Technology

7 Tech Stocks So Strong That High Valuations Might Not Even Matter

Published:

Last Updated:

The bull market is now seven and a half years old. Stocks are valued high at 18 times forward 12-month earnings. It’s an election year, and investors keep proving over and over that they want to buy their favorite stocks on pullbacks.

24/7 Wall St. has seen many warnings that the market is overlooking. Still, some stocks have continued to surge day in and day out. The technology sector has been hot in 2016, and some of the stocks have such strong charts that their fundamentals may not even matter to technicians. Pure technicians, or chartists, may not necessarily pay that much attention to the news feeds and they certainly overlook things like P/E ratios, EBITDA growth, debt-to-equity, dividend coverage and other ratios that traditional investors would care about.

We have tracked seven technology stocks that have just managed to defy gravity of late. Not all are taking out their all-time highs, but many are.

As a reminder, for a stock to be strong it means much of the gains have already been seen. Technicians follow trends until the trends no longer work, then they move on to something else. Another issue to consider is that by the time many charts get written about the moves may be closer to an end rather than the start of something new.

AMD

Advanced Micro Devices Inc. (NASDAQ: AMD) rose 2.24% to $7.51 on Friday, and the stock just seems to keep defying the skeptical investors. The driver here is graphics, as well as virtual reality and artificial intelligence (AI) and learning. AMD last saw Jefferies raise its price target to $9 from $6.75 with a Buy rating, and Canaccord Genuity just recently said that AMD is even becoming competitive to Intel again in terms of personal computing CPUs. As far as valuations go, AMD is expected to lose money in 2016, and most analysts still expect losses in 2017.

Shares of AMD were last seen trading at $7.38, with a consensus analyst price target of $5.70 and a 52-week trading range of $1.65 to $8.00.

Amazon

Almost without notice, Amazon.com Inc. (NASDAQ: AMZN) managed to hit yet another all-time high on Friday. Many of us still think of Amazon as the endless shopping mall that extends right to your front door, but its Amazon Web Services unit is also a driving force. Amazon hasn’t traded on a rational earnings valuation for so long that there is almost no reason to point out that its shares are valued even at 80 times 2017 earnings.

Amazon hit an all-time high of $776.00 on Friday, up from a 52-week low of $474.00. Its consensus price target is $870.33.

NVIDIA

NVIDIA Inc. (NASDAQ: NVDA) is winning from graphics, but mobile and smaller processing is also helping. The company is not only a winner in graphics, but AI, learning and much more. The stock also has risen handily, despite a 1% drop on Friday to $62.53. It is loved, with analysts chasing targets much higher after solid earnings. NVIDIA has been around for years and years now and is still valued at about 35 times expected 2016 earnings.

NVIDIA has a consensus price target of $64.72 and a 52-week trading range of $21.74 to $63.50.

Seagate Technology

Seagate Technology PLC (NASDAQ: STX) was a big earnings winner, and what makes this recovery strength different from the rest of this group of strong tech stocks is that it remains drastically lower than its 52-week high. Its earnings report was quite strong. RBC Capital Markets recently raised its target to $34 from $31, but to start off the month Jefferies raised its target to $38 from $32. Seagate’s acquisition of Dot Hill Systems is even being challenged by a small group of Dot Hill shareholders. Another thing that makes Seagate so different is that it is valued at only about 11 times the current year’s earnings expectations.

Shares of Seagate recently were trading at $33.95, with a consensus price target of $31.94 and a 52-week range of $18.42 to $50.91.

SINA

It may be Chinese, but SINA Corp. (NASDAQ: SINA) saw a gain of almost 4% on Friday’s. The current driving force here is that SINA has authorized the distribution of Weibo shares on a pro rata basis, and the company is decreasing its stake to 51% from 54%. SINA is valued at close to 80 times expected year’s earnings expectations.

SINA shares hit a new 52-week high of $85.24 Tuesday morning. The consensus price target is $78.08, and the 52-week low is $36.21.

