BlackBerry Ltd. (NASDAQ: BBRY) has witnessed one of the greatest falls from grace and prime time in the modern era of consumer electronics. The company has a relatively new CEO in John Chen, and he is considered stellar for keeping things up better than they might otherwise be. The problem here is that some analysts and some investors are still very concerned about BlackBerry’s future.

Credit Suisse’s Kulbinder Garcha did raise estimates after the struggling handset and mobile operating system maker beat earnings. Garcha remains quite cautious here, with an Underperform rating and a very negative $6.00 price target. That is about one-third lower than the current share price.

BlackBerry shares were actually up more than 3% on Monday, trading at $8.89. Does that mean that the street is discounting what Credit Suisse has to say here? According to Garcha’s report:

BlackBerry reported results better than consensus with revenues of $557 million, EPS of -$0.03, and an underlying operating loss of $30 million (versus Credit Suisse’s -$53 million estimate). While the company may currently be showing possible signs of a recovery, we note that much of this strength can be attributed to intellectual property licensing sales of $53 million this quarter, which was structured with an upfront payment.

Credit Suisse’s $6.00 price target was reiterated, but the firm did raise estimates to -$0.29 earnings per share (EPS) from -$0.36 EPS for fiscal year 2016 and moved fiscal 2017 EPS to -$0.30 EPS from -$0.34 EPS.

Is it possible that the hardware section is seeing signs of recovery? Credit Suisse was looking at corporate gross margin of 40.2%, but BlackBerry brought in 44.9% margin on that front. Garcha said:

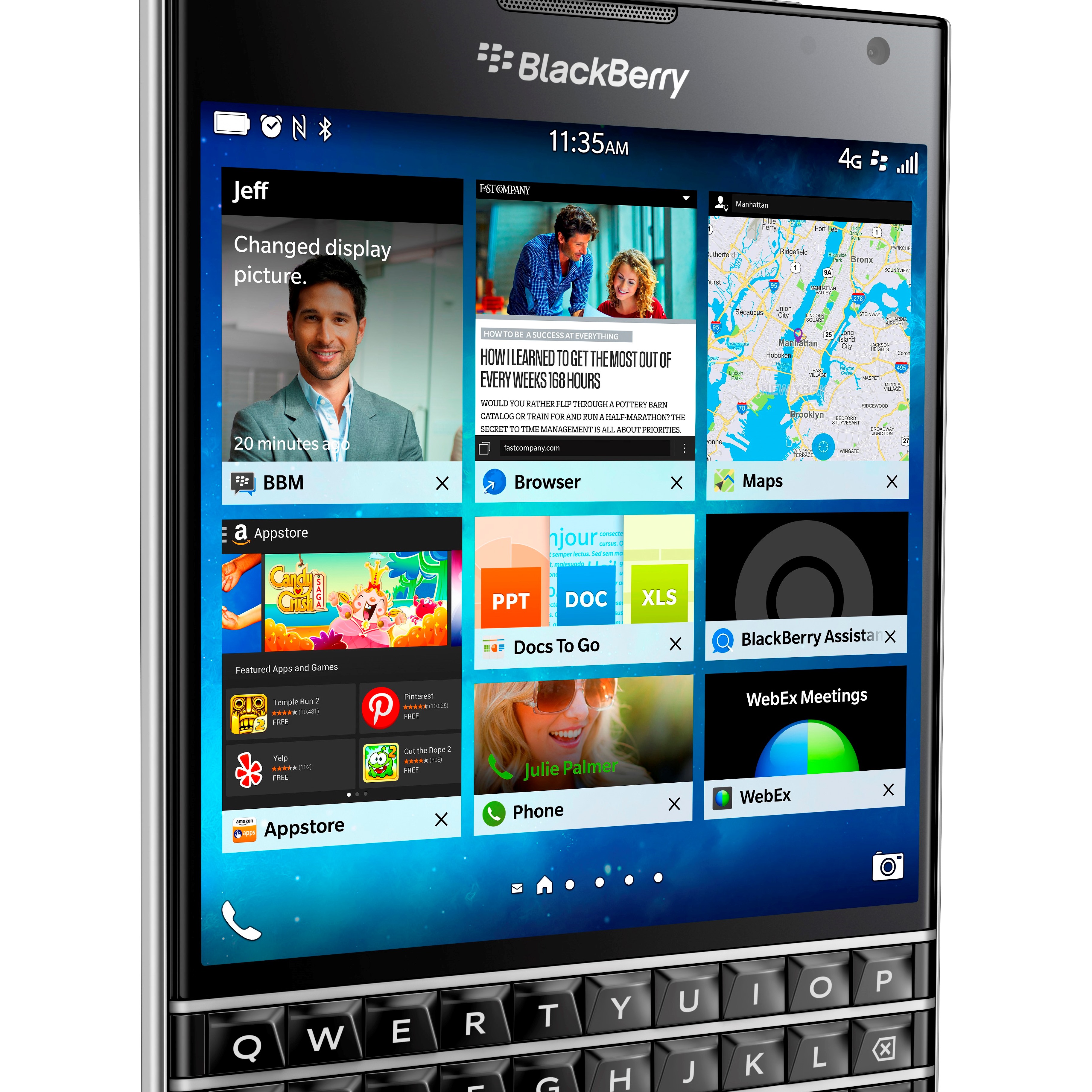

The company continues to commit to the smartphone segment with the recent launch of its new Priv smartphone, which runs on Android as opposed to its own OS system. This commitment led to a hardware rebound this quarter with average selling prices rising to ~$315 from ~$240 last quarter. We forecast hardware revenues of $265 million next quarter (down 3% from a year ago but up 19% sequentially).

The reason for continued negativity is that Garcha sees a difficult transition ahead. He thinks BlackBerry still faces a challenging transition. Several reasons were cited:

- Services continue to see an accelerated decline.

- Despite software revenues being strong, its sustainability is doubted as the IP licensing revenue seems unpredictable.

- Acquisition quality (like Good Technology) is a concern.

On valuations, Garcha cautioned:

We see inherent challenges in turning around the services stream, as well as the subscale loss making hardware business. Assuming shutting down the hardware business by the end of Fiscal Year 2016 and winding down the services business by the end of Fiscal Year 2017, we arrive at a net asset value of $3.3 billion (about $6 per share), which suggests an approximate 25% downside from the current market price.

BlackBerry shares closed at $8.61 on Friday, and Credit Suisse said that its downside was about 25% from that level. Still, it is the gain of more than 3% on Monday that led to the one-third lower valuation. At $8.89, BlackBerry shares have a 52-week range of $5.96 to $12.63. While $6.00 is far more negative than most analysts, the reality is that the consensus analyst price target of $7.49 is more than $1.00 under the current stock price.

If investors want competing analyst calls there are some. RBC Capital Markets actually raised its price target to $9.00 from $8.00. BMO Capital Markets also raised its price target to $8.00 from $7.00. A less negative call was seen from JPMorgan, starting coverage as Neutral and with a $9.00 price target.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.