Oppenheimer reiterated a Perform rating for BlackBerry. This rating was based on the firm’s belief that the company is irreversibly deteriorating.

Device revenues and shipment were both down 31% year over year. Average sales price improved 1% year over year and 14% sequentially to $240. Hardware gross margin was positive for the quarter. Software revenues were unexpectedly strong, doubling sequentially — primarily on licensing. Service revenues were down 19% sequentially. Gross margin improved over 200 basis points to 50.3%.

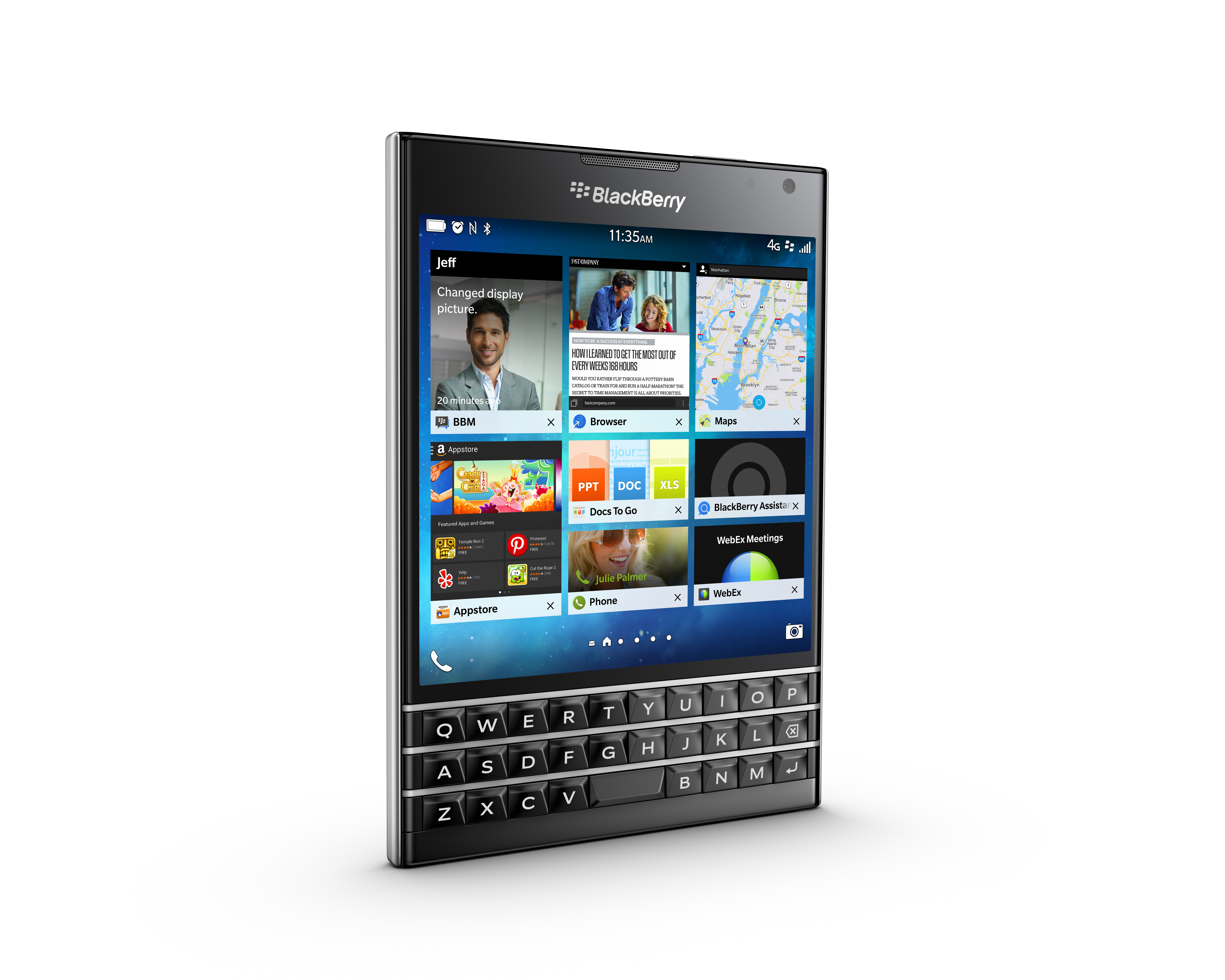

The company shipped 1.1 million handsets, in line with Oppenheimer’s bearish estimate and below consensus. BlackBerry added two more Taiwanese original design manufacturing partners, which the firm believes are intended to help hardware profitability.

As for software, BlackBerry’s management reiterated that it will continue investing in its software business with focus on mobile security. Management stressed that core enterprise software, newly acquired business and licensing revenues will provide growth.

ALSO READ: 2 Possibilities With BlackBerry, and the Likelihood of Each

In Oppenheimer’s report:

Management reiterated its $500 million software revenues target for fiscal 2016 and 15% Q/Q decline in Service revenues. We adjust our fiscal 2016 estimates revenues/EPS from $2,264 million/-$0.52 to $2,334 million/-$0.32, and introduce fiscal 2017 estimates revenues/EPS of $2,071 million/-$0.34.

Ultimately the firm believes that BlackBerry has executed well to grow its Software revenues from core enterprise customers and tuck-in acquisitions. However Oppenheimer believes a turnaround in the Devices business will prove to be difficult.

Canaccord Genuity maintained a Hold rating but cuts its price target to $8 from $10. Part of the reasoning behind this rating was that BlackBerry reported weak first-quarter results that were masked by one-time payments from licensing deals.

The firm detailed in its report:

While reclassified software and technology licensing revenue was well above our and consensus software only estimates, the strong sales were driven by significant one-time payments from the two technology licensing deals signed during the quarter. In fact, management lowered its overall fiscal 2016 software-related sales expectations from $600 million to ~$500 million due to lower BBM expectations. Also, the $500 million includes licensing revenue versus prior expectations not implying licensing revenue. Based on management’s fiscal 2016 growth expectations for the core EMM business, we believe BlackBerry faces the challenging task of selling not just EMM subscriptions but must also upsell increasing amounts of VAS and close additional technology licensing deals to meet its lowered fiscal 2016 targets. Further, we believe the continued steep decline in high margin services business and ongoing tepid hardware sales will remain a headwind to meaningful profitability during fisacal 2016/fiscal 2017.

BlackBerry anticipates the core enterprise mobility management (EMM) business should grow 20% to 25% year over year, compared to fiscal 2015. It also expects gradually increasing contributions from the introduced value-added services through the year.

ALSO READ: UBS Says to Buy Only These 2 Cybersecurity Stocks

Considering these trends, Canaccord Genuity believes the company would need to close substantial additional technology licensing deals through fiscal 2016 to meet its lowered target. Given the lack of visibility into the cadence of these deals and whether these deals would have a recurring revenue component, the brokerage firm remains cautious on the long-term sustainability of this new licensing revenue.

Canaccord Genuity finished its report saying:

Due to our lowered overall sales and particularly software sales estimates partially offset by lowered operating expenses assumptions, we lower our fiscal 2016/fiscal 2017 pro-forma EPS estimates from $0.05/$0.12 to ($0.20)/$0.04. Valuation: Our $8 price target is based on our updated sum-of-parts valuation.

Shares of BlackBerry were essentially flat at $8.80 late Wednesday morning. The stock has a consensus analyst price target of $8.99 and a 52-week trading range of $8.59 to $12.63.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.