Technology

3 Old-School Dividend Tech Stocks Could Outperform in Volatile 2016

Published:

Last Updated:

With 2016 off to the worst start ever, many technology investors are very concerned over the possible direction for the rest of 2016. While concerns over a production slowdown at Apple may be overblown, the bottom line is the Nasdaq is already down almost 8%, and things could get worse before they get better.

One smart move for investors looking to stay long the technology sector could be to rotate capital to some of the old-school mega cap technology companies. While they may not have the pizzazz of some of the Internet of Things darlings, they do have staying ability. That makes good sense in a rocky market.

We screened the Merrill Lynch research database, and found three stocks that just might be the ticket for investors who have been jolted by the horrible start to the 2016 trading year. All are rated Buy at Merrill Lynch.

Cisco

This is one of the top mega-cap technology stock picks on Wall Street and perhaps a surprising defensive pick for volatile markets like we have witnessed. Cisco Systems Inc. (NASDAQ: CSCO) posted disappointing earnings in November, and many on Wall Street have lowered their price targets for the networking giant significantly. Cisco is also one of the 24/7 Wall St. top 10 stocks to own for the next decade.

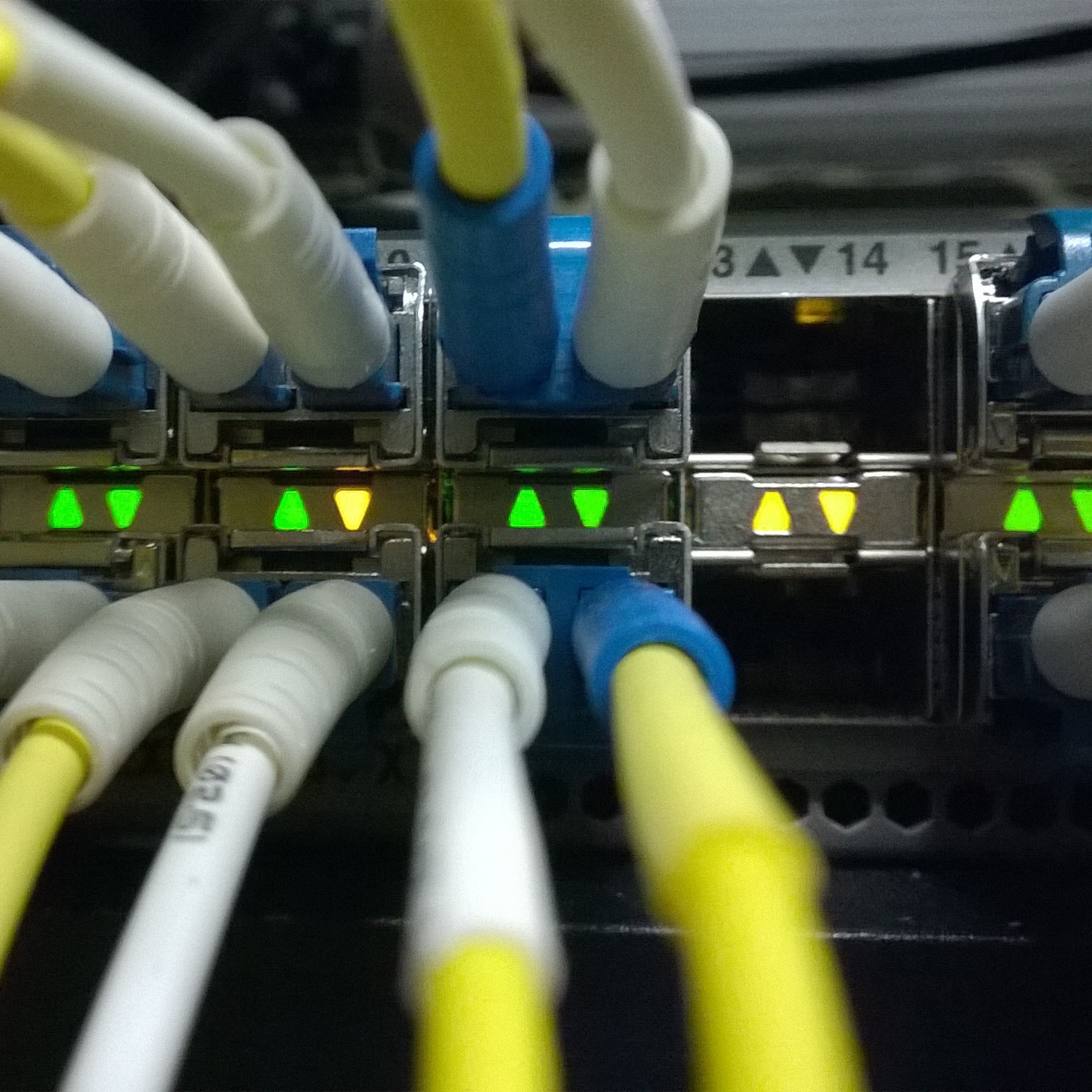

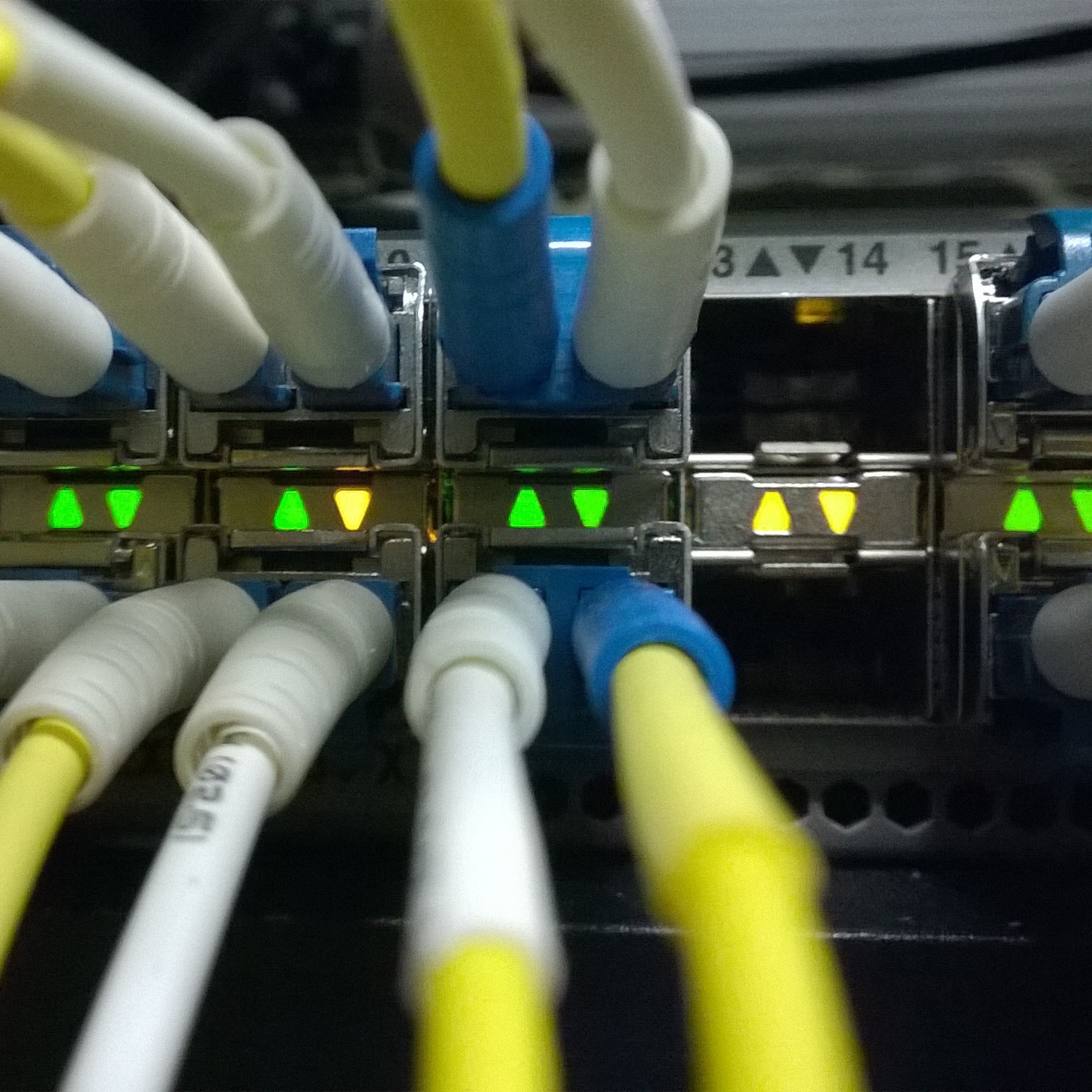

Cisco won an important contract last year for the Verizon build-out of the company’s next-generation 100G metro network. While Cisco’s optical business is small as a part of total revenue, this win is seen by Wall Street as a significant endorsement of the investments Cisco has made into its optics business.

