

ALSO READ: Deutsche Bank’s Top 3 Cybersecurity Stocks to Buy

So, what about Greenpeace? Does it seem like a coincidence that the release from Amazon is so close to the new report from Greenpeace?

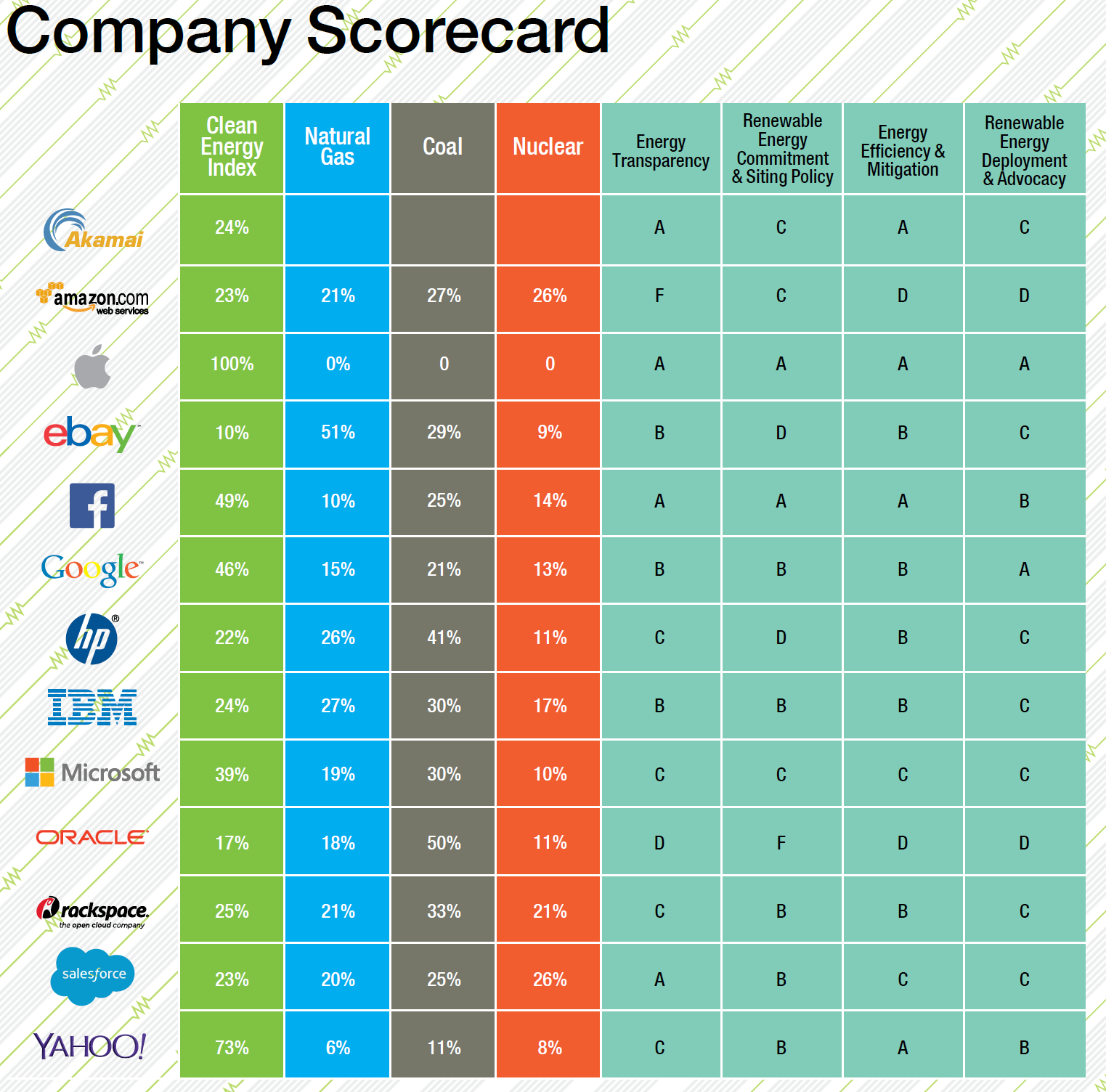

24/7 Wall St. receives regular communications from many groups. Some are conservative, some are liberal. Some are from business groups, and some communications are coming from labor unions or consumer advocacy groups. It turns out that Greenpeace has been giving Amazon very poor grades to Amazon Web Services for some time. Greenpeace’s “Clicking Green” report named Amazon one of tech’s biggest polluters in 2014. Now the new report, called Click Clean, is out for 2015 and AWS was given poor marks yet again.

