One thing smart investors should keep in mind is things that are said and promised during a red-hot election need to be taken with a gigantic grain of salt. With Donald Trump winning the White House, many investors are immediately scared of huge protectionist trade policies. These cannot be imposed unilaterally, and needless to say, the rhetoric will give way to common sense solutions.

One sector getting absolutely destroyed is technology, over fears of trade changes with China and a host of other issues, not the least of which was rhetoric directed at Trump from high-profile Silicon Valley executives. Cooler heads will prevail, as Trump knows that technology is an engine of growth, strength and jobs in the United States.

We screened the Merrill Lynch research database and found four high-profile mega-cap technology stocks that have been hammered. Known in Wall Street parlance as the FANG stocks, they represent the biggest and best in technology. While only suitable for more aggressive-styled accounts, the ability for investors to buy partial positions cheap is very enticing.

Alphabet

The search giant continues to expand and is even working on a driverless car now. Alphabet Inc. (NASDAQ: GOOGL) provides online advertising services in the United States, the United Kingdom and rest of the world. It offers performance and brand advertising services, and it operates through Google and Other Bets segments. The Google segment includes principal internet products, such as Search, Ads, Commerce, Maps, YouTube, Apps, Cloud, Android, Chrome and Google Play, as well as technical infrastructure and newer efforts, such as virtual reality.

The Google segment also sells hardware products, comprising Chromecast, Chromebooks and Nexus. The Other Bets segment includes businesses such as Access/Google Fiber, Calico, Nest, Verily, GV, Google Capital, X and other initiatives.

The company reported earnings last month against some very tough comparisons from this time last year. Alphabet announced fiscal first quarter results that produced 20% year-on-year growth in revenues to $22.45 billion, in line with most expectations. On a constant-currency basis, revenues grew 23%. Google segment revenues for the quarter were up 20% over the prior year. While Google’s operating profit grew by 16.7%, the operating margin declined by just under 1% basis point.

The Merrill Lynch price objective for the stock is $970, while the Wall Street consensus target price is $963.74. The shares closed Friday at $771.75, down a whopping 10% in the past three weeks.

Amazon

This company is the absolute leader in online retail and a dominant player in cloud storage business. Amazon.com Inc. (NASDAQ: AMZN) serves consumers through retail websites that primarily include merchandise and content purchased for resale from vendors and those offered by third-party sellers. In addition, the company serves developers and enterprises through Amazon Web Services (AWS), which provides compute, storage, database, analytics, applications and deployment services that enable virtually various businesses.

AWS is the undisputed leader in the cloud now, and many top analysts team see the company expanding and moving up the enterprise information value chain and targeting a larger total addressable market. The company has had numerous recent product announcements, including Aurora for relational database engine, Quick Sight for business intelligence and AWS Database Migration Support Service.

Amazon reported a mixed quarter in October, and top analysts around Wall Street noted that revenues were in line and margins were soft. Guidance was below expectations as the company continues to invest, but the sales midpoint was also below expectations. Many suggest buying the dip as nothing here changes the view that Amazon is best positioned to benefit from the shift of commerce from offline to online, and it is also looking to expand to Australia.

Merrill Lynch has a $960 price target, and the consensus target is $921.63. Shares closed Friday at $739.01, down 12.3% in just over two weeks.