Symantec

Because Symantec Corp. (NASDAQ: SYMC) has been a disappointment for so many years and range bound for so long, it feels hard to ever get excited about. Still, its shares have kept rising after its plan to break back up and after acquiring Blue Coat for more data security. Again, technicians tell you the news doesn’t matter — or at least that the market tells you what you need to know. Symantec has been around forever, but maybe analysts have a hard time valuing this one right now with so much change happening. Still, Symantec is valued at almost 22 times expected 2016 earnings.

Shares of Symantec were trading at $24.60, after hitting a new 52-week high of $24.69. The consensus price target is $23.98, and the 52-week low is $16.14.

Momo

The market value of Momo Inc. (NASDAQ: MOMO) is now $4.6 billion, and was shares traded up yet again on Tuesday at the start of the first real week of September. Momo is a mobile-based social networking platform located in China, and its stock is very thinly followed by analysts but valued at close to 70 times expected earnings. JPMorgan recently started Momo as Overweight with a $26 target, a price that is already close to coming to fruition.

Shares of Momo recently traded at $23.68, with a consensus price target of $19.35 and a 52-week range of $6.72 to $25.62.

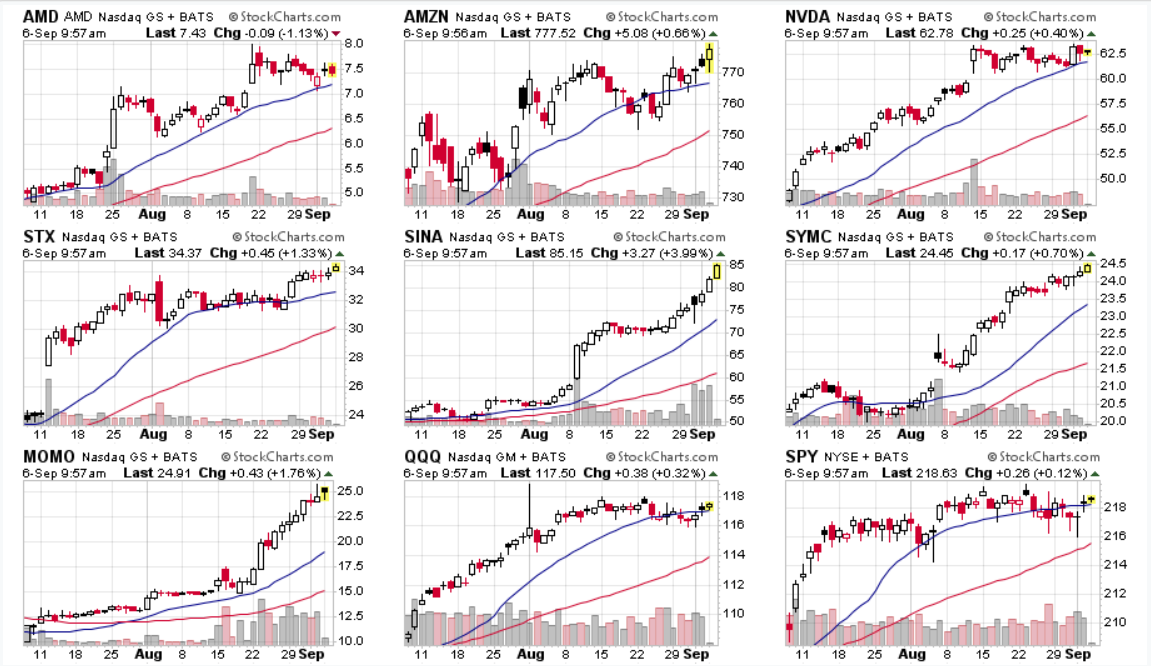

A chart montage (expandable) from StockCharts.com has been offered below, using the Spyders and Nasdaq 100 ETFs for a reference.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.