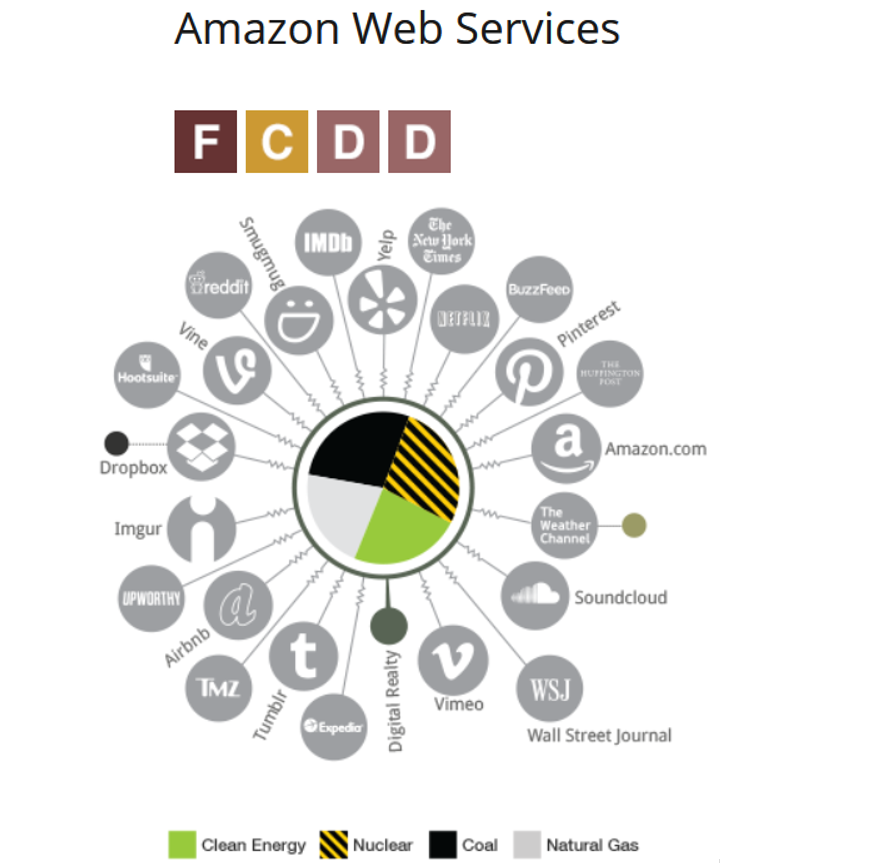

The four grades issued were F, C, D and D, and that is despite Greenpeace acknowledging that AWS did adopt a long-term commitment to 100% renewable energy for its footprint in November of 2014. Below are some condensed comments taken directly from the Greenpeace note:

Amazon Web Services continues to dominate the cloud computing market, providing all or part of the digital infrastructure behind many of the best known and fastest growing online brands, including Netflix, Pinterest, Imgur and Reddit. While AWS remains highly competitive on price for its cloud infrastructure, a number of AWS customers have privately expressed concern over the lack of data and attention being paid to the environmental footprint associated with the AWS cloud. … Despite these potentially significant shifts, the continued lack of transparency on the energy performance of the AWS cloud, combined with significant expansion of its infrastructure in utility territories that have little to no renewable energy capacity, would appear to indicate that AWS has not yet determined how it is going to make its commitment to renewable energy become real.

Greenpeace provided AWS with facility power demand estimates to review. AWS responded that the estimates were not correct, but did not provide alternative data. Using conservative calculations based on public records, Greenpeace has used the best information available to derive power demand. … Greenpeace invites AWS to provide more accurate data for its facility power demands.

What investors may care about here depends on how they view Amazon’s stock valuation and business model, and they may differ or agree with Greenpeace. At issue is that Amazon already has its foot in so many segments and operates often at losses or barely above breakeven. Now investors have to ask this on a near-term expense versus long-term impact of energy use: how much will this cost Amazon?

ALSO READ: 9 Analyst Stocks Under $10 With Huge Upside

Amazon has a $202 billion market cap, based on a $435.00 or so share price. Its 2014 revenues were $88.98 billion, and Yahoo! Finance shows that operating income for the entire year was a mere $178 million (down from $745 million in 2013 and $676 million in 2012), while net income from continuing operations was in the red at -$241 million in 2015 (versus $274 million positive in 2013 and a loss of $39 million in 2012).

Amazon already pushes its investors to accept low margins or negative margins on many aspects of its business. At the same time, it keeps disrupting businesses and entire business sectors.

ALSO READ: 10 Stocks to Own for the Next Decade

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.