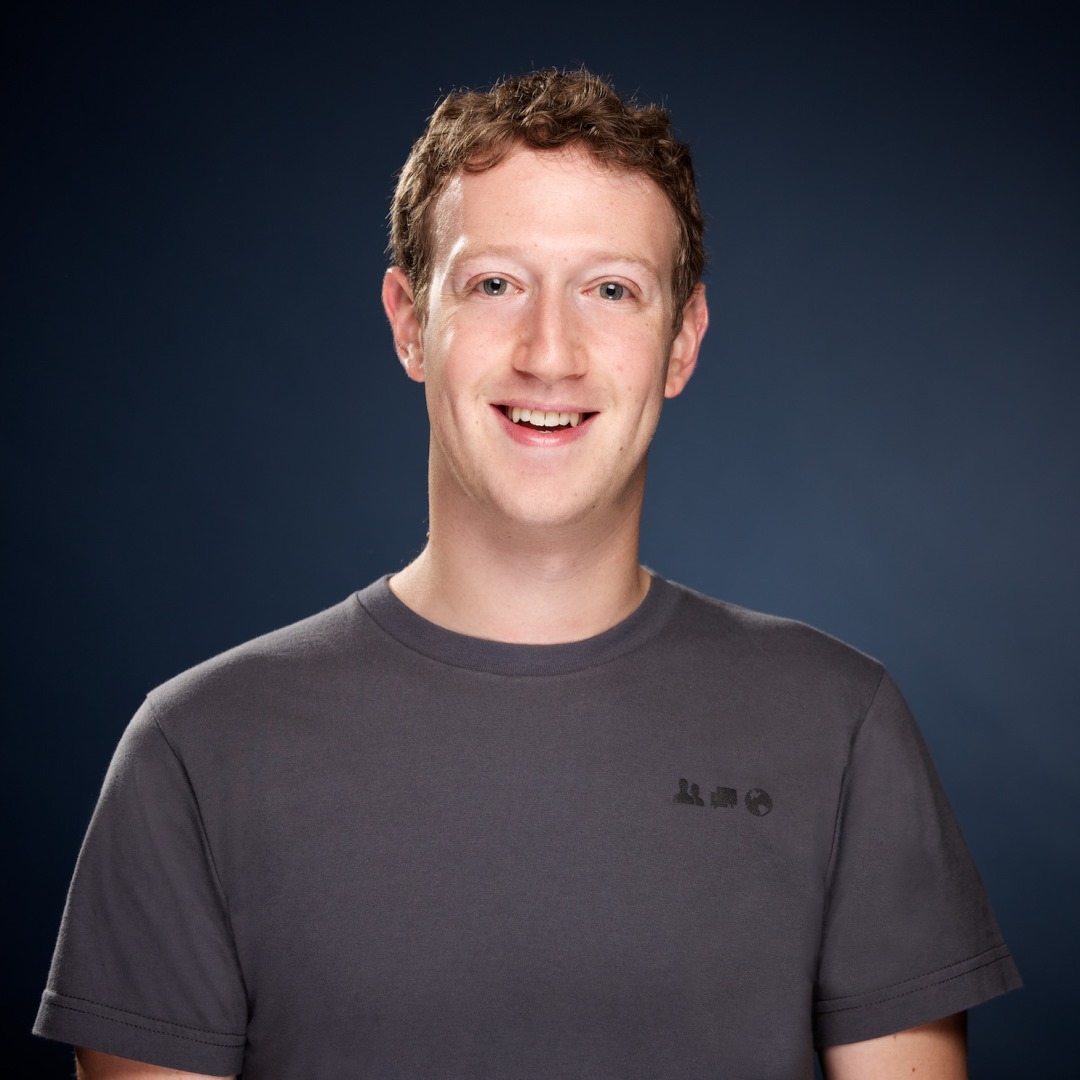

The huge social media leader has posted gigantic quarterly numbers that truly blew most of Wall Street away. Facebook Inc. (NASDAQ: FB) operates as a mobile application and website that enables people to connect, share, discover and communicate each other on mobile devices and personal computers worldwide.

Its solutions also include Instagram, a mobile application that enables people to take photos or videos, customize them with filter effects, and share them with friends and followers in a photo feed or send them directly to friends; Messenger, a messaging application for mobile and web on various platforms and devices, which enable people to reach others instantly, as well as enable businesses to engage with customers; and WhatsApp Messenger, a mobile messaging application.

Most Wall Street analysts point to the fact that Facebook remains the top beneficiary of the adoption of mobile internet trends, with total U.S. internet time spent on Facebook and Messenger. Facebook also develops Oculus VR technology and content platform, which allows people to enter an immersive and interactive environment to play games, consume content and connect with others.

Top Wall Street analysts feel that Facebook’s long-term forecasts are more easily attainable, especially as the company continues to grow and employ new platforms for online advertising. It should be noted that Facebook had grown to an astounding $341.78 billion market cap in less than five years.

The $150 Merrill Lynch price target is less than the consensus target of $156.60. The shares closed Friday at $119.02.

Netflix

This Wall Street darling has been mauled and is down over 10% from highs printed in late October and could offer solid upside. Netflix Inc. (NASDAQ: NFLX) is the world’s leading internet television network, with more than 70 million members in over 190 countries enjoying more than 125 million hours of TV shows and movies per day, including original series, documentaries and feature films. Members can watch as much as they want, anytime, anywhere, on nearly any internet-connected screen. Members can play, pause and resume watching, all without commercials or commitments.

Netflix is available on virtually any device with an internet connection, including personal computers, tablets, smartphones, smart TVs and game consoles, and it automatically provides the best possible streaming quality based on available bandwidth. Many titles, including Netflix original series and films, are available in high-definition with Dolby Digital Plus 5.1 surround sound and some in Ultra HD 4K. Advanced recommendation technologies with up to five user profiles help members discover entertainment they’ll love.

The Merrill Lynch price target is $141. The consensus target is $122.33. Shares closed most recently at $114.78.

While the uncertainty is far from over, you can bet that a President Trump will reach out to the Silicon Valley titans and they will reach back. While they may not like him, they need to get along to keep the technology growth engine strong, which Trump knows is good for jobs and the nation as a whole.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.