Voxeljet AG (NYSE: VJET) is set to report its fiscal fourth-quarter financial results after the markets close on Thursday. The consensus estimates from Thomson Reuters are calling for a net loss of $0.12 per share on $7.59 million in revenue. The same period from the previous year had a net loss of $0.03 per share on $6.94 million in revenue.

3D printing was an industry that took a backseat after 2014 and saw a significant downturn during this time as well. However, after one of the industry leaders reported earnings recently, Voxeljet and a few other major 3D printing stocks made significant runs. This could be a potential catalyst for Voxeljet’s earnings.

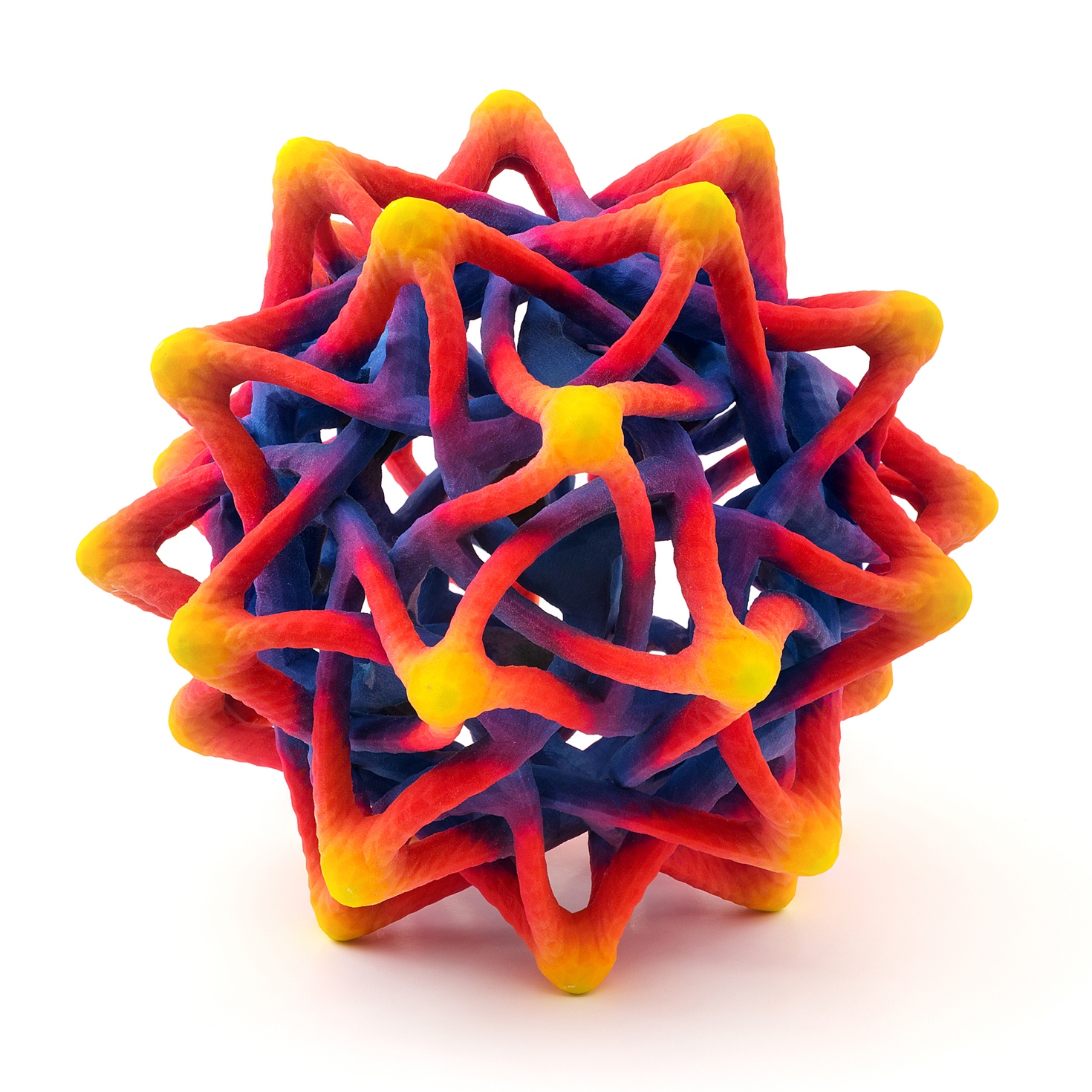

This company provides 3D printers and on-demand parts services to industrial and commercial customers. Its 3D printers employ a powder binding, additive manufacturing technology to produce parts using various material sets. The company operates in two segments, Systems and Services. The Systems segment focuses on the production, development, and sale of 3D printers. The Services segment prints on-demand parts for its customers, as well as creates parts, molds, cores, and models using 3D computer-aided design at its service center.

A few analysts weighed in on Voxeljet prior to the release of the earnings report:

- Citigroup reiterated a Hold rating with a $5 price target.

- Jefferies reiterated a Hold rating with a $5 price target.

- Brean Capital reiterated a Hold rating.

So far in 2016 Voxeljet has outperformed the broad markets with the stock up over 20% year to date. However over the past 52-weeks the stock is down about 35%.

Shares of Voxeljet were last trading up 4% at $5.65, with a consensus analyst price target of $5.74 and a 52-week trading range of $3.50 to $9.26.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.