Cisco investors receive a solid 3.35% dividend. The Merrill Lynch price target for the stock is $30, and the Thomson/First Call consensus target is $31.02. The shares closed most recently at $25.27.

Intel

This top chip stock traded sideways all last year and actually closed down from where it started 2015, but with $21 billion of cash on the books, the dividend looks very safe. Intel Corp. (NASDAQ: INTC) is one of the companies that is regarded as having among the highest shareholders cash returns at approximately 8%, but has lagged high growth specialty chip stocks.

Intel purchased chip rival Altera last year for a massive $16.8 billion, and the deal finally closed on December 28. Some on Wall Street viewed the deal pessimistically, citing its high cost, aggressive growth assumptions on the part of Intel and the increase in debt. Others feel the addition will help Intel start to move away from the PC dependence. Intel’s acquisition of the company puts it into the traditional fabless market of programmable logic devices. By 2020, 50% of Altera’s product line could be manufactured at Intel facilities.

Intel’s NAND flash memory business has a strong focus on enterprise opportunities. Many on Wall Street think that the company’s new chip, which is a collaboration with Micron Technology called the 3D XPoint, could be primarily In-Memory compute in servers, and its launch should coincide with Intel’s Purley platform server launch in 2016.

Intel investors receive a 3% dividend. Merrill Lynch recently raised its price target to $40. The consensus target is $36.22, and shares closed Monday at $32.06.

Microsoft

This is another top technology stock that gives investors a degree of mega-cap tech safety, and it has a massive $99 billion sitting on the balance sheet. Microsoft Inc. (NASDAQ: MSFT) continues to find an increasing amount of support from portfolio managers who have been adding the software giant to their holdings at an increasingly faster pace all of this year.

Numerous Wall Street analysts feel that Microsoft has become a clear number two in the public or hyper-scale cloud infrastructure market with Azure, which is the company’s cloud computing platform offering. Some have flagged Azure as a solid rival to Amazon’s AWS service, but they maintain that Microsoft is discounting Azure for large enterprises such that Azure may be cheaper than AWS for larger users.

Top analysts believe the company continues to make steady progress with its cloud transition and expect Office 365 and Azure to be solid contributors to top and bottom lines for the next several years. While not likely to snag the top slot from Amazon, it could add huge incremental revenue for years to come.

With gaming revenues growing at a huge pace, the Xbox continues to gain ever more fans as the ultimate console to own. The company continues to upgrade the popular device, and many think that it could dominate Sony’s PlayStation down the road.

Microsoft investors receive a solid 2.75% dividend, and the forward valuation remains compelling. The Merrill Lynch price target is $63. The consensus target is $57.66 Shares closed Monday at $52.30